Are BMW And Porsche Losing Ground In China? A Deep Dive Into Market Dynamics

Table of Contents

H2: The Rise of Domestic Chinese Automakers

The Chinese automotive industry has undergone a dramatic transformation, fueled by innovation and government support. This has directly impacted the market share of established luxury brands like BMW and Porsche.

H3: Increased Competition and Technological Advancement

Chinese automakers like Nio, Xpeng, and BYD are no longer simply playing catch-up; they're setting the pace in certain segments. Their rapid technological advancements, particularly in electric vehicles (EVs) and autonomous driving features, are directly challenging the dominance of traditional luxury brands.

- Competitive Features: Nio's battery swap technology, Xpeng's advanced driver-assistance systems (ADAS), and BYD's Blade Battery technology offer compelling alternatives to established players. These features, often at more competitive price points, are appealing to a growing segment of Chinese consumers.

- Market Share Shift: Data from the China Association of Automobile Manufacturers (CAAM) reveals a steady increase in market share for domestic brands, particularly in the EV sector, while the growth rate of foreign luxury brands has plateaued or even declined in recent years. This shift underscores the increasing competitiveness of the Chinese market.

H3: Shifting Consumer Preferences

The preferences of Chinese consumers are evolving rapidly, driven by a younger generation embracing technology and sustainability. This shift is heavily influencing the demand for luxury vehicles.

- Appeal of Domestic EVs: Younger, tech-savvy Chinese consumers are increasingly drawn to domestically produced EVs, valuing their innovative features, advanced technology, and often, more affordable price tags. Government incentives for EV purchases further boost this trend.

- EV Adoption Rate: China's rapid adoption rate of electric vehicles is transforming the automotive landscape. The growing popularity of EVs is impacting the sales figures of traditional combustion-engine luxury cars, putting pressure on brands like BMW and Porsche to accelerate their electrification strategies.

H2: Economic Factors and Geopolitical Influences

Beyond the competitive landscape, macroeconomic factors and geopolitical events are significantly affecting the luxury car market in China.

H3: Economic Slowdown and Trade Tensions

China's economic growth has slowed in recent years, impacting consumer spending and confidence. Furthermore, trade tensions between China and Germany, including potential tariffs on imported vehicles, have added further complexity to the market.

- Economic Impact: Fluctuating currency exchange rates and decreased consumer confidence directly affect the demand for luxury goods, including high-end vehicles from BMW and Porsche.

- Trade Relations: Import tariffs or trade restrictions imposed on German vehicles would significantly increase the cost of BMW and Porsche models in China, impacting their competitiveness and potentially reducing sales.

H3: Supply Chain Disruptions

Global supply chain disruptions, including semiconductor chip shortages and port congestion, have created significant challenges for automakers, impacting the availability and pricing of vehicles in China.

- Chip Shortages and Logistics: The global chip shortage has caused delays in vehicle production and deliveries, affecting sales figures for both domestic and foreign brands. Increased transportation costs further contribute to higher vehicle prices.

- Delivery Times and Pricing: Longer delivery times and increased prices are impacting consumer purchasing decisions. This is especially pertinent in the luxury car segment, where buyers often expect immediate availability and premium service.

H2: Marketing and Brand Strategies

The success of BMW and Porsche in China hinges on adapting their marketing and branding strategies to resonate with the evolving preferences of the Chinese consumer.

H3: Adapting to the Chinese Market

BMW and Porsche's marketing effectiveness in China is crucial. They must understand and cater to the nuances of this dynamic market.

- Marketing Campaign Effectiveness: Analyzing the effectiveness of their advertising campaigns and digital marketing strategies is critical. Tailoring campaigns to resonate with specific consumer segments within China is essential.

- Dealership Networks: A strong and accessible dealership network is vital for providing premium customer service and building brand loyalty.

H3: Localizing Products and Services

Tailoring products and services to meet the specific preferences of Chinese consumers is no longer optional; it's a necessity.

- Localized Features and Models: Offering vehicle models and features specifically designed to meet the needs and preferences of Chinese drivers is crucial for market success. This may include features related to connectivity, comfort, or even specific design elements.

- Success of Localized vs. Non-Localized Models: Data comparing the sales performance of localized versus non-localized models will highlight the importance of adaptation.

