Parental College Funding Concerns Diminish, Yet Student Loan Usage Remains Steady: Survey Findings

Table of Contents

Declining Parental Anxiety Regarding College Costs

While the cost of college continues to climb, our survey indicates a notable shift in parental attitudes towards funding higher education. This decrease in anxiety doesn't signal a lessening of the financial burden, but rather a change in approach and expectation.

Shift in Parental Savings Strategies

Parents are adapting their savings strategies, moving beyond traditional savings accounts and embracing more diverse approaches to parental college funding.

- Increased use of 529 plans: These tax-advantaged savings plans are becoming increasingly popular, offering significant benefits for long-term college savings. Our survey showed a 15% increase in 529 plan usage over the past five years.

- Reliance on family contributions: Many families are relying more heavily on contributions from grandparents, other relatives, or family trusts to supplement savings and reduce reliance on loans.

- Exploration of alternative funding options: Parents are actively seeking scholarships, grants, and other forms of financial aid to offset college expenses, reducing the pressure on personal savings.

Impact of Increased Financial Literacy

Improved financial literacy among parents plays a crucial role in managing their anxieties about college costs.

- Access to online resources: Websites, educational platforms, and online calculators provide valuable tools for budgeting, planning, and exploring various funding options.

- Workshops and financial advisors: Many parents are attending workshops and seeking guidance from financial advisors specializing in college planning, leading to more informed decision-making.

- Positive trends in parental financial planning: Our survey reveals a 20% increase in parents who started planning for their children's college education before the child entered high school.

Changing Expectations About Post-Secondary Education

Parental expectations regarding post-secondary education are also evolving. The high cost of a four-year university is prompting families to explore alternatives.

- Increased consideration of vocational training: Vocational schools and trade programs offer faster pathways to employment and potentially lower overall costs compared to traditional four-year colleges.

- Community college as a stepping stone: Many parents are viewing community college as a cost-effective way for students to complete general education requirements before transferring to a four-year institution.

- Factors influencing these changes: The significant cost of higher education, evolving job market trends, and a reevaluation of the perceived value of different educational paths are major drivers of these shifting expectations.

Persistent Reliance on Student Loans Despite Reduced Parental Contributions

Despite the decreasing parental anxiety and evolving strategies, our survey highlights a concerning trend: student loan usage remains remarkably high.

Rising Tuition Costs and the Loan Gap

The persistent reliance on student loans is primarily driven by the ever-increasing cost of tuition, which continues to outpace the growth in financial aid.

- Statistics on student loan debt: The average student loan debt continues to rise, impacting graduates' financial well-being for years after graduation.

- Types of loans used: Students increasingly rely on a combination of federal and private loans, increasing their overall debt burden.

- Average loan amounts: The average loan amounts borrowed are significantly higher than previous years, reflecting the escalating tuition costs.

Lack of Awareness of Alternative Funding Options

Many students remain unaware of the numerous alternative funding options beyond student loans.

- Need for improved awareness: Students need better access to information about scholarships, grants, and work-study programs.

- Utilizing college financial aid offices: College financial aid offices can provide personalized guidance and assistance in securing financial aid.

- Leveraging online resources and mentorship programs: Online platforms and mentorship programs can connect students with valuable resources and support.

The Psychological Impact of Student Debt

The weight of student loan debt extends far beyond the financial aspect, significantly impacting students' mental and emotional well-being.

- Consequences of high debt: High levels of debt can delay major life milestones like homeownership and starting a family.

- Difficulty saving: The burden of loan repayments makes saving for retirement or other long-term goals extremely challenging.

- Impact on career choices: Students may choose career paths based on salary potential rather than personal interests, prioritizing debt repayment over career fulfillment.

Conclusion

Our survey reveals a fascinating dichotomy: while parental anxiety surrounding parental college funding is decreasing due to evolving strategies and increased financial literacy, the reliance on student loans persists, largely due to rising tuition costs and a lack of awareness regarding alternative funding options. The persistent challenge of affording higher education requires a multifaceted approach. Students and families must proactively explore all available resources, including scholarships, grants, and work-study programs, to minimize reliance on loans.

