Manufacturing Tax Credit Expansion: Key Details In Ontario's Budget

Table of Contents

Increased Credit Rate

The most impactful change is the substantial increase in the Manufacturing Tax Credit rate. This directly translates to greater tax savings for businesses, freeing up capital for investment and expansion.

- Previous rate: 8% (Example - Replace with actual previous rate)

- New rate: 12% (Example - Replace with actual new rate)

- Effective date: January 1, 2024 (Example - Replace with actual date)

- Impact on business size: The increased rate benefits businesses of all sizes, from small-scale operations to large enterprises. Larger businesses with significant capital expenditures will see proportionally larger tax savings, fueling further investment and job creation. Smaller businesses will benefit from increased cash flow, allowing them to invest in upgrades and expansion opportunities that might otherwise be financially unfeasible.

This heightened incentive encourages businesses to invest in new equipment, modernize their facilities, and expand their operations, creating a ripple effect of positive economic growth throughout the province. The increased rate is a clear signal of the Ontario government's commitment to supporting the manufacturing industry.

Expanded Eligibility Criteria

The expansion of the Manufacturing Tax Credit in Ontario extends its benefits to a broader range of businesses, fostering inclusivity and driving innovation within the sector.

- Industries now eligible: The updated criteria now include businesses involved in advanced manufacturing, clean technologies, automotive parts manufacturing, agri-food processing, and other high-growth sectors. (Replace with specific industries from the actual budget).

- Qualifying expenditures: Eligible expenditures now encompass a wider range of investments including machinery and equipment purchases, research and development activities, and investments in automation technologies. (Provide more detail from the official guidelines).

- Removal of restrictive clauses: Previous limitations on eligibility (if any existed, specify them here and how they were removed).

By broadening eligibility, the Ontario government supports a more diverse range of manufacturing activities, encouraging innovation and competitiveness within the province. This inclusive approach ensures that a wider spectrum of businesses can reap the rewards of this significant tax incentive.

Simplified Application Process

Accessing the benefits of the Manufacturing Tax Credit Ontario is now significantly easier thanks to a streamlined application process.

- Simplified process: The application is primarily available through a user-friendly online portal, minimizing paperwork and reducing administrative burdens.

- Processing times: The government aims to process applications within [Insert timeframe from official guidelines] (Example: 4-6 weeks).

- Support and inquiries: Businesses can access support and address inquiries by contacting the Ontario Ministry of Finance (or the relevant agency) through their website or by phone at [Insert phone number].

This streamlined approach saves businesses valuable time and resources, allowing them to focus on their core operations while promptly receiving the tax relief they deserve. The simplified application process is a testament to the Ontario government's commitment to making this incentive accessible to all eligible businesses.

Long-Term Economic Impact

The expanded Manufacturing Tax Credit is poised to deliver significant long-term benefits to the Ontario economy, strengthening its competitiveness on a national and global scale.

- Projected job creation: The initiative is expected to create [Insert projected number] new jobs across the province (Replace with official projections).

- Increased manufacturing output: The increased investment spurred by the credit is projected to lead to a [Insert percentage or numerical increase] rise in manufacturing output.

- Attracting foreign investment: The improved business environment and enhanced incentives will attract further foreign direct investment into Ontario's manufacturing sector.

This initiative aligns perfectly with the Ontario government's overall economic development strategy, demonstrating a strategic commitment to building a robust and prosperous manufacturing sector. The long-term benefits extend beyond mere tax savings, contributing to overall economic growth and prosperity for the province.

Conclusion

The expansion of the Manufacturing Tax Credit in Ontario presents a compelling opportunity for manufacturers of all sizes. The increased credit rate, broadened eligibility, and simplified application make it easier than ever to access this crucial support. Don't miss out on the advantages of the Manufacturing Tax Credit Ontario. Contact the Ontario Ministry of Finance (or relevant government agency - insert website here) to learn more and begin the application process. Maximize your tax benefits and contribute to the growth of Ontario's thriving manufacturing sector by taking advantage of this enhanced Manufacturing Tax Credit Ontario today.

Featured Posts

-

Chinese Stock Market Surge Assessing The Impact Of Us Negotiations And Recent Data

May 07, 2025

Chinese Stock Market Surge Assessing The Impact Of Us Negotiations And Recent Data

