Ontario Budget 2024: Expanded Manufacturing Tax Credit Expected

Table of Contents

Current State of the Ontario Manufacturing Tax Credit

The Ontario Manufacturing Tax Credit currently provides a tax reduction to eligible businesses engaged in manufacturing activities within the province. Understanding its current structure is crucial before examining the anticipated changes.

- Current Eligibility Requirements for Businesses: Businesses must be incorporated in Ontario and carry on manufacturing activities that meet specific criteria. This often includes activities such as processing, assembling, and fabricating goods. Specific industry classifications are typically defined by the government.

- Current Tax Rate Percentage and Calculation Methods: The current tax rate is [Insert Current Rate - this information needs to be sourced from official government documents]. The calculation is generally based on a percentage of eligible manufacturing expenses incurred during the tax year.

- Examples of Qualifying Manufacturing Activities: These typically include activities such as food processing, automotive manufacturing, aerospace manufacturing, and the production of various consumer goods. Precise details are outlined in the official program guidelines.

- Limitations and Exclusions of the Current Program: Certain expenses are not eligible, and there may be limitations on the maximum credit amount a business can claim. These details should be verified through official government resources.

Expected Expansions in the 2024 Budget

While the specifics are yet to be officially released, several reports and expert opinions suggest potential expansions to the Ontario Manufacturing Tax Credit in the 2024 budget. It is important to remember that these are predictions and should be treated as such until confirmed by the government.

- Potential Increase in the Tax Credit Rate: Some analysts predict an increase in the tax credit rate, potentially making it more attractive for businesses to invest in Ontario. This could range from a small percentage point increase to a more substantial revision.

- Possible Expansion of Eligible Manufacturing Activities: The scope of qualifying activities might be broadened to include industries currently excluded or to encompass a wider range of manufacturing processes.

- Expected Changes to Eligibility Criteria: The government might lower the barriers to entry, potentially including smaller businesses or specific sectors that were previously ineligible. This would make the tax credit accessible to a larger segment of Ontario's manufacturing community.

- Potential Extension of the Program's Timeframe: The program's duration might be extended to provide manufacturers with long-term certainty and encourage sustained investment.

Impact on Ontario Manufacturers

An expanded Ontario Manufacturing Tax Credit will likely have a significant positive impact on Ontario's manufacturing landscape.

- Increased Profitability and Competitiveness for Ontario Manufacturers: A higher tax credit will directly increase profitability, allowing businesses to be more competitive both domestically and internationally. This enhanced competitiveness could lead to greater market share.

- Stimulus for Investment in New Technologies and Equipment: Increased profitability will empower manufacturers to invest in modernizing their facilities, adopting new technologies, and improving efficiency. This is crucial for remaining competitive in a globalized market.

- Potential Job Creation and Economic Growth within the Province: Increased investment and competitiveness will stimulate job creation, boosting employment within the manufacturing sector and indirectly impacting related industries. This contributes to broader economic growth across Ontario.

- Attracting New Manufacturing Businesses to Ontario: A more generous tax credit could attract new manufacturers to set up operations in Ontario, boosting the province's overall manufacturing capacity and economic output. This inflow of new investment and jobs would strengthen the economy.

Challenges and Considerations

While the expansion presents significant opportunities, it’s crucial to consider potential challenges:

- Potential Administrative Burden for Businesses Claiming the Credit: Increased complexity in the program could lead to higher administrative costs for businesses in managing the claim process.

- Potential Impact on Provincial Budget and Deficit: The expanded tax credit will likely involve a significant increase in government expenditure, potentially affecting the provincial budget and deficit.

- Ensuring Equitable Distribution of Benefits Across Different Manufacturers: The design of the program needs to ensure that benefits are distributed fairly across different sizes and types of manufacturers, preventing unfair advantages for certain businesses.

Preparing for the Expanded Ontario Manufacturing Tax Credit

Manufacturers should proactively prepare for the potential changes to the Ontario Manufacturing Tax Credit.

- Review Current Manufacturing Processes and Eligibility for the Credit: Analyze your manufacturing activities to identify areas where you can maximize the benefits of the expanded credit.

- Consult with Tax Advisors to Understand Potential Implications: Engage tax professionals to understand the changes and how they will impact your business’s tax obligations and planning.

