Escape To The Country: Finding Your Dream Home For Under £1m

Table of Contents

1. Defining Your Ideal Country Lifestyle and Budget

Before you start searching for properties, it's crucial to define your ideal country lifestyle and set a realistic budget. This involves careful consideration of several key factors.

H3: Location, Location, Location

Choosing the right region is paramount. Consider factors like:

- Proximity to amenities: Do you need easy access to schools, hospitals, and shops, or are you happy with a more secluded lifestyle?

- Commuting distance: If you need to commute to work, factor in travel time and costs. Living further from major cities often means lower property prices, but longer commutes.

- Landscape preferences: Do you dream of coastal living, rolling hills, or sprawling plains? The type of landscape you prefer will significantly impact your location choices.

- Average house prices: Research average house prices in different counties and villages to ensure your budget aligns with your location aspirations. Explore areas slightly further from major towns for better value. Websites like Rightmove and Zoopla provide detailed property price data.

H3: Setting a Realistic Budget

The price of the house itself is only one component of your overall cost. You must factor in:

- Stamp duty: This tax is based on the property's purchase price and can significantly impact your overall expenditure.

- Legal fees: Solicitor fees for conveyancing can amount to several thousand pounds.

- Renovation costs: Older properties often require renovations or repairs, adding to the total cost. Budget realistically for unexpected repairs.

- Moving expenses: Moving costs, including removal firms and potential storage, should also be included.

- Mortgage options: Explore different mortgage options, including fixed-rate, variable-rate, and interest-only mortgages. Secure pre-approval to understand your borrowing capacity.

2. Finding Your Dream Property

Once you've defined your ideal lifestyle and budget, it's time to start your property search.

H3: Utilizing Online Property Portals

Online property portals like Rightmove and Zoopla are invaluable resources:

- Multiple platforms: Use several platforms to maximize your reach and discover a wider range of properties.

- Effective search filters: Utilize the advanced search filters to refine your search by price, location, property type, and other criteria. Save your preferred searches and set up alerts for new listings.

- Thorough checks: Always carefully check property details, including photos, descriptions, and floor plans, before arranging viewings.

H3: Engaging Estate Agents

Estate agents play a vital role in the property-buying process:

- Local expertise: They have in-depth knowledge of the local market and can alert you to properties that match your criteria.

- Negotiation skills: They can assist with negotiations and ensure you achieve the best possible price.

- Viewing arrangements: They arrange viewings and provide valuable information about the properties.

- Reputable agents: Choose reputable agents with a good track record and positive reviews.

H3: Auctions and Private Sales

Consider exploring alternative options:

- Auctions: Auctions can offer opportunities to purchase properties below market value but involve risks and require careful research.

- Private sales: These offer more flexibility in negotiations but may lack the transparency of estate agent sales.

3. The Legal and Financial Processes

Securing a mortgage and navigating the legal processes are crucial steps:

H3: Securing a Mortgage

- Credit score: A good credit score is essential for securing a mortgage.

- Mortgage lenders: Compare different mortgage lenders and interest rates to find the best deal.

- Financial advice: Seek professional financial advice to understand your borrowing capacity and choose the right mortgage product.

H3: Solicitors and Conveyancing

- Reliable solicitor: Choose a reliable solicitor experienced in conveyancing.

- Conveyancing process: Understand the key stages involved in conveyancing, including searches, contracts, and exchange of contracts.

- Contract review: Thoroughly review all contracts and seek legal advice if needed.

Conclusion

Escaping to the country and finding your dream home for under £1m requires careful planning, thorough research, and realistic budgeting. By defining your ideal lifestyle, setting a realistic budget, utilizing online portals and estate agents effectively, and navigating the legal and financial processes efficiently, you can make your dream a reality. Start your journey to escape to the country for under £1 million today! Find your dream country escape under £1m now – your idyllic rural retreat awaits!

