Pakistan Economic Crisis: IMF's Review Of $1.3 Billion Loan And Geopolitical Implications

Table of Contents

The IMF's Conditions and Pakistan's Economic Realities

The IMF's loan disbursement is contingent upon Pakistan meeting a stringent set of conditions aimed at restoring fiscal sustainability and macroeconomic stability. These conditions demand significant reforms across various sectors, placing immense pressure on the already strained Pakistani economy.

-

Fiscal reforms and revenue generation: The IMF insists on increasing tax revenue through measures like broadening the tax base and enhancing tax collection efficiency. This includes reducing tax exemptions and addressing tax evasion, while simultaneously reducing government expenditure, particularly subsidies on fuel and energy.

-

Structural reforms: The program emphasizes improving governance, tackling corruption, and enhancing the transparency and efficiency of state-owned enterprises. This is crucial for attracting foreign investment and fostering economic growth.

-

Exchange rate adjustments and monetary policy tightening: The IMF advocates for a market-determined exchange rate, which might involve further devaluation of the Pakistani Rupee. Simultaneously, monetary policy tightening through increased interest rates aims to curb inflation.

-

Debt restructuring and sustainable debt management: Pakistan needs to negotiate debt restructuring with its creditors to achieve sustainable debt levels and ensure long-term fiscal stability. This involves addressing its high debt-to-GDP ratio.

-

Impact on the Pakistani population: These measures, while necessary for long-term economic health, will likely exacerbate existing hardships for the Pakistani population. Inflation, already high, is expected to remain elevated, impacting purchasing power and potentially pushing more people into poverty.

Pakistan's capacity to meet these conditions is severely challenged by its current economic woes. The country faces a severe balance of payments crisis, high inflation (currently exceeding 25%), and slow GDP growth. Its debt-to-GDP ratio is alarmingly high, further limiting its fiscal maneuverability. Implementing these reforms swiftly and effectively will require strong political will and effective implementation mechanisms, which remain significant hurdles.

Geopolitical Implications of the Loan Review

The IMF's decision is not solely an economic matter; it carries significant geopolitical weight. Regional and global powers exert considerable influence on the IMF's decision-making process, adding layers of complexity to the situation.

-

China's role: China's significant investment in Pakistan's infrastructure through the China-Pakistan Economic Corridor (CPEC) makes it a key stakeholder. The success of CPEC is intrinsically linked to Pakistan's economic stability, and any disruption caused by the crisis could impact Chinese investments and regional stability.

-

US foreign policy: The US, a major player in the region, has its own strategic interests in Pakistan. Its foreign policy stance towards Pakistan, particularly concerning counterterrorism and regional security, will indirectly influence the IMF's decisions.

-

Influence of other regional players: Other regional players like India and Saudi Arabia, along with other international financial institutions, also have a vested interest in the outcome and may exert their influence on the situation.

-

Implications for regional stability: Failure to secure the IMF loan could destabilize Pakistan, with potentially far-reaching regional consequences. This could include increased social unrest, potential for political instability, and an increase in geopolitical risks.

-

Shifts in alliances and partnerships: The crisis could lead to shifts in alliances and partnerships as Pakistan seeks financial assistance and support from various sources, potentially altering the regional power dynamics.

The impact on Pakistan's relationship with China

The IMF's conditions, particularly those related to debt sustainability, could significantly impact Pakistan's ability to repay its loans from China, potentially straining its relationship with its major economic partner. A failure to meet IMF targets might necessitate renegotiating terms with China, potentially altering the planned phases of CPEC projects.

Potential Solutions and Future Outlook for the Pakistani Economy

Addressing the Pakistan economic crisis requires a multi-pronged approach combining short-term stabilization measures with long-term structural reforms.

-

Economic diversification: Reducing dependence on specific sectors (like textiles) and promoting diversification into technology, renewable energy, and other high-growth sectors is crucial.

-

Investment in human capital: Investing in education, healthcare, and skills development is essential for long-term economic growth.

-

Sustainable development goals: Aligning economic policies with the UN's sustainable development goals, focusing on environmental sustainability and social equity, is crucial for achieving inclusive growth.

-

Improving governance and tackling corruption: Effective governance, transparency, and accountability are paramount for attracting foreign investment and fostering economic growth.

-

Seeking additional financial assistance: Exploring financial assistance from other international organizations and friendly countries can provide crucial short-term relief.

The likelihood of success for these solutions depends on effective implementation, political will, and a collaborative approach involving both domestic and international stakeholders. The future outlook for the Pakistani economy remains uncertain, contingent upon the successful implementation of reforms and the securing of further financial assistance. The path to long-term economic growth will be challenging but achievable with decisive action and sustained commitment.

