Podcast: Making The Most Of Low Inflation

Table of Contents

Understanding the Low Inflation Environment

Causes of Low Inflation

Low inflation, generally defined as a sustained annual inflation rate below 2%, can stem from several interconnected factors. Understanding these causes is the first step towards developing effective strategies.

- Decreased Consumer Demand: When consumer spending slows, businesses often lower prices to stimulate sales, leading to lower inflation. This can be triggered by economic uncertainty, job losses, or changes in consumer confidence.

- Technological Advancements: Technological innovation often increases efficiency and productivity, driving down the cost of goods and services. This can exert downward pressure on prices.

- Globalization: Increased global competition can lead to lower prices for consumers as businesses compete for market share. Imports from countries with lower production costs can also contribute to lower inflation.

- Monetary Policy: Central banks, like the Federal Reserve in the US, use monetary policy tools (e.g., interest rate adjustments) to influence inflation. A restrictive monetary policy can curb inflation, but it can also slow economic growth.

[Link to relevant economic news article on current inflation rates] [Link to a report on the impact of globalization on prices]

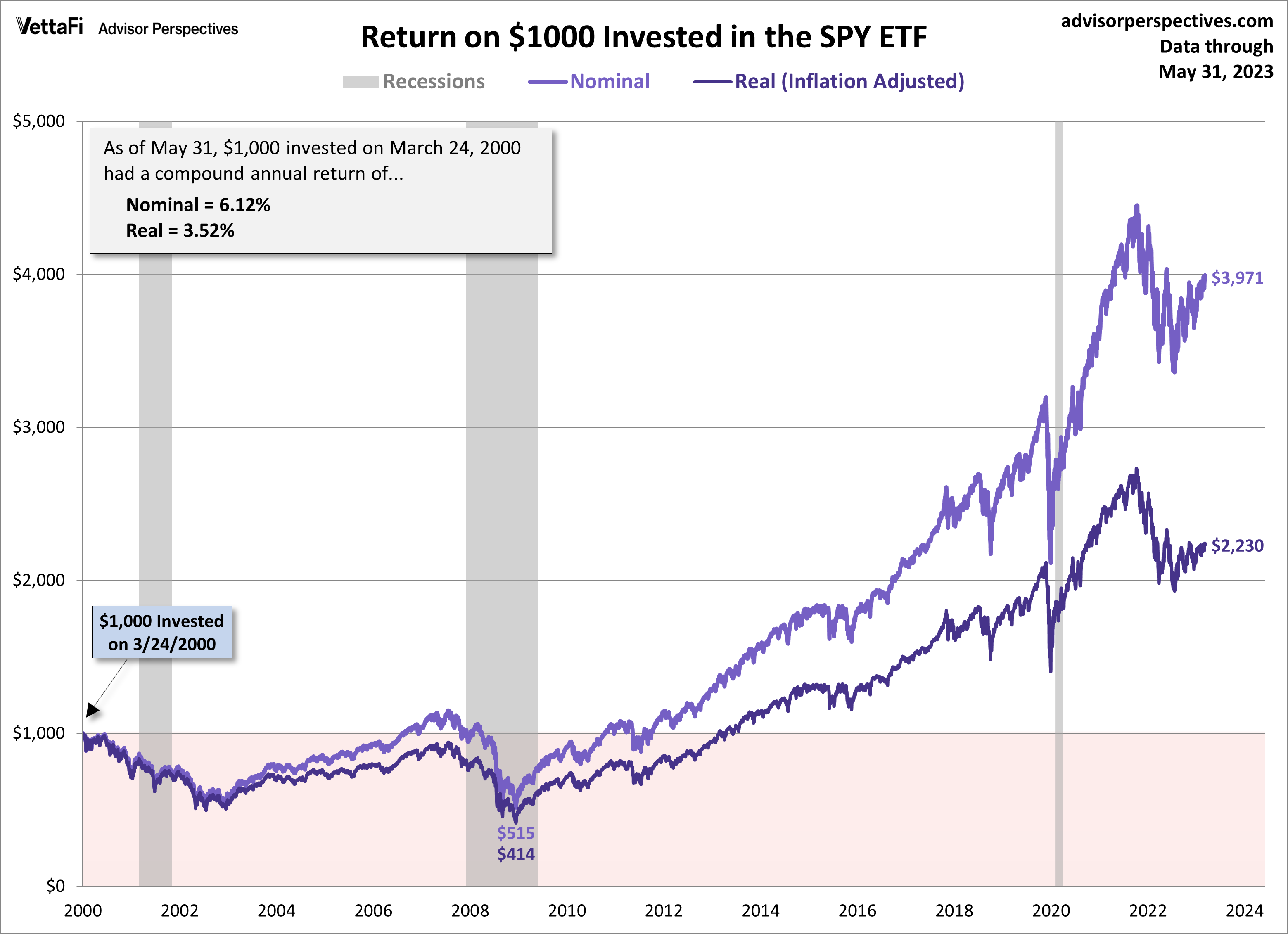

Impact of Low Inflation on Savings and Investments

Low inflation directly impacts the real return on your savings and investments. While it might seem beneficial to have prices remain stable, low inflation erodes the purchasing power of your money over time. A low return on your savings means your money isn't growing as fast as it could be, potentially hindering your long-term financial goals.

- Savings Accounts: Low interest rates on savings accounts mean your money grows slowly, barely keeping pace with, or even lagging behind, inflation.

- Bonds: Bond yields are often closely tied to inflation rates. Low inflation can result in lower bond yields, reducing the return on your investment.

- Erosion of Purchasing Power: Even if your savings grow slightly, low inflation can still diminish their purchasing power. What you could buy with $100 today might cost more in the future, even if your $100 has nominally increased.

For example, if inflation is 1% and your savings account earns 0.5%, your real return is negative 0.5%, meaning your purchasing power is declining.

