Palantir Technology Stock: Should You Invest Before May 5th?

Table of Contents

Palantir's Recent Financial Performance and Future Projections

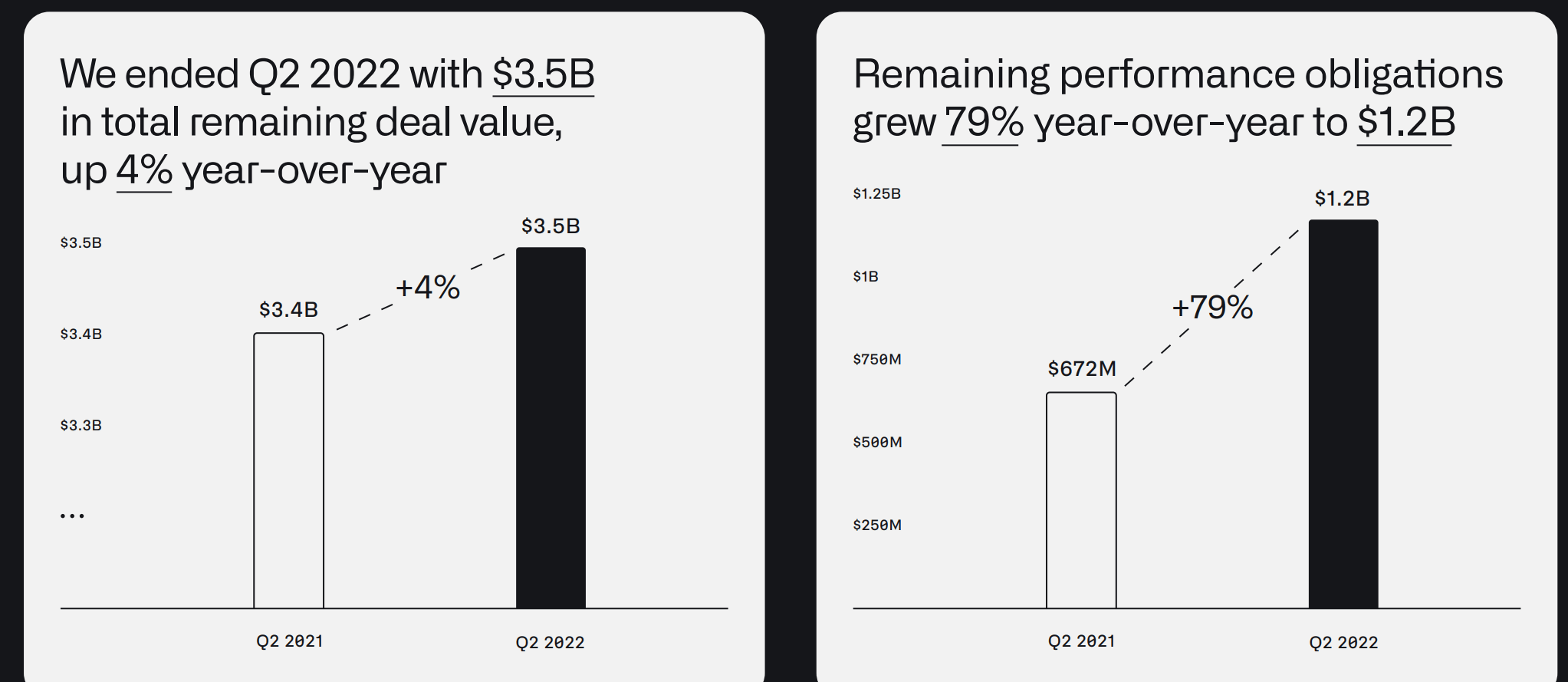

Analyzing Palantir's recent financial performance is crucial for assessing its investment potential. Examining quarterly earnings reports reveals key trends in revenue growth, profitability, and overall financial health. While Palantir has shown significant revenue growth, profitability remains a key area of focus for investors. Analyzing the trajectory of these key performance indicators (KPIs) is essential for determining future prospects.

- Revenue growth rate in the last few quarters: Examine the percentage increase in revenue quarter-over-quarter and year-over-year. Look for consistent growth or signs of acceleration or deceleration.

- Profitability margins and their trajectory: Analyze gross and operating margins to gauge Palantir's efficiency and ability to translate revenue into profit. Is the trend improving, worsening, or remaining stagnant?

