XRP Investment Surge: Trump's Endorsement Fuels Institutional Interest

Table of Contents

Trump's Endorsement: The Catalyst for XRP's Rise

While not a direct endorsement, Donald Trump's increasingly positive stance towards cryptocurrencies in general has fueled speculation about his potential favor towards specific digital assets, including XRP. Although he hasn't explicitly mentioned XRP by name, his pronouncements on the future of finance and his criticisms of traditional banking systems have been interpreted by some as indirectly supportive of cryptocurrencies like XRP, which aim to disrupt traditional financial models. This interpretation, coupled with the general pro-business sentiment often associated with Trump, has been enough to ignite speculation within the crypto community.

- Specific statement or action by Trump that fueled speculation: Trump's repeated criticisms of the Federal Reserve and his advocacy for alternative financial systems have been cited by many as contributing to the recent XRP price increase. His pronouncements on the need for a stronger dollar, albeit indirectly, have been linked by some analysts to a perceived rise in interest in alternative currencies like XRP. (Source: [Insert News Source and Date Here])

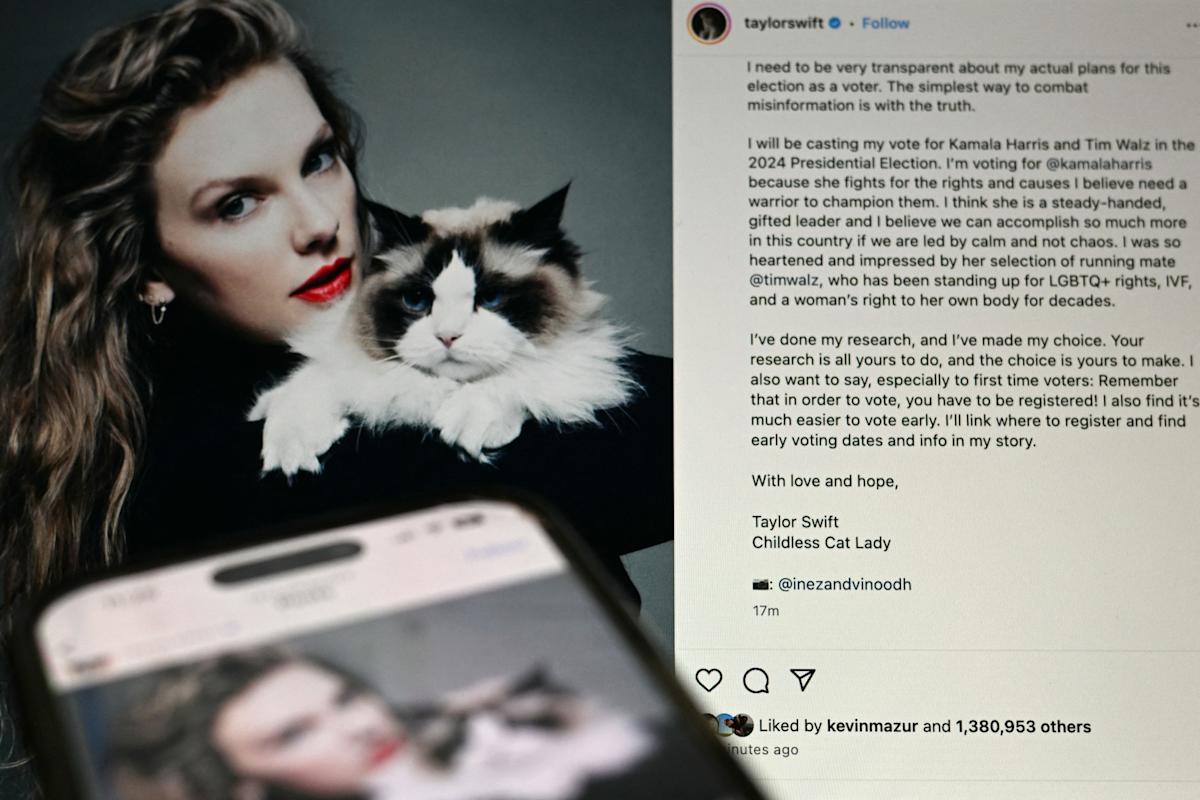

- Social media reaction and impact on XRP price: Social media platforms, particularly Twitter, exploded with discussion following the emergence of news stories connecting Trump's stance on finance to XRP. This increased visibility correlated with a notable surge in XRP's price. (Source: [Insert Social Media Analytics Data Source Here])

- Analysis of the psychological effect of Trump's endorsement on investor confidence: The perceived endorsement triggered a significant surge in investor confidence, leading to increased buying pressure and a rapid price increase. This illustrates the power of influential figures to shape market sentiment in the volatile world of cryptocurrencies.