May 07, 2025 -

Rihanna Debuts Giant Engagement Ring Rocks Cherry Red Heels

May 07, 2025

Rihanna Debuts Giant Engagement Ring Rocks Cherry Red Heels

May 07, 2025 -

Wynns New Seafood Restaurant Plans Finally Unveiled

May 07, 2025

Wynns New Seafood Restaurant Plans Finally Unveiled

May 07, 2025 -

Keanu Reeves On John Wick 5 The Latest Updates And Fan Reactions

May 07, 2025

Keanu Reeves On John Wick 5 The Latest Updates And Fan Reactions

May 07, 2025 -

George Pickens Trade Speculation Heats Up As Nfl Draft Continues

May 07, 2025

George Pickens Trade Speculation Heats Up As Nfl Draft Continues

May 07, 2025

Latest Posts

-

Is Saving Private Ryan No Longer The Best War Movie Fan Reactions

May 08, 2025

Is Saving Private Ryan No Longer The Best War Movie Fan Reactions

May 08, 2025 -

Warfare On Screen 5 Movies That Balance Action And Emotion

May 08, 2025

Warfare On Screen 5 Movies That Balance Action And Emotion

May 08, 2025 -

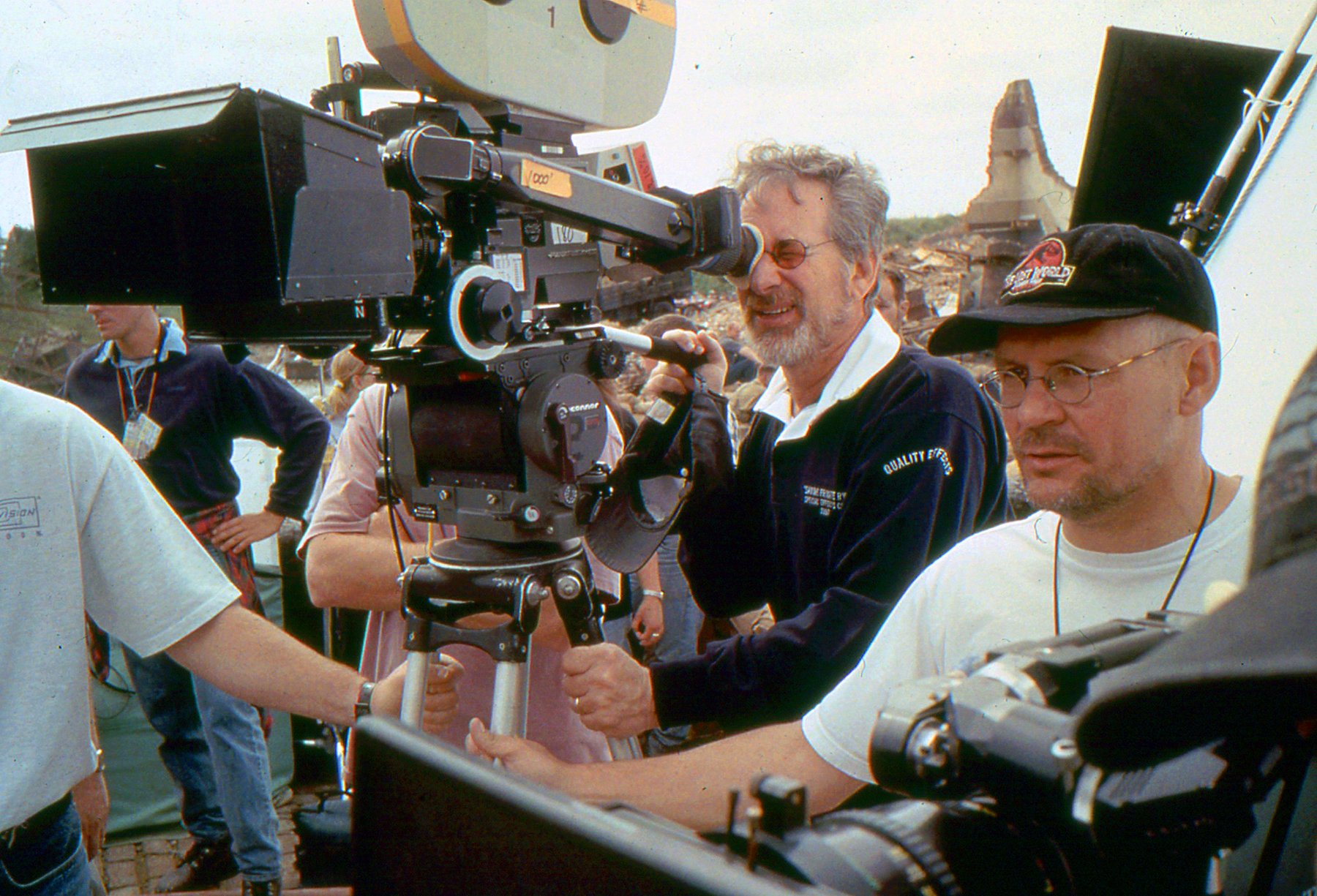

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan

May 08, 2025 -

Do You Know These 20 Facts About Saving Private Ryan

May 08, 2025

Do You Know These 20 Facts About Saving Private Ryan

May 08, 2025 -

5 Military Films A Powerful Mix Of Heart And Warfare

May 08, 2025

5 Military Films A Powerful Mix Of Heart And Warfare

May 08, 2025