Low Inflation and Borrowing Costs

One potential advantage of a low-inflation environment is lower borrowing costs. Lower inflation often leads to lower interest rates on loans and mortgages.

- Lower Interest Rates: This can make borrowing more attractive for large purchases like homes or cars.

- Debt Management: Lower interest rates can make it easier to manage existing debt, potentially freeing up more of your income for other financial goals.

- Rate Comparison is Crucial: While lower interest rates are generally positive, it's crucial to compare rates from multiple lenders to secure the best possible terms.

Strategic Actions During Low Inflation

Optimizing Investment Strategies

Low inflation necessitates a careful review of your investment strategy. While low inflation can be a challenge for fixed-income investments, it can present opportunities in other areas.

- Stocks: Historically, stocks have outperformed bonds during periods of low inflation, although this is not guaranteed.

- Real Estate: Real estate can be a good inflation hedge, though it is also subject to market fluctuations.

- Alternative Investments: Consider diversifying into alternative investments like commodities or private equity, depending on your risk tolerance and financial goals.

- Diversification: A diversified investment portfolio is vital, spreading your risk across various asset classes and reducing your vulnerability to any single market downturn.

Maximizing Savings Potential

Even in a low-inflation environment, maximizing your savings is essential. While returns might be modest, you can still make progress by strategically employing different saving vehicles.

- High-Yield Savings Accounts: These accounts offer competitive interest rates compared to standard savings accounts.

- Money Market Accounts: These accounts offer a higher return than savings accounts but typically with some limitations on withdrawals.

- Certificates of Deposit (CDs): CDs provide a fixed interest rate for a specific term, offering a predictable return, albeit often lower than other investment options.

- Comparison Shopping: Actively compare interest rates and terms from different financial institutions to find the best options for your needs.

Debt Management in Low Inflation

Low inflation presents a prime opportunity to tackle debt. Lower interest rates can significantly reduce your debt repayment burden.