- Comparison to other instances of celebrity endorsements influencing crypto markets: The impact of Trump's perceived endorsement on XRP mirrors similar trends observed with other celebrity endorsements in the crypto market. Past instances show that even indirect associations with well-known personalities can have a dramatic impact on crypto prices. (Source: [Insert relevant research or news articles here])

Institutional Investors Showing Increased Interest in XRP

Evidence suggests a parallel increase in institutional investment in XRP, although obtaining precise data on institutional holdings remains challenging due to the nature of private investment. Several indicators, however, point towards a growing interest.

- Examples of specific institutional investors showing interest (if available): While specific names are often kept confidential, increased trading volume on major exchanges and on-chain analysis showcasing large transactions suggest significant institutional activity. (Source: [Insert Data Source, e.g., TradingView, CoinMetrics])

- Reasons why institutions might be drawn to XRP: Several factors could be driving institutional interest. Ripple's extensive network of partnerships with banks and financial institutions provides a strong foundation for XRP adoption. Furthermore, XRP's relatively low transaction fees and speed compared to other cryptocurrencies could be appealing for large-scale transactions. Finally, the potential for scalability inherent in XRP's design adds to its allure for institutions.

- Comparison of XRP's institutional adoption compared to other cryptocurrencies: Compared to Bitcoin or Ethereum, XRP’s institutional adoption may still be in its early stages, but the recent surge suggests a potential shift in the market. The relative speed and lower transaction costs of XRP could be attractive to institutions looking for efficiency.

- Analysis of potential risks and rewards for institutional XRP investment: Institutional investors weigh the potential rewards of early adoption with the risks associated with the SEC lawsuit and market volatility. High rewards are possible, but the risk profile needs careful evaluation.

Ripple's Ongoing Legal Battle and Its Impact on XRP Investment

The ongoing SEC lawsuit against Ripple Labs, the company behind XRP, significantly impacts investor sentiment.

- Summary of the SEC vs. Ripple case: The SEC alleges that XRP is an unregistered security, a claim Ripple vehemently denies. The legal battle remains ongoing, with unpredictable outcomes.

- Analysis of the potential legal outcomes and their impact on XRP price: A ruling in favor of the SEC could negatively impact XRP's price, while a favorable outcome for Ripple could lead to substantial price increases. The uncertainty surrounding the legal outcome contributes to XRP's volatility.

- How the ongoing legal battle has influenced investor confidence and risk tolerance: The lawsuit has created uncertainty and significantly affects investor confidence. Some investors remain cautious, while others see the potential for substantial gains if Ripple prevails.

- Discussion on how news related to the lawsuit affects XRP trading volume and price volatility: Positive news regarding the lawsuit typically leads to increased trading volume and price surges, while negative news results in the opposite effect.

Technical Analysis: Understanding the XRP Price Movement

Analyzing XRP's price charts reveals interesting trends. (Note: This section would require inclusion of actual charts and technical indicators. Replace the bracketed information with specific technical analysis.)

