Should You Buy Palantir Stock After Its 30% Fall?

Table of Contents

Palantir's Recent Performance and the 30% Drop

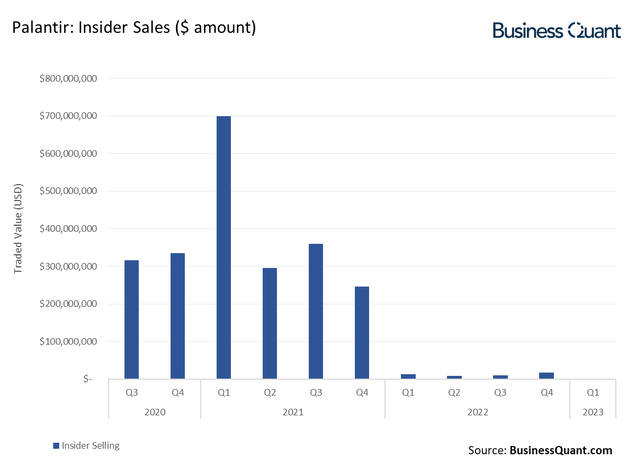

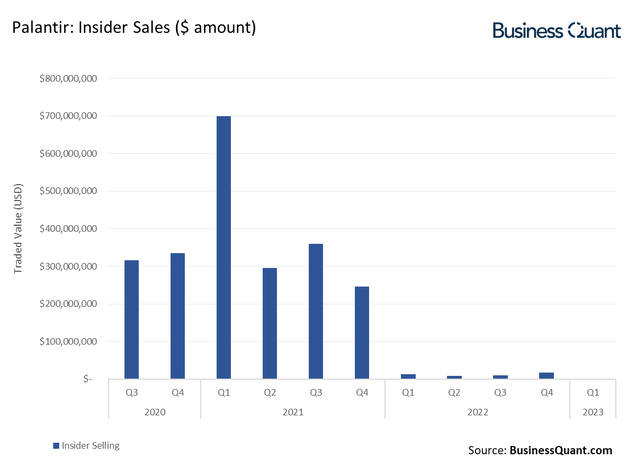

The dramatic 30% fall in Palantir's stock price wasn't a sudden event; it reflects a confluence of factors impacting investor sentiment. While the broader tech sector downturn played a significant role, Palantir's performance also contributed to the decline. Disappointing earnings reports, concerns about its reliance on government contracts, and a generally cautious market outlook all contributed to the sell-off.

[Insert a chart showing Palantir's stock price movement over the relevant period, highlighting the 30% drop.]

- Specific factors contributing to the price fall: Missed earnings expectations, increased competition in the data analytics market, concerns about future growth prospects.

- Comparison to other tech stocks' performance: Compare Palantir's decline to that of similar companies in the tech sector to gauge the extent of its underperformance. (e.g., "While other tech stocks experienced declines, Palantir's drop was significantly steeper, suggesting unique company-specific issues.")

- Analysis of trading volume during the decline: High trading volume during the price drop could indicate a significant shift in investor sentiment, while low volume might suggest a more temporary correction.

Analyzing Palantir's Fundamentals

Despite the recent stock price volatility, a thorough analysis of Palantir's fundamentals is crucial for determining its long-term viability and investment potential. While the short-term picture may look bleak, evaluating key financial metrics offers a more comprehensive view.

Palantir's revenue growth, though fluctuating, demonstrates consistent expansion in its core government and commercial sectors. While profitability remains a work in progress, the company is showcasing progress towards achieving sustainable profitability. Its cash flow situation is relatively strong, providing a buffer against potential economic headwinds. Its flagship products, Gotham and Foundry, continue to attract significant government and commercial clients, securing its position within the data analytics market.

- Key financial metrics and their trends: Present a concise overview of revenue, profit margins, debt levels, and cash flow, emphasizing any positive or negative trends.

- Analysis of customer acquisition and retention: How successfully is Palantir attracting and retaining new clients? This is a key indicator of future growth potential.