Call to Action: Navigating the complexities of parental college funding and student loan debt requires careful planning and research. Explore resources such as the Federal Student Aid website and your college's financial aid office to learn more about available aid options and strategies for managing student loan debt. Proactive planning and thorough research are essential for securing an affordable path to higher education. Start planning your approach to parental college funding today.

Featured Posts

-

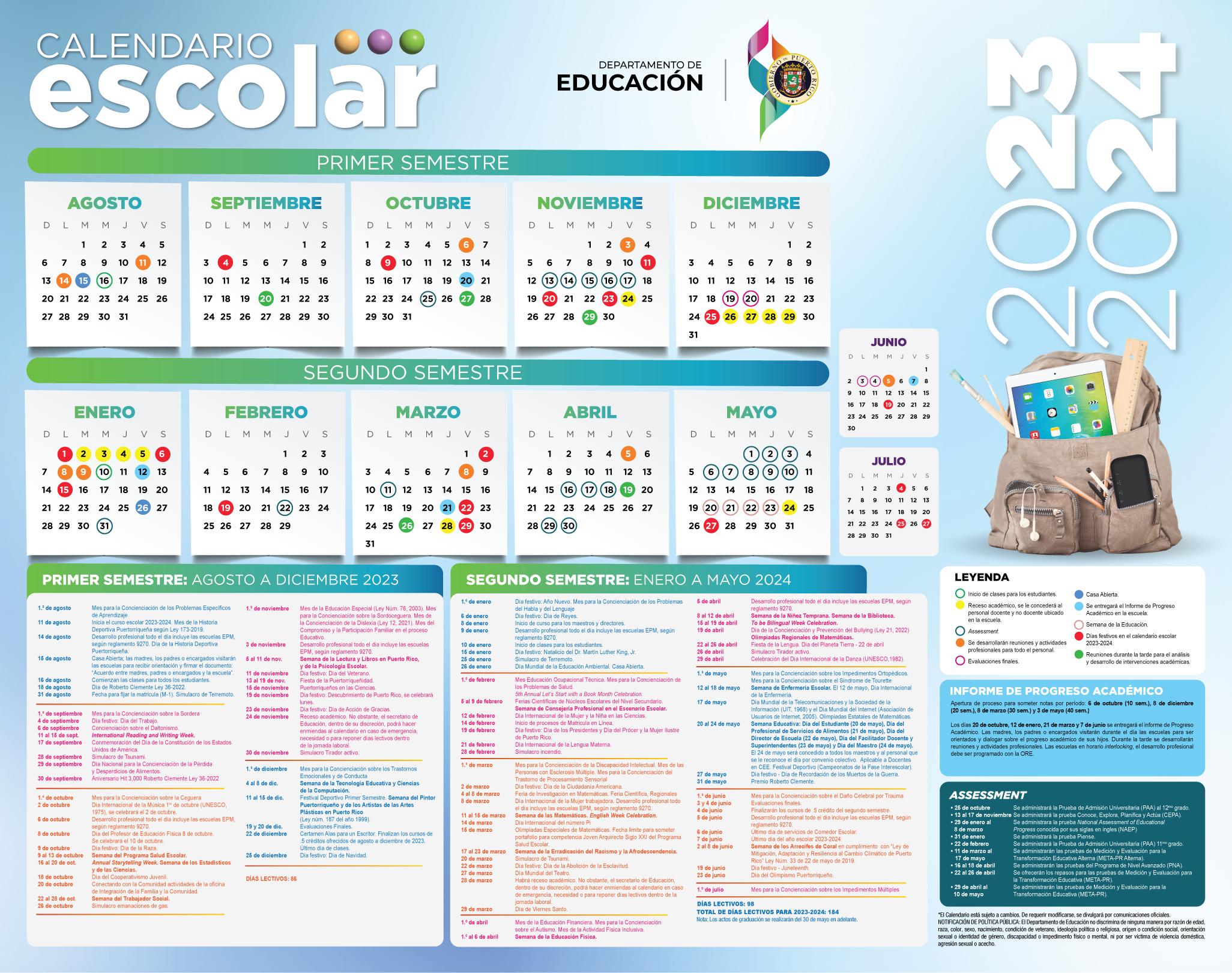

Prestamos Estudiantiles Impagados Nuevas Medidas Del Departamento De Educacion

May 17, 2025

Prestamos Estudiantiles Impagados Nuevas Medidas Del Departamento De Educacion

