One Cryptocurrency Standing Strong Amidst The Trade War

Table of Contents

Bitcoin's Decentralized Nature as a Protective Factor

Bitcoin's inherent decentralization acts as a significant buffer against the volatility caused by geopolitical events like trade wars. This inherent characteristic contributes significantly to its Cryptocurrency Trade War Resilience.

Reduced Vulnerability to Geopolitical Events

- Lack of centralized control: Unlike traditional financial systems susceptible to government intervention and sanctions, Bitcoin operates on a decentralized network. This makes it less vulnerable to trade restrictions or regulatory changes impacting traditional markets. Its resilience to government control is a key factor in its ability to withstand trade war pressures.

- Global network of nodes: Bitcoin's network spans the globe. Disruptions in one geographic region have minimal impact on its overall functionality. This global distribution is a critical element of its Cryptocurrency Trade War Resilience.

- Example: During previous trade disputes, Bitcoin transactions continued largely unaffected, showcasing its resilience in the face of international tensions. This historical performance reinforces its position as a potential safe haven asset.

Enhanced Security and Transparency

Bitcoin's underlying blockchain technology contributes significantly to its stability. Its transparent and secure nature boosts its Cryptocurrency Trade War Resilience.

- Immutable ledger: The blockchain's transparent and immutable nature provides a high degree of trust and verifiability. This reduces uncertainty during times of economic instability, making it a more reliable asset.

- Cryptographic security measures: Robust cryptographic security measures protect against hacking and manipulation, making it a more secure store of value compared to centralized systems vulnerable to manipulation during times of crisis.

- Comparison with centralized systems: Centralized systems, conversely, are more vulnerable to manipulation and government intervention, highlighting Bitcoin's advantage.

Technological Advancements Driving Bitcoin's Strength

Bitcoin's ongoing development and technological advancements further enhance its ability to withstand economic shocks, solidifying its Cryptocurrency Trade War Resilience.

Scalability and Efficiency Improvements

Ongoing upgrades and innovations are improving Bitcoin's transaction speed and cost-effectiveness.

- SegWit and Lightning Network: Implementations like SegWit and the Lightning Network have significantly improved transaction throughput, addressing scalability concerns and making it more efficient during periods of high demand.

- Enhanced Efficiency: These improvements make Bitcoin a more attractive option during market volatility, as users can process transactions faster and more cheaply.

- Comparison with slower cryptocurrencies: Compared to slower or less efficient cryptocurrencies, Bitcoin's improvements solidify its position as a leading digital asset, strengthening its Cryptocurrency Trade War Resilience.

Growing Adoption and Ecosystem Development

The expanding use of Bitcoin across various sectors demonstrates its resilience beyond speculative trading.

- Real-world applications: Bitcoin's adoption is expanding beyond mere speculation. Its use in cross-border payments and as a store of value is growing rapidly.

- Growing user base: The increasing number of users, merchants, and developers actively contributing to the Bitcoin ecosystem underscores its enduring appeal and strengthens its long-term viability.

- Beyond speculation: This showcases Bitcoin’s resilience beyond speculation, highlighting its potential as a long-term investment.

Bitcoin's Unique Value Proposition in a Turbulent Market

Bitcoin's unique characteristics position it as an appealing investment option during periods of economic uncertainty, demonstrating its Cryptocurrency Trade War Resilience.

Hedging Against Traditional Assets

Many investors view Bitcoin as a safe-haven asset during trade conflicts and market volatility.

- Inflation hedge: Its limited supply makes it a potential hedge against inflation or currency devaluation.

- Comparison with gold: Often compared to gold, Bitcoin offers similar properties as a store of value but with greater accessibility and speed of transaction.

- Price stability (relative): While volatile in the short term, Bitcoin has historically shown relative price stability compared to other cryptocurrencies during periods of global economic uncertainty.

Potential for Long-Term Growth

Bitcoin's future prospects and ongoing developments contribute to its long-term growth potential.

- Technological roadmap: Continued development and technological upgrades are expected to enhance its efficiency, security, and scalability.

- Market capitalization and adoption rate projections: Positive projections for market capitalization and adoption rate suggest significant growth potential.

- Fundamental value proposition: Bitcoin's fundamental value proposition as a decentralized, secure, and transparent digital currency strengthens its position for long-term success.

Conclusion

Bitcoin's resilience amidst global trade wars is undeniable. Its decentralized nature, technological advancements, and unique value proposition contribute significantly to its Cryptocurrency Trade War Resilience. Its ability to function independently of traditional financial systems, combined with its growing adoption and ongoing development, makes it a compelling asset in uncertain times.

