Palantir Stock Investment: Weighing The Risks And Rewards Of A Potential 40% Increase In 2025

Table of Contents

Palantir's Business Model and Growth Potential

Palantir's core business revolves around providing advanced data analytics solutions, primarily to government agencies and increasingly to commercial clients. This sophisticated technology helps organizations sift through massive datasets to uncover actionable insights, improving decision-making and operational efficiency.

Data Analytics and Government Contracts

Palantir's revenue is significantly bolstered by substantial government contracts. This dependence, while providing a steady income stream, also introduces a level of risk. However, the increasing demand for sophisticated data analytics within the public sector bodes well for continued growth.

- Key Government Contracts: Palantir holds significant contracts with agencies such as the CIA, the Department of Defense, and various other intelligence and defense organizations globally. The exact values are often confidential for national security reasons, but publicly available information points towards billions in contracts over multiple years.

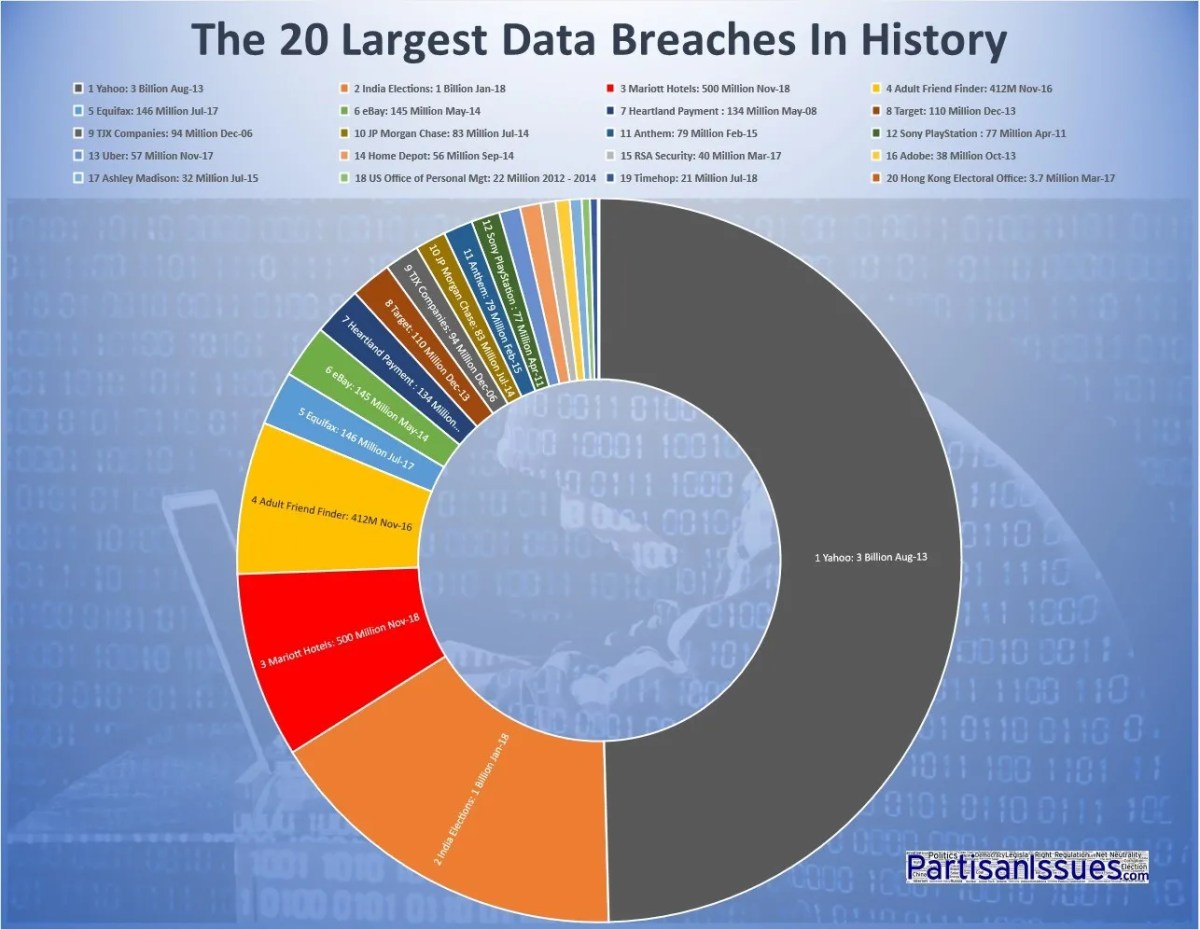

- Growing Public Sector Demand: The ongoing need for enhanced cybersecurity, fraud detection, and predictive policing drives the demand for Palantir's powerful data analytics platform within government bodies worldwide.

- Commercial Sector Expansion: Palantir is actively expanding its reach into the commercial sector, partnering with companies in healthcare, finance, and other industries needing advanced data analysis capabilities. This diversification is crucial for reducing reliance on government contracts and driving future growth.

Technological Innovation and Future Projections

Palantir's commitment to research and development is a key driver of its future growth potential. Continuous innovation ensures its platform stays ahead of the curve, adapting to evolving data landscapes and client needs.

