Nigel Farage And NatWest Settle Debanking Dispute

Table of Contents

The Background of the Dispute

The saga began with NatWest's decision to close Mr. Farage's personal and business accounts. The exact timeline remains somewhat opaque, with differing accounts emerging from both sides. However, the closure sparked immediate controversy, with Mr. Farage publicly accusing the bank of politically motivated actions, citing his outspoken political views as the underlying reason. NatWest, initially, offered explanations focused on adherence to anti-money laundering regulations and risk assessment procedures. This explanation, however, failed to quell the intense public and political reaction.

The ensuing public outcry was substantial. The case quickly escalated, becoming a major talking point across various media outlets and attracting significant attention from political figures on both sides of the spectrum. The perceived implications for freedom of speech and the potential for politically motivated debanking fueled the debate.

- Date of account closure: [Insert precise date if available, otherwise approximate timeframe].

- Initial statements from NatWest: [Summarize NatWest's initial public statements regarding the closure].

- Initial statements from Farage: [Summarize Mr. Farage's initial public statements regarding the closure].

- Political figures involved: [List key political figures who commented on the dispute, specifying their stances].

- Public perception and media coverage: [Describe the overall public and media reaction, noting prevalent opinions and sentiments].

The Terms of the Settlement

The specifics of the settlement between Nigel Farage and NatWest remain partially undisclosed, with confidentiality clauses likely in place. However, reports suggest that the dispute ended with an undisclosed financial settlement for Mr. Farage. While neither party has offered detailed public statements on the precise terms, the resolution implies some degree of concession from NatWest, though the bank has not admitted any wrongdoing. The settlement itself may avoid a protracted and costly legal battle, potentially setting a precedent for future debanking disputes.

- Key elements of the agreement: [Outline known details of the settlement agreement, focusing on confirmed information].

- Confidentiality clauses: [Mention the likely presence of confidentiality clauses, acknowledging the limitations on public information].

- Public statements made after the settlement: [Summarize any public statements released by either party following the settlement].

- Legal implications for future debanking cases: [Speculate on the potential legal implications of the settlement for similar cases in the future, cautiously avoiding definitive statements].

Implications and Wider Debate

The settlement's implications are far-reaching. For NatWest, the controversy has undoubtedly damaged its reputation, raising concerns about its approach to risk assessment and its potential susceptibility to accusations of political bias. Other banks are likely to face increased scrutiny regarding their debanking practices, prompting reviews of their internal policies and procedures. The case has intensified the wider debate surrounding the balance between financial security, customer rights and political neutrality within the financial services sector.

The implications extend beyond the banking sector. The dispute raises fundamental questions about freedom of speech and the potential for financial institutions to exert undue influence on political activity. The debate will likely continue to involve discussions around regulation, transparency, and the need for clearer guidelines for banks in handling accounts associated with politically active individuals.

- Potential changes in bank policies: [Discuss the likely changes in banking policies regarding account closures, particularly focusing on risk assessments and due diligence].

- Increased scrutiny of financial institutions: [Analyze the increased scrutiny financial institutions are likely to face regarding their debanking practices following the Farage-NatWest case].

- Legal challenges to debanking procedures: [Discuss potential future legal challenges to debanking procedures as a result of this case].

- Future implications for political figures and their banking relationships: [Discuss the implications for political figures in the UK and beyond in their future relationships with banks].

The Role of Regulation

Financial regulators, such as the Financial Conduct Authority (FCA) in the UK, play a crucial role in overseeing debanking practices. Current regulations aim to balance the need for robust anti-money laundering measures with the protection of customer rights. However, the Farage-NatWest dispute highlights potential gaps in these regulations or ambiguities in their application. This case could lead to calls for stricter guidelines or more transparent processes for account closures, potentially involving independent review mechanisms to ensure impartiality.

- Relevant regulatory bodies: [List the key regulatory bodies involved in overseeing banking practices in the UK].

- Current regulations on account closures: [Summarize existing UK regulations concerning account closures].