3. Conclusion:

The potential decline of BMW and Porsche's market share in China is a complex issue, influenced by a confluence of factors. Increased competition from technologically advanced domestic brands, a shift in consumer preferences towards EVs, economic headwinds, supply chain disruptions, and the need for effective localized marketing strategies are all key elements. The most significant takeaway is the imperative for these established luxury brands to aggressively adapt to the rapidly changing Chinese automotive market. Understanding the evolving landscape of the Chinese automotive market is crucial. Continue to monitor how BMW and Porsche adapt their strategies to address the challenges and maintain their position in this fiercely competitive market. Keep reading for more analysis on whether BMW and Porsche are truly losing ground in China.

Featured Posts

-

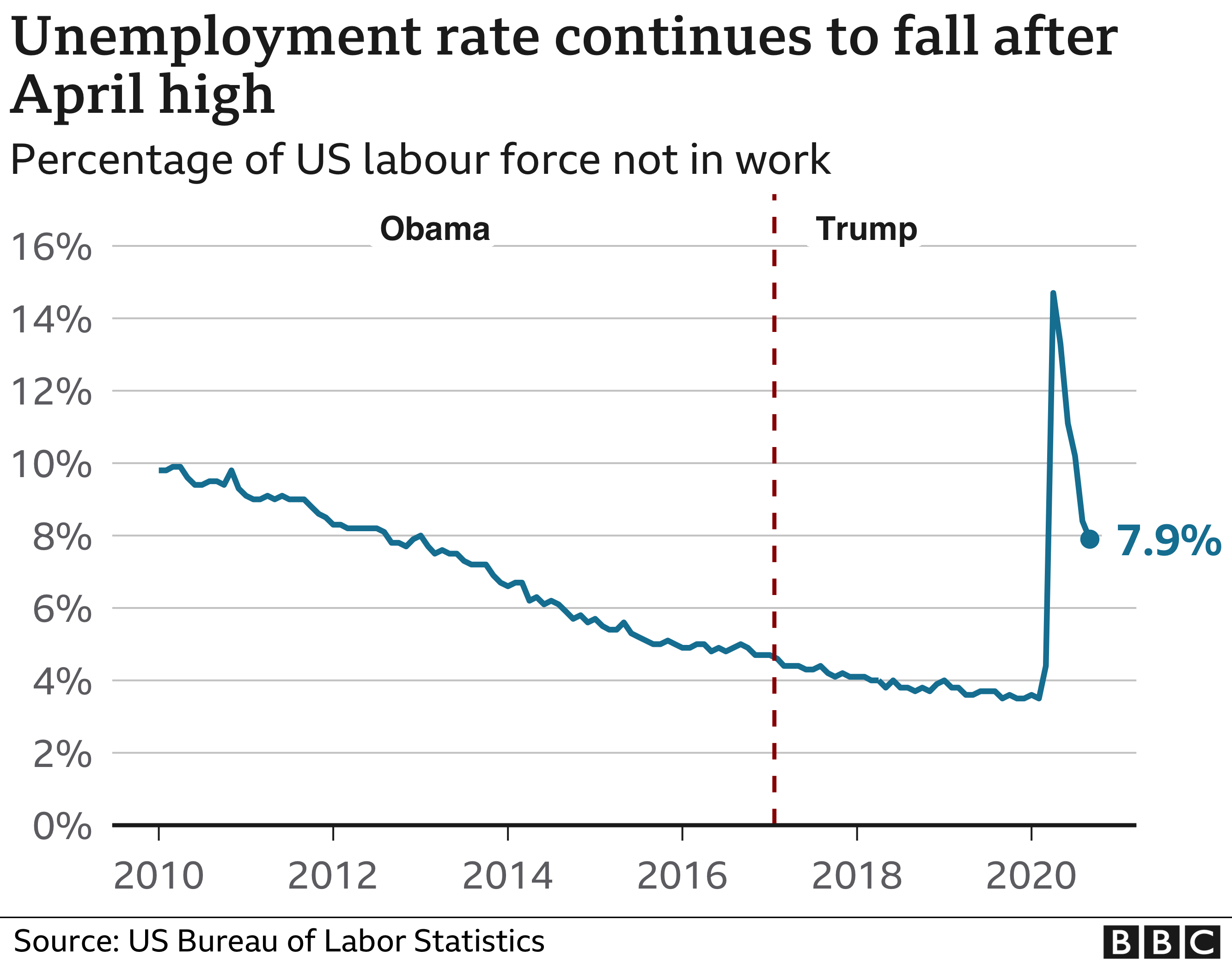

177 000 Jobs Added In April U S Unemployment Rate Remains At 4 2

May 05, 2025

177 000 Jobs Added In April U S Unemployment Rate Remains At 4 2

May 05, 2025 -

Hong Kongs Us Dollar Peg Intervention After A Two Year Pause

May 05, 2025

Hong Kongs Us Dollar Peg Intervention After A Two Year Pause

May 05, 2025 -

Nhl Standings Update Key Matchups And Playoff Scenarios For Friday

