Moody's Downgrade: Impact On Dow Futures And Dollar

Table of Contents

Understanding the Moody's Downgrade and its Rationale

Moody's, a leading credit rating agency, recently downgraded the United States' credit rating, citing concerns about the nation's fiscal strength and the ongoing political gridlock surrounding the debt ceiling. This downgrade specifically affected the US government's sovereign debt rating, moving it from [Insert Original Rating] to [Insert Downgraded Rating]. This action carries immense weight, as it reflects a diminished assessment of the US government's ability to manage its debt and meet its financial obligations. The rationale behind Moody's decision centers on several key factors:

- Deteriorating Fiscal Strength: Moody's highlighted the increasing US government debt burden and the projected trajectory of fiscal deficits over the next few years. This reflects a weakening in the nation's creditworthiness, impacting its ability to borrow at favorable interest rates.

- Political Gridlock and Erosion of Governance Strength: The repeated near-misses on the debt ceiling, coupled with partisan divisions in Congress, signaled a concerning erosion of governance strength. This uncertainty adds further risk to the nation's fiscal outlook.

- Challenges in Fiscal Policy Coordination: The agency expressed concern over the lack of a cohesive long-term fiscal strategy. This makes it difficult to predict the future trajectory of government debt and spending.

Bullet Points:

- Key concerns included rising government debt, political polarization hindering effective fiscal policy, and a lack of a long-term fiscal consolidation plan.

- Compared to previous ratings, this downgrade marks a significant shift from the previously stable outlook and is a departure from the long-held AAA rating.

- This action potentially sets a precedent for future downgrades if the identified issues remain unaddressed.

Impact on Dow Futures: Immediate and Projected Effects

The announcement of the Moody's downgrade triggered immediate volatility in Dow Futures. [Insert data/chart showing the immediate market reaction – e.g., percentage drop, trading volume spike]. This reflects a decline in investor confidence and a reassessment of the risk associated with US equities.

The potential for further volatility in Dow Futures remains high, with the short-term outlook largely dependent on how the market interprets the government's response to the downgrade. Several scenarios are possible:

- Scenario 1 (Positive): Swift action by the government to address fiscal concerns could lead to a gradual recovery in investor sentiment and a stabilization of Dow Futures.

- Scenario 2 (Negative): Continued political gridlock and a lack of effective fiscal policy could trigger a prolonged period of market uncertainty and further declines in Dow Futures.

Bullet Points:

- The Dow Futures experienced a [Insert Percentage]% drop within [Timeframe] of the announcement.

- Trading volume surged significantly, indicating heightened investor activity and uncertainty.

- Many analysts predict increased market volatility in the coming weeks and months, but the long-term impact is still uncertain.

The Dollar's Response: Strengthening or Weakening?

The relationship between a credit rating downgrade and a nation's currency is complex. While a downgrade typically signals a weakening of the economy, it can also lead to a short-term flight to safety, potentially strengthening the dollar as investors seek refuge in perceived safe-haven assets.

In the immediate aftermath of the Moody's downgrade, the US Dollar Index [Insert Data/Chart showing the impact on the USD index]. This [strengthening/weakening] can be attributed to [explain the reasons – e.g., flight to safety, market uncertainty, investor sentiment].

Bullet Points:

- The USD index experienced a [Percentage]% change following the downgrade announcement.

- Compared to other major currencies like the Euro and Yen, the dollar's performance was [Explain relative performance].

- The flight to safety dynamic played a significant role in the immediate response, but this may be temporary.

Long-Term Implications and Mitigation Strategies

The long-term implications of the Moody's downgrade are significant, impacting the US economy and global markets. Increased borrowing costs, reduced investor confidence, and a potential loss of global economic leadership are key concerns.

Mitigation strategies require a multifaceted approach involving both government and private sector actions:

- Government Actions: Implementing long-term fiscal reforms to reduce the national debt, promoting bipartisan cooperation to ensure stability, and demonstrating effective governance are crucial.

- Investor Strategies: Diversification of investment portfolios, careful risk management, and a focus on assets perceived as safe havens are recommended steps for investors.

Bullet Points:

- The government could implement measures such as spending cuts, tax increases, or a combination of both to reduce the fiscal deficit.

- Investors may consider shifting assets towards less risky investments or hedging strategies to mitigate potential losses.

- Long-term recovery will depend on successful implementation of fiscal reforms and renewed investor confidence.

Conclusion: Navigating the Aftermath of the Moody's Downgrade

The Moody's downgrade has had a palpable impact on Dow Futures and the US dollar, triggering immediate market volatility and raising concerns about the long-term economic outlook. The key takeaway is the need for proactive responses from both the government and investors to address the underlying issues and navigate the ensuing uncertainty. Stay informed about future developments related to the Moody's downgrade and its ongoing impact by following reputable financial news sources and consulting with financial advisors. Understanding and adapting to this evolving situation is crucial for effectively managing risk and making informed investment decisions in the face of this significant credit rating challenge. Remember to carefully consider the implications of the Moody's downgrade on your investment strategies and seek professional financial advice when needed.

Featured Posts

-

Manchester Citys Next Manager An Arsenal Legend

May 21, 2025

Manchester Citys Next Manager An Arsenal Legend

May 21, 2025 -

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 21, 2025

Warner Bros Eyes Reddit Post For Sydney Sweeney Film Adaptation

May 21, 2025 -

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhoging

May 21, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhoging

May 21, 2025 -

Low Rock Vapors Of Morphine Northcote Show

May 21, 2025

Low Rock Vapors Of Morphine Northcote Show

May 21, 2025 -

The End Of Ryujinx Nintendo Contact Forces Emulator Closure

May 21, 2025

The End Of Ryujinx Nintendo Contact Forces Emulator Closure

May 21, 2025

Latest Posts

-

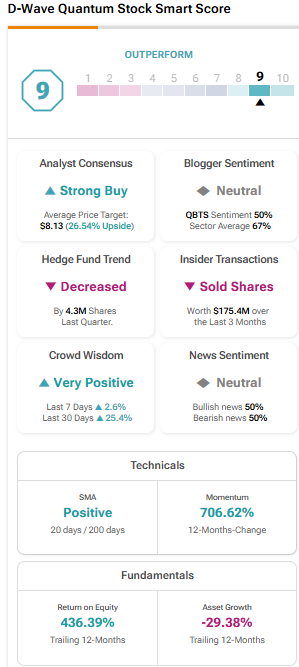

D Wave Quantum Inc Qbts Stock Market Activity This Weeks Developments

May 21, 2025

D Wave Quantum Inc Qbts Stock Market Activity This Weeks Developments

May 21, 2025 -

D Wave Quantum Qbts Stock Plunges Kerrisdale Capitals Valuation Concerns

May 21, 2025

D Wave Quantum Qbts Stock Plunges Kerrisdale Capitals Valuation Concerns

May 21, 2025 -

Factors Contributing To D Wave Quantum Inc Qbts Stocks Friday Gains

May 21, 2025

Factors Contributing To D Wave Quantum Inc Qbts Stocks Friday Gains

May 21, 2025 -

Understanding The Monday Increase In D Wave Quantum Qbts Stock Price

May 21, 2025

Understanding The Monday Increase In D Wave Quantum Qbts Stock Price

May 21, 2025 -

D Wave Quantum Qbts A Comprehensive Investment Analysis

May 21, 2025

D Wave Quantum Qbts A Comprehensive Investment Analysis

May 21, 2025