- Key Technological Advancements: Palantir is continuously developing its AI and machine learning capabilities, enhancing its platform's ability to process and interpret vast quantities of complex data.

- Industry Predictions: Industry analysts foresee significant growth in the data analytics market, and Palantir's unique position, particularly its strong government presence, suggests it is well-placed to benefit significantly. Many forecasts project strong revenue growth for the coming years.

- New Product Launches and Partnerships: Palantir's strategic partnerships and the launch of new products designed to address emerging market needs will play a significant role in shaping its future growth trajectory.

Assessing the Risks of Palantir Stock Investment

Investing in Palantir stock, like any tech stock, carries inherent risks. Understanding these risks is paramount before making any investment decisions.

Volatility and Market Sentiment

Palantir's stock price, like many tech stocks, is subject to significant volatility. Market sentiment, news cycles, and geopolitical events can significantly impact its valuation.

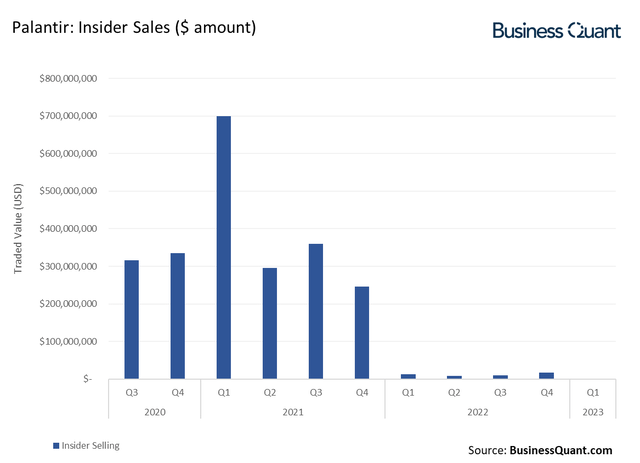

- Historical Stock Price Fluctuations: Analyzing Palantir's historical stock performance reveals considerable price swings, reflecting the sensitivity of its valuation to various market factors.

- Negative Impact Factors: Geopolitical instability, economic downturns, increased competition, and negative news coverage can all negatively influence Palantir's stock price.

Financial Performance and Valuation

A thorough assessment of Palantir's financial performance is essential. Analyzing revenue, profitability, debt levels, and valuation metrics against competitors provides a clearer picture of its financial health and investment potential.

- Profitability and Path to Sustained Profitability: Palantir's path to sustained profitability is a key factor to consider. Investors should scrutinize its financial statements to evaluate its progress in this area.

- Cash Flow and Debt Burden: Analyzing Palantir's cash flow and debt levels offers insights into its financial stability and its ability to weather potential economic downturns.

- Valuation Compared to Competitors: Comparing Palantir's valuation metrics (such as its Price-to-Earnings ratio) to those of its competitors in the data analytics sector provides a benchmark for assessing its relative value.

Strategies for Mitigating Risks and Maximizing Returns

To maximize potential returns while mitigating risks associated with Palantir stock investment, a strategic approach is crucial.

Diversification and Portfolio Management

Diversification is key to mitigating risk. A well-diversified investment portfolio should include a range of assets, not just Palantir stock.

- Diversified Portfolio: Include other tech stocks and non-tech stocks across different sectors to reduce overall portfolio volatility.

- Financial Advisor Consultation: Seeking advice from a qualified financial advisor is highly recommended. They can help you develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Long-Term vs. Short-Term Investment Approach

The choice between a long-term or short-term investment strategy depends on your individual circumstances and risk tolerance.

- Long-Term Holding: Given Palantir's growth potential, a long-term investment approach might be suitable for investors with a higher risk tolerance and a longer time horizon.

- Short-Term Trading: Short-term trading involves greater risk but offers the potential for quicker returns. However, it requires a deep understanding of market dynamics and a higher risk tolerance.

Conclusion

Palantir's potential for growth is undeniable, driven by its strong position in the data analytics market and its innovative technology. However, investing in Palantir stock also entails significant risks, including volatility and the challenges of achieving sustained profitability. The prediction of a 40% increase by 2025 is purely speculative and should not be taken as a guarantee. By diversifying your portfolio, adopting a well-defined investment strategy, and seeking professional advice, you can mitigate risks and potentially benefit from Palantir's growth. Remember to conduct thorough research and consult a financial advisor before making any Palantir stock investment decisions. Continue learning about Palantir stock and its potential; informed investment decisions are always the best ones.

Featured Posts

-

T Mobile Penalty 16 Million For Years Of Data Breaches

May 09, 2025

T Mobile Penalty 16 Million For Years Of Data Breaches

May 09, 2025 -

Should You Buy Palantir Stock After Its 30 Fall

May 09, 2025

Should You Buy Palantir Stock After Its 30 Fall

May 09, 2025 -

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025 -

Maddie Mc Cann Autoridades Britanicas Detienen A Mujer Polaca

May 09, 2025

Maddie Mc Cann Autoridades Britanicas Detienen A Mujer Polaca

May 09, 2025 -

Analiza E Lojes Se Psg 11 Faktore Te Dominimit

May 09, 2025

Analiza E Lojes Se Psg 11 Faktore Te Dominimit

May 09, 2025