Navigating The Inflation Maze: The Bank Of Canada's Policy Predicament

Table of Contents

The Current Inflationary Landscape in Canada

Underlying Causes of Inflation

The current inflationary pressure in Canada is a complex issue with multiple contributing factors. Understanding these inflation drivers is crucial to assessing the Bank of Canada's response. Key contributors include:

- Supply chain disruptions and bottlenecks: The lingering effects of the pandemic, coupled with geopolitical instability, have created significant bottlenecks in global supply chains. This has led to shortages of goods and increased production costs, pushing up prices.

- Increased energy prices (oil, natural gas): The war in Ukraine and global energy demand have driven up the price of oil and natural gas, significantly impacting Canadian energy prices and contributing to overall inflation.

- Strong consumer demand: Pent-up demand following the pandemic lockdowns, combined with government stimulus measures, has fueled strong consumer spending, putting upward pressure on prices.

- Global factors influencing Canadian inflation: Canada's economy is intertwined with the global economy. Inflationary pressures in other countries, such as the United States, inevitably spill over into the Canadian market.

These factors have led to a significant increase in the Canadian inflation rate, impacting various sectors of the economy.

Measuring Inflation and its Impact

The primary metric used to measure inflation in Canada is the CPI Canada (Consumer Price Index). The CPI tracks the average change in prices paid by urban consumers for a basket of goods and services. A rising CPI indicates increasing inflation.

The impact of inflation is far-reaching:

- Housing: Rising construction costs and increased demand have driven up housing prices, making homeownership less accessible for many Canadians.

- Food: Food prices have been significantly impacted by supply chain disruptions and increased energy costs, leading to higher grocery bills for consumers.

- Transportation: Increased fuel prices have driven up transportation costs, impacting both individuals and businesses.

This high inflation impact on essential goods and services reduces consumer spending and dampens business investment, creating a challenging economic environment.

The Bank of Canada's Policy Tools and Challenges

Interest Rate Hikes as a Primary Tool

The Bank of Canada's primary tool for managing inflation is adjusting interest rate hikes. By increasing interest rates, the Bank aims to make borrowing more expensive, thereby reducing consumer spending and investment, cooling down the economy, and curbing inflationary pressures. However, this is a delicate balancing act.

- Potential Downsides: Aggressive interest rate hikes risk triggering a recession. Raising rates too quickly can stifle economic growth and lead to job losses.

- Lagged Effects: Monetary policy operates with a lag. The full impact of an interest rate change is not felt immediately, making it challenging for the Bank to fine-tune its policy response. Understanding the Bank of Canada interest rates and their impact requires careful consideration of these lagged effects.

Balancing Economic Growth and Inflation Control

The Bank of Canada faces the difficult task of balancing economic growth and inflation control. Raising interest rates too aggressively risks pushing the economy into a recession, while failing to raise rates sufficiently could allow inflation to become entrenched. This monetary policy trade-off requires careful judgment and monitoring of economic indicators.

Potential Scenarios and Future Outlook

Optimistic Scenario

In an optimistic scenario, the Bank of Canada's targeted interest rate hikes effectively curb inflation without triggering a significant economic slowdown. The inflation forecast predicts a gradual decline in inflation throughout 2024, returning to the Bank's target range of 1-3% by the end of the year. This scenario is predicated on continued improvements in global supply chains and a moderation in energy prices.

Pessimistic Scenario

A pessimistic scenario sees inflation remaining stubbornly high, necessitating more aggressive interest rate hikes. This could lead to a significant economic slowdown or even a recession, accompanied by increased unemployment. The Canadian economy may face prolonged periods of uncertainty under this forecast.

The Role of Government Fiscal Policy

It is crucial to acknowledge the role of government fiscal policy in influencing inflation. Government spending and taxation decisions can either exacerbate or mitigate inflationary pressures. The interaction between monetary and fiscal policy significantly affects the overall economic outlook.