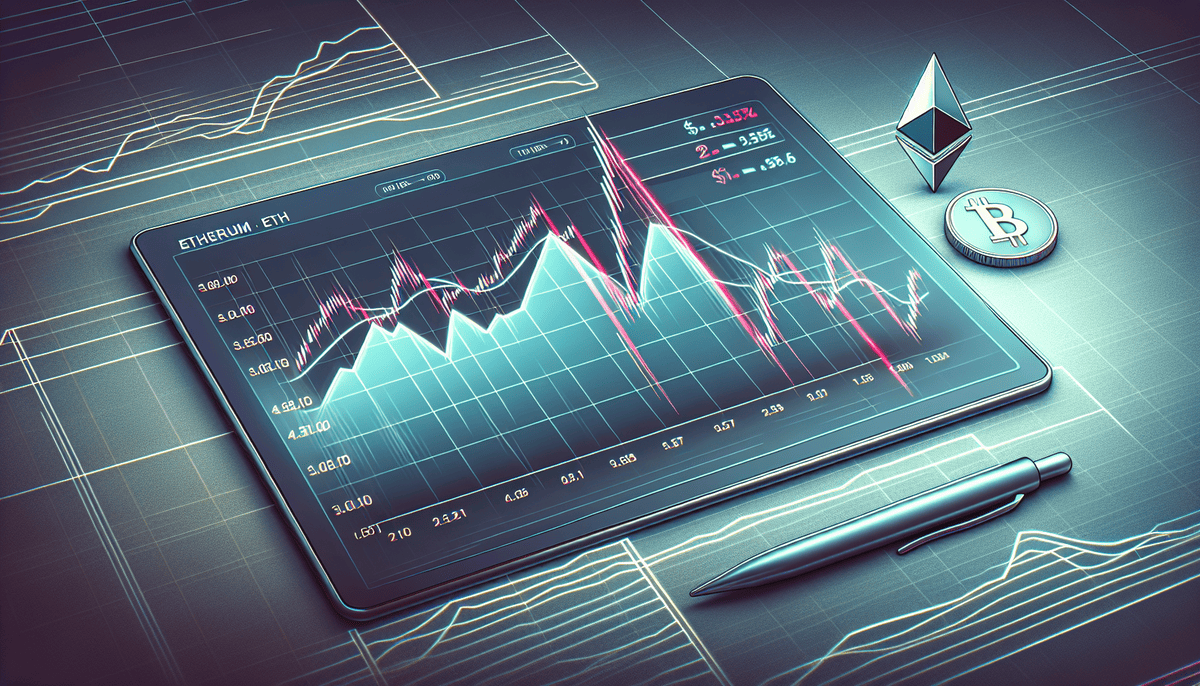

- Key price levels (support and resistance) to watch: [Insert key support and resistance levels with chart illustration]

- Chart patterns indicating bullish or bearish trends: [Insert chart patterns analysis with illustration]

- Volume analysis to confirm price movements: [Insert volume analysis with illustration]

- Discussion of potential future price projections based on technical indicators: [Insert price projection based on technical analysis with caveats and disclaimers]

Future Outlook: Is the XRP Investment Surge Sustainable?

The sustainability of the current XRP investment surge hinges on several factors.

- Factors contributing to long-term growth potential: Widespread adoption by financial institutions, positive resolution of the SEC lawsuit, and increasing market capitalization are key factors influencing long-term growth.

- Potential challenges and risks facing XRP: The SEC lawsuit remains a major risk. Competition from other cryptocurrencies and regulatory uncertainty also pose significant challenges.

- Overall prediction of XRP's future price and adoption: Predicting future price is inherently speculative. However, considering the factors above, a balanced perspective is essential.

- Advice for potential investors on risk management: Diversification, thorough research, and understanding personal risk tolerance are crucial before investing in XRP or any cryptocurrency.

Conclusion:

The confluence of Trump's perceived endorsement, increased institutional interest, and the ongoing SEC lawsuit has created a dynamic environment for XRP investment. While the legal battle adds uncertainty, the potential for significant growth remains. However, investing in XRP involves substantial risk. Conduct thorough research, consult with a financial advisor, and carefully manage your risk before making any investment decisions. Don't miss the potential of the XRP market, but approach it with caution and informed decision-making. Learn more about smart XRP investment strategies and navigate the exciting, yet volatile, world of this digital asset.

Featured Posts

-

Warriors Vs Rockets Playoffs Expert Predictions And Betting Odds

May 07, 2025

Warriors Vs Rockets Playoffs Expert Predictions And Betting Odds

May 07, 2025 -

Grayscale Etf Filing Will It Push Xrp To New Price Records

May 07, 2025

Grayscale Etf Filing Will It Push Xrp To New Price Records

May 07, 2025 -

Steelers Star Wide Receiver Future Uncertain After Team Decision

May 07, 2025

Steelers Star Wide Receiver Future Uncertain After Team Decision

May 07, 2025 -

The Timberwolves Fate How Chris Finchs Leadership Impacts The Season

May 07, 2025

The Timberwolves Fate How Chris Finchs Leadership Impacts The Season

May 07, 2025 -

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

May 07, 2025

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

May 07, 2025

Latest Posts

-

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025

67 Million Ethereum Liquidation Event Implications And Market Outlook

May 08, 2025 -

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025

Ethereum Price Prediction Cross X Indicators Suggest Imminent 4 000 Surge

May 08, 2025 -

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025

Ethereums Bullish Trend Massive Eth Accumulation And Price Forecast Analysis

May 08, 2025 -

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025

Ethereum Liquidations Surge To 67 M Is A Further Market Selloff Imminent

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025