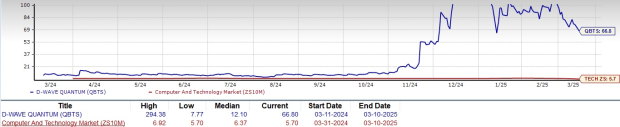

QBTS Stock Earnings Report: Potential Market Reactions And Investment Strategies

Table of Contents

Understanding the QBTS Earnings Report

Key Metrics to Watch

The QBTS earnings report will contain several key metrics that investors should carefully scrutinize. These metrics provide a comprehensive picture of the company's financial health and future prospects. Key data points to focus on include:

- Revenue growth: Year-over-year and quarter-over-quarter comparisons will reveal the trajectory of QBTS's sales. A strong upward trend suggests robust growth and positive momentum for the QBTS stock price.

- Earnings per share (EPS): This metric indicates the portion of a company's profit allocated to each outstanding share. An EPS that beats analyst expectations often leads to a positive market reaction and increased QBTS stock price. A miss, however, can significantly impact the QBTS stock price negatively.

- Guidance: Management's outlook for future performance provides valuable insights into their expectations for revenue, earnings, and other key performance indicators. Positive guidance can boost investor confidence, leading to a rise in QBTS investment.

- Key performance indicators (KPIs): These metrics are specific to QBTS's business model and offer a deeper understanding of its operational efficiency and success. Analyzing these KPIs alongside other financial data will provide a more holistic picture of the QBTS stock performance. For instance, customer acquisition cost (CAC) and customer lifetime value (CLTV) are important KPIs for many companies and should be carefully considered.

- Debt levels and cash flow: Analyzing QBTS's debt-to-equity ratio and operating cash flow provides insights into its financial health and stability. High debt levels or declining cash flow can raise concerns, impacting the QBTS stock price.

Analyzing the Context

Analyzing the QBTS earnings report in isolation isn't sufficient. A thorough analysis requires considering several contextual factors:

- Macroeconomic factors: The overall economic climate significantly impacts stock performance. Inflation, interest rate changes, and broader market trends influence investor sentiment and can affect the QBTS stock price regardless of the company's performance.

- Industry trends: How is QBTS performing relative to its competitors? Analyzing the performance of similar companies helps assess QBTS's competitive position and market share. Understanding industry-wide challenges or opportunities is crucial for interpreting the QBTS earnings report.

- Company-specific news: Recent announcements, partnerships, or challenges related to QBTS can significantly affect investor sentiment and the QBTS stock price. Stay informed about any significant company-specific developments before and after the earnings report.

Potential Market Reactions to QBTS Earnings

The market's reaction to the QBTS earnings report will depend heavily on whether the results meet, beat, or miss expectations.

Positive Earnings Surprise

- Potential for significant stock price increase: Exceeding expectations often triggers a wave of buying, leading to a substantial increase in the QBTS stock price.

- Increased investor confidence and buying pressure: Positive results reinforce investor confidence, encouraging further investment and upward pressure on the QBTS stock price.

- Attraction of new investors and increased trading volume: Strong earnings can attract new investors, leading to increased trading volume and further price appreciation.

Negative Earnings Surprise

- Potential for significant stock price decline: Disappointing results can trigger widespread selling, leading to a considerable drop in the QBTS stock price.

- Investor sell-offs and decreased trading volume: Negative news often results in investor sell-offs, reducing trading volume and further depressing the QBTS stock price.

- Potential for negative media coverage impacting sentiment: Negative earnings reports often attract negative media attention, which can further amplify the downward pressure on the QBTS share price.

Meeting Expectations

- Stock price may experience minor fluctuations: Meeting expectations generally leads to less dramatic market reactions. The QBTS stock price may experience minor fluctuations depending on broader market sentiment.

- Investor reaction likely depends on broader market conditions: If the broader market is positive, meeting expectations might still lead to modest gains. Conversely, a negative market environment might lead to minor losses even if QBTS meets expectations.

- Potential for sideways trading or consolidation: The QBTS stock price might consolidate or trade sideways until further information or events provide a clearer direction.

Investment Strategies Based on QBTS Earnings

Developing a robust investment strategy requires careful planning and adaptability.

Before the Earnings Report

- Review your risk tolerance and investment goals: Understand your comfort level with risk and align your investment strategy with your long-term financial goals.

- Research analyst ratings and price targets: Review analyst reports and price targets to gauge the consensus view on QBTS's prospects.

- Consider diversifying your portfolio to mitigate risk: Diversification helps reduce the impact of any single investment's underperformance.

After the Earnings Report

- Analyze the actual results and compare them to expectations: Carefully examine the reported figures and compare them to your own expectations and analyst forecasts.

- Assess the market reaction and adjust your strategy accordingly: Observe how the market reacts to the earnings announcement and adapt your strategy based on the new information.

- Consider buying the dip if the stock price falls significantly (after careful analysis): If the QBTS stock price drops significantly after a negative surprise, consider buying more shares if your analysis suggests the drop is overdone. However, this should be a carefully considered decision, not a knee-jerk reaction.

