Pakistan Stock Market Instability: Exchange Portal Outage Amidst Rising Concerns

Table of Contents

The PSX Portal Outage: Technical Glitch or Deeper Issue?

The unexpected shutdown of the PSX online trading portal sent shockwaves through the market. Understanding the nature of this outage is crucial to assessing its broader implications for the Pakistan Stock Market's stability.

Technical Explanation of the Outage:

The exact cause of the outage remains officially unclear, with the PSX releasing only limited statements. However, speculation abounds. Was it a simple server malfunction, a targeted cyberattack, or perhaps a combination of factors contributing to an overload on the system?

- Duration of the outage and its impact on trading volume: The outage lasted for [insert actual duration if known, otherwise estimate and cite source], significantly impacting trading volume and causing disruption for numerous investors. This disruption led to delayed transactions and potential losses for traders.

- Official statements from the PSX regarding the cause of the outage: [Insert official statements from the PSX, if available. If not, state this clearly and mention the lack of transparency]. The lack of detailed information fuels speculation and further erodes investor confidence.

- Speculation regarding the cause (cybersecurity breach, overload, etc.): Several theories are circulating, including a potential cybersecurity breach, an unexpected surge in trading activity overwhelming the system, or underlying infrastructure issues within the PSX's IT network. Independent investigations may be needed to determine the root cause.

- Comparison with past outages (if any) and their impact: [If there have been previous outages, compare their duration, impact, and the PSX's response. This historical context helps determine if this is a recurring issue].

Investor Reactions and Market Sentiment:

The PSX portal outage triggered immediate and significant reactions within the market. Investor confidence, already fragile due to macroeconomic factors, took a further hit.

- Immediate market reaction (e.g., sharp drops, increased volatility): The outage led to [describe the immediate market reaction – e.g., a sharp drop in the KSE-100 index, increased volatility in trading, etc.].

- Investor sentiment surveys and anecdotal evidence: [Cite any available investor sentiment surveys or reports. Include anecdotal evidence from investors and financial analysts about their reactions and concerns]. The overall sentiment suggests a growing distrust in the PSX's reliability and the stability of the Pakistan Stock Market.

- Impact on foreign investment: The outage could deter foreign investors, further limiting capital inflow and hindering economic growth. The incident raises questions about the security and reliability of the PSX for international participants.

- Analysis of trading activity before, during, and after the outage: A comparative analysis of trading data before, during, and after the outage is needed to fully understand its impact on market liquidity and investor behavior. This analysis might reveal patterns related to investor risk aversion and market sentiment.

Underlying Factors Contributing to Pakistan Stock Market Instability

The PSX portal outage is merely a symptom of deeper issues affecting the Pakistan Stock Market's stability. Macroeconomic factors and regulatory shortcomings play a significant role.

Macroeconomic Factors:

The Pakistan Stock Market's instability is intrinsically linked to the country's broader economic challenges.

- Current inflation rates and their impact on investor confidence: High inflation rates erode purchasing power and create uncertainty about future returns, making investors hesitant to invest.

- Analysis of the Pakistani Rupee's exchange rate and its volatility: A volatile exchange rate increases currency risk, deterring both domestic and foreign investors.

- Political climate and its influence on market sentiment: Political instability and uncertainty create an environment of risk aversion, negatively impacting investor sentiment and market confidence.

- Impact of global economic factors on the Pakistan Stock Market: Global economic downturns and fluctuations further exacerbate existing vulnerabilities in the Pakistan Stock Market.

Regulatory and Governance Issues:

Regulatory shortcomings and governance issues contribute to a lack of investor trust and market volatility.

- Transparency and regulatory oversight of the PSX: Concerns remain about the transparency and effectiveness of regulatory oversight within the PSX. Increased transparency is essential for restoring confidence.

- Effectiveness of existing regulations in protecting investors: The efficacy of current regulations in protecting investors from market manipulation and fraud needs to be reviewed and strengthened.

- Potential areas for regulatory improvement: Areas requiring improvement include strengthening investor protection mechanisms, enhancing market surveillance, and promoting better corporate governance practices.

- Comparison with regulatory frameworks in other emerging markets: A comparison with regulatory frameworks in other emerging markets can identify best practices and inform potential reforms in Pakistan.

Potential Solutions and Future Outlook for the Pakistan Stock Market

Addressing the Pakistan Stock Market's instability requires a multi-pronged approach combining short-term solutions with long-term strategies.

Short-Term Solutions:

Immediate steps are needed to mitigate the impact of the outage and restore investor confidence.

- Improved IT infrastructure and cybersecurity measures for the PSX: Investing in robust IT infrastructure and strengthening cybersecurity measures are crucial for preventing future outages.

- Enhanced communication strategies to address investor concerns: The PSX needs to adopt clearer and more transparent communication strategies to build trust and manage investor expectations effectively.

- Temporary measures to support the market: Temporary measures such as providing liquidity support or reducing transaction fees might be necessary to stabilize the market in the short term.

Long-Term Strategies:

Long-term solutions require a holistic approach focused on sustainable growth and development.

- Macroeconomic reforms to address inflation and currency devaluation: Addressing macroeconomic imbalances through fiscal and monetary policies is crucial for creating a more stable economic environment.

- Strengthening regulatory frameworks and improving governance: Enhancing the regulatory framework, improving corporate governance, and promoting transparency are essential for building investor confidence.

- Attracting foreign investment through policy reforms: Attracting foreign investment requires implementing investor-friendly policies, reducing bureaucratic hurdles, and creating a stable and predictable investment climate.

