Palantir's Blowouts: Understanding The Risks Of Its High Stock Multiple

Table of Contents

Palantir's Valuation Compared to Peers

Palantir's business model, centered around providing powerful data analytics and software solutions to government and commercial clients, has attracted significant investment. However, its valuation, reflected in its high stock multiple, warrants careful scrutiny. We will compare Palantir's valuation to its peers using commonly used financial ratios.

Analyzing the Price-to-Sales (P/S) Ratio

The Price-to-Sales (P/S) ratio offers a useful benchmark, particularly for high-growth companies like Palantir that may not yet be consistently profitable. Comparing Palantir's P/S ratio to similar companies in the data analytics and software sectors reveals whether its valuation is justified.

- Palantir's P/S Ratio: (Insert current P/S ratio here).

- Competitor Comparisons:

- Company A: (P/S ratio) – Often cited as a competitor, but its focus on [specific area] differentiates it.

- Company B: (P/S ratio) – A more direct competitor, but with a smaller market share.

- Company C: (P/S ratio) – A larger, more established player with a broader product portfolio.

The differences in P/S ratios may reflect variations in growth rates, profitability, market share, and investor sentiment. Palantir's higher P/S ratio may indicate higher growth expectations or a premium assigned to its innovative technology. However, it also suggests higher risk. (Include a chart comparing P/S ratios for visual clarity.)

Examining the Price-to-Earnings (P/E) Ratio

The Price-to-Earnings (P/E) ratio provides another perspective on valuation, relating the stock price to earnings per share. However, relying solely on the P/E ratio for a high-growth company like Palantir can be misleading.

- Palantir's P/E Ratio: (Insert current P/E ratio, if applicable. Note if it's negative due to current losses).

- Growth Prospects and Profitability: Palantir's current profitability (or lack thereof) significantly impacts its P/E ratio. Future earnings projections are crucial in evaluating this metric. Any significant changes in revenue streams will directly affect its P/E ratio.

- Limitations: In a volatile sector, relying on a P/E ratio alone can be inaccurate because it doesn't fully account for high growth potential, or potential future losses.

Risks Associated with High Growth and Future Projections

Palantir's high stock multiple highlights the inherent risks associated with its growth trajectory and business model.

Dependence on Government Contracts

A substantial portion of Palantir's revenue stems from government contracts. This dependence creates several risks:

- Budget Cuts: Government budget constraints can significantly impact contract renewals and future awards.

- Political Changes: Shifts in political priorities or administrations can lead to changes in procurement policies and funding allocations.

- Contractual Risks: Delays, disputes, or unexpected termination of contracts could negatively affect Palantir's revenue stream.

While Palantir is diversifying its client base, its reliance on government contracts remains a considerable risk factor. (Provide examples of major contracts and their respective values)

Competition in the Data Analytics Market

The data analytics market is highly competitive, with both established tech giants and innovative startups vying for market share.

- Key Competitors: (List key competitors, e.g., AWS, Google Cloud, Microsoft Azure, etc., and their strengths.)

- Palantir's Competitive Advantages: Palantir's advanced platform, strong government relationships, and specialized expertise provide a degree of competitive advantage.

- Competitive Disadvantages: Higher pricing and a potentially steeper learning curve for customers could hinder Palantir's market penetration.

The Impact of Economic Downturns

Economic downturns typically reduce technology spending, which could disproportionately affect Palantir.

- Reduced Spending: Both government and commercial clients might reduce or delay spending on data analytics solutions during economic recessions.

- Contract Cancellations: In severe economic conditions, contracts might be cancelled or renegotiated, impacting Palantir's revenue.

Alternative Valuation Methods and Considerations

To gain a more comprehensive understanding of Palantir's valuation, it's essential to consider alternative methods.

Discounted Cash Flow (DCF) Analysis

DCF analysis provides an intrinsic valuation by discounting future expected cash flows to their present value.

- Challenges: Forecasting future cash flows for a high-growth company like Palantir is inherently uncertain. Assumptions about growth rates, discount rates, and terminal value significantly influence the valuation.

- Key Assumptions: A DCF model relies on various assumptions, such as revenue growth rates, operating margins, and capital expenditures. Sensitivity analysis is vital to understand the impact of changes in these assumptions.

