Recent Increase In Bitcoin Mining: A Detailed Look

Table of Contents

The Rising Price of Bitcoin and its Impact on Mining Profitability

The most significant factor contributing to the recent increase in Bitcoin mining is the rising price of Bitcoin itself. A higher Bitcoin price directly translates to increased profit margins for miners, incentivizing more individuals and organizations to participate in the process.

Increased Bitcoin Value

- Example 1: When Bitcoin's price surged from $30,000 to $60,000, the profitability of mining operations nearly doubled, attracting new miners.

- Example 2: A sustained price above $50,000 for several months significantly boosted the return on investment for miners, leading to expanded operations and new entrants into the market.

