Chinese Stock Market Surge: Assessing The Impact Of US Negotiations And Recent Data

Table of Contents

The Role of US-China Trade Negotiations

The ongoing saga of US-China trade relations has significantly influenced the trajectory of the Chinese stock market. The ebb and flow of negotiations, punctuated by periods of escalating tariffs and hopeful de-escalation, have created significant volatility.

Easing Trade Tensions

Positive developments in US-China trade talks have undeniably boosted investor confidence.

- Phase One Deal Progress: The partial trade agreement reached in 2020, though not resolving all issues, significantly reduced immediate trade uncertainty.

- De-escalation of Rhetoric: A decrease in aggressive rhetoric from both sides has contributed to a more optimistic outlook among investors.

Reduced trade uncertainty encourages foreign direct investment (FDI) in China. Companies are more willing to invest when the risk of sudden tariff hikes or trade restrictions is lessened. This inflow of capital directly fuels stock market growth. However, it's crucial to acknowledge that significant risks remain in the US-China relationship. The potential for future disagreements and the lingering threat of further tariffs cannot be ignored.

Impact of Tariffs and Sanctions

Past tariffs and sanctions have had a demonstrably negative impact on specific sectors of the Chinese stock market.

- Impact on Technology Sector: Tariffs on technology goods significantly affected Chinese tech companies reliant on US components and markets.

- Impact on Agricultural Sector: Sanctions targeting agricultural exports led to price fluctuations and market instability.

The easing or potential removal of these measures contributes to the current surge by mitigating previous negative impacts and restoring investor confidence in affected sectors. However, the possibility of future tariff increases or new sanctions remains a significant threat, underscoring the inherent volatility of this relationship.

Influence of Recent Economic Data

Positive economic data released by China has further fueled the stock market surge, providing concrete evidence of a strengthening economy.

Positive GDP Growth and Economic Indicators

Recent reports paint a picture of robust economic growth in China.

- GDP Growth: China's GDP grew by [Insert recent GDP growth percentage] in [Insert timeframe], exceeding expectations.

- Industrial Production: Industrial production increased by [Insert percentage] demonstrating strong manufacturing activity.

- Retail Sales: Retail sales figures also showed positive growth, indicating healthy consumer spending.

These positive indicators demonstrate a resilient Chinese economy, attracting both domestic and foreign investors. However, it’s important to consider potential limitations in the reported data and the possibility of discrepancies between official statistics and the ground reality.

Inflation and Monetary Policy

Inflation rates and the Chinese government’s monetary policy play a crucial role in shaping investor sentiment.

- Inflation Rate: The current inflation rate in China stands at [Insert current inflation rate], remaining relatively stable.

- Monetary Policy Response: The central bank’s response to inflation, including interest rate adjustments, influences investment decisions.

Monetary policy directly impacts interest rates, affecting borrowing costs for businesses and investors. A balanced approach to monetary policy is crucial; overly aggressive tightening could stifle growth, while inaction in the face of rising inflation could erode investor confidence.

Shifting Investor Sentiment and Market Speculation

The surge in the Chinese stock market is also driven by shifts in investor sentiment and speculative activity.

Increased Foreign Investment

A significant driver of the market surge is increased foreign investment.

- Foreign Investment Inflows: [Insert statistics on foreign investment inflows].

- Reasons for Increased Interest: This surge in foreign investment reflects a renewed confidence in the Chinese economy and its long-term growth prospects.

While increased foreign investment is positive, over-reliance on it poses a risk. A sudden shift in global sentiment could trigger a rapid outflow of foreign capital, leading to market instability.

Speculative Bubbles and Market Volatility

The rapid rise in certain sectors raises concerns about potential speculative bubbles.

- Volatile Sectors: [Mention specific examples of sectors experiencing high volatility].

- Factors Contributing to Speculation: Easy access to credit, optimistic growth projections, and herd behavior can all contribute to speculative bubbles.