May 17, 2025 -

Nba Game 4 No Call Controversy Pistons Outraged

May 17, 2025

Nba Game 4 No Call Controversy Pistons Outraged

May 17, 2025 -

La Fires Landlords Exploiting Renters Amidst Crisis Claims Reality Star

May 17, 2025

La Fires Landlords Exploiting Renters Amidst Crisis Claims Reality Star

May 17, 2025 -

Choosing The Best Crypto Casino Jackbits Instant Withdrawal Advantage

May 17, 2025

Choosing The Best Crypto Casino Jackbits Instant Withdrawal Advantage

May 17, 2025 -

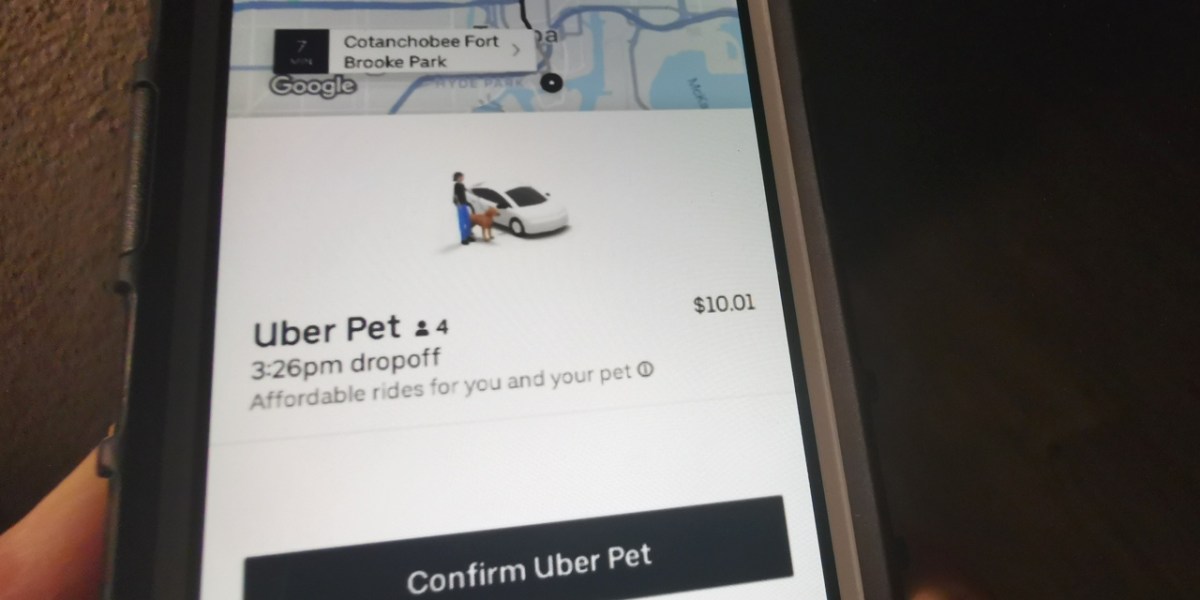

Convenient Pet Transport Uber Pet Launches In Delhi And Mumbai

May 17, 2025

Convenient Pet Transport Uber Pet Launches In Delhi And Mumbai

May 17, 2025

Latest Posts

