New Rules Sought By Indian Insurers For Bond Forward Transactions

Table of Contents

Current Challenges Faced by Insurers in Bond Forward Transactions

The existing regulatory framework for bond forward transactions in India presents several challenges for insurers. While the IRDAI has established guidelines for investment practices, specific aspects of bond forward transactions require greater clarity and standardization. These shortcomings hinder efficient risk management and potentially expose insurers to unnecessary risks.

-

Lack of clarity on accounting treatment: The current guidelines lack specific detail on the accounting and valuation of bond forward contracts, leading to inconsistencies in financial reporting across different insurance companies. This impacts comparability and transparency.

-

Difficulties in risk management and hedging strategies: The absence of a comprehensive framework for managing the risks associated with bond forwards limits the effectiveness of hedging strategies employed by insurers. This increases vulnerability to market fluctuations.

-

Limited transparency and potential for market manipulation: A lack of standardized reporting requirements and transparency in bond forward transactions increases the potential for market manipulation and unethical practices.

-

Concerns regarding compliance and reporting requirements: The existing regulations may be ambiguous or insufficient, making it challenging for insurers to ensure full compliance and accurate reporting, potentially leading to penalties and reputational damage. This highlights the need for improved clarity within Indian insurance regulations regarding bond market participation.

Key Proposals for New Rules on Bond Forward Transactions

To address these shortcomings, Indian insurers are advocating for significant changes to the regulatory framework governing bond forward transactions. These proposals aim to enhance transparency, improve risk management, and promote a more robust and stable market.

-

Clearer guidelines on accounting and valuation of bond forwards: Insurers are pushing for detailed guidelines on accounting practices, including valuation methods and the treatment of gains and losses related to bond forward contracts. This would ensure consistent financial reporting across the industry.

-

Enhanced risk management frameworks tailored to bond forwards: The proposed changes include the development of specific risk management frameworks tailored to the unique characteristics of bond forward transactions. This would involve robust stress testing methodologies and appropriate capital adequacy requirements.

-

Improved transparency and disclosure requirements: Insurers are advocating for mandatory disclosures of all material information related to bond forward transactions, promoting greater transparency and reducing the potential for market manipulation. This includes details of the contracts, counterparties, and risk exposures.

-

Streamlined reporting processes for regulatory compliance: The proposed reforms aim to simplify the reporting processes for bond forward transactions, minimizing the administrative burden on insurers while improving the efficiency and effectiveness of regulatory oversight.

-

Potential introduction of standardized contracts: Standardizing bond forward contracts would reduce ambiguity and complexity, allowing for easier comparison and risk assessment across different transactions.

Potential Impacts of New Regulations on the Indian Insurance and Bond Markets

The implementation of these new regulations is expected to have a significant positive impact on both the Indian insurance sector and the broader bond market.

-

Improved risk management leading to greater financial stability: Clearer guidelines and enhanced risk management frameworks will significantly improve the financial stability of Indian insurance companies.

-

Increased investor confidence and participation in the bond market: Greater transparency and reduced risk will attract more investors, boosting liquidity and efficiency in the Indian bond market.

-

Enhanced transparency and reduced potential for market abuse: Improved transparency measures will deter market manipulation and other unethical practices, promoting fair play and increased investor confidence.

-

Better alignment with international best practices: Adopting these new rules will bring Indian regulations closer to international best practices, attracting foreign investment and integration into global financial markets.

-

Stimulated growth in the Indian insurance sector: By facilitating efficient risk management and greater market participation, the new rules are likely to stimulate growth within the Indian insurance sector.

While largely positive, potential negative impacts could include increased compliance costs for insurers in the short term. However, the long-term benefits of enhanced stability and market efficiency are likely to outweigh these initial costs.

Conclusion: The Future of Bond Forward Transactions in the Indian Insurance Sector

The proposed new rules for bond forward transactions represent a crucial step towards modernizing the Indian insurance sector. Addressing the current challenges through clearer accounting standards, robust risk management frameworks, and improved transparency is vital for ensuring the stability and growth of the insurance and bond markets. The potential benefits – enhanced risk management, increased investor confidence, and better alignment with international standards – are significant. Staying informed about developments in Indian insurance regulations for bond forward transactions and the IRDAI's final decisions on these proposed rule changes is crucial for all stakeholders in the Indian financial market. Regularly check the IRDAI website and other relevant financial news sources for updates. The future of efficient and transparent bond forward transactions in India hinges on these regulatory reforms.

Featured Posts

-

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 10, 2025

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 10, 2025 -

Snls Failed Harry Styles Impression The Stars Disappointment

May 10, 2025

Snls Failed Harry Styles Impression The Stars Disappointment

May 10, 2025 -

Bangkok Post Highlights Urgent Need For Transgender Rights In Thailand

May 10, 2025

Bangkok Post Highlights Urgent Need For Transgender Rights In Thailand

May 10, 2025 -

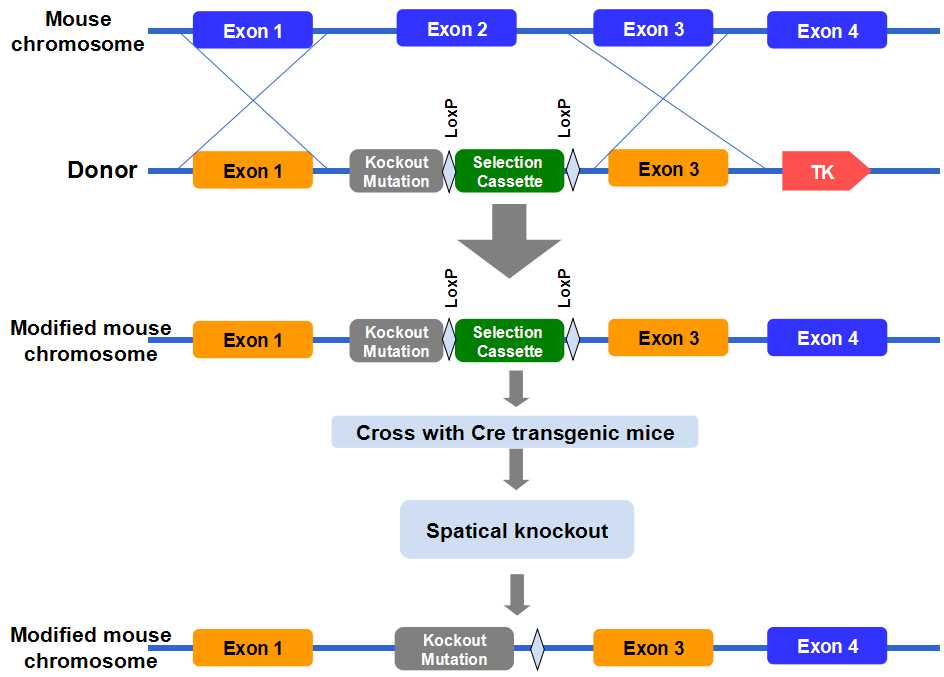

The Truth About Us Funding For Transgender Mouse Studies

May 10, 2025

The Truth About Us Funding For Transgender Mouse Studies

May 10, 2025 -

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025

Space X Valuation Soars Musks Stake Exceeds Tesla Investment By 43 Billion

May 10, 2025