While the global economic landscape remains uncertain, Bitcoin stands as a beacon of stability in the cryptocurrency market. Learn more about Bitcoin and explore its potential as a resilient investment option in the face of future trade wars and market volatility. Explore Bitcoin investment opportunities today! (Include relevant links here)

Featured Posts

-

Seven Iditarod Newcomers Race To Nome Their Stories And Challenges

May 09, 2025

Seven Iditarod Newcomers Race To Nome Their Stories And Challenges

May 09, 2025 -

Mstwa Fyraty Me Alerby Alqtry Bed Antqalh Mn Alahly Almsry

May 09, 2025

Mstwa Fyraty Me Alerby Alqtry Bed Antqalh Mn Alahly Almsry

May 09, 2025 -

Solve The Nyt Spelling Bee April 12 2025 Clues And Solutions

May 09, 2025

Solve The Nyt Spelling Bee April 12 2025 Clues And Solutions

May 09, 2025 -

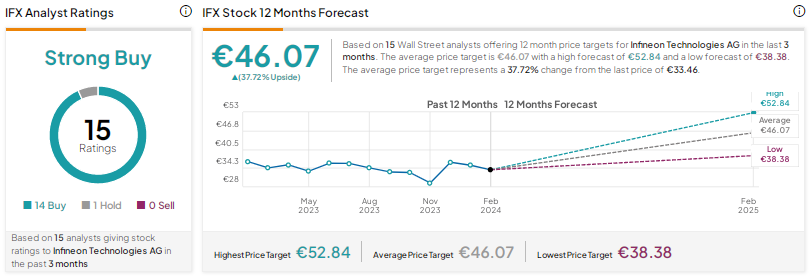

Trump Tariffs Weigh On Infineon Ifx Sales Guidance And Market Outlook

May 09, 2025

Trump Tariffs Weigh On Infineon Ifx Sales Guidance And Market Outlook

May 09, 2025 -

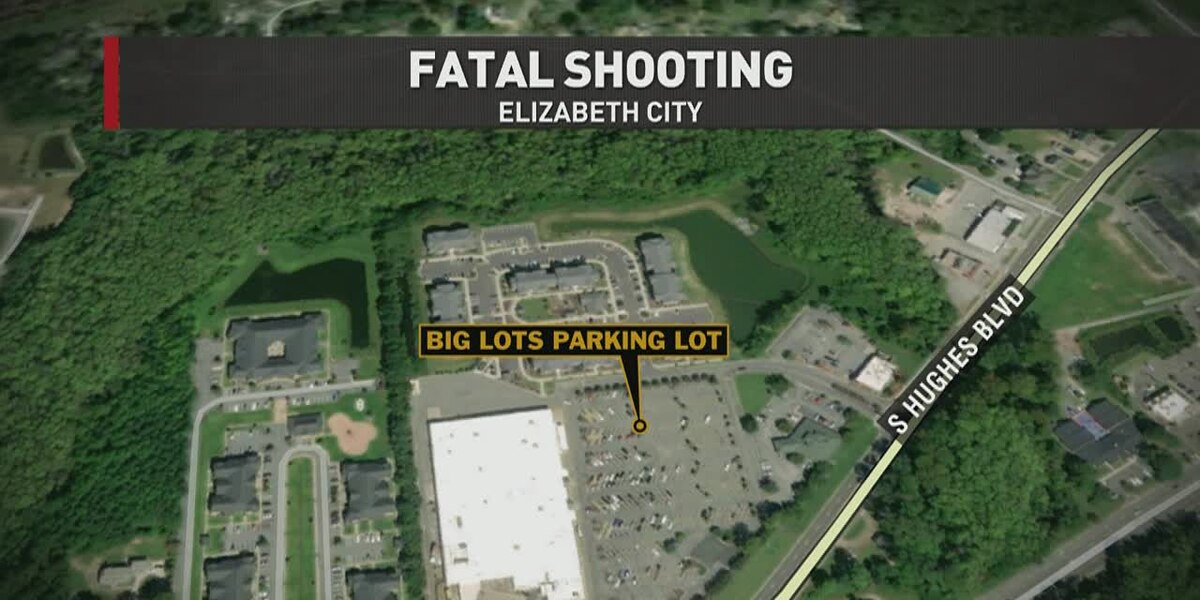

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartment Communities

May 09, 2025