- Assessment of competitive landscape and market share: How does Palantir stack up against its competitors? Does it hold a significant market share or is it facing increasing pressure?

Assessing the Risk and Reward of Investing in Palantir Stock Now

Investing in Palantir stock, even after its significant drop, involves both substantial risks and potential rewards. It's vital to carefully weigh both aspects before making any investment decision.

The risks are undeniable: Palantir's valuation remains relatively high, its reliance on government contracts can lead to revenue instability, and competition within the data analytics sector is fierce. However, the potential rewards are equally significant. Palantir holds a first-mover advantage in certain niche markets and possesses the potential for substantial growth fueled by increasing demand for advanced data analytics solutions across diverse industries.

- Risk factors and their potential impact: Clearly outline the risks involved, such as dependence on government contracts, competition, and valuation. Quantify the potential impact of these risks where possible.

- Upside potential and expected return on investment: Based on your analysis of Palantir's fundamentals and market prospects, estimate the potential for future growth and return on investment.

- Comparison to similar investments in the tech sector: How does the risk-reward profile of Palantir compare to other similar investments in the tech sector?

Expert Opinions and Analyst Ratings on Palantir Stock

To gain a more balanced perspective, it's essential to consider the opinions of financial analysts and experts. Analyst ratings on Palantir stock vary, reflecting the diverse views on its future prospects. While some analysts maintain a "buy" rating, citing its long-term growth potential, others express caution, highlighting the inherent risks.

- Summary of key analyst ratings (buy, sell, hold): Present a summary of current analyst ratings, clearly indicating the proportion of each rating.

- Quotes from prominent analysts and their rationale: Include relevant quotes from analysts to showcase the diverse viewpoints.

- Mention of any recent news or updates affecting analyst sentiment: Consider any recent news or announcements that have impacted analyst sentiment.

Conclusion: Should You Buy Palantir Stock After its 30% Fall? A Final Verdict

The 30% drop in Palantir stock price presents a complex investment scenario. While the recent performance has been disappointing, a closer look at the company's fundamentals reveals a business with strong potential for future growth, albeit with inherent risks. The varied opinions among financial analysts further highlight the uncertainty surrounding Palantir's future.

Ultimately, whether or not you should buy Palantir stock depends on your individual risk tolerance and investment horizon. If you're a long-term investor with a high-risk tolerance and believe in Palantir's long-term vision and market position, the current price might present a compelling entry point. However, if you're risk-averse, it's advisable to proceed with caution.

Call to action: Consider investing in Palantir stock after conducting thorough due diligence. Learn more about Palantir's future by researching their financial reports and industry analyses. Make an informed decision about Palantir shares based on your own research and risk assessment. Share this article with others interested in Palantir stock!

Featured Posts

-

Harry Styles On Snl Impression A Disappointed Response

May 09, 2025

Harry Styles On Snl Impression A Disappointed Response

May 09, 2025 -

Aeroport Permi Posledstviya Silnogo Snegopada

May 09, 2025

Aeroport Permi Posledstviya Silnogo Snegopada

May 09, 2025 -

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Scandal

May 09, 2025

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Scandal

May 09, 2025 -

Lightning Defeat Oilers 4 1 Kucherov Leads The Charge

May 09, 2025

Lightning Defeat Oilers 4 1 Kucherov Leads The Charge

May 09, 2025 -

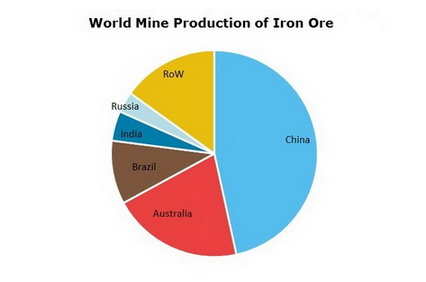

Chinas Steel Production Cuts Impact On Iron Ore Prices

May 09, 2025

Chinas Steel Production Cuts Impact On Iron Ore Prices

May 09, 2025