-

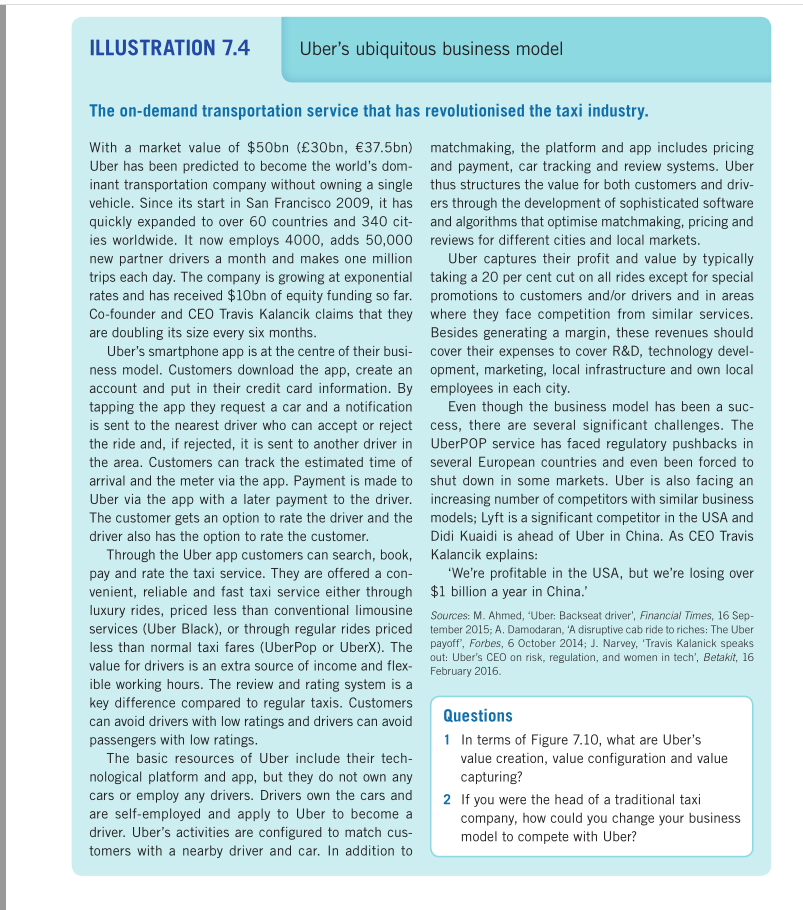

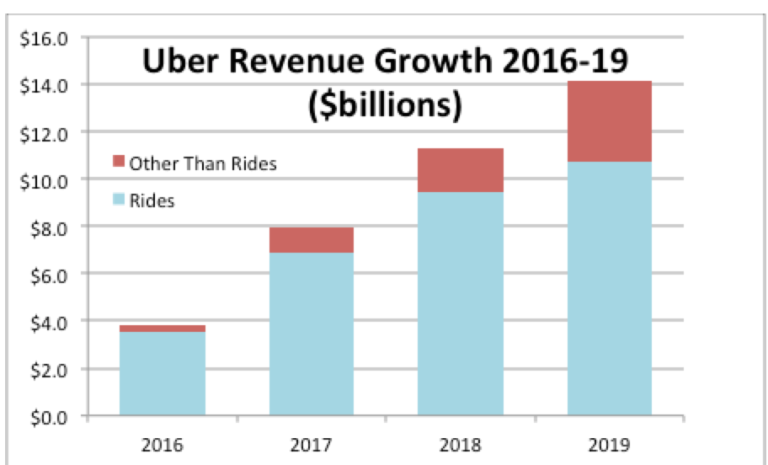

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025

Analyzing Ubers Resilience In A Potential Recession

May 17, 2025 -

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025

Taking Your Pet On Uber In Mumbai Complete Guide

May 17, 2025 -

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025

Ubers Stock Performance Defying Recessionary Trends

May 17, 2025 -

Why Uber Might Weather An Economic Downturn

May 17, 2025

Why Uber Might Weather An Economic Downturn

May 17, 2025 -

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025

Uber Pet Policy Mumbai How To Transport Your Furry Friend

May 17, 2025