Conclusion

The Pakistan Economic Crisis presents a formidable challenge, and the IMF's loan review stands as a critical juncture. The conditions imposed by the IMF, while necessary for long-term stability, will impose significant short-term hardship. The geopolitical implications are far-reaching, influencing regional stability and power dynamics. Understanding the intricacies of the Pakistan Economic Crisis and the IMF's role is crucial for informed decision-making. Further research into the potential solutions and geopolitical ramifications is essential for navigating this complex situation.

Featured Posts

-

Dispute On Bbc Show Joanna Pages Comments On Wynne Evans Performance

May 10, 2025

Dispute On Bbc Show Joanna Pages Comments On Wynne Evans Performance

May 10, 2025 -

Uk Visa Restrictions Report Highlights Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report Highlights Potential Nationality Limits

May 10, 2025 -

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025

10 Film Noir Movies Guaranteed To Thrill You

May 10, 2025 -

Military Academies Face Book Review Mandate From The Pentagon

May 10, 2025

Military Academies Face Book Review Mandate From The Pentagon

May 10, 2025 -

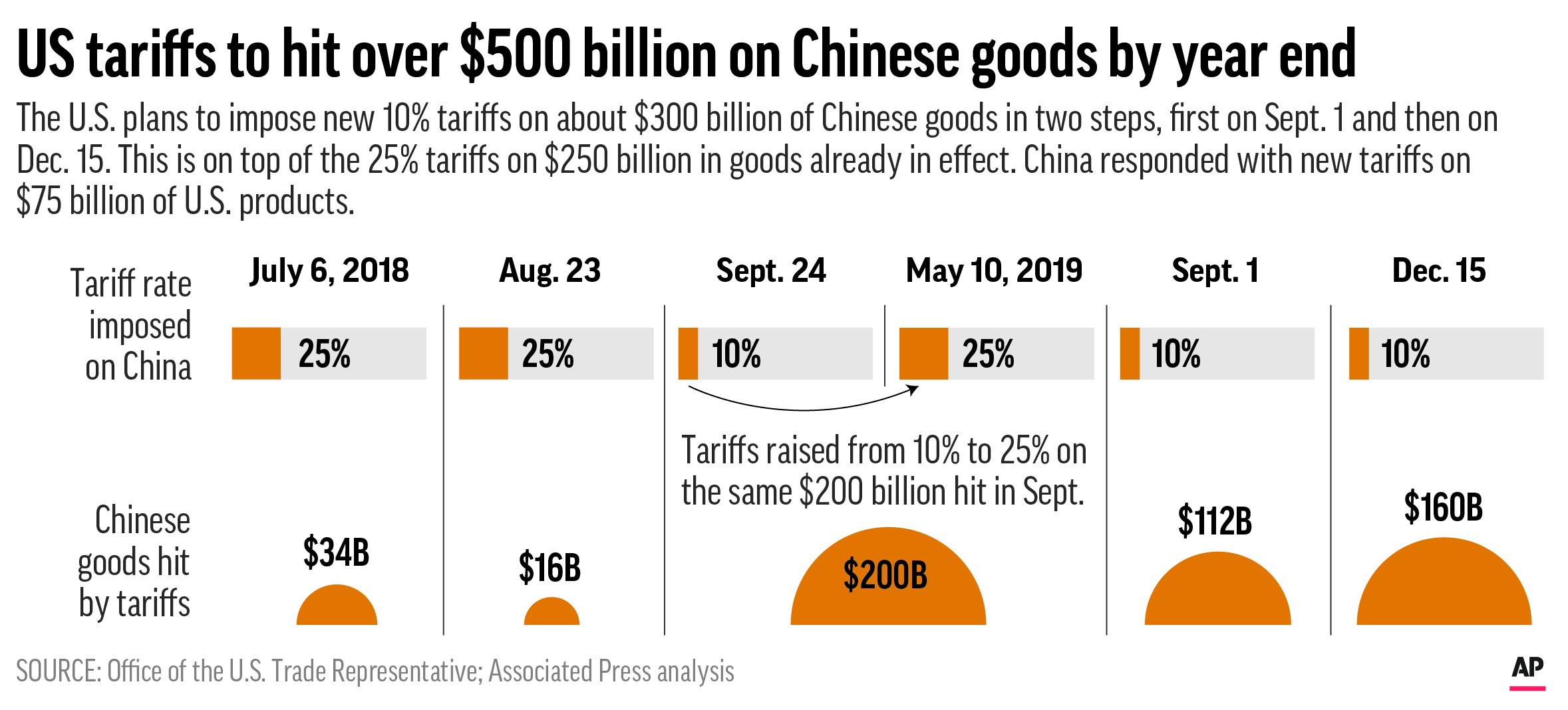

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 10, 2025

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 10, 2025