Palantir Stock: A Deep Dive Into Q1 2024 Government And Commercial Performance

Table of Contents

Palantir Technologies (PLTR) released its Q1 2024 earnings report, revealing key insights into its performance across both government and commercial sectors. This deep dive analyzes the results, examining the growth drivers, challenges faced, and the overall implications for Palantir stock. We will explore the key figures, providing investors with a comprehensive understanding of Palantir's current trajectory and helping you determine if Palantir stock is a good investment for your portfolio.

Palantir Government Revenue: A Closer Look at Q1 2024 Performance

Analyzing Government Contract Wins and Renewals:

Palantir's government business remains a significant revenue driver. Analyzing Q1 2024 performance requires examining contract wins, renewals, and their impact on overall revenue.

- Significant Contract Wins: While specific details may be limited due to confidentiality agreements surrounding government contracts, analysts should look for public announcements regarding new or expanded partnerships with key government agencies. Large-scale contract wins in areas such as defense, intelligence, and national security significantly boost Palantir's government revenue and demonstrate continued trust from key clients. These contracts often involve multi-year agreements, providing revenue visibility for future periods.

- Contract Renewal Rates: High contract renewal rates are crucial indicators of Palantir's success in delivering value to its government clients. A consistent high renewal rate demonstrates customer satisfaction and strengthens the predictability of future revenue streams. Investors should carefully review the Q1 2024 report for information regarding renewal rates and the length of renewed contracts.

- Q1 2024 vs. Previous Quarters: Comparing Q1 2024 government revenue to previous quarters and yearly projections provides valuable context. Sustained growth showcases a healthy and expanding government business, while a decline may signal potential challenges in securing or renewing contracts. Analyzing the variance and identifying the underlying reasons is critical.

Keywords: Palantir government contracts, US government contracts, defense contracts, intelligence contracts, government spending on technology.

Assessing the Impact of Geopolitical Factors:

Geopolitical events significantly influence government spending and, consequently, Palantir's contracts.

- Global Instability's Influence: Increased geopolitical tensions often lead to heightened government spending on national security and intelligence. This can positively impact Palantir's revenue, as government agencies seek its data analytics solutions for enhanced security and situational awareness. Conversely, periods of reduced geopolitical tension might lead to decreased spending.

- Risks and Opportunities: While increased spending can create opportunities, geopolitical instability presents risks. Changes in government priorities or budget allocations could affect contract awards and renewals. Investors need to consider these risks when assessing the potential impact on Palantir's future government revenue.

Keywords: Geopolitical risk, international relations, government spending, national security.

Palantir Commercial Revenue: Growth Drivers and Challenges in Q1 2024

Examining Growth in Key Commercial Sectors:

Palantir's commercial business is expanding into various sectors, with healthcare and finance showing particular promise.

- Key Growth Sectors: The Q1 2024 report should highlight the growth in specific commercial sectors. Analyzing the performance within these sectors (e.g., healthcare data analytics, financial risk management) helps assess the success of Palantir's strategies to penetrate these markets. Strong growth in key commercial sectors signals the scalability and adaptability of Palantir's platform.

- Customer Acquisition and Retention: Examining customer acquisition and retention rates is vital for understanding commercial business health. High acquisition rates indicate successful marketing and sales strategies, while high retention suggests customer satisfaction and long-term value.

Keywords: Palantir commercial revenue, commercial clients, healthcare data analytics, financial data analytics.

Addressing Challenges and Opportunities in the Commercial Market:

Despite the growth, Palantir faces challenges in the competitive commercial market.

- Market Competition: The data analytics market is highly competitive, with established players and new entrants vying for market share. Analyzing Palantir's competitive strategies and its ability to differentiate its platform is crucial. Understanding its competitive advantages, such as its advanced data integration capabilities and strong security features, is important.

- Overcoming Challenges and Capitalizing on Opportunities: Palantir's strategies to overcome challenges and capitalize on market opportunities, such as strategic partnerships, targeted marketing campaigns, and product innovation, should be analyzed. Successful implementation of these strategies can positively influence commercial revenue growth and market penetration.

Keywords: Market competition, data analytics market, business intelligence, software as a service (SaaS).

Overall Financial Performance and Stock Valuation

Key Financial Metrics and Analysis:

A comprehensive analysis of Palantir's Q1 2024 financial performance involves scrutinizing key metrics.

- Revenue, Operating Income, Net Income, and Cash Flow: Reviewing these metrics provides a holistic view of Palantir's financial health. Growth in revenue is positive, but sustained profitability (operating income and net income) and strong cash flow are equally important indicators of long-term sustainability.

- Comparison to Analyst Expectations and Previous Quarters: Comparing Q1 2024 results to analyst expectations and previous quarters provides valuable context. Beating expectations suggests positive momentum, while falling short might indicate underlying challenges.

Keywords: Palantir earnings, revenue growth, profitability, cash flow.

Implications for Palantir Stock Price:

The Q1 2024 results significantly impact Palantir's stock valuation.

