Nonessential Spending Decline: A Challenge For Credit Card Companies

Table of Contents

Reduced Transaction Volumes and Revenue

The core business model of credit card companies relies heavily on transaction fees, which are directly impacted by a decline in nonessential spending. Lower purchase volumes translate to reduced interchange fees for credit card issuers, impacting their profitability. This is particularly evident in sectors heavily reliant on discretionary spending.

-

Lower purchase volumes translate to reduced interchange fees for credit card issuers. Interchange fees are the fees that merchants pay to credit card networks for processing transactions. When consumers spend less on nonessential items, the number of transactions decreases, leading to a direct reduction in these fees for credit card companies.

-

Decreased spending on travel, entertainment, and dining directly impacts revenue streams. These categories represent a significant portion of nonessential spending. The reduced travel, fewer restaurant visits, and less entertainment spending directly translates to lower transaction volumes and reduced revenue for credit card companies.

-

Impact on reward programs and profitability due to less spending. Many credit cards offer rewards programs based on spending. A decline in nonessential spending reduces the rewards earned by consumers, potentially impacting customer loyalty and the overall profitability of these programs for credit card issuers.

The correlation between nonessential spending and credit card company profits is undeniable. A recent study by [cite a relevant study if possible] showed a [insert statistic, e.g., 15%] drop in credit card transaction volume correlating with a [insert statistic, e.g., 10%] decrease in profits for major credit card issuers in Q[insert quarter]. This clearly highlights the vulnerability of the industry to shifts in consumer spending habits.

Increased Risk of Delinquency and Defaults

Consumers facing financial strain due to inflation, rising interest rates, and recessionary fears may struggle to repay credit card debts, leading to a rise in delinquencies and defaults. This poses a significant risk to credit card companies' financial health.

-

Increased financial pressure on consumers resulting from inflation and recessionary fears. As the cost of living increases and economic uncertainty grows, consumers are forced to prioritize essential spending, leading to reduced capacity for nonessential purchases and potential difficulties in managing credit card debt.

-

Higher likelihood of missed payments and increased charge-off rates for credit card companies. Missed payments directly translate into increased delinquencies and charge-offs, which represent a significant loss for credit card companies.

-

Potential impact on credit scores and consumer credit availability. High delinquency rates can negatively affect credit scores, impacting consumers' ability to access credit in the future. This further exacerbates the financial challenges for both consumers and the credit card industry.

Credit card companies employ various methods to mitigate this risk, including sophisticated risk assessment models to identify high-risk applicants, offering debt management programs to assist struggling borrowers, and proactively contacting customers who show signs of financial difficulty. However, the effectiveness of these measures is being tested by the current economic climate.

Strategic Adaptations by Credit Card Companies

Credit card companies are responding to the nonessential spending decline by implementing various strategies to maintain profitability and market share. These adaptations involve shifting focus, product diversification, and targeted marketing.

-

Focus on expanding essential spending categories (e.g., groceries, utilities). Credit card companies are increasingly focusing on acquiring customers who use their cards for essential purchases, offering rewards and incentives for these transactions.

-

Development of new products and services tailored to changing consumer needs. This includes introducing credit cards with features specifically designed for budget management, prioritizing affordability and offering flexible payment options.

-

Implementation of targeted marketing campaigns focusing on value and affordability. Marketing strategies are shifting towards highlighting the value proposition of credit cards, emphasizing competitive interest rates, rewards programs, and other benefits to attract and retain customers.

-

Increased focus on building customer loyalty and retention. Credit card companies are implementing loyalty programs and personalized offers to encourage customer retention in a competitive environment.

The Rise of Buy Now, Pay Later (BNPL) Services

The decline in nonessential spending has also spurred increased competition from Buy Now, Pay Later (BNPL) services. These services offer consumers flexible payment options at the point of sale, often targeting younger demographics.

