Organic Growth Takes Precedence: Cenovus CEO On Potential MEG Acquisition

Table of Contents

Cenovus's Stance on Organic Growth Strategies

Prioritizing Internal Expansion and Efficiency

Cenovus is firmly committed to a strategy of internal expansion and operational efficiency to drive its future growth. This approach, prioritizing Cenovus organic growth, focuses on maximizing returns from existing assets rather than pursuing large-scale acquisitions. This commitment is reflected in several key initiatives:

- Significant Investment in Technology: Cenovus is investing heavily in advanced technologies to enhance oil recovery rates and improve operational efficiency across its existing oil sands and upstream operations. This includes leveraging data analytics and automation to optimize production processes.

- Enhanced Oil Recovery (EOR) Projects: The company is actively pursuing EOR projects to extend the lifespan of existing oil fields and boost production from mature assets. These projects utilize innovative techniques to extract additional oil that would otherwise be unrecoverable.

- Streamlining Operations and Cost Reduction: Cenovus is continually striving to streamline its operations, reduce costs, and improve overall productivity. This includes initiatives focused on optimizing logistics, supply chain management, and workforce efficiency.

The financial advantages of Cenovus organic growth are substantial. Internal expansion generally carries lower risk and potentially higher returns compared to acquisitions, minimizing the uncertainties associated with integrating a new company. Data, though not publicly released in specific detail by Cenovus in this case, consistently supports the higher ROI typically associated with organic strategies.

The Financial Case for Organic Growth Over Acquisition

The decision to prioritize organic growth over a major acquisition like the proposed MEG deal has significant financial implications. Acquisitions often involve substantial upfront costs, increased debt levels, and integration challenges that can negatively impact shareholder returns.

- Debt Management: A large acquisition would significantly increase Cenovus's debt burden, potentially hindering future investment opportunities and impacting credit ratings. Organic growth allows for more controlled capital expenditure and maintains a stronger financial position.

- Capital Expenditure: Organic growth strategies typically require lower upfront capital expenditure compared to acquisitions. This allows Cenovus to allocate resources more efficiently across its existing assets and strategic initiatives.

- Shareholder Returns: By focusing on internal growth and operational efficiency, Cenovus aims to generate higher free cash flow, leading to increased shareholder dividends and share buybacks.

The financial models used internally at Cenovus, while not publicly available, likely showcase a more favorable EBITDA and free cash flow projection under the organic growth scenario compared to the potential MEG acquisition.

Evaluating the MEG Acquisition Opportunity

While the potential acquisition of MEG Energy presented certain strategic advantages, such as increased market share and potential synergies, the Cenovus leadership ultimately concluded that the risks and complexities associated with the acquisition outweighed the potential benefits in the current strategic context.

- Strategic Synergies: While some synergies might exist, integration complexities and potential cultural clashes would likely offset any immediate gains.

- Regulatory Hurdles: Acquisitions often face significant regulatory scrutiny, which can lead to delays and uncertainty. The regulatory landscape for energy mergers and acquisitions is currently complex.

- Integration Challenges: Successfully integrating a large acquisition requires significant management time, resources, and expertise. This could distract from the company's core focus on operational excellence and organic growth.

The Broader Implications for the Energy Sector

Industry Trends and Organic Growth Strategies

The energy sector is undergoing a significant transformation, driven by a growing focus on ESG (environmental, social, and governance) factors and the transition towards cleaner energy sources. Cenovus's emphasis on organic growth aligns with these trends, allowing for more targeted investments in sustainable practices and operational improvements. Many other energy companies are also prioritizing organic growth to manage risks and optimize capital allocation within this evolving landscape.

Investor Sentiment and Market Reaction

The market's reaction to Cenovus's decision to prioritize organic growth has been mixed, reflecting the complexities of the energy sector's current dynamics. While some investors may have initially favored a larger acquisition for potential growth, others appreciate the focus on responsible investment and potentially higher long-term returns from a less risky organic approach. This strategic choice may also shape investor sentiment toward other energy companies considering similar acquisitions.

Conclusion: Cenovus's Focus on Sustainable Organic Growth

Cenovus Energy's decision to prioritize organic growth over the potential MEG acquisition reflects a strategic commitment to building sustainable, long-term value for shareholders. This approach mitigates the risks and uncertainties associated with large-scale acquisitions, allowing for a more controlled and efficient allocation of capital. The focus on internal expansion, operational efficiency, and technological innovation presents a financially sound and strategically prudent path forward for Cenovus. By emphasizing Cenovus organic growth, the company is positioning itself for success in the evolving energy landscape. Stay informed about Cenovus Energy's commitment to sustainable organic growth by following our updates and exploring their investor relations materials.

