Parents Less Worried About College Costs, But Student Loans Still A Factor: Survey Results

Table of Contents

Decreasing Concerns About Overall College Costs

While the cost of higher education remains substantial, the survey indicates a noteworthy decrease in parental worry about overall college costs. This seemingly paradoxical trend warrants a closer examination.

Shifting Economic Factors

Several factors could contribute to this reduction in anxiety.

-

Increased Awareness of Financial Aid Options and Scholarships: Parents are becoming increasingly savvy about the availability of financial aid, grants, and scholarships, leading to a more optimistic outlook on affordability. Many online resources and college financial aid offices offer guidance on navigating the complex application process.

-

Improved Understanding of Budgeting and Cost-Saving Strategies: With access to online budgeting tools and financial literacy resources, parents are better equipped to plan and manage college expenses. This proactive approach reduces financial stress and improves their ability to afford higher education.

-

Changes in Family Income or Savings: Improved economic conditions for some families might also contribute to a lessened sense of worry. Increased savings or higher disposable incomes may enable parents to feel more confident in their ability to meet college costs.

-

Survey Data Highlights: The survey revealed a 15% decrease in parents reporting "extreme worry" about overall college costs compared to similar surveys conducted five years ago. This decrease was particularly pronounced among families in higher income brackets.

-

Demographic Trends: The reduction in worry seems to correlate with regional variations in income levels, with families in higher-income areas reporting less concern than those in lower-income areas.

-

Expert Opinion: Financial advisor Sarah Miller states, "Increased access to information and improved financial literacy are empowering parents to feel more in control of college planning."

The Persistent Shadow of Student Loan Debt

Despite the lessening worry about overall costs, the specter of student loan debt continues to cast a long shadow.

High Levels of Student Loan Indebtedness

The reality is that student loan debt remains a significant burden for many graduates.

-

Statistics: The average student loan debt for a graduating student is currently around $37,000, a figure that has been steadily rising over the past decade.

-

Long-Term Implications: This debt can have profound long-term consequences, including delayed homeownership, reduced retirement savings, and limitations on career choices.

-

Impact on Mental Health: The stress of managing substantial student loan debt can significantly impact mental health and overall well-being.

-

Survey Data on Student Loan Debt: A striking 80% of parents surveyed expressed significant concern about their children accumulating excessive student loan debt.

-

Types of Student Loans: Understanding the differences between federal and private student loans, and their varying interest rates, is crucial for effective financial planning.

-

Government Initiatives: While government initiatives like income-driven repayment plans offer some relief, the overall burden of student loan debt remains a major challenge.

Strategies for Navigating College Finances

Proactive financial planning is essential for mitigating the financial burden of higher education.

Proactive Financial Planning

Families can employ several strategies to better manage college expenses.

-

Start Saving Early: Begin saving for college as early as possible, even small contributions can make a significant difference over time.

-

Explore Funding Options: Investigate various funding options including scholarships, grants, federal student loans, and 529 plans.

-

Create a Realistic Budget: Develop a detailed budget that considers tuition, fees, room and board, books, and other expenses.

-

Utilize Resources: Take advantage of online resources such as financial aid calculators and educational websites offering guidance on college planning.

-

Helpful Links: [Link to a relevant financial aid calculator] [Link to a government website on student aid]

-

Communication with Students: Open and honest communication with students about financial responsibility is key to fostering understanding and shared responsibility.

-

Return on Investment (ROI): Carefully consider the cost and potential return on investment of different college choices.

The Future of College Affordability

The ongoing challenges related to college affordability require proactive solutions.

Ongoing Challenges and Potential Solutions

Several factors continue to impact college affordability.

-

Increasing Tuition Costs: The persistent rise in tuition costs remains a major hurdle for many families.

-

Government Funding: Increased government funding for financial aid programs is crucial to ensuring broader access to higher education.

-

Innovative Approaches: Exploring innovative approaches such as online learning, alternative credentialing, and competency-based education can help increase accessibility and affordability.