- Plan for Potential Investments and Expansions Based on the Anticipated Credit: The increased profitability from the credit can provide an opportunity for strategic investments and expansion plans.

- Stay Informed About Updates and Announcements Regarding the Ontario Budget 2024: Monitor official government sources for updates regarding the budget and the specifics of the expanded Ontario Manufacturing Tax Credit.

Conclusion:

The anticipated expansion of the Ontario Manufacturing Tax Credit in the 2024 budget holds significant promise for Ontario's manufacturing sector. The potential for increased profitability, job creation, and investment is substantial. By carefully considering the potential changes and preparing accordingly, Ontario manufacturers can position themselves to leverage the benefits of this crucial initiative. Stay informed about the details of the Ontario Budget 2024 and consult with financial professionals to fully understand how the expanded Ontario Manufacturing Tax Credit can benefit your business. Don't miss out on this opportunity to strengthen your manufacturing operations and contribute to Ontario's economic growth.

Featured Posts

-

Svitskiy Vikhid Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 07, 2025

Svitskiy Vikhid Rianni Shiroki Dzhinsi Ta Bliskuchi Prikrasi

May 07, 2025 -

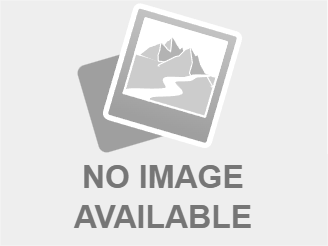

5880 Potential Is This Altcoin The Next Xrp Whale Activity Fuels Speculation

May 07, 2025

5880 Potential Is This Altcoin The Next Xrp Whale Activity Fuels Speculation

May 07, 2025 -

Addressing Ps 5 Stuttering Performance Issues And Their Solutions

May 07, 2025

Addressing Ps 5 Stuttering Performance Issues And Their Solutions

May 07, 2025 -

Onet Le Chateau Votre Sejour Ideal Au Lioran

May 07, 2025

Onet Le Chateau Votre Sejour Ideal Au Lioran

May 07, 2025 -

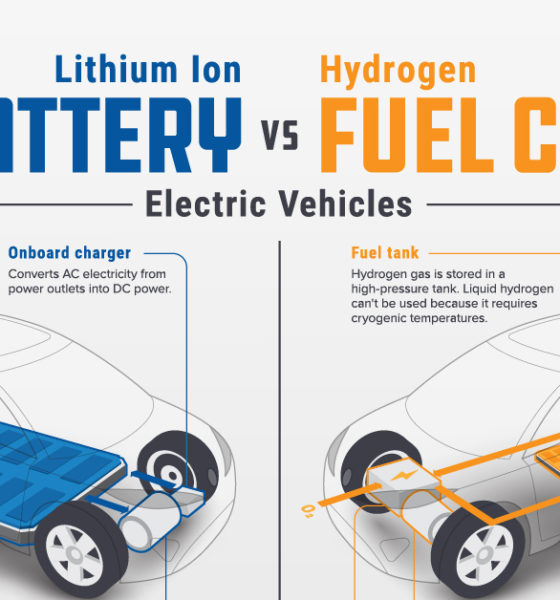

The Future Of European Public Transport Hydrogen Vs Battery Buses

May 07, 2025

The Future Of European Public Transport Hydrogen Vs Battery Buses

May 07, 2025

Latest Posts

-

Jjz Kylye Tby Thfz Lahwr Hayykwrt Awr Dley Edlyh Ka Ahm Aqdam

May 08, 2025

Jjz Kylye Tby Thfz Lahwr Hayykwrt Awr Dley Edlyh Ka Ahm Aqdam

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Jjz Ke Lye Tby Bymh Ka Prwgram Shrwe

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Jjz Ke Lye Tby Bymh Ka Prwgram Shrwe

May 08, 2025 -

Sht Ky Dykh Bhal Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Shwlt

May 08, 2025

Sht Ky Dykh Bhal Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Nyy Tby Bymh Shwlt

May 08, 2025 -

Askwlwn Ke Nye Awqat Kar Lahwr Py Ays Ayl 2024

May 08, 2025

Askwlwn Ke Nye Awqat Kar Lahwr Py Ays Ayl 2024

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kylye Tby Bymh Ka Aelan

May 08, 2025

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kylye Tby Bymh Ka Aelan

May 08, 2025