Qualitative Factors

Beyond quantitative metrics, qualitative factors play a significant role in Palantir's valuation.

- Brand Reputation: Palantir's strong brand reputation in the government and intelligence sectors contributes positively to its valuation.

- Technological Innovation: Continued innovation and technological leadership are crucial for maintaining its competitive edge.

- Management Team: The experience and expertise of Palantir's management team influence investor confidence.

- Market Sentiment: Overall market sentiment towards the technology sector and growth stocks significantly affects Palantir's stock price.

Conclusion: Navigating the Risks of Palantir's High Stock Multiple

Investing in Palantir based on its current high stock multiple requires a thorough understanding of the inherent risks. The company's dependence on government contracts, intense competition, and vulnerability to economic downturns all contribute to this risk. While its innovative technology and strong brand reputation offer significant potential, investors must carefully weigh these factors against the high valuation. Thorough due diligence, including detailed financial analysis and an assessment of qualitative factors, is crucial before investing in high-growth, high-multiple stocks like Palantir. Understanding Palantir's high stock multiple and assessing the risks of Palantir's stock valuation are paramount before committing any capital. Conduct further research to make informed decisions aligned with your risk tolerance.

Featured Posts

-

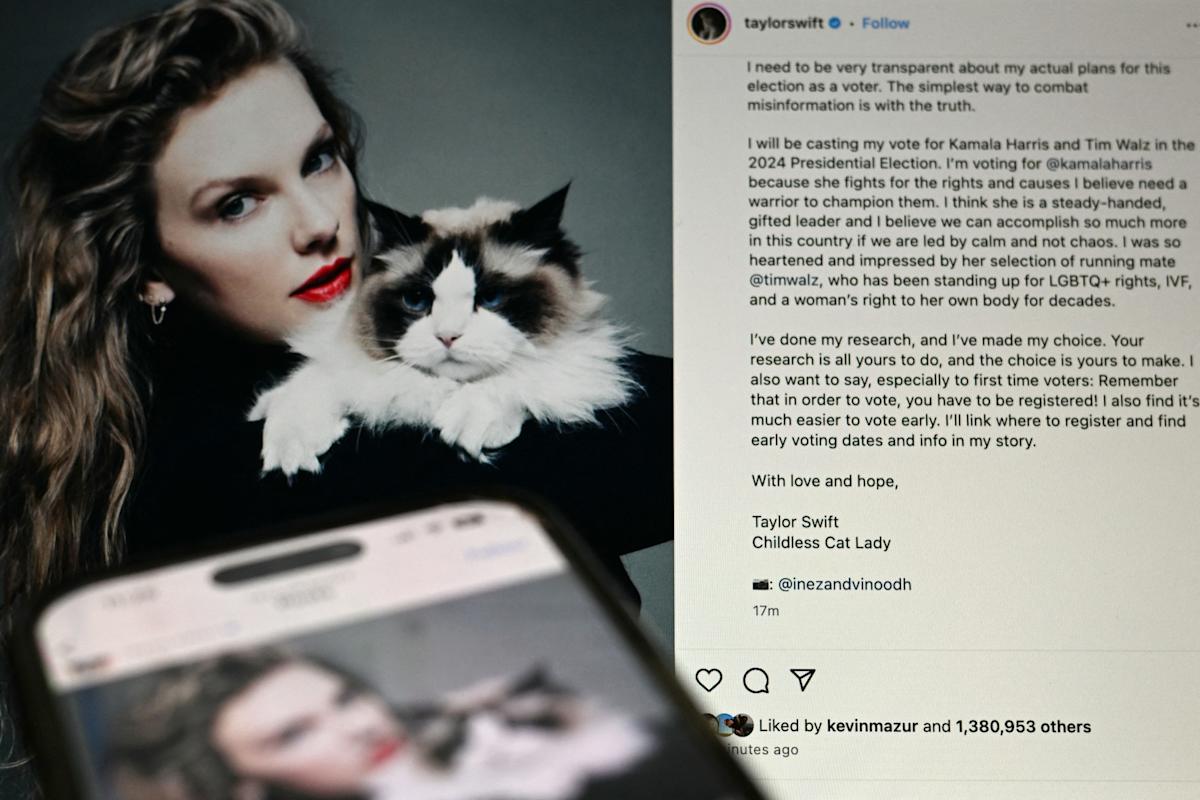

Xrp Investment Surge Trumps Endorsement Fuels Institutional Interest

May 07, 2025

Xrp Investment Surge Trumps Endorsement Fuels Institutional Interest

May 07, 2025 -

Tuesday April 15 2025 Daily Lotto Numbers

May 07, 2025

Tuesday April 15 2025 Daily Lotto Numbers

May 07, 2025 -

Is John Wicks Return In John Wick 5 Possible Keanu Reeves Fate Explored

May 07, 2025

Is John Wicks Return In John Wick 5 Possible Keanu Reeves Fate Explored

May 07, 2025 -

Lewis Capaldi Spotted Looking Healthy And Happy With Unlikely Pal

May 07, 2025

Lewis Capaldi Spotted Looking Healthy And Happy With Unlikely Pal

May 07, 2025 -

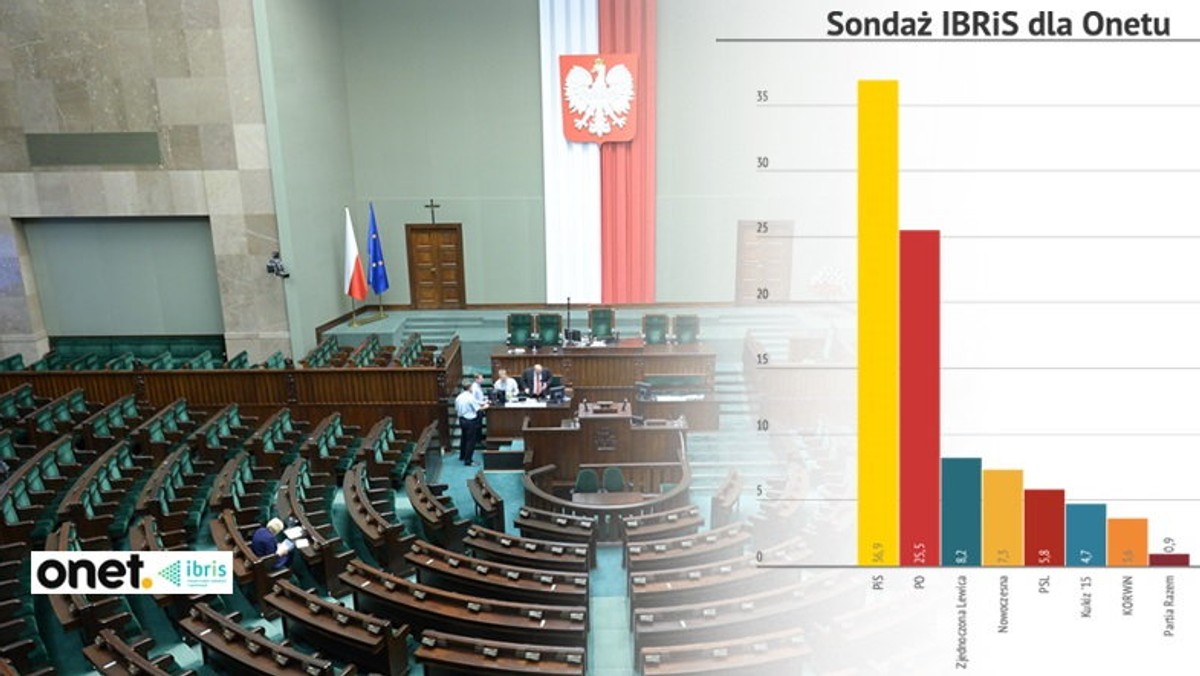

Badanie Ib Ri S Dla Onetu Kto Cieszy Sie Najwiekszym Zaufaniem Polakow

May 07, 2025

Badanie Ib Ri S Dla Onetu Kto Cieszy Sie Najwiekszym Zaufaniem Polakow

May 07, 2025

Latest Posts

-

76

May 08, 2025

76

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

2 0 76

May 08, 2025

2 0 76

May 08, 2025 -

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025

Champions League Final Inter Milans Triumph Against Barcelona

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025