-

BNPL services often target younger demographics, potentially diverting spending from credit cards. BNPL services are appealing to younger consumers who may be less inclined to use traditional credit cards.

-

Competition with BNPL services in acquiring and retaining customers. The rise of BNPL creates competitive pressure for credit card companies, forcing them to adapt and innovate to stay relevant.

-

Potential regulatory scrutiny surrounding BNPL services and their implications for credit card companies. The rapid growth of BNPL has also attracted regulatory attention, raising concerns about consumer protection and financial stability, indirectly impacting the credit card industry.

Conclusion

The decline in nonessential spending presents a significant and multifaceted challenge for credit card companies. Reduced transaction volumes, increased delinquency risk, and competition from emerging payment options necessitate strategic adaptations to navigate this evolving landscape. Credit card companies must focus on diversifying revenue streams, managing risk effectively, and innovating to meet changing consumer preferences. The future success of the industry hinges on adapting to this nonessential spending decline and creating sustainable business models that thrive in a more cautious economic environment. Understanding this nonessential spending decline and its ramifications is crucial for both credit card companies and consumers alike. By proactively addressing the challenges presented by the decline in nonessential spending, the credit card industry can ensure its continued relevance and stability.

Featured Posts

-

Nbas Investigation Of Ja Morant Timeline And Potential Consequences

Apr 24, 2025

Nbas Investigation Of Ja Morant Timeline And Potential Consequences

Apr 24, 2025 -

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025

Selling Sunset Star Accuses Landlords Of Price Gouging Amid La Fires

Apr 24, 2025 -

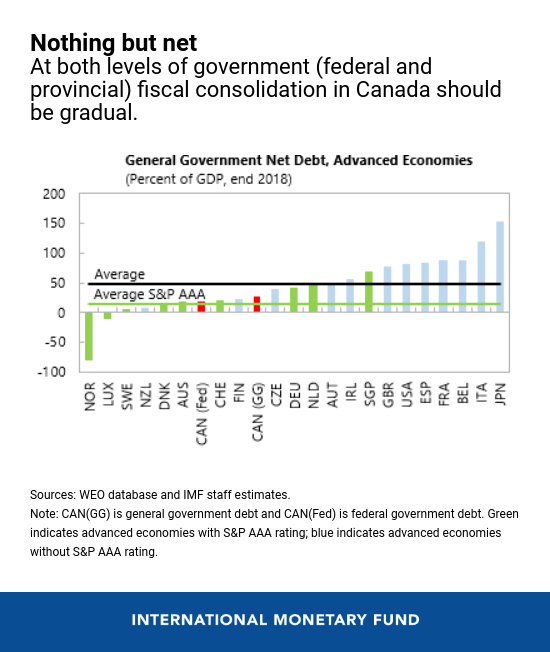

Canadas Economic Outlook The Importance Of Fiscal Responsibility

Apr 24, 2025

Canadas Economic Outlook The Importance Of Fiscal Responsibility

Apr 24, 2025 -

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025 -

Latest Oil Prices Today Market News And Analysis For April 23

Apr 24, 2025

Latest Oil Prices Today Market News And Analysis For April 23

Apr 24, 2025

Latest Posts

-

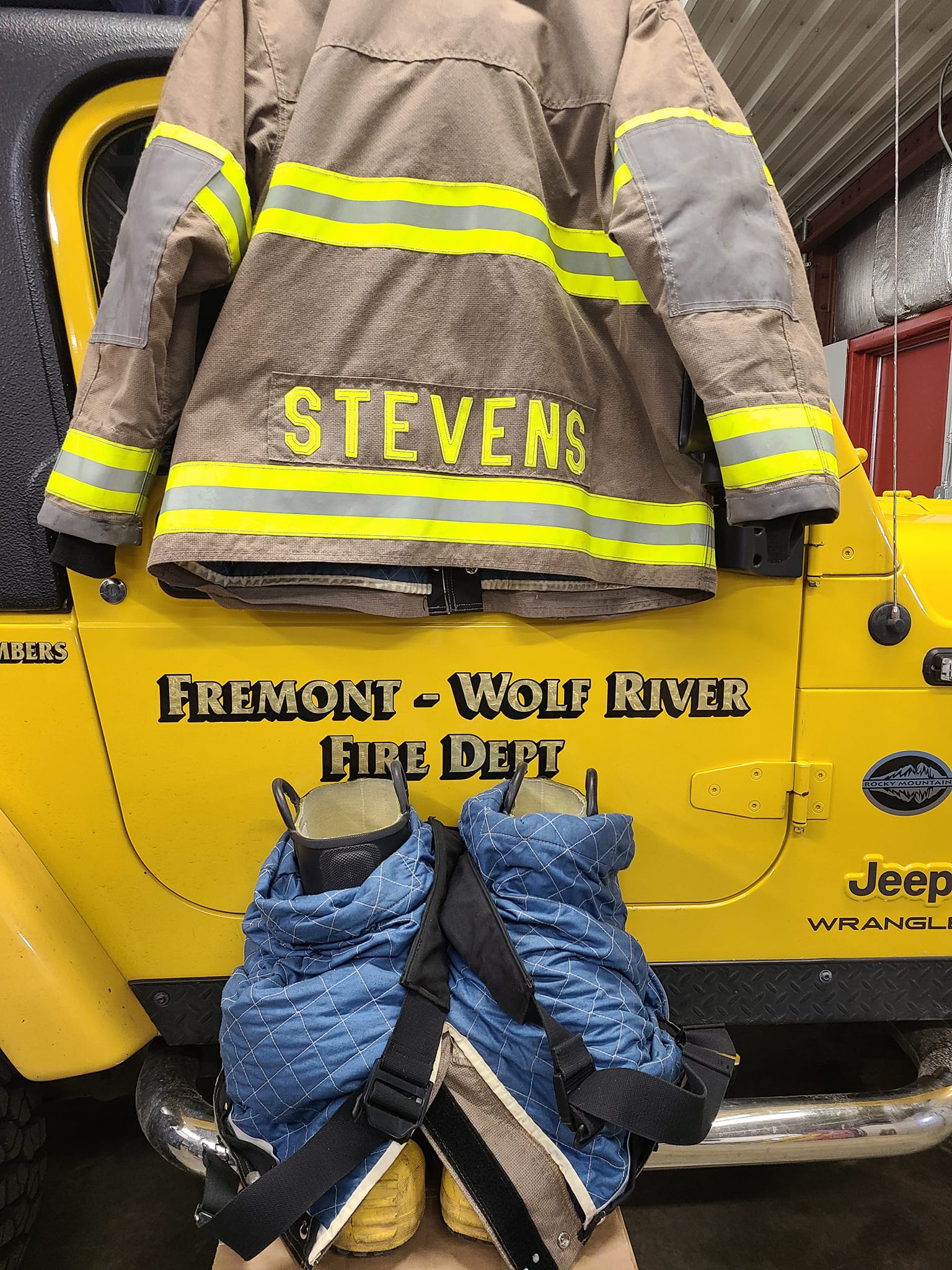

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025

Remembering A Hero Fremont Wolf River Firefighter Honored At National Memorial

May 12, 2025 -

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025

New Music Jessica Simpson Receives Support From Eric Johnson

May 12, 2025 -

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025

National Fallen Firefighters Memorial Honoring Fremonts Wolf River Firefighter

May 12, 2025 -

Jessica Simpson Credits Eric Johnson For New Music

May 12, 2025

Jessica Simpson Credits Eric Johnson For New Music

May 12, 2025 -

Fremont Wolf River Firefighter Honored National Fallen Firefighters Memorial

May 12, 2025

Fremont Wolf River Firefighter Honored National Fallen Firefighters Memorial

May 12, 2025