-

Survey Expectations: The survey indicated that parents expect college costs to continue to increase, albeit at a slower rate than in previous years.

-

Future Trends: Predicting future trends in college affordability requires considering factors such as technological advancements, economic conditions, and government policies.

-

Policy Changes: Policy changes aimed at controlling tuition costs and expanding financial aid programs are essential for improving college affordability.

Conclusion

While the survey reveals a decrease in overall parental worry about college costs, the significant concern surrounding student loan debt persists. Proactive financial planning, including early saving, exploration of various funding options, and realistic budgeting, is paramount. Understanding the long-term implications of student loan debt and utilizing available resources is crucial for families navigating the complexities of higher education financing. Don't let student loan debt derail your child's future. Learn more about effective strategies for reducing college costs and managing student loan debt effectively by [link to relevant page].

Featured Posts

-

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025

Todays Mlb Matchup Yankees Vs Mariners Predictions And Best Odds

May 17, 2025 -

Significant Increase In Indian Real Estate Investment 47 In Q1 2024

May 17, 2025

Significant Increase In Indian Real Estate Investment 47 In Q1 2024

May 17, 2025 -

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025 -

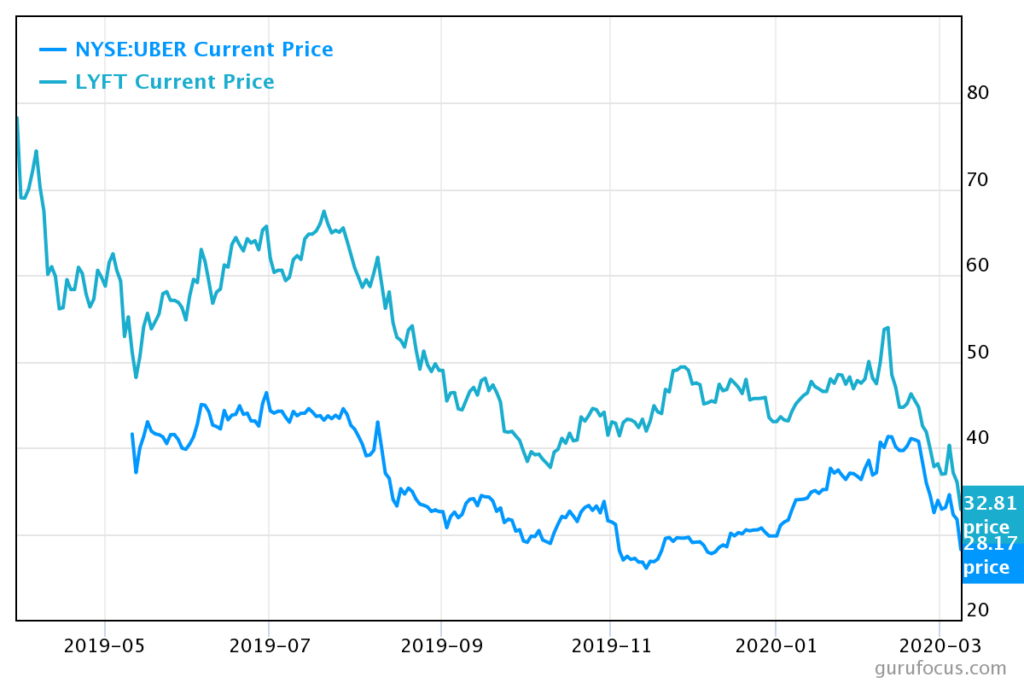

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025

Uber Stock And Recession Why Analysts See Resilience

May 17, 2025 -

Formal Trade Deal On The Horizon Chinas Ambassador Signals Interest In Canada Partnership

May 17, 2025

Formal Trade Deal On The Horizon Chinas Ambassador Signals Interest In Canada Partnership

May 17, 2025

Latest Posts

-

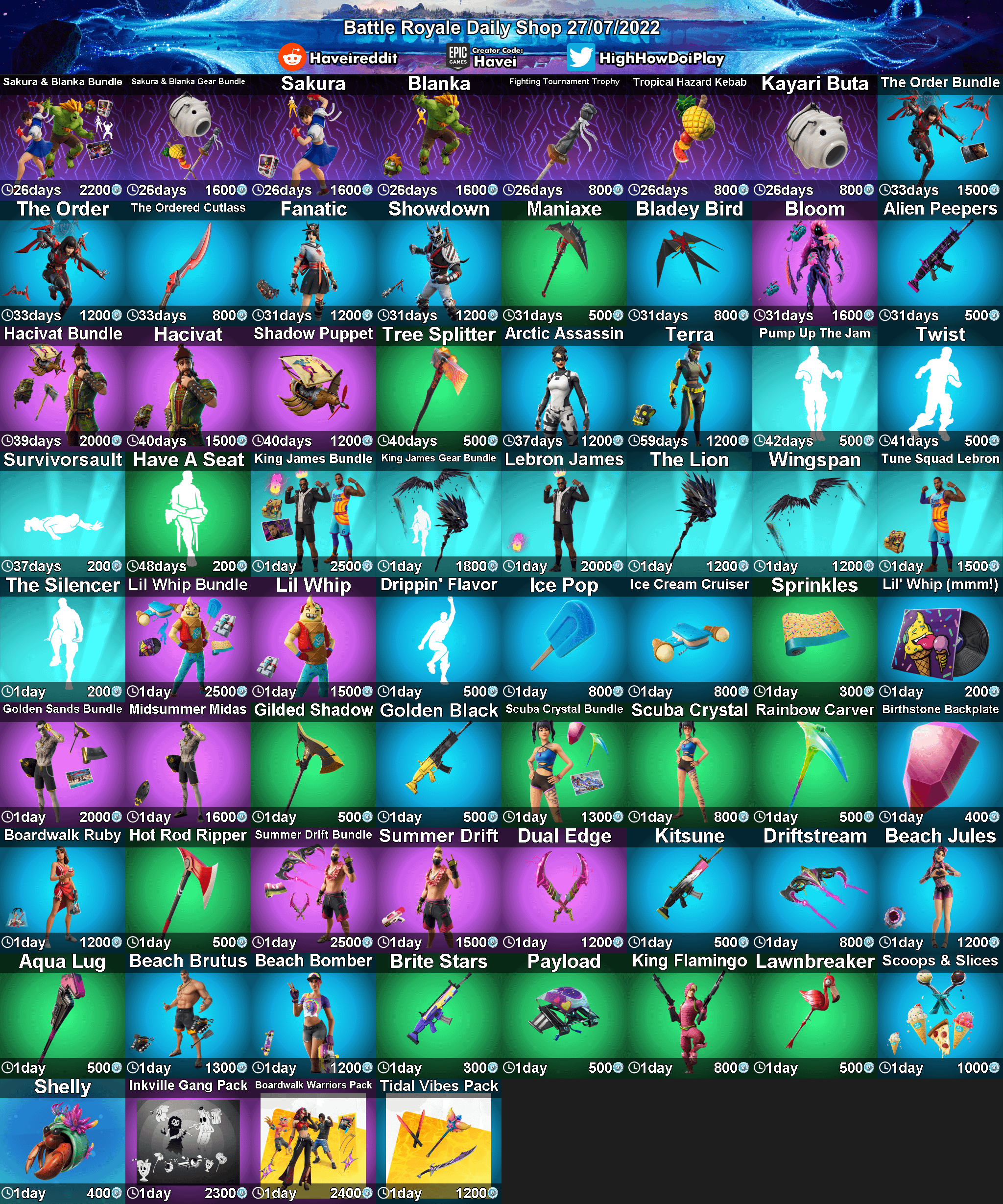

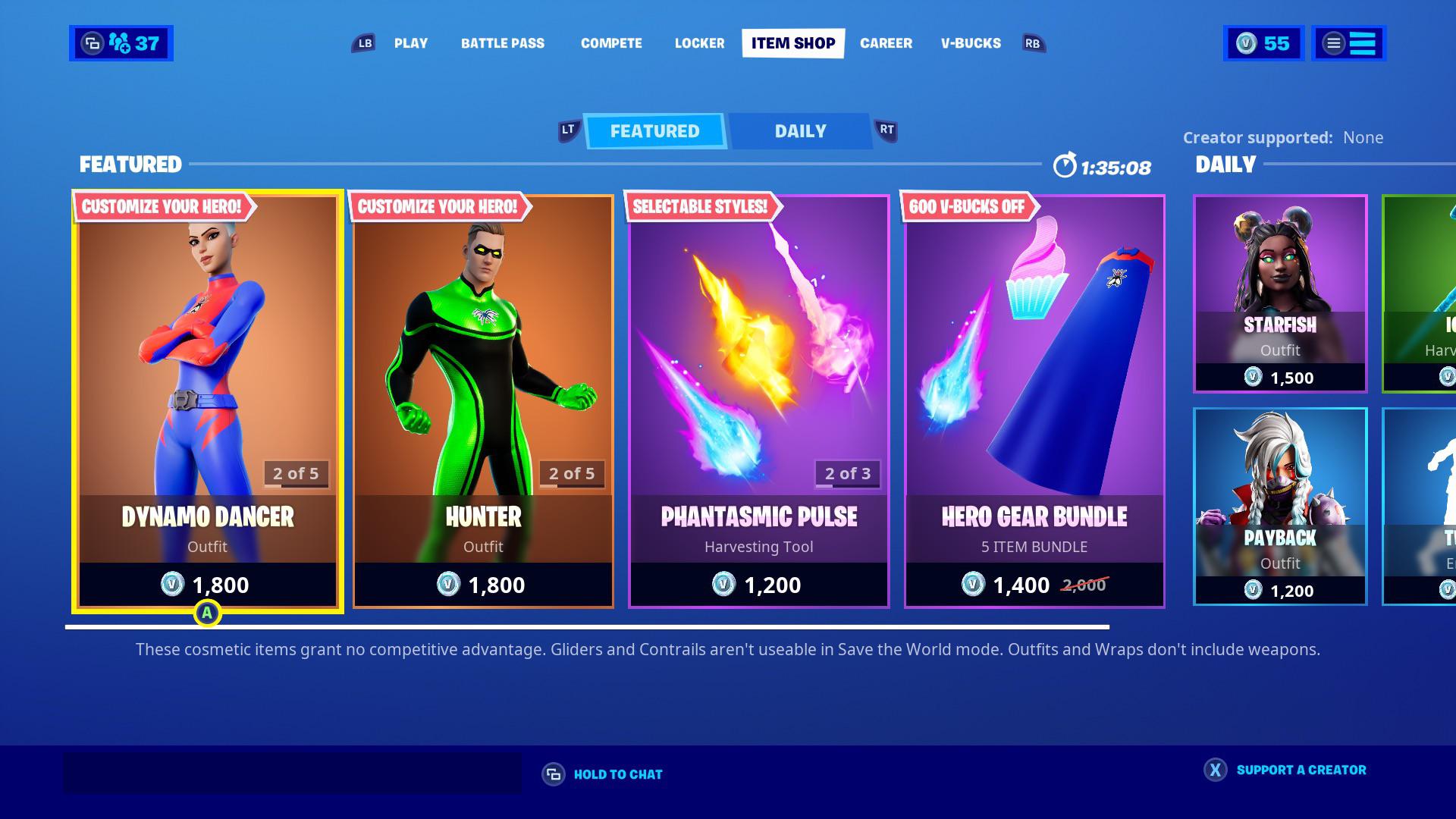

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025 -

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025 -

Fortnites Item Shop Gets A Useful New Feature

May 17, 2025

Fortnites Item Shop Gets A Useful New Feature

May 17, 2025