Pounce Now: S&P 500 Downside Protection Strategies

Table of Contents

Understanding S&P 500 Risk

Before diving into specific S&P 500 downside protection strategies, it's crucial to grasp the inherent risks involved in investing in the index.

Market Volatility and its Impact

The S&P 500, like any stock market index, experiences periods of significant volatility. Market downturns, sometimes triggered by economic uncertainty, geopolitical events, or unexpected crises, can lead to substantial portfolio losses. The 2008 financial crisis and the COVID-19 market crash serve as stark reminders of the potential impact of market volatility on even the most diversified portfolios. Understanding this inherent risk is the first step towards effective risk management.

Identifying Your Risk Tolerance

Before implementing any S&P 500 downside protection strategy, it's critical to assess your personal risk tolerance. Your risk tolerance determines your comfort level with potential investment losses. Generally, investors are categorized into conservative, moderate, and aggressive profiles.

- Define market volatility and its measurement (e.g., standard deviation): Market volatility, often measured using standard deviation, quantifies the extent to which the price of an asset fluctuates over time. A higher standard deviation indicates greater volatility and higher risk.

- Explain the relationship between risk and return: Generally, higher potential returns are associated with higher levels of risk. Understanding this relationship is vital for making informed investment decisions.

- Provide examples of different risk tolerance questionnaires: Many online resources and financial advisors offer risk tolerance questionnaires to help investors determine their risk profile.

S&P 500 Downside Protection Strategies

Several strategies can help mitigate the downside risk associated with S&P 500 investments.

Put Options

Put options are contracts that give the holder the right, but not the obligation, to sell a specific asset (in this case, an S&P 500 index fund or ETF) at a predetermined price (the strike price) before a specific date (the expiration date). Buying put options acts as insurance against a decline in the S&P 500.

- Explain the mechanics of buying put options: You pay a premium to acquire a put option. If the S&P 500 falls below the strike price before the expiration date, you can exercise the option, limiting your losses.

- Discuss different types of put options (e.g., protective puts): Protective puts involve buying put options on assets you already own, creating a floor for your investment.

- Highlight the costs and benefits of using put options: While put options offer downside protection, they come with a cost (the premium). The benefit is the potential to limit losses during market downturns.

Inverse ETFs

Inverse exchange-traded funds (ETFs) aim to deliver returns that are the inverse of the performance of a specific index, such as the S&P 500. These ETFs profit when the underlying index declines.

- Explain how inverse ETFs work: These ETFs typically use derivatives to achieve their inverse correlation with the underlying index.

- Discuss the risks of using leveraged inverse ETFs: Leveraged inverse ETFs amplify both gains and losses, increasing risk significantly. These are generally not suitable for long-term holding.

- Provide examples of relevant inverse ETFs: Many brokers offer inverse S&P 500 ETFs. It's important to carefully research and understand the specific risks associated with each.

Hedged Mutual Funds and ETFs

Some mutual funds and ETFs employ hedging strategies to mitigate downside risk. These funds may use various techniques, including options and derivatives, to protect against market declines.

- Explain the investment strategies employed by hedged funds/ETFs: The specific strategies vary depending on the fund, but often involve short selling or hedging positions.

- Discuss the fees associated with these products: Hedged funds often charge higher fees than traditional index funds.

- Highlight potential advantages and disadvantages: Advantages include potential downside protection, but disadvantages may include lower potential returns and higher fees.

Diversification

Diversification remains a fundamental S&P 500 downside protection strategy. Don't put all your eggs in one basket. Diversifying across various asset classes reduces your overall portfolio risk.

- Explain the benefits of asset allocation: Strategic asset allocation involves spreading your investments across different asset classes like stocks, bonds, real estate, and commodities.

- Discuss different asset classes (e.g., bonds, real estate, commodities): Each asset class has a unique risk-return profile and reacts differently to market fluctuations.

- Provide examples of diversified portfolios: A well-diversified portfolio might include a mix of stocks (including international stocks), bonds, and real estate investment trusts (REITs).

Choosing the Right Strategy

Selecting the appropriate S&P 500 downside protection strategy depends on several factors.

Assessing Your Investment Goals

Your investment goals (retirement planning, short-term gains, etc.) heavily influence your choice of strategy. Long-term investors might prioritize diversification, while short-term investors might use options for more tactical protection.

Considering Transaction Costs and Fees

Always factor in transaction costs and fees associated with each strategy. High fees can significantly erode returns, especially over the long term.

Seeking Professional Financial Advice

For personalized guidance tailored to your risk tolerance, investment goals, and financial situation, consider consulting a qualified financial advisor. They can help you assess your risk profile and select the most suitable S&P 500 downside protection strategy.

Conclusion

This article has explored several effective S&P 500 downside protection strategies, from utilizing put options and inverse ETFs to employing diversification and seeking professional advice. Remember that no single strategy guarantees complete protection, but a well-informed approach can significantly reduce your risk. Don't wait for a market downturn to act – proactively implement your chosen S&P 500 downside protection strategy today. Start planning your S&P 500 downside protection strategy now and secure your financial future.

Featured Posts

-

Cong Nhan Dien Luc Mien Nam Hanh Trinh Chinh Phuc Du An 500k V Mach 3

May 01, 2025

Cong Nhan Dien Luc Mien Nam Hanh Trinh Chinh Phuc Du An 500k V Mach 3

May 01, 2025 -

Cruising In 2025 Everything You Need To Know About The Latest Ships

May 01, 2025

Cruising In 2025 Everything You Need To Know About The Latest Ships

May 01, 2025 -

Road Warriors Texas Tech Tops Kansas 78 73

May 01, 2025

Road Warriors Texas Tech Tops Kansas 78 73

May 01, 2025 -

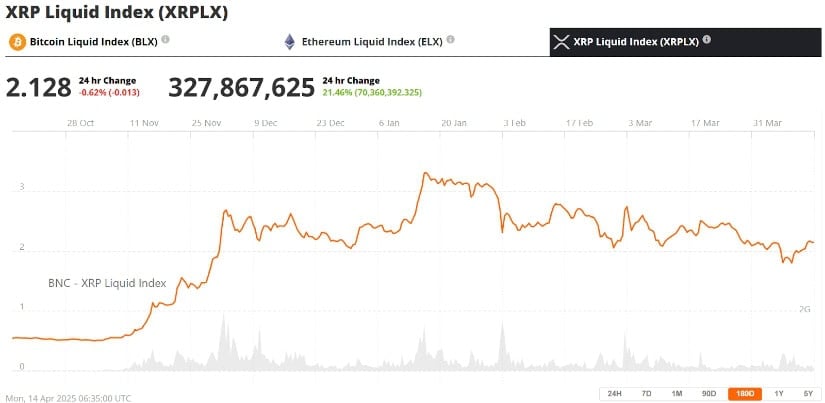

Xrp Etf Hopes Sec Developments And Ripples Future

May 01, 2025

Xrp Etf Hopes Sec Developments And Ripples Future

May 01, 2025 -

Explaining The Delays In Storm Damage Assessments In Kentucky

May 01, 2025

Explaining The Delays In Storm Damage Assessments In Kentucky

May 01, 2025