President Trump: No Immediate Plans To Replace Fed Chair Powell

Table of Contents

Economic Stability as a Key Factor

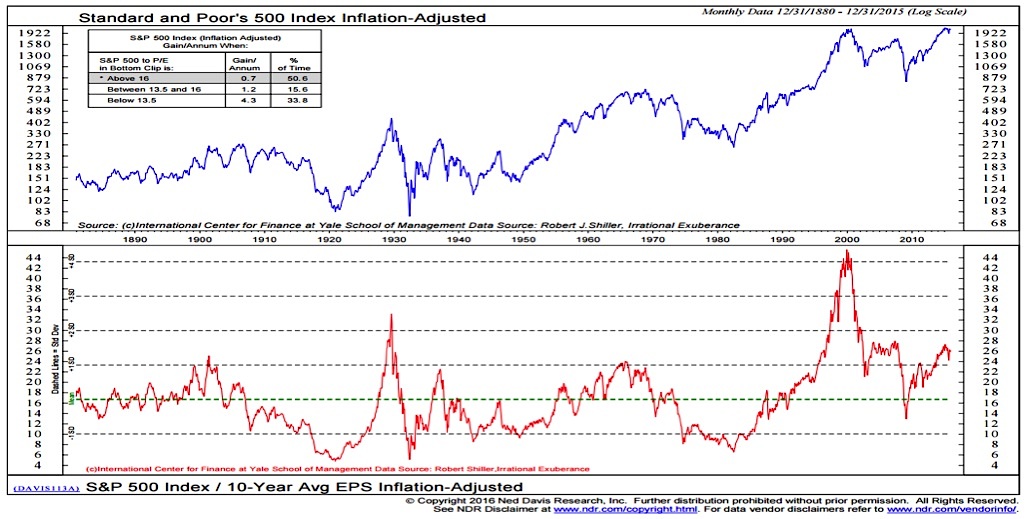

The current economic climate plays a significant role in President Trump's decision to hold off on replacing Fed Chair Powell. While not without its challenges, the US economy currently exhibits several positive indicators that mitigate the risks associated with a sudden leadership change at the Federal Reserve.

- Relatively Low Unemployment Rates: Unemployment remains historically low, suggesting a strong labor market. This stability makes a drastic shift in monetary policy less desirable.

- Stable, Albeit Slow, Economic Growth: The economy is experiencing steady, if not spectacular, growth. This controlled expansion reduces the urgency for immediate changes in leadership at the Fed.

- Inflation Remaining Within the Fed's Target Range: Inflation remains relatively tame, within the Federal Reserve's target range. This avoids the need for drastic interventions that a new Chair might implement.

- Potential Risks to the Economy, Such as Trade Wars: While trade tensions continue to pose a threat, the current economic indicators suggest a degree of resilience. Introducing further economic uncertainty through a sudden change in Fed leadership could exacerbate these existing risks.

Replacing Powell at this time could significantly increase economic uncertainty, leading to market volatility and potentially eroding investor confidence. A new chair, especially one with a dramatically different approach to monetary policy, could disrupt the carefully calibrated balance the Fed has currently established.

Political Ramifications of a Powell Replacement

The potential political fallout from a sudden replacement of Jerome Powell is another significant factor. Such a move would likely have far-reaching consequences for President Trump and the political landscape.

- Potential Backlash from Both Democrats and Moderate Republicans: Replacing Powell would likely be viewed by Democrats as blatant political interference in an independent central bank. Even some moderate Republicans might express concern over executive overreach.

- Damage to President Trump's Reputation and Credibility: A widely perceived politically motivated replacement could damage President Trump's reputation, particularly given the ongoing focus on his relationship with the Federal Reserve.

- Increased Scrutiny of Presidential Influence over the Federal Reserve: The move would undoubtedly invite intense scrutiny of the relationship between the executive branch and the Federal Reserve's independence, leading to increased debate over the appropriate level of presidential influence.

The timing of a potential replacement is also crucial, especially given the upcoming elections. A change now could significantly impact the political narrative and potentially harm President Trump's reelection chances. The potential for negative political pressure surrounding the "President Trump Fed Chair Powell" dynamic is a major consideration.

Powell's Performance and the President's Shifting Stance

President Trump has previously expressed strong criticism of Powell, particularly regarding interest rate hikes. However, his stance seems to have evolved somewhat.

- Contrast the President's Earlier Calls for Lower Interest Rates with the Current Situation: President Trump's earlier calls for lower interest rates were largely fueled by his desire for continued economic expansion. The current economic climate, while not booming, also doesn’t necessitate immediate drastic rate cuts.

- Analyze Any Potential Shifts in the President's Perspective: The shift in the President's perspective might be attributed to a number of factors, including reassessment of the economic data and advice from his economic advisors.

- Discuss the Influence of Economic Advisors and Other Political Figures: Key economic advisors and political strategists likely play a substantial role in shaping the President's views on this matter.

This evolution in the President's thinking, coupled with the relatively stable economic conditions, contributes significantly to the decision against an immediate replacement of Fed Chair Powell. The interplay between interest rate policy, monetary policy, and the President’s evolving perspective on the Federal Reserve's role is vital in understanding the current situation.

Alternative Paths for Presidential Influence on the Fed

Even without replacing Powell, President Trump retains avenues to influence the Federal Reserve's policies.

- Public Statements and Pressure on the Fed to Adopt a Particular Policy: The President can continue to publicly express his views on monetary policy, exerting indirect pressure on the Fed to consider his preferences.

- Appointments to Other Key Positions Within the Federal Reserve System: The President has opportunities to shape the Federal Reserve's future direction through appointments to other key positions within the system.

- Lobbying Efforts Through Congressional Channels: The President can also indirectly influence the Fed through lobbying efforts with Congress, potentially affecting legislation related to the Federal Reserve's operations.

While these methods provide avenues for policy influence, they also carry limitations and potential risks. Overt pressure could damage the Fed's independence and credibility, potentially undermining its effectiveness. The balance between indirect pressure and maintaining the Fed's independence is a delicate one.

Conclusion

This article has examined the multifaceted factors contributing to President Trump's decision to refrain from immediately replacing Fed Chair Jerome Powell. Economic stability, political ramifications, Powell's recent performance, and alternative methods of influencing the Federal Reserve have all played significant roles in shaping this decision. The interplay between the President Trump Fed Chair Powell dynamic and the broader US economic landscape is complex and requires careful consideration.

While there are no immediate plans to replace President Trump Fed Chair Powell, the situation remains fluid. Stay informed on the latest developments regarding the relationship between the President and the Federal Reserve by following reputable news sources and continuing to research the keyword "President Trump Fed Chair Powell". Understanding this dynamic is crucial for comprehending the future direction of US economic policy.

Featured Posts

-

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025

Two New Oil Refineries Planned Saudi Arabia India Collaboration

Apr 24, 2025 -

Emerging Markets Erase Losses Outpacing Us Stock Market Slump

Apr 24, 2025

Emerging Markets Erase Losses Outpacing Us Stock Market Slump

Apr 24, 2025 -

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025 -

Market Surge Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025

Market Surge Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025 -

Bold And The Beautiful April 3 Recap Full Details Of Liams Health Crisis After Bill Clash

Apr 24, 2025

Bold And The Beautiful April 3 Recap Full Details Of Liams Health Crisis After Bill Clash

Apr 24, 2025

Latest Posts

-

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025 -

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025 -

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025 -

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025 -

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025