Palantir Stock Down 30%: Is This A Buying Opportunity?

Table of Contents

Analyzing the 30% Drop in Palantir Stock

Understanding the Reasons Behind the Decline

Several factors likely contributed to the recent significant drop in Palantir stock price. Understanding these factors is crucial for evaluating whether the current price presents a genuine buying opportunity. The volatility of the stock market also plays a considerable role.

-

Market Corrections and Growth Stocks: The recent market correction has disproportionately impacted growth stocks like Palantir. Investors often rotate out of growth sectors during periods of uncertainty, leading to price drops even for fundamentally strong companies. This market volatility is a significant factor impacting the Palantir stock price.

-

Financial Reports and Earnings Calls: Any recent financial reports or earnings calls revealing lower-than-expected revenue or profit margins could have negatively impacted investor confidence. Closely examining these reports is critical for a thorough PLTR stock analysis.

-

Competition in the Big Data Analytics Market: Palantir faces stiff competition from established players and emerging startups in the big data analytics market. Increased competition can pressure profit margins and hinder growth, affecting investor sentiment towards PLTR stock.

-

Geopolitical Events: Geopolitical events affecting government contracts, a significant portion of Palantir's revenue, could also contribute to stock price fluctuations. Uncertainty surrounding these contracts can lead to volatility in the Palantir stock price.

Evaluating Palantir's Long-Term Potential

Despite the recent drop, Palantir boasts significant strengths and long-term potential. The company's innovative technology and expanding market presence suggest a promising future.

-

Strong Government Contracts and Partnerships: Palantir maintains strong relationships with government agencies, securing lucrative and long-term contracts. These contracts provide a stable revenue stream and contribute to the company’s overall financial health.

-

Growth in the Commercial Sector: Palantir is actively expanding its presence in the commercial sector, diversifying its revenue streams and reducing dependence on government contracts. This commercial growth is a crucial aspect of the company's long-term strategy.

-

Innovation in Artificial Intelligence and Data Analytics: Palantir continues to innovate in artificial intelligence and data analytics, developing cutting-edge technologies that address the evolving needs of its clients. This innovation is a key driver of Palantir's competitive advantage.

-

Potential for Future Market Expansion: The global market for data analytics is rapidly expanding, presenting significant opportunities for Palantir's growth and market share expansion. This growth potential is attractive to long-term investors.

Comparing Palantir to Industry Peers

Comparing Palantir's performance to its competitors provides valuable context for assessing its current valuation. While a direct comparison depends on specific metrics, it's essential to consider key factors like revenue growth and market share.

- Revenue Growth: How does Palantir's revenue growth compare to industry leaders like Snowflake or Databricks?

- Market Share: What is Palantir's market share in specific sectors, and how is it changing over time?

- Valuation Metrics: How does Palantir's valuation (Price-to-Sales ratio, for example) compare to its competitors? Is it overvalued or undervalued relative to its growth prospects?

Assessing the Risk and Reward

Risk Factors Associated with Investing in Palantir

Investing in Palantir, like any stock, involves inherent risks. It is essential to understand and evaluate these risks before making an investment decision.

- High Stock Price Volatility: PLTR stock is known for its volatility, meaning its price can fluctuate significantly in short periods.

- Potential for Future Financial Losses: Despite its potential, there's always a risk of future financial losses, particularly in a rapidly changing technological landscape.

- Dependence on a Small Number of Large Clients: Palantir's reliance on a few large clients, especially government agencies, creates vulnerability to changes in these relationships.

Potential Returns and Investment Strategies

Despite the risks, Palantir's long-term growth potential offers significant rewards for patient investors.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, mitigating the impact of short-term price fluctuations.

- Long-Term Investment Strategy: Investing in Palantir with a long-term perspective allows for weathering short-term market volatility and benefiting from the company's potential growth.

- Diversification: Diversifying your investment portfolio across different asset classes reduces overall risk.

Conclusion: Is Palantir Stock a Buy After the 30% Drop?

The 30% drop in Palantir stock presents a complex investment scenario. While the decline offers a potentially attractive entry point for long-term investors who believe in the company's long-term potential, significant risks remain. The high volatility and dependence on government contracts warrant careful consideration. A thorough understanding of the company’s financials, competitive landscape, and future growth prospects is crucial before investing. While the recent drop might present a buying opportunity for some, it's not a guaranteed win.

Conduct your own research and consider your risk tolerance before investing in Palantir stock (PLTR). Always consult with a qualified financial advisor to discuss your investment strategy and whether Palantir aligns with your individual financial goals.