- Consider taking profits if the stock price rises significantly: If the QBTS stock price surges after a positive surprise, consider taking some profits to secure gains.

- Long-term vs. short-term investment strategies: Align your investment approach with your long-term or short-term goals. Long-term investors might be less affected by short-term fluctuations in the QBTS stock price.

Conclusion

The QBTS stock earnings report presents both opportunities and risks for investors. By carefully analyzing key metrics, understanding potential market reactions, and developing a well-informed investment strategy, you can navigate this period effectively. Remember to conduct thorough due diligence, consider your risk tolerance, and adjust your approach based on the actual results and market sentiment following the QBTS earnings announcement. Stay informed on all QBTS stock news and continue to monitor the QBTS stock price and market analysis to make well-informed investment decisions concerning your QBTS investment. Don't miss out – actively participate in the QBTS stock market analysis and capitalize on the opportunities presented by the QBTS earnings report.

Featured Posts

-

Trump Administrations Ai Policy A Landmark Bill Yet Unresolved Issues Persist

May 21, 2025

Trump Administrations Ai Policy A Landmark Bill Yet Unresolved Issues Persist

May 21, 2025 -

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025

Nyt Mini Crossword Answers Today March 18 2025 Clues And Solutions

May 21, 2025 -

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025

How Brexit Is Hampering Uk Luxury Exports To The Eu

May 21, 2025 -

Who Is Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025

Who Is Paulina Gretzky Dustin Johnsons Wife Career And Family

May 21, 2025 -

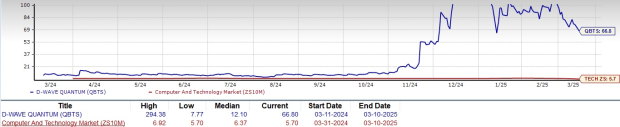

Klopps Liverpool Transforming Doubters Into Believers A Detailed Analysis

May 21, 2025

Klopps Liverpool Transforming Doubters Into Believers A Detailed Analysis

May 21, 2025

Latest Posts

-

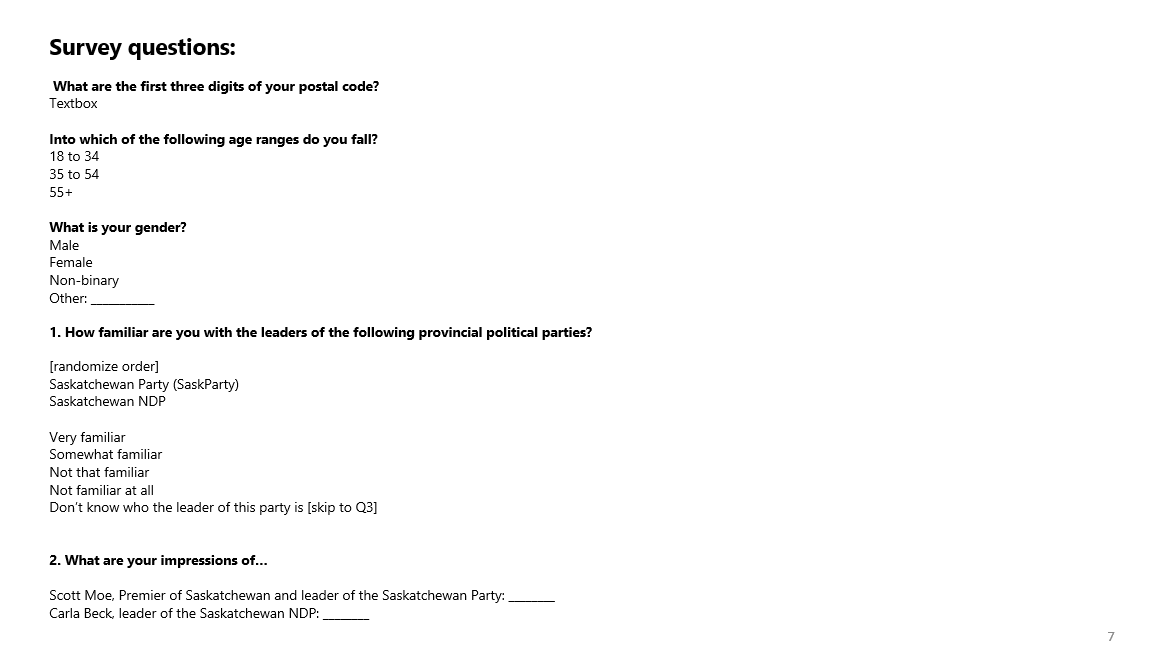

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025 -

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025 -

Saskatchewan Political Panel Exploring Western Separation

May 22, 2025

Saskatchewan Political Panel Exploring Western Separation

May 22, 2025 -

Financial Times Bp Chief Targets Valuation Doubling Rejects Us Listing

May 22, 2025

Financial Times Bp Chief Targets Valuation Doubling Rejects Us Listing

May 22, 2025 -

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025

Bp Ceos Plan Double Valuation Remain On London Stock Exchange

May 22, 2025