QIAGEN Announces Robust Preliminary Q1 2025 Financial Performance

Table of Contents

Strong Revenue Growth in Q1 2025

QIAGEN reported a significant surge in Q1 2025 revenue, demonstrating impressive growth compared to the same period in the previous year. This robust revenue growth was observed across various product categories, showcasing the strength and breadth of QIAGEN's offerings within the molecular diagnostics market.

- Revenue Breakdown by Product Category: While specific figures are pending the official release, preliminary data indicates substantial growth across all major product categories. Sample & assay technologies, a cornerstone of QIAGEN's business, experienced a double-digit percentage increase in revenue. Similarly, revenue from instruments and consumables also showed considerable expansion, reflecting strong demand for QIAGEN's comprehensive solutions.

- Key Growth Drivers:

- New product launches, particularly in the area of next-generation sequencing (NGS), significantly contributed to the overall revenue growth.

- Expansion into new geographical markets, with particular success in emerging economies, also played a crucial role.

- Strategic partnerships and collaborations further boosted Q1 2025 revenue.

- Geographical Growth: North America and Europe continued to be strong markets, but Asia-Pacific showed exceptional growth, demonstrating the increasing adoption of QIAGEN's technologies in this region. This geographical diversification strengthens QIAGEN's resilience and future growth potential. The keywords "Q1 2025 revenue," "product categories," "sample technologies," "assay technologies," and "geographical growth" are all key in understanding this section.

Increased Profitability and Margin Expansion

Beyond revenue growth, QIAGEN's Q1 2025 results highlighted a significant improvement in profitability and margin expansion. This demonstrates the company's efficiency and ability to translate increased sales into higher profits.

- Key Profitability Metrics: Preliminary data points towards a substantial increase in gross margin, operating margin, and net income. While precise figures await the official report, the positive trend is undeniable.

- Drivers of Improved Profitability:

- Effective cost-cutting measures, achieved through operational efficiencies and streamlined processes, contributed significantly to margin expansion.

- Increased sales volume, driven by strong demand for QIAGEN's products, leveraged economies of scale and further enhanced profitability.

- Strategic pricing strategies also played a role in boosting margins.

- Impact on Earnings Per Share (EPS): The improved profitability translated into a positive impact on earnings per share (EPS), a key indicator for investors. This increase in EPS reflects the strong financial performance of QIAGEN in Q1 2025. The use of keywords like "profitability," "margin expansion," "gross margin," "operating margin," "net income," "earnings per share," and "EPS" accurately reflects the context of this section.

Positive Outlook for the Full Year 2025

Based on the strong Q1 2025 performance, QIAGEN has issued a positive outlook for the full year. This reinforces confidence in the company's growth trajectory and future prospects.

- Full-Year Guidance: QIAGEN has raised its full-year revenue guidance, reflecting the positive momentum from Q1 2025. This upward revision showcases the company's confidence in its ability to deliver strong results throughout the year.

- Influencing Factors: While the outlook is positive, market trends, competitive landscape, and potential regulatory changes could influence future performance. QIAGEN is actively monitoring these factors and adapting its strategies accordingly.

- Strategic Initiatives: QIAGEN plans to continue investing in research and development (R&D), expanding its product portfolio, and exploring strategic acquisitions to further enhance its market position and long-term growth. This proactive approach underscores QIAGEN’s commitment to innovation and market leadership. The keywords "full-year outlook," "2025 guidance," "market trends," "strategic initiatives," and "future performance" are strategically included here.

Key Takeaways and Implications for Investors

QIAGEN's preliminary Q1 2025 results demonstrate a remarkable financial performance, exceeding initial expectations. The robust revenue growth, increased profitability, and positive full-year outlook have significant implications for investors.

- Key Achievements: Q1 2025 saw significant achievements, including strong revenue growth across all major product categories, substantial margin expansion, and a positive impact on EPS.

- Long-Term Growth Potential: QIAGEN's performance underlines its strong long-term growth potential within the rapidly expanding molecular diagnostics market. The company's commitment to innovation, strategic partnerships, and geographical expansion positions it for continued success.

- Investor Recommendations: The preliminary Q1 2025 results suggest a positive outlook for QIAGEN's stock. However, investors should consider broader market conditions and conduct their own due diligence before making investment decisions. The keywords "investor implications," "stock price," "dividend," "long-term growth," and "QIAGEN stock" are prominent in this section.

Conclusion: QIAGEN's Robust Q1 2025 Performance Signals Strong Future Growth

QIAGEN's preliminary Q1 2025 financial performance is undeniably impressive. The robust revenue growth, increased profitability, and positive full-year outlook collectively paint a picture of a company on a strong upward trajectory. These results not only bode well for QIAGEN's future but also significantly impact investors and the broader molecular diagnostics landscape. To stay updated on QIAGEN's financial performance and learn more about QIAGEN's Q1 2025 results, visit their investor relations website or contact their investor relations team. Explore QIAGEN's investment opportunities and stay informed about this dynamic leader in the molecular diagnostics market.

Featured Posts

-

Analyst Insight Should You Buy This Entertainment Stock Now

May 29, 2025

Analyst Insight Should You Buy This Entertainment Stock Now

May 29, 2025 -

Mother Sentenced For Trafficking Missing Child Body Parts Sold

May 29, 2025

Mother Sentenced For Trafficking Missing Child Body Parts Sold

May 29, 2025 -

Regi Bukszak Erdemes E Atnezni Oket

May 29, 2025

Regi Bukszak Erdemes E Atnezni Oket

May 29, 2025 -

Heitingas Coaching Style A Closer Look At The Bum Pats And Forehead Kisses

May 29, 2025

Heitingas Coaching Style A Closer Look At The Bum Pats And Forehead Kisses

May 29, 2025 -

Advocate Reports Paramedic Success At Police And Emergency Services Games

May 29, 2025

Advocate Reports Paramedic Success At Police And Emergency Services Games

May 29, 2025

Latest Posts

-

Complete Guide To Air Jordan Releases June 2025 Edition

May 30, 2025

Complete Guide To Air Jordan Releases June 2025 Edition

May 30, 2025 -

Uerduen Gazze Den Tahliye Edilen Kanserli Cocuklar Icin Umut Isigi

May 30, 2025

Uerduen Gazze Den Tahliye Edilen Kanserli Cocuklar Icin Umut Isigi

May 30, 2025 -

Air Jordan June 2025 Release Dates Must Know Info For Sneakerheads

May 30, 2025

Air Jordan June 2025 Release Dates Must Know Info For Sneakerheads

May 30, 2025 -

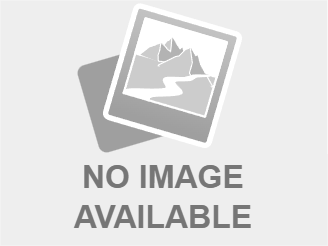

Hl Stunhy Alatfaqyat Aljdydt Azmt Almyah Byn Alardn Wswrya

May 30, 2025

Hl Stunhy Alatfaqyat Aljdydt Azmt Almyah Byn Alardn Wswrya

May 30, 2025 -

Altfawl Alardny Tfasyl Atfaqyat Almyah Aljdydt Me Swrya

May 30, 2025

Altfawl Alardny Tfasyl Atfaqyat Almyah Aljdydt Me Swrya

May 30, 2025