Palantir Stock Prediction Before May 5th: Should You Buy?

Table of Contents

Palantir's Recent Performance & Financial Health

Analyzing Palantir's recent financial health is crucial for any PLTR stock prediction. We need to examine key metrics to understand the company's trajectory. Let's delve into the details:

-

Review of Q4 2023 earnings: Examining the most recent quarterly earnings report reveals insights into revenue growth, profitability, and overall financial performance. A strong Q4 could signal positive momentum for the stock. Conversely, a disappointing report might indicate a need for caution.

-

Analysis of revenue growth trajectory: Sustained and accelerating revenue growth is a positive indicator of a healthy and expanding business. We need to look at the trend over several quarters to assess the sustainability of this growth. Slowing growth could be a cause for concern.

-

Evaluation of operating margins: Operating margins reveal Palantir's efficiency in managing its operations. Improving margins suggest increased profitability and better cost control, a favorable sign for investors.

-

Assessment of debt levels and cash reserves: A healthy balance sheet with manageable debt and ample cash reserves provides financial flexibility and resilience against economic downturns. High debt levels or low cash reserves could be red flags.

By carefully examining these financial metrics, we can gain a clearer picture of Palantir's current financial health and its potential for future growth.

Upcoming Catalysts and Events Affecting Palantir Stock

Several upcoming events and catalysts could significantly impact Palantir's stock price before May 5th. These external factors play a crucial role in any accurate Palantir stock prediction.

-

Potential new contract announcements: Securing large government or commercial contracts can significantly boost Palantir's revenue and investor confidence. Announcements of significant new partnerships could trigger positive market reactions.

-

Product releases and updates: The launch of new products or substantial updates to existing platforms can influence investor sentiment. Innovative offerings that address market needs can drive growth and attract new customers.

-

Impact of geopolitical instability: Global geopolitical events can significantly impact Palantir's business, particularly its government contracts. Increased tensions or conflicts might lead to increased demand for Palantir's services, while decreased tensions might have the opposite effect.

-

Influence of macroeconomic factors (inflation, interest rates): Economic conditions such as inflation and interest rates significantly affect investor sentiment and market valuations. Rising interest rates can make investment in growth stocks like Palantir less attractive.

These factors, in conjunction with Palantir's internal performance, contribute to the overall forecast.

Technical Analysis of Palantir Stock

While not a substitute for fundamental analysis, technical analysis can offer additional insights. (Disclaimer: This is not financial advice.)

-

Key support and resistance levels: Identifying these levels on the chart can help predict potential price movements. A break above resistance could signal upward momentum, while a break below support might indicate a downward trend.

-

Analysis of moving averages: Moving averages smooth out price fluctuations and can help identify trends. A bullish crossover (short-term MA crossing above long-term MA) could be a positive sign.

-

Review of relative strength index (RSI): RSI helps identify overbought or oversold conditions. An RSI above 70 might suggest the stock is overbought, while an RSI below 30 might suggest it's oversold.

-

Identification of potential breakout points: These points on the chart represent potential turning points in the stock's price movement.

Technical analysis should be used cautiously and in conjunction with fundamental analysis for a comprehensive view.

Risks and Potential Downsides of Investing in Palantir

Investing in Palantir, like any stock, involves risks. A comprehensive Palantir stock prediction must account for these potential downsides.

-

Competition from established tech giants: Palantir faces competition from larger, more established technology companies with substantial resources. This competition could impact its market share and revenue growth.

-

Concerns about data privacy and security regulations: Palantir operates in a data-sensitive industry, making it susceptible to regulatory changes and potential legal challenges related to data privacy and security.

-

Market sensitivity to interest rate changes: As a growth stock, Palantir is more sensitive to interest rate changes than more established companies. Rising interest rates can reduce investor appetite for growth stocks.

-

Potential for slower-than-expected revenue growth: The company's growth trajectory is not guaranteed. Slower-than-expected growth could negatively impact the stock price.

Expert Opinions and Analyst Ratings

To gain a broader perspective, it's essential to consider expert opinions and analyst ratings. (Note: Always verify information with original sources).

-

Summary of key analyst ratings (buy, hold, sell): A range of analyst ratings provides a spectrum of viewpoints on Palantir's future prospects.

-

Analysis of price target ranges: Analyst price targets indicate the expected future price of the stock. A wide range of price targets suggests significant uncertainty.

-

Review of analyst reports and predictions: Reading analyst reports offers detailed insights into their reasoning behind their ratings and predictions.

By reviewing analyst opinions, we can add another layer to our Palantir stock prediction.

Conclusion

Predicting Palantir's stock price before May 5th requires considering its recent financial performance, upcoming catalysts, potential risks, and expert opinions. While some factors suggest potential for growth, others point to potential risks. This analysis highlights the complexity of accurately predicting stock prices.

Call to Action: Based on this analysis and your own research, decide if you should consider buying, selling, or holding PLTR stock. Remember, this Palantir stock prediction is not financial advice. Conduct thorough due diligence and consult a financial advisor before making any investment decisions. Your personal risk tolerance and financial goals should be the primary drivers of your investment strategy.

Featured Posts

-

Black Rock Etf A Billionaire Backed Investment With 110 Growth Projections For 2025

May 09, 2025

Black Rock Etf A Billionaire Backed Investment With 110 Growth Projections For 2025

May 09, 2025 -

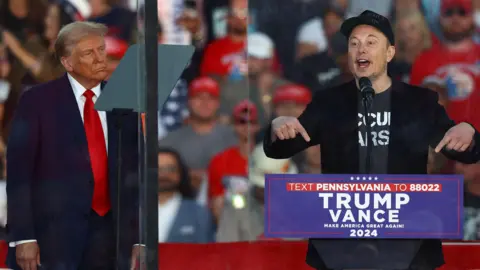

The Impact Of Trumps First 100 Days On Elon Musks Fortune

May 09, 2025

The Impact Of Trumps First 100 Days On Elon Musks Fortune

May 09, 2025 -

The Epstein Case Pam Bondis Role And The Purported Client List

May 09, 2025

The Epstein Case Pam Bondis Role And The Purported Client List

May 09, 2025 -

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Scandal

May 09, 2025

Emmerdale Star Amy Walsh Speaks Out On Wynne Evans Strictly Scandal

May 09, 2025 -

Young Thugs Back Outside Album Release Date Speculation And Hype

May 09, 2025

Young Thugs Back Outside Album Release Date Speculation And Hype

May 09, 2025