Conclusion

The Bank of Canada faces a complex challenge in navigating the current inflationary environment. Balancing economic growth with inflation control requires careful consideration of multiple factors and potential trade-offs. Understanding the Bank of Canada's inflation policy, its tools, and the potential scenarios is critical. The potential risks associated with different policy choices highlight the need for a nuanced and data-driven approach. Understanding the Bank of Canada's inflation policy is crucial for navigating these uncertain economic times. Stay informed and prepare for the potential consequences of their decisions. Visit the Bank of Canada website ([link to Bank of Canada website]) for the latest updates and information.

Featured Posts

-

Tuesdays Sharp Decline In Core Weave Crwv Stock A Detailed Look

May 22, 2025

Tuesdays Sharp Decline In Core Weave Crwv Stock A Detailed Look

May 22, 2025 -

Is De Nederlandse Woningmarkt Echt Betaalbaar Abn Amro En Geen Stijl Oneens

May 22, 2025

Is De Nederlandse Woningmarkt Echt Betaalbaar Abn Amro En Geen Stijl Oneens

May 22, 2025 -

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Success

May 22, 2025

Jim Cramers Take On Core Weave Crwv A Scrappy Companys Success

May 22, 2025 -

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025

Hellfest A Mulhouse Concert Au Noumatrouff

May 22, 2025 -

Reddits Viral Sensation A Missing Girl Hoax And Its Hollywood Connection

May 22, 2025

Reddits Viral Sensation A Missing Girl Hoax And Its Hollywood Connection

May 22, 2025

Latest Posts

-

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025

Cac Tuyen Duong Ket Noi Tp Hcm Va Ba Ria Vung Tau Huong Dan Chi Tiet

May 22, 2025 -

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025

Kham Pha Mang Luoi Giao Thong Tp Hcm Ba Ria Vung Tau

May 22, 2025 -

Du An Cau Ma Da Dong Nai Binh Phuoc Duoc Ket Noi Khoi Cong Thang 6

May 22, 2025

Du An Cau Ma Da Dong Nai Binh Phuoc Duoc Ket Noi Khoi Cong Thang 6

May 22, 2025 -

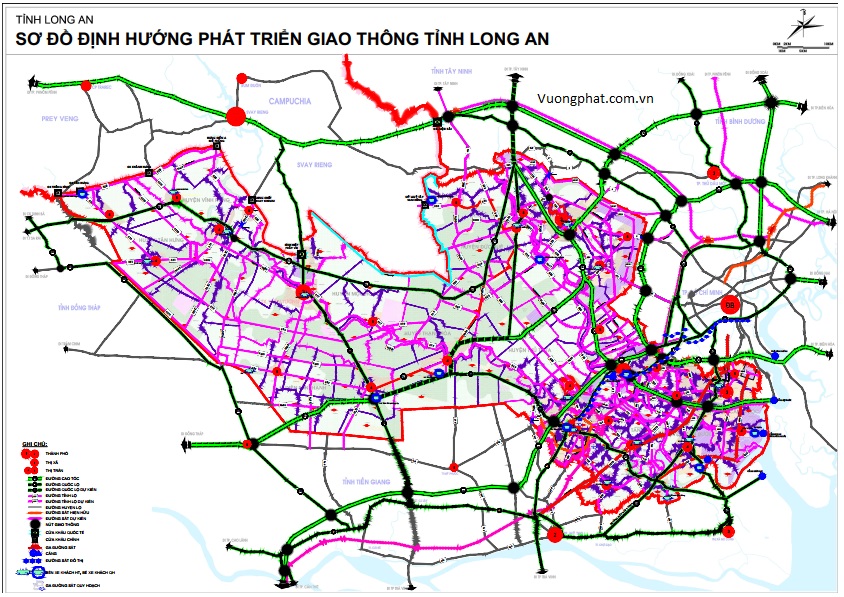

Chien Luoc Phat Trien 7 Tuyen Giao Thong Chinh Tp Hcm Long An

May 22, 2025

Chien Luoc Phat Trien 7 Tuyen Giao Thong Chinh Tp Hcm Long An

May 22, 2025 -

Giai Doan Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Hien Trang Va Tuong Lai

May 22, 2025

Giai Doan Ket Noi Giao Thong Tp Hcm Ba Ria Vung Tau Hien Trang Va Tuong Lai

May 22, 2025