Market Reaction: Dow Futures And Dollar Weaken Post-Moody's Downgrade

Table of Contents

Moody's Downgrade: A Deep Dive

The Rationale Behind the Downgrade:

Moody's cited a confluence of factors contributing to its decision to downgrade the US credit rating. Their report highlighted persistent fiscal challenges, including the ongoing struggle to address the nation's burgeoning debt and the repeated near-misses on the debt ceiling. The agency specifically pointed to the erosion of governance strength and effectiveness, stemming from the increasing political polarization and gridlock in Washington. This lack of progress on fiscal issues, they argued, poses a significant risk to the US's long-term fiscal strength. Keywords used here include fiscal strength, debt ceiling, political gridlock, US debt.

Historical Context of US Credit Rating Downgrades:

While relatively rare, this is not the first time the US credit rating has faced scrutiny. Understanding the historical context is crucial. While previous instances, though less severe, often prompted market volatility, they also provide insights into how the markets typically respond to such events. Analyzing previous reactions helps frame the current situation and provides valuable historical perspective.

- Specific fiscal challenges cited by Moody's: High and rising debt burden, projected continued deficit spending, and lack of a long-term fiscal consolidation plan.

- Key political factors contributing to the downgrade: Political gridlock hindering bipartisan cooperation on fiscal issues and the repeated near-defaults on the debt ceiling.

- Comparison to other countries' credit ratings: Moody's downgrade positions the US amongst a select group of nations with similar credit rating challenges, underscoring the seriousness of the situation.

Immediate Market Reaction: Dow Futures and Dollar Plunge

Dow Futures' Sharp Decline:

Following the announcement, Dow futures experienced a sharp decline, reflecting immediate investor concerns. The drop, exceeding [Insert Percentage Drop Here]%, signified a significant loss of confidence in the US economy's short-term prospects. This volatility underscores the futures market's sensitivity to news impacting the overall health of the US stock market. Keywords: futures market, stock market volatility, investor sentiment, Dow Jones Industrial Average.

Dollar Weakness and Implications:

The Moody's downgrade also led to a weakening US dollar against major global currencies. This reflects a decline in investor confidence in the US economy and potentially reduced demand for dollar-denominated assets. The weakening dollar can have significant implications for international trade, impacting the price of imports and exports. A weaker dollar can make US exports cheaper, potentially boosting economic growth but it could also increase the price of imported goods, leading to inflation. Keywords: currency exchange rates, foreign investment, global markets, US dollar.

- Percentage drop in Dow futures: [Insert Specific Percentage]

- Impact on different sectors of the stock market: [Describe impact on various sectors, e.g., technology, finance, etc.]

- Changes in currency exchange rates against major currencies: [List changes against EUR, GBP, JPY, etc.]

- Analysis of trading volume: [Mention increase or decrease in trading volume]

Longer-Term Implications and Predictions

Impact on Interest Rates:

The downgrade could lead to increased borrowing costs for the US government and potentially higher interest rates across the economy. This is because investors might demand higher yields on US Treasury bonds to compensate for the increased perceived risk. Higher interest rates could dampen economic growth by making borrowing more expensive for businesses and consumers. Keywords: interest rates, US Treasury bonds, borrowing costs.

Investor Confidence and Future Investment:

The Moody's downgrade is likely to negatively impact investor confidence, potentially leading to a decrease in foreign and domestic investment in US assets. This could further hinder economic growth and exacerbate existing fiscal challenges. Keywords: risk aversion, long-term investment, economic growth, foreign direct investment.

Potential Government Response:

The US government will likely need to respond to address the concerns raised by Moody's. This could involve implementing fiscal reforms aimed at reducing the national debt and improving the country's long-term fiscal outlook. The effectiveness and speed of such responses will heavily influence market sentiment in the coming months. Keywords: fiscal policy, debt reduction, economic reforms, government spending.

- Predictions for interest rate changes: [Offer reasoned predictions based on economic analysis]

- Possible shifts in investment strategies: [Discuss potential changes in portfolio allocations]

- Analysis of potential government policy changes: [Suggest likely policy responses and their potential impact]

Conclusion: Navigating the Aftermath of Moody's Downgrade

Moody's downgrade of the US credit rating has triggered significant market reactions, including a sharp drop in Dow futures and a weakening US dollar. The immediate implications are clear, but the longer-term consequences remain uncertain. The potential impact on interest rates, investor confidence, and future economic growth underscores the severity of the situation. Understanding the market's reaction to this event is crucial for investors and policymakers alike.

Stay informed about further developments regarding the Moody's downgrade and its impact on Dow futures and the dollar by following reputable financial news sources and subscribing to market analysis services. Monitoring the evolving situation and making informed investment decisions in light of the market reaction to Moody's downgrade is paramount in the coming weeks and months. The ongoing impact of this credit rating adjustment demands constant vigilance and careful consideration.

Featured Posts

-

Exploring The Themes In Suki Waterhouses On This Love Lyrics

May 20, 2025

Exploring The Themes In Suki Waterhouses On This Love Lyrics

May 20, 2025 -

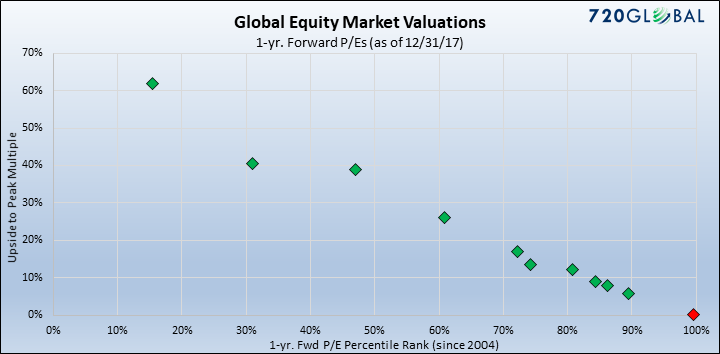

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025

Ignoring High Stock Market Valuations Bof As Rationale For Investors

May 20, 2025 -

Isabelle Nogueira Anuncia Maiara E Maraisa Para Festival Da Cunha Em Manaus

May 20, 2025

Isabelle Nogueira Anuncia Maiara E Maraisa Para Festival Da Cunha Em Manaus

May 20, 2025 -

Michael Schumacher De Mallorca A Suiza En Helicoptero Para Reunion Familiar

May 20, 2025

Michael Schumacher De Mallorca A Suiza En Helicoptero Para Reunion Familiar

May 20, 2025 -

L Integrale Agatha Christie Une Exploration De Son Univers

May 20, 2025

L Integrale Agatha Christie Une Exploration De Son Univers

May 20, 2025

Latest Posts

-

The Trump Effect How Trade Policies And Statehood Rhetoric Impact Wayne Gretzkys Legacy

May 20, 2025

The Trump Effect How Trade Policies And Statehood Rhetoric Impact Wayne Gretzkys Legacy

May 20, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 20, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Career

May 20, 2025 -

Trumps Actions Fuel Debate Wayne Gretzky And The Question Of Canadian Patriotism

May 20, 2025

Trumps Actions Fuel Debate Wayne Gretzky And The Question Of Canadian Patriotism

May 20, 2025 -

Wayne Gretzkys Daughter Paulina Makes Rare Public Appearance With Husband

May 20, 2025

Wayne Gretzkys Daughter Paulina Makes Rare Public Appearance With Husband

May 20, 2025 -

Getting To Know Paulina Gretzky Dustin Johnsons Wife Family And Work

May 20, 2025

Getting To Know Paulina Gretzky Dustin Johnsons Wife Family And Work

May 20, 2025