- Potential future regulatory actions: [Discuss potential changes to regulations in response to the controversy, acknowledging the speculative nature].

Conclusion

The settlement of the Nigel Farage and NatWest debanking dispute marks a significant moment in the ongoing debate about debanking practices and their implications for freedom of speech and political activity. The undisclosed terms, while offering a resolution, leave lingering questions about the balance between risk management, regulatory compliance, and the potential for political influence in the financial sector. The case has undeniably raised the bar for transparency and accountability within banking, prompting calls for reform and a deeper examination of existing regulations.

Understanding the nuances of debanking disputes is crucial for navigating the complexities of the modern financial landscape. Stay informed about future developments in this evolving area by following reputable news sources and engaging in informed discussions about debanking and its impact on financial freedom. The debate surrounding debanking remains far from over.

Featured Posts

-

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025

Emission Matinale Mathieu Spinosi Joue Du Violon

May 03, 2025 -

Rethinking Middle Management How They Contribute To A Thriving Workplace

May 03, 2025

Rethinking Middle Management How They Contribute To A Thriving Workplace

May 03, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 03, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 03, 2025 -

Dramatic Facelift Leaves Fans Questioning Celebritys Appearance

May 03, 2025

Dramatic Facelift Leaves Fans Questioning Celebritys Appearance

May 03, 2025 -

Reform Uk On The Brink Five Key Threats To Nigel Farages Party

May 03, 2025

Reform Uk On The Brink Five Key Threats To Nigel Farages Party

May 03, 2025

Latest Posts

-

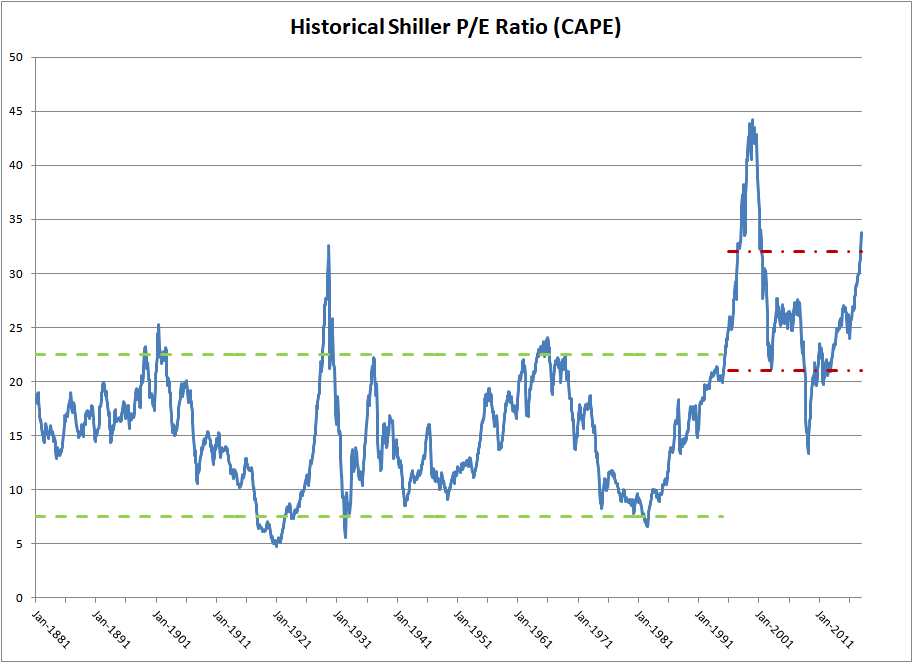

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025 -

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025

Effective Middle Management Key To A Thriving Company Culture

May 04, 2025 -

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025

The Untapped Potential Of Middle Management Fostering Growth And Productivity

May 04, 2025 -

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025

The Impact Of Opt Outs On Googles Search Ai Training With Web Content

May 04, 2025 -

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025

Los Angeles Wildfires A New Frontier For Disaster Betting

May 04, 2025