May 05, 2025

Nhl Standings Update Key Matchups And Playoff Scenarios For Friday

May 05, 2025 -

Thunderbolts Can Marvels Anti Hero Team Revitalize The Mcu

May 05, 2025

Thunderbolts Can Marvels Anti Hero Team Revitalize The Mcu

May 05, 2025 -

Stefano Domenicali And Formula 1s Explosive Growth A Strategic Analysis

May 05, 2025

Stefano Domenicali And Formula 1s Explosive Growth A Strategic Analysis

May 05, 2025

Latest Posts

-

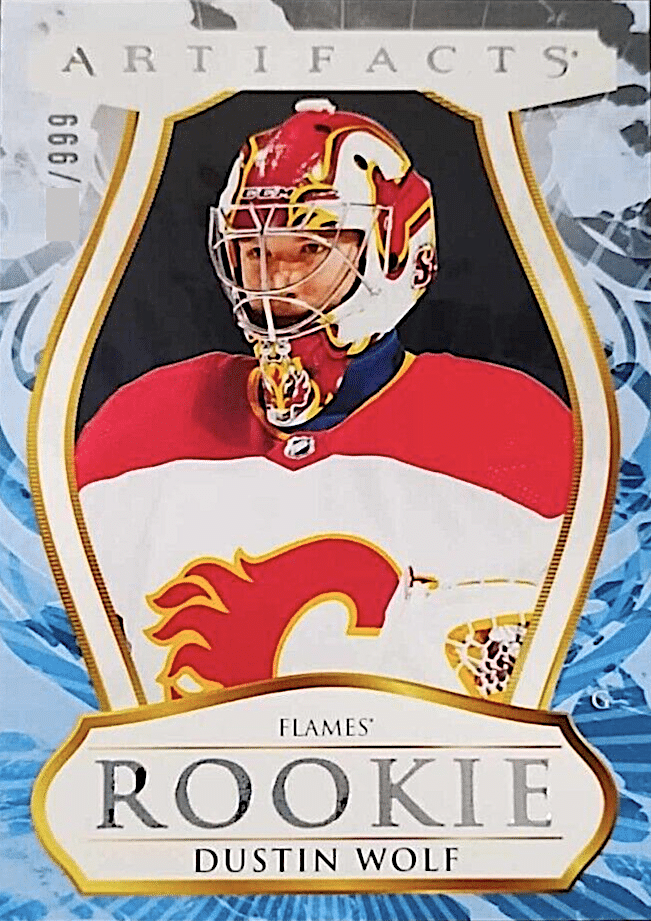

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025

Calgary Flames Wolf Playoff Outlook And Calder Trophy Possibilities In Nhl Com Interview

May 05, 2025 -

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025

All Caps 2025 Capitals Playoff Strategy And Vanda Pharmaceuticals Inc Collaboration

May 05, 2025 -

Vanda Pharmaceuticals Inc Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025

Vanda Pharmaceuticals Inc Partners With Capitals For 2025 Playoffs Initiatives

May 05, 2025 -

Us Tv Ratings For Stanley Cup Playoffs Fall Short Of Expectations

May 05, 2025

Us Tv Ratings For Stanley Cup Playoffs Fall Short Of Expectations

May 05, 2025 -

Stanley Cup Playoffs A Decline In Us Viewership Explained

May 05, 2025

Stanley Cup Playoffs A Decline In Us Viewership Explained

May 05, 2025