- Prioritize High-Interest Debt: Focus on paying down high-interest debt first to minimize the overall interest paid.

- Debt Consolidation: Consider consolidating multiple debts into a single loan with a lower interest rate.

- Refinancing: Refinancing existing loans (like mortgages) at a lower interest rate can save you money over the life of the loan.

Planning for the Future Amidst Low Inflation

Long-Term Financial Goals

Low inflation necessitates adjusting your long-term financial planning to account for potentially slower growth in your investments.

- Retirement Savings: You may need to save more aggressively or adjust your retirement timeline to compensate for lower returns.

- Regular Contributions: Maintaining consistent contributions to your savings and investment accounts is crucial to achieving your long-term financial goals.

Protecting Against Inflationary Surges

While currently experiencing low inflation, it's crucial to prepare for potential inflationary surges in the future.

- Inflation-Protected Securities (TIPS): These government bonds adjust their principal value based on inflation, protecting your investment from the erosion of purchasing power.

- Diversification: Maintain a diversified investment portfolio that includes assets that generally perform well during inflationary periods (e.g., commodities, real estate).

Harnessing the Power of Low Inflation

Low inflation presents both challenges and opportunities. By understanding the causes and impacts of low inflation, implementing strategic investment and savings plans, and preparing for potential future shifts, you can effectively navigate this economic climate. Proactive financial planning and informed decision-making are key to making the most of low inflation and securing your financial future. Listen to our podcast for expert insights on navigating low inflation and learn how to thrive financially during this period. Learn more about maximizing your returns during low inflation by listening to our latest episode! Don't miss our podcast on how to thrive financially during low inflation.

Featured Posts

-

Nora Fatehis Stunning Floral Saree Looks

May 27, 2025

Nora Fatehis Stunning Floral Saree Looks

May 27, 2025 -

Dow Jones And S And P 500 Stock Market Analysis For May 26

May 27, 2025

Dow Jones And S And P 500 Stock Market Analysis For May 26

May 27, 2025 -

Free Streaming Of Survivor Season 48 Episode 13 Legal And Safe Methods

May 27, 2025

Free Streaming Of Survivor Season 48 Episode 13 Legal And Safe Methods

May 27, 2025 -

Ozbroyennya Vid Nimechchini Onovleniy Spisok Viyskovoyi Dopomogi Ukrayini

May 27, 2025

Ozbroyennya Vid Nimechchini Onovleniy Spisok Viyskovoyi Dopomogi Ukrayini

May 27, 2025 -

Mila Kuniss Dramatic Weight Loss For A Role The Grape Diet And Hospital Stays

May 27, 2025

Mila Kuniss Dramatic Weight Loss For A Role The Grape Diet And Hospital Stays

May 27, 2025

Latest Posts

-

Emergency Red Tide Warning Cape Cod Beaches Closed

May 30, 2025

Emergency Red Tide Warning Cape Cod Beaches Closed

May 30, 2025 -

Urgent Warning Second Harmful Algal Bloom In Kodiak Waters Impacts Shellfish

May 30, 2025

Urgent Warning Second Harmful Algal Bloom In Kodiak Waters Impacts Shellfish

May 30, 2025 -

Country Diary A Foragers Guide To Roastable Carrot Relatives

May 30, 2025

Country Diary A Foragers Guide To Roastable Carrot Relatives

May 30, 2025 -

Gare Du Nord Paralysee Bombe De La Seconde Guerre Mondiale Decouverte

May 30, 2025

Gare Du Nord Paralysee Bombe De La Seconde Guerre Mondiale Decouverte

May 30, 2025 -

Double Trouble Harmful Algal Blooms Hit Kodiak Shellfish Harvest Twice

May 30, 2025

Double Trouble Harmful Algal Blooms Hit Kodiak Shellfish Harvest Twice

May 30, 2025