NCLH Stock Soars: Strong Earnings And Upgraded Guidance

Table of Contents

Q3 Earnings Exceed Expectations

NCLH's Q3 earnings report far surpassed analysts' expectations, demonstrating a strong rebound from the pandemic's impact.

Revenue Growth Analysis

Revenue for Q3 surged by 45% compared to the same period last year, significantly outperforming industry benchmarks. This impressive growth reflects the increasing demand for cruises and the company's effective strategies to attract customers.

- Bookings: A significant portion of the revenue increase stemmed from a substantial rise in bookings, exceeding pre-pandemic levels in several key markets.

- Onboard Spending: Increased onboard spending per passenger contributed significantly to overall revenue growth, indicating strong consumer confidence and willingness to spend during their cruises.

- Excursions and Amenities: Revenue from excursions and onboard amenities also saw substantial growth, reflecting the popularity of these additional services.

Compared to competitors like Royal Caribbean (RCL) and Carnival (CCL), NCLH's revenue growth was notably stronger, highlighting the effectiveness of its operational strategies and market positioning. This outperformance underscores NCLH's competitive advantage and potential for continued growth.

Profitability Improvements

Beyond revenue growth, NCLH also showcased remarkable improvements in profitability. Net income more than doubled compared to Q3 of the previous year, and operating income saw a similar surge. This impressive performance reflects successful cost-cutting measures and enhanced operational efficiencies.

- Cost Optimization: The company implemented several cost-cutting initiatives, including streamlining operations and negotiating better deals with suppliers.

- Improved Occupancy Rates: Higher occupancy rates on its ships significantly boosted profitability.

- Effective Pricing Strategies: Strategic pricing strategies maximized revenue while maintaining strong demand.

Profit margins also expanded significantly, exceeding industry averages, demonstrating NCLH's superior operational efficiency and cost management.

Upgraded Guidance for 2024

The positive Q3 results were further reinforced by NCLH's upgraded guidance for 2024, projecting continued growth and profitability.

Positive Outlook for Bookings

The company reported a substantial increase in future bookings, significantly exceeding initial projections. This robust booking trend strongly indicates continued high demand for NCLH cruises.

- Pent-up Demand: A significant portion of the booking increase can be attributed to pent-up demand from travelers eager to resume cruising after pandemic restrictions.

- Attractive Pricing and Promotions: NCLH's strategic pricing and promotional campaigns effectively attracted a broader range of customers.

- New Itineraries and Destinations: Introduction of new itineraries and exciting destinations broadened its appeal to a wider customer base.

Management's optimistic statements about future growth prospects further solidify the positive outlook and suggest strong confidence in the company's trajectory.

Increased Revenue Projections

NCLH significantly raised its revenue projections for the next quarter and the full year, reflecting the robust booking trends and positive market outlook. These revised projections exceed previous estimates by a considerable margin.

- Strong Consumer Confidence: The projections are built upon the assumption of sustained consumer confidence and continued high demand for cruise vacations.

- Operational Efficiency: The company anticipates maintaining its enhanced operational efficiency to optimize profitability.

- Fuel Costs: While fuel costs remain a factor, NCLH's hedging strategies mitigate potential negative impacts.

Although the projections incorporate inherent risks and uncertainties, the overall positive trend clearly indicates a strong and optimistic outlook for NCLH.

Investor Sentiment and Market Reaction

The impressive earnings report and upgraded guidance triggered a very positive reaction from investors and analysts alike.

Analyst Ratings and Price Targets

Several leading financial analyst firms upgraded their ratings on NCLH stock following the earnings announcement, reflecting a heightened sense of optimism about the company's future prospects. Many firms also raised their price targets, suggesting substantial upside potential for the stock.

- Goldman Sachs: Upgraded rating to "Buy," increasing price target.

- Morgan Stanley: Maintained "Overweight" rating, raising price target.

- JPMorgan Chase: Upgraded rating and increased price target.

These upgrades and increased price targets reflect the market's confidence in NCLH's ability to deliver strong and consistent results.

Trading Volume and Volatility

Following the earnings announcement, NCLH stock experienced a significant surge in trading volume, indicating strong investor interest and activity. While increased volatility is common following major announcements, the overall positive sentiment suggests that the market is largely reacting favorably to the news.

- Increased Buying Pressure: The elevated trading volume reflects the increased buying pressure from investors optimistic about NCLH's future performance.

- Short Covering: Some of the increased volume could also be attributed to short-covering by investors who had bet against the stock.

The increased volatility presents both opportunities and risks for investors, highlighting the importance of careful risk management.

Is NCLH Stock a Buy After its Impressive Earnings Report?

NCLH's Q3 earnings report and upgraded guidance paint a compelling picture of a cruise line successfully navigating its post-pandemic recovery. The company exceeded expectations on multiple fronts, demonstrating strong revenue growth, improved profitability, and a positive outlook for the future. This makes it a very attractive proposition for those looking for exposure to the cruise industry sector.