Featured Posts

-

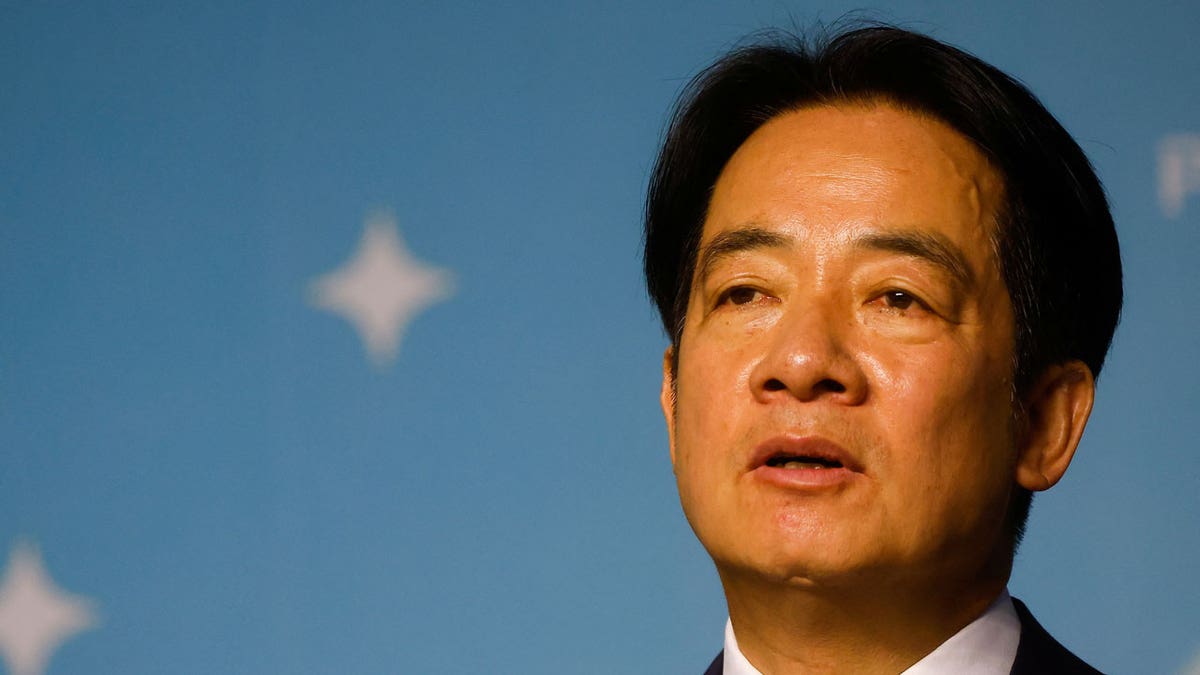

New Totalitarian Threat Taiwans Lai Sounds Alarm In Ve Day Speech

May 09, 2025

New Totalitarian Threat Taiwans Lai Sounds Alarm In Ve Day Speech

May 09, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025 -

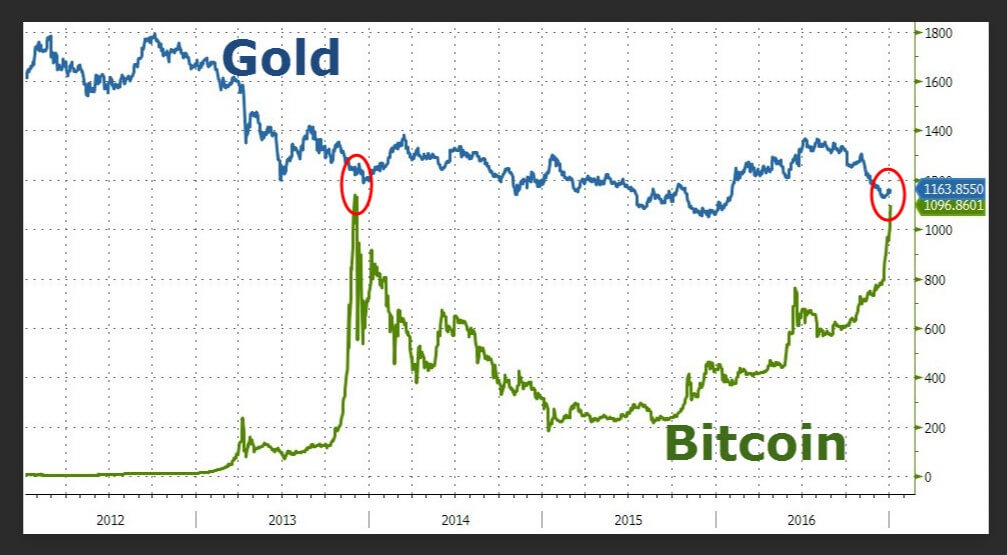

Micro Strategy Vs Bitcoin Investment Strategies For 2025 And Beyond

May 09, 2025

Micro Strategy Vs Bitcoin Investment Strategies For 2025 And Beyond

