Microsoft-Activision Deal: FTC's Appeal And Future Implications

Table of Contents

The FTC's Case Against the Merger

The Federal Trade Commission (FTC) argues that Microsoft's acquisition of Activision Blizzard will create a monopoly, stifling competition and harming consumers. Their core concern centers around the anti-competitive practices they believe the merger will enable.

Concerns about Anti-Competitive Practices

The FTC's primary concern revolves around the potential for Microsoft to leverage its ownership of Activision Blizzard to gain an unfair advantage, particularly concerning the immensely popular Call of Duty franchise.

- Reduced competition amongst console manufacturers: The FTC argues that Microsoft could use Call of Duty and other Activision Blizzard titles to lock players into the Xbox ecosystem, disadvantaging competitors like Sony's PlayStation.

- Potential for Microsoft to make Call of Duty exclusive to Xbox, harming PlayStation players: This would significantly impact PlayStation players, potentially driving them to switch consoles or abandoning the franchise entirely. The loss of a major title like Call of Duty could severely damage PlayStation's market share.

- Impact on subscription services like Game Pass: The FTC worries that Microsoft might use Activision Blizzard games to make its Game Pass subscription service even more attractive, further solidifying its market dominance and potentially pushing out competitors' subscription offerings.

- Loss of innovation due to less competition: A lack of competition, the FTC argues, could stifle innovation within the gaming industry, leading to less choice and higher prices for consumers.

Legal Strategy and Arguments

The FTC's legal strategy involves presenting a comprehensive case demonstrating the anti-competitive nature of the deal. This includes:

- Focus on the dominance of Call of Duty: The FTC highlights the immense popularity and market share of Call of Duty, arguing that its exclusivity to Xbox would be a significant blow to competitors.

- Analysis of the cloud gaming market: The FTC is examining Microsoft's potential to dominate the rapidly growing cloud gaming market by leveraging Activision Blizzard's portfolio of titles.

- Examination of Microsoft's past acquisitions and their market impact: The FTC is reviewing Microsoft's history of acquisitions to determine if a pattern of anti-competitive behavior exists.

Microsoft's Defense and Counterarguments

Microsoft counters the FTC's claims, arguing that the acquisition will actually increase competition and benefit consumers.

Claims of Enhanced Competition

Microsoft maintains that the merger will enhance competition by:

- Expanding game availability across platforms: Microsoft has pledged to continue releasing Call of Duty on PlayStation, among other platforms, despite the FTC's concerns.

- Emphasis on benefits for developers and creators: Microsoft highlights the potential benefits for game developers, arguing that the acquisition will provide greater resources and opportunities for innovation.

- Claims of investment in game development and technology: Microsoft claims that the merger will lead to increased investment in game development, benefiting both consumers and the industry as a whole.

Agreements and Concessions

To address the FTC's concerns, Microsoft has made several significant concessions:

- Details of the proposed Call of Duty agreements: Microsoft has committed to keeping Call of Duty on PlayStation for at least several more years, attempting to allay the FTC’s concerns about exclusivity.

- Impact of these agreements on the FTC's case: The long-term effects of these agreements on the FTC's legal standing remain to be seen.

- Potential future renegotiations: The possibility of future renegotiations of these agreements adds uncertainty to the situation.

Potential Outcomes and Implications

The outcome of the FTC's appeal remains uncertain, with several potential scenarios:

Scenarios Following the Appeal

- FTC victory: An FTC victory could block the merger entirely, setting a significant precedent for future mergers and acquisitions in the gaming industry.

- Microsoft victory: A win for Microsoft would allow the merger to proceed, potentially leading to further industry consolidation.

- Compromise: A compromise might involve Microsoft making further concessions to satisfy the FTC's concerns.

Global Regulatory Landscape

The Microsoft-Activision deal is facing scrutiny from regulators worldwide. The US outcome will influence regulatory decisions in other regions:

- Regulatory actions in the EU, UK, and other regions: Similar regulatory battles are playing out in the EU and UK, showcasing the global significance of this deal.

- Harmonization of regulatory approaches across jurisdictions: The different approaches taken by various regulatory bodies could impact future cross-border mergers and acquisitions.

- Impact on cross-border mergers and acquisitions: The outcome will establish crucial precedents for future cross-border deals within the gaming industry.

Conclusion

The FTC's appeal against the Microsoft-Activision deal is a pivotal moment for the gaming industry. The outcome will profoundly impact competition, innovation, and the future of game acquisitions. Understanding the complexities of this legal battle—the FTC's concerns, Microsoft's defenses, and the far-reaching implications—is critical for anyone involved in or interested in the future of gaming. Stay informed about the developments in the Microsoft-Activision deal and its impact on the gaming landscape. Regularly check for updates on this landmark case to stay ahead of the curve.

Featured Posts

-

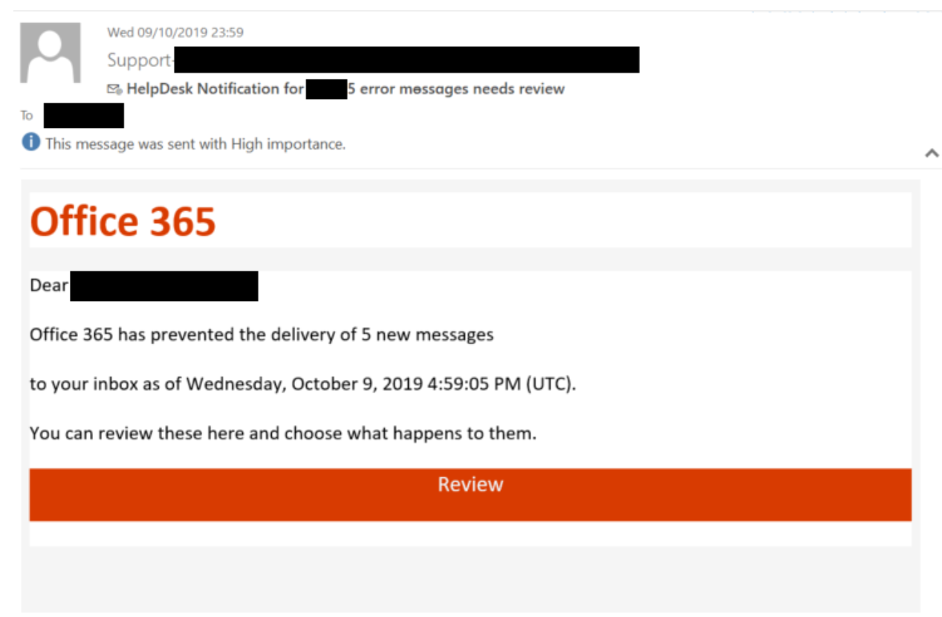

Exec Office365 Breaches Net Millions For Crook Fbi Claims

Apr 23, 2025

Exec Office365 Breaches Net Millions For Crook Fbi Claims

Apr 23, 2025 -

Daftar Program Televisi Spesial Ramadan 2025 Ibadah Dan Hiburan Seru

Apr 23, 2025

Daftar Program Televisi Spesial Ramadan 2025 Ibadah Dan Hiburan Seru

Apr 23, 2025 -

Guemueshane Okullar Tatil Mi 24 Subat Pazartesi Son Dakika Guencellemesi

Apr 23, 2025

Guemueshane Okullar Tatil Mi 24 Subat Pazartesi Son Dakika Guencellemesi

Apr 23, 2025 -

Yelich Returns To The Diamond First Spring Start After Back Surgery

Apr 23, 2025

Yelich Returns To The Diamond First Spring Start After Back Surgery

Apr 23, 2025 -

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025