- Key performance indicators (KPIs) and their significance: Beyond revenue and margins, consider other KPIs such as customer acquisition cost, customer churn rate, and average revenue per user (ARPU) to gain a holistic view of Palantir's business performance.

- Significant contracts won or lost: Major contract wins or losses can significantly impact Palantir's revenue and stock price. Research any notable announcements related to new contracts or contract renewals.

Analyst predictions and ratings provide further insight into Palantir's future prospects. Consolidating various analyst opinions can offer a well-rounded picture, though remember that these predictions are not guarantees.

Market Sentiment and the Impact of Geopolitical Events

Market sentiment and geopolitical events significantly influence Palantir's stock price. The overall market trend (bullish or bearish) impacts all stocks, including PLTR. Specific factors within the technology sector, such as interest rate hikes, also play a role.

- Overall market trends (bullish or bearish): A bullish market generally supports higher stock prices, while a bearish market can lead to declines.

- Specific factors influencing the tech sector: Regulatory changes, technological advancements, and investor confidence in the tech sector as a whole can all influence Palantir's share price.

- Impact of geopolitical instability on government contracts: Palantir's significant government contracts make it sensitive to geopolitical events. Increased global uncertainty might lead to increased demand for Palantir's services, or it might cause delays or cancellations.

- Investor confidence in the company's long-term growth: Positive news about Palantir's innovation, market expansion, and financial performance boosts investor confidence, potentially leading to higher stock prices.

Competitive Landscape and Palantir's Competitive Advantages

Palantir operates in a competitive big data analytics market. Understanding its competitive advantages is essential. Key competitors include established players and emerging startups. Palantir differentiates itself through its proprietary technology, strong government relationships, and expertise in complex data analysis.

- Key competitors and their market share: Identify the major players in the big data analytics market and their relative market shares. This helps assess Palantir's position within the industry.

- Palantir's technological differentiation: Palantir's proprietary technology, particularly its Gotham platform, gives it a competitive edge. Understand the unique features and capabilities that set it apart.

- Palantir's strengths in specific market segments: Palantir excels in certain niches, such as government intelligence and financial services. Identify these key areas of strength.

- Potential threats from competitors: Analyze the potential challenges from established and emerging competitors, including pricing pressures and technological innovations.

Risks and Potential Downsides of Investing in Palantir Before May 5th

Investing in Palantir stock, before May 5th or any date, involves inherent risks. Consider these potential downsides before making an investment decision.

- High valuation compared to its peers: Palantir's valuation might be considered high relative to its profitability and growth compared to its competitors.

- Dependence on government contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

- Potential for future losses or slowing growth: While Palantir has shown growth, there's always a risk of future losses or slower-than-expected growth.

- Market volatility and its impact on the stock price: The stock market is inherently volatile, and Palantir's stock price can fluctuate significantly based on various factors.

Conclusion: Should You Invest in Palantir Stock Before May 5th?

This analysis of Palantir Technology stock provides insights into its financial performance, market position, and potential risks. While Palantir shows promise in the big data analytics market, potential investors should carefully weigh the potential rewards against the considerable risks. The company's strong government relationships and proprietary technology offer a degree of competitive advantage, but its reliance on government contracts and high valuation represent significant challenges. Before making any investment decisions related to Palantir stock or any other security, remember to conduct your own thorough due diligence, considering your individual risk tolerance and financial goals. The information provided here should not be considered financial advice. Further research on Palantir stock, PLTR stock, and Palantir investment opportunities is strongly encouraged.

Featured Posts

-

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025 -

Should You Buy Palantir Stock Today A Detailed Investment Overview

May 09, 2025

Should You Buy Palantir Stock Today A Detailed Investment Overview

May 09, 2025 -

Matthijs De Ligt Inter Milans Potential Loan Move From Man United

May 09, 2025

Matthijs De Ligt Inter Milans Potential Loan Move From Man United

May 09, 2025 -

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025

Nottingham Attack Survivors Speak Out A First Hand Account

May 09, 2025 -

Elon Musk Remains Richest On Hurun Global Rich List 2025 Despite 100 Billion Loss

May 09, 2025

Elon Musk Remains Richest On Hurun Global Rich List 2025 Despite 100 Billion Loss

May 09, 2025