- Fostering a more transparent and efficient market environment: Improving market efficiency, enhancing transparency, and strengthening investor protection are vital for fostering a healthy and thriving Pakistan Stock Market.

Conclusion

The recent Pakistan Stock Market instability, highlighted by the PSX portal outage, underscores the need for urgent action. Addressing both the immediate technical challenges and the underlying macroeconomic and regulatory issues is crucial for restoring investor confidence and fostering sustainable growth. Implementing the short-term solutions while simultaneously pursuing long-term strategies is vital for ensuring the stability and the future success of the Pakistan Stock Market. Understanding the complexities of Pakistan Stock Market instability, and taking proactive measures, is paramount for securing a more robust and resilient financial future. Stay informed on developments concerning Pakistan Stock Market instability to make informed investment decisions.

Featured Posts

-

Los Angeles Wildfires The Ethics Of Betting On Natural Calamities

May 10, 2025

Los Angeles Wildfires The Ethics Of Betting On Natural Calamities

May 10, 2025 -

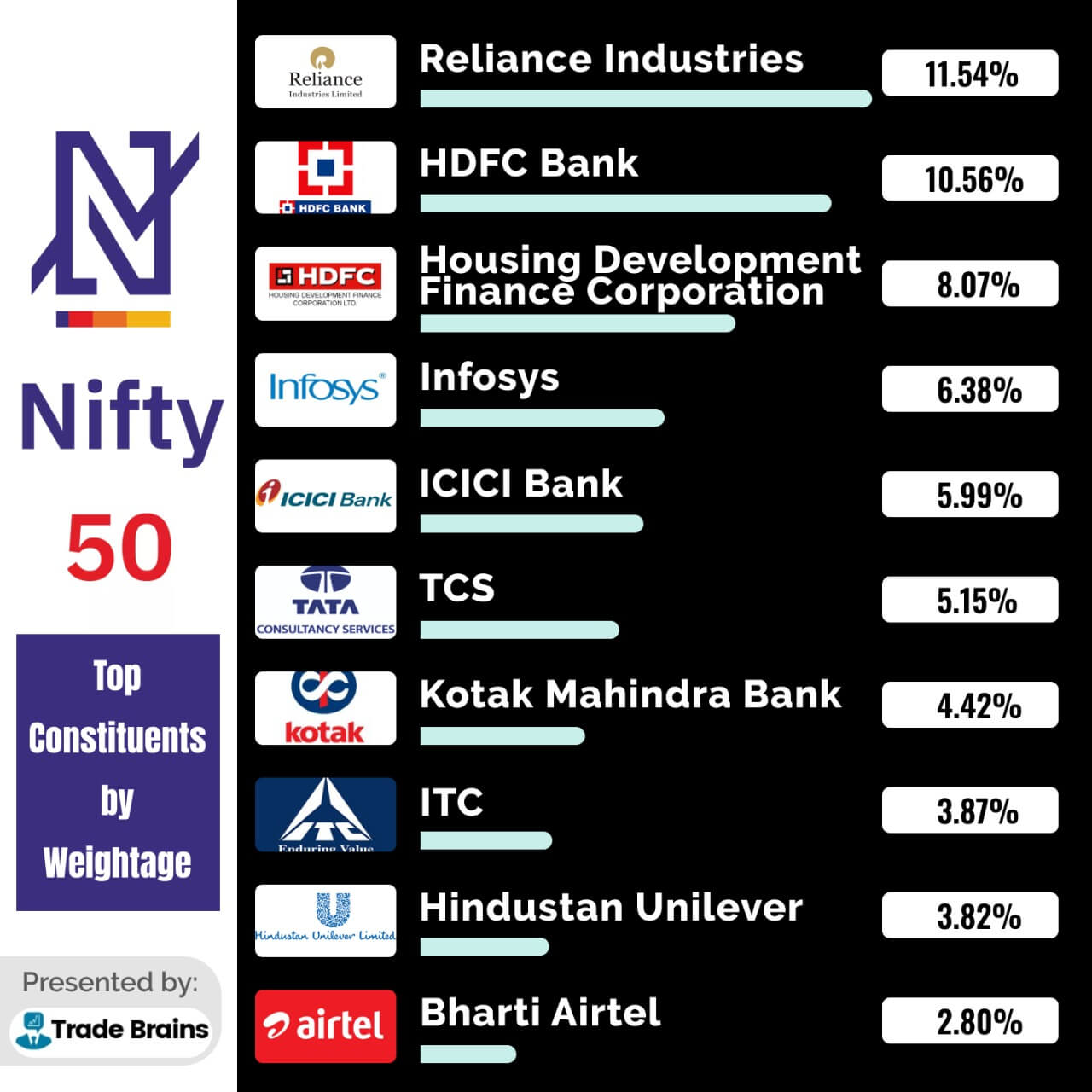

Choppy Trade Flat Finish Analyzing Todays Sensex And Nifty 50 Performance

May 10, 2025

Choppy Trade Flat Finish Analyzing Todays Sensex And Nifty 50 Performance

May 10, 2025 -

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025

Palantirs Path To A Trillion Dollar Market Cap A 2030 Forecast

May 10, 2025 -

Metas Whats App Spyware Verdict A Costly Setback But Not The End

May 10, 2025

Metas Whats App Spyware Verdict A Costly Setback But Not The End

May 10, 2025 -

Leading Nhl Scorer Leon Draisaitl Injured Oilers Face Setback

May 10, 2025

Leading Nhl Scorer Leon Draisaitl Injured Oilers Face Setback

May 10, 2025