May 09, 2025 -

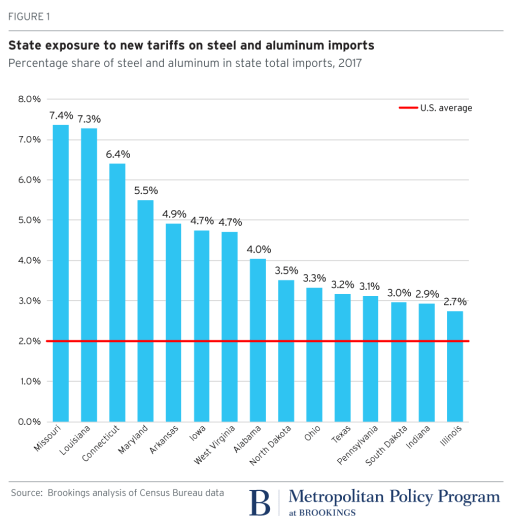

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 09, 2025

Us Tariffs French Minister Pushes For Increased Eu Retaliation

May 09, 2025 -

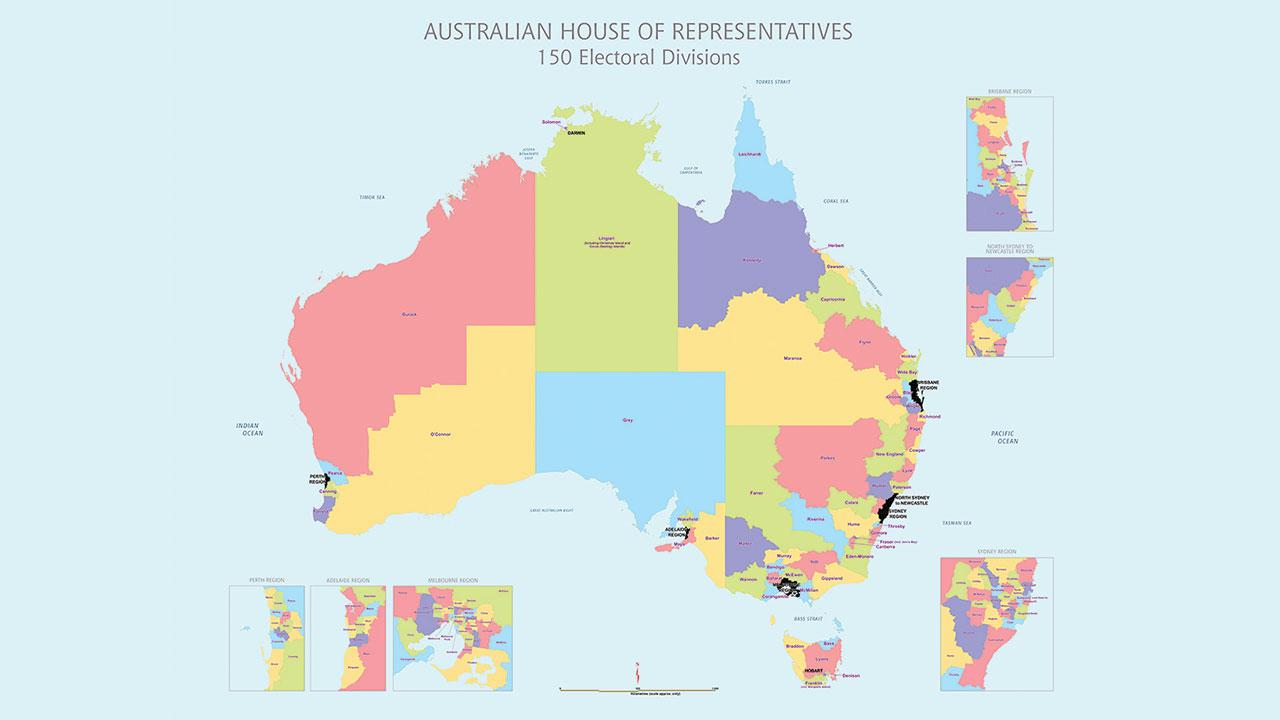

Edmonton Federal Electoral Boundaries Understanding The Changes And Their Impact

May 09, 2025

Edmonton Federal Electoral Boundaries Understanding The Changes And Their Impact

May 09, 2025