The potential for a market correction is a significant risk. A sudden decline could negatively impact investor confidence and lead to substantial losses.

Conclusion: Understanding the Chinese Stock Market Surge

The recent surge in the Chinese stock market is a complex phenomenon driven by a combination of factors: easing US-China trade tensions, positive economic data reflecting strong GDP growth and industrial output, and increased foreign investment. However, it's crucial to maintain a balanced perspective. The potential for future trade disputes, the risks associated with inflation and monetary policy, and the possibility of speculative bubbles all introduce considerable uncertainty. Stay updated on the latest developments in US-China relations and Chinese economic data to make informed decisions regarding investments in the Chinese stock market. Understanding the intricacies of this dynamic market is crucial for navigating its potential ups and downs.

Featured Posts

-

Onet Premium Z Faktem Najlepsza Oferta W Promocyjnej Cenie

May 07, 2025

Onet Premium Z Faktem Najlepsza Oferta W Promocyjnej Cenie

May 07, 2025 -

Governments Plan For A Successful Ldc Graduation

May 07, 2025

Governments Plan For A Successful Ldc Graduation

May 07, 2025 -

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

May 07, 2025

Nba Fines Anthony Edwards 50 000 For Vulgar Comment To Fan

May 07, 2025 -

Cleveland Cavaliers Round 2 Tickets Go On Sale Tuesday

May 07, 2025

Cleveland Cavaliers Round 2 Tickets Go On Sale Tuesday

May 07, 2025 -

Jenna Ortega Confirms Real Reason For Leaving Scream 7

May 07, 2025

Jenna Ortega Confirms Real Reason For Leaving Scream 7

May 07, 2025

Latest Posts

-

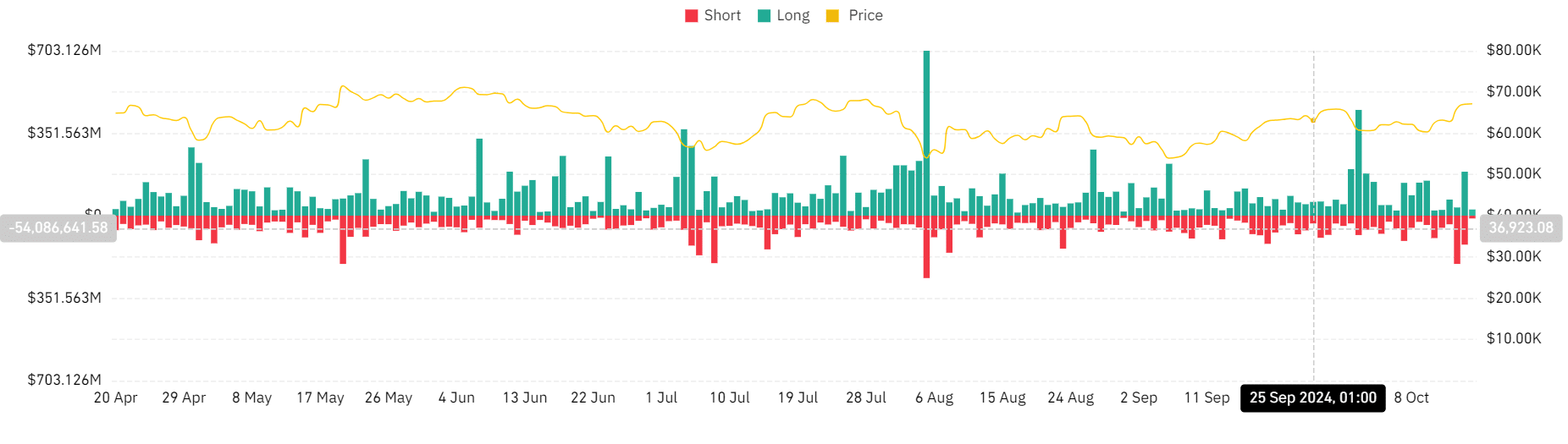

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025