Featured Posts

-

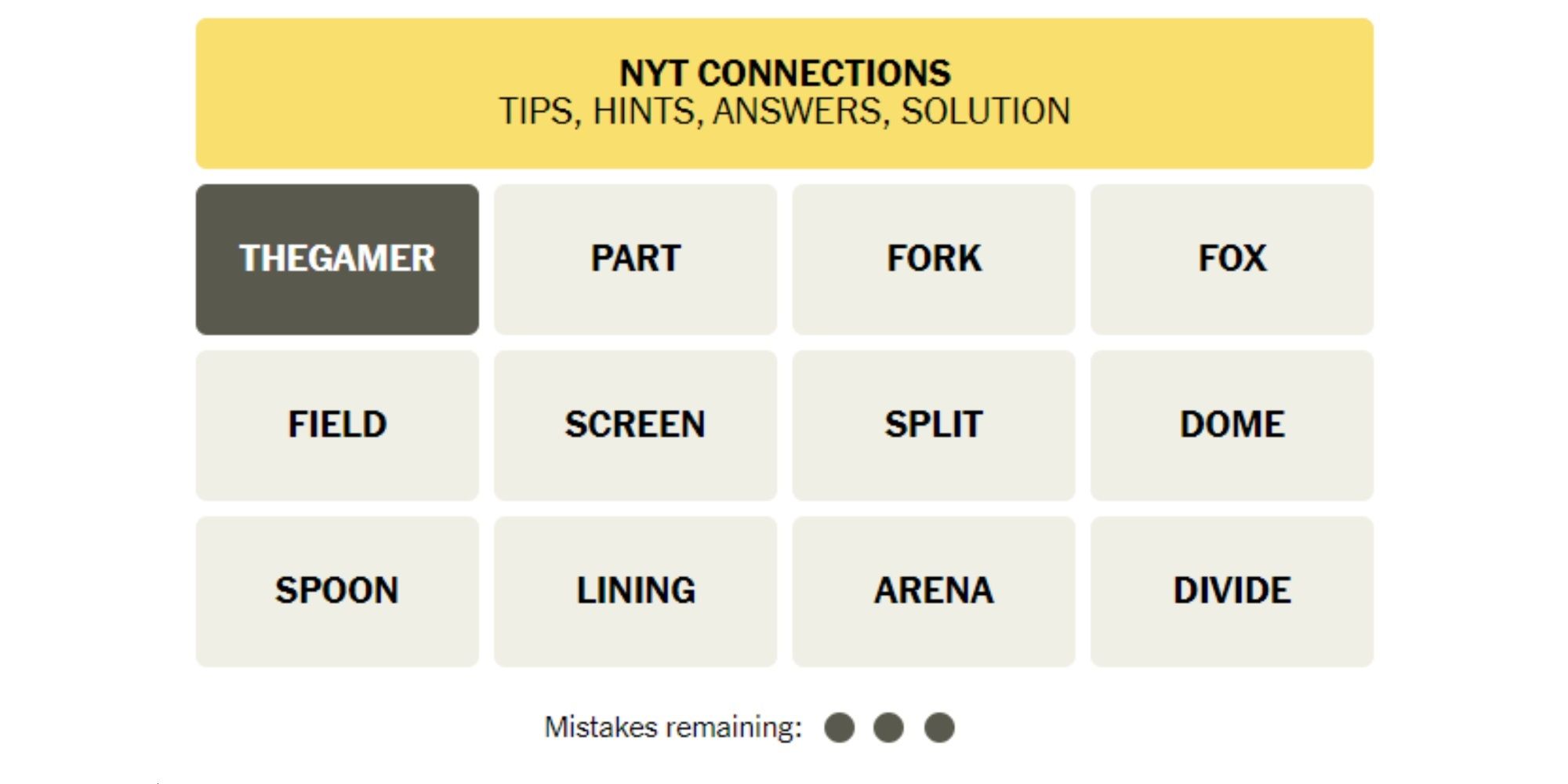

Solving New York Times Connections Puzzle 646 March 18 2025 Guide

May 25, 2025

Solving New York Times Connections Puzzle 646 March 18 2025 Guide

May 25, 2025 -

Planning Your Memorial Day Trip Smartest Flight Dates For 2025

May 25, 2025

Planning Your Memorial Day Trip Smartest Flight Dates For 2025

May 25, 2025 -

Porsche Now Porsche

May 25, 2025

Porsche Now Porsche

May 25, 2025 -

Significant Delays On M6 Southbound Following Collision

May 25, 2025

Significant Delays On M6 Southbound Following Collision

May 25, 2025 -

Darwin Homicide Investigation Teen In Custody Following Nightcliff Theft

May 25, 2025

Darwin Homicide Investigation Teen In Custody Following Nightcliff Theft

May 25, 2025

Latest Posts

-

18 Brazilian Nationals Charged Over 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 25, 2025

18 Brazilian Nationals Charged Over 100 Firearms Seized In Mass Gun Trafficking Crackdown

May 25, 2025 -

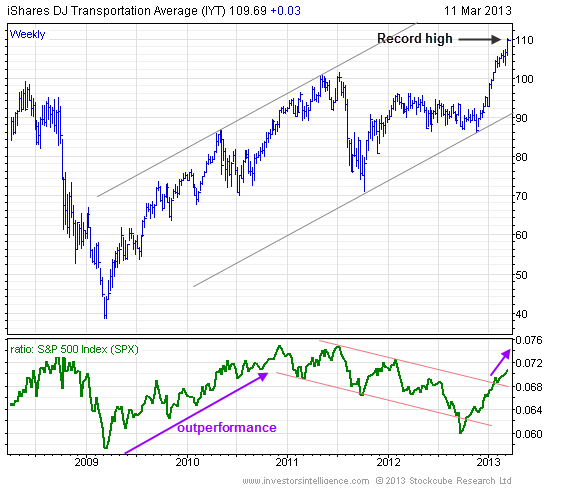

Dow Jones Cautious Uptrend Continues Analysis Of Recent Pmi Data

May 25, 2025

Dow Jones Cautious Uptrend Continues Analysis Of Recent Pmi Data

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf What Is Net Asset Value And Why Does It Matter

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf What Is Net Asset Value And Why Does It Matter

May 25, 2025 -

Strong Pmi Data Supports Dow Jones Steady Rise

May 25, 2025

Strong Pmi Data Supports Dow Jones Steady Rise

May 25, 2025 -

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025