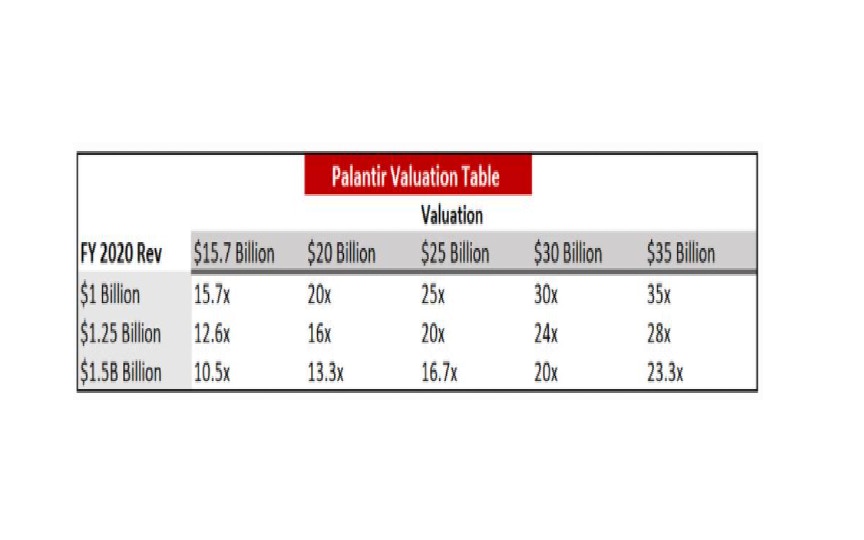

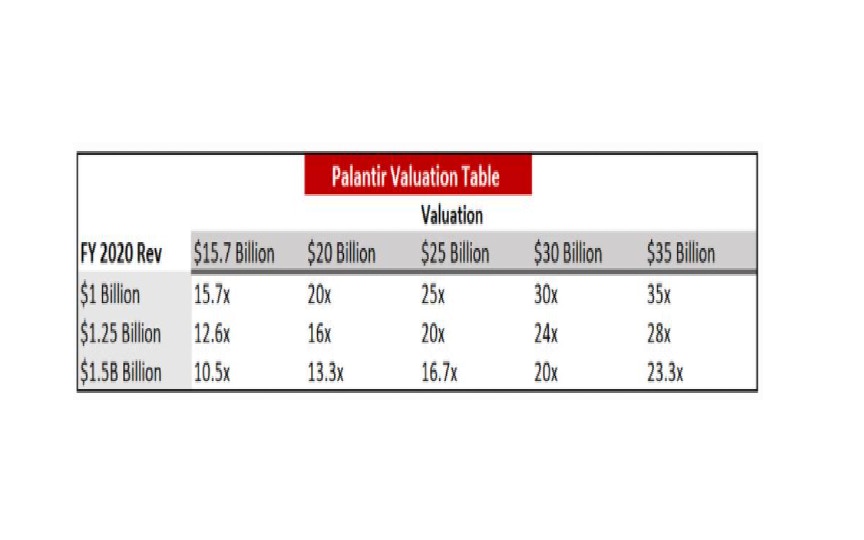

- Stock Valuation and Future Growth Potential: Analyzing how the Q1 2024 results influence the current stock valuation involves assessing future growth potential. Sustained revenue growth, profitability, and strong market positioning can support a higher valuation.

- Investor Sentiment and Market Trends: Investor sentiment and overall market trends play a significant role in Palantir's stock price. Positive investor sentiment and a bullish market can drive the stock price higher, while negative sentiment and a bearish market can lead to price declines.

Keywords: Palantir stock price, stock market analysis, investment strategy, stock valuation.

Conclusion

Palantir's Q1 2024 performance presented a mixed bag, showcasing continued growth in both its government and commercial segments. While strong government contracts contributed significantly to revenue, the commercial sector's performance will require close monitoring. Investors should carefully assess the long-term growth prospects, paying attention to contract renewal rates, expansion into new commercial markets, and the overall competitive landscape. Understanding these factors is crucial for making informed decisions regarding Palantir stock. Further research into Palantir's future plans and market positioning will be crucial for evaluating the long-term value of a Palantir stock investment. Conduct thorough due diligence before making any investment decisions related to Palantir stock.

Featured Posts

-

Palantir Technologies Stock Buy Sell Or Hold An Investors Guide

May 09, 2025

Palantir Technologies Stock Buy Sell Or Hold An Investors Guide

May 09, 2025 -

Uk Visa Restrictions Nigerians And Pakistanis Face Scrutiny

May 09, 2025

Uk Visa Restrictions Nigerians And Pakistanis Face Scrutiny

May 09, 2025 -

Police Face Misconduct Meeting Following Nottingham Attacks Investigation

May 09, 2025

Police Face Misconduct Meeting Following Nottingham Attacks Investigation

May 09, 2025 -

The Hollywood Strike A Joint Effort By Actors And Writers

May 09, 2025

The Hollywood Strike A Joint Effort By Actors And Writers

May 09, 2025 -

Largest Fentanyl Seizure In Us History Pam Bondis Announcement And Its Implications

May 09, 2025

Largest Fentanyl Seizure In Us History Pam Bondis Announcement And Its Implications

May 09, 2025