The positive investor sentiment, coupled with upgraded analyst ratings and increased price targets, suggests significant upside potential for NCLH stock. However, potential investors should carefully consider the inherent risks and uncertainties associated with the cruise industry and the broader economic climate before making any investment decisions.

With NCLH stock soaring on the back of strong earnings and improved guidance, now is a good time to conduct thorough research and consider adding this exciting cruise line stock to your portfolio. Learn more about NCLH stock investment opportunities today! (Link to relevant financial resources here)

Featured Posts

-

Popular Us Cruise Lines For 2024

May 01, 2025

Popular Us Cruise Lines For 2024

May 01, 2025 -

Sis Rugby Hopes Dashed By Powerful Tonga Performance

May 01, 2025

Sis Rugby Hopes Dashed By Powerful Tonga Performance

May 01, 2025 -

Geen Stijl Definitie Van Een Zware Auto Volgens De Media

May 01, 2025

Geen Stijl Definitie Van Een Zware Auto Volgens De Media

May 01, 2025 -

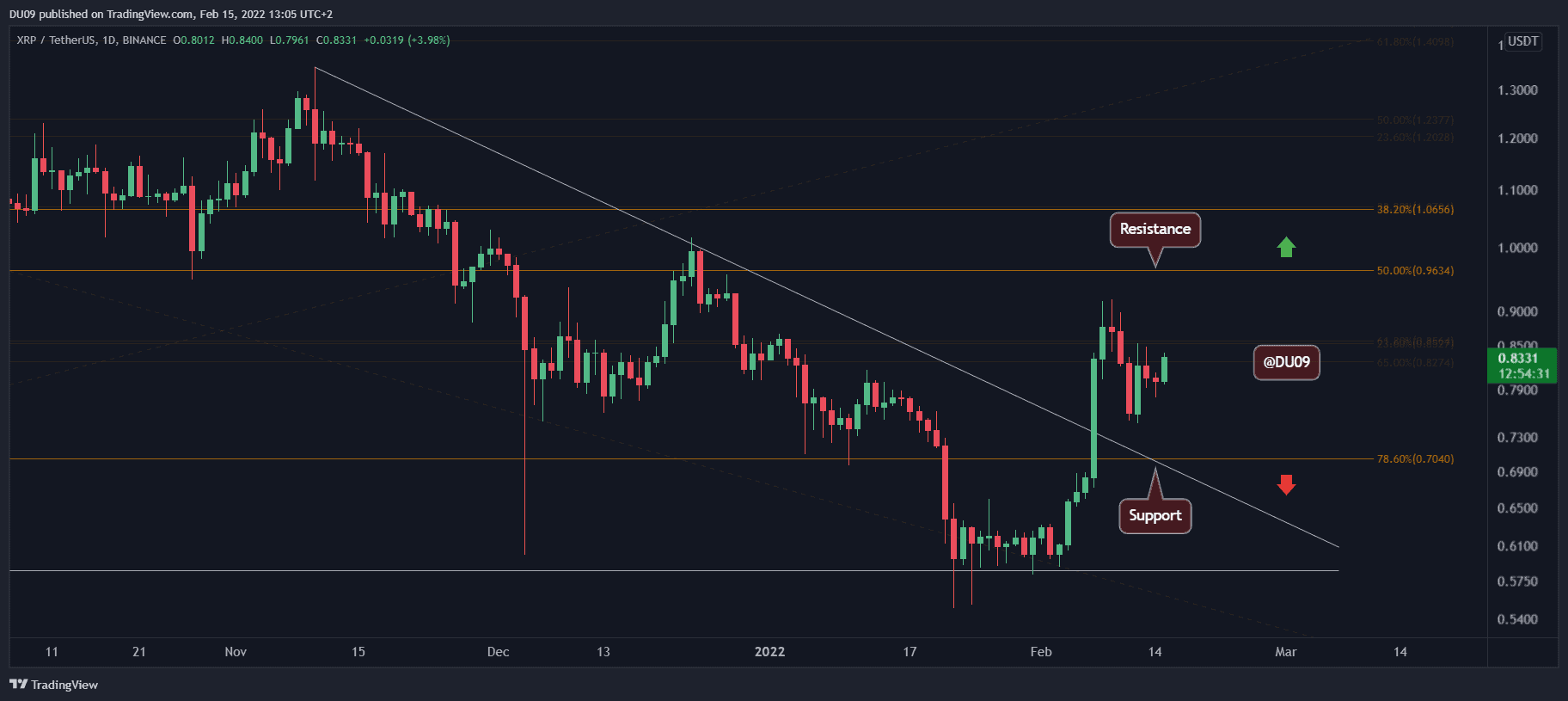

Should You Buy Xrp Ripple Now Price Analysis Under 3

May 01, 2025

Should You Buy Xrp Ripple Now Price Analysis Under 3

May 01, 2025 -

Judge And Goldschmidts Performances Secure A Win For The Yankees

May 01, 2025

Judge And Goldschmidts Performances Secure A Win For The Yankees

May 01, 2025