Featured Posts

-

Ineligibilite De Marine Le Pen Analyse De Sa Decision De Faire Appel

May 26, 2025

Ineligibilite De Marine Le Pen Analyse De Sa Decision De Faire Appel

May 26, 2025 -

Understanding The Tensions Between Claire Williams And George Russell

May 26, 2025

Understanding The Tensions Between Claire Williams And George Russell

May 26, 2025 -

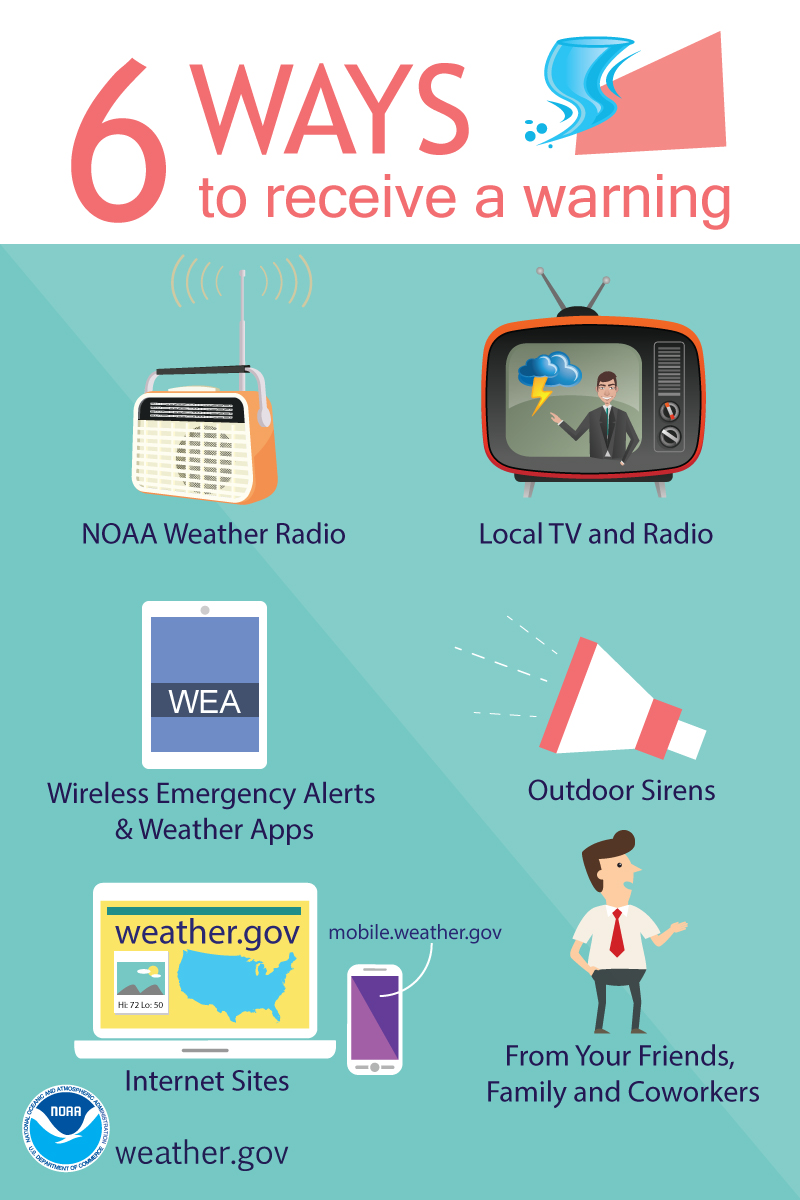

Severe Weather Alert Flood Warning And Safety Precautions Nws

May 26, 2025

Severe Weather Alert Flood Warning And Safety Precautions Nws

May 26, 2025 -

Leclerc Fastest In Monaco Gp Fp 1 Verstappen Closes The Gap

May 26, 2025

Leclerc Fastest In Monaco Gp Fp 1 Verstappen Closes The Gap

May 26, 2025 -

Jenson Fw 22 Extended A Deeper Look

May 26, 2025

Jenson Fw 22 Extended A Deeper Look

May 26, 2025

Latest Posts

-

Abd Tueketici Kredisi Artisi Beklentilerin Uezerinde Bir Performans

May 28, 2025

Abd Tueketici Kredisi Artisi Beklentilerin Uezerinde Bir Performans

May 28, 2025 -

5000 Personal Loans Options For Borrowers With Bad Credit

May 28, 2025

5000 Personal Loans Options For Borrowers With Bad Credit

May 28, 2025 -

Finance Loans For Beginners A Simple Guide To Application And Repayment

May 28, 2025

Finance Loans For Beginners A Simple Guide To Application And Repayment

May 28, 2025 -

Abd De Tueketici Kredileri Beklentileri Asti Yeni Veriler Ve Analiz

May 28, 2025

Abd De Tueketici Kredileri Beklentileri Asti Yeni Veriler Ve Analiz

May 28, 2025 -

Personal Loans For Bad Credit Up To 5000 With Direct Lenders

May 28, 2025

Personal Loans For Bad Credit Up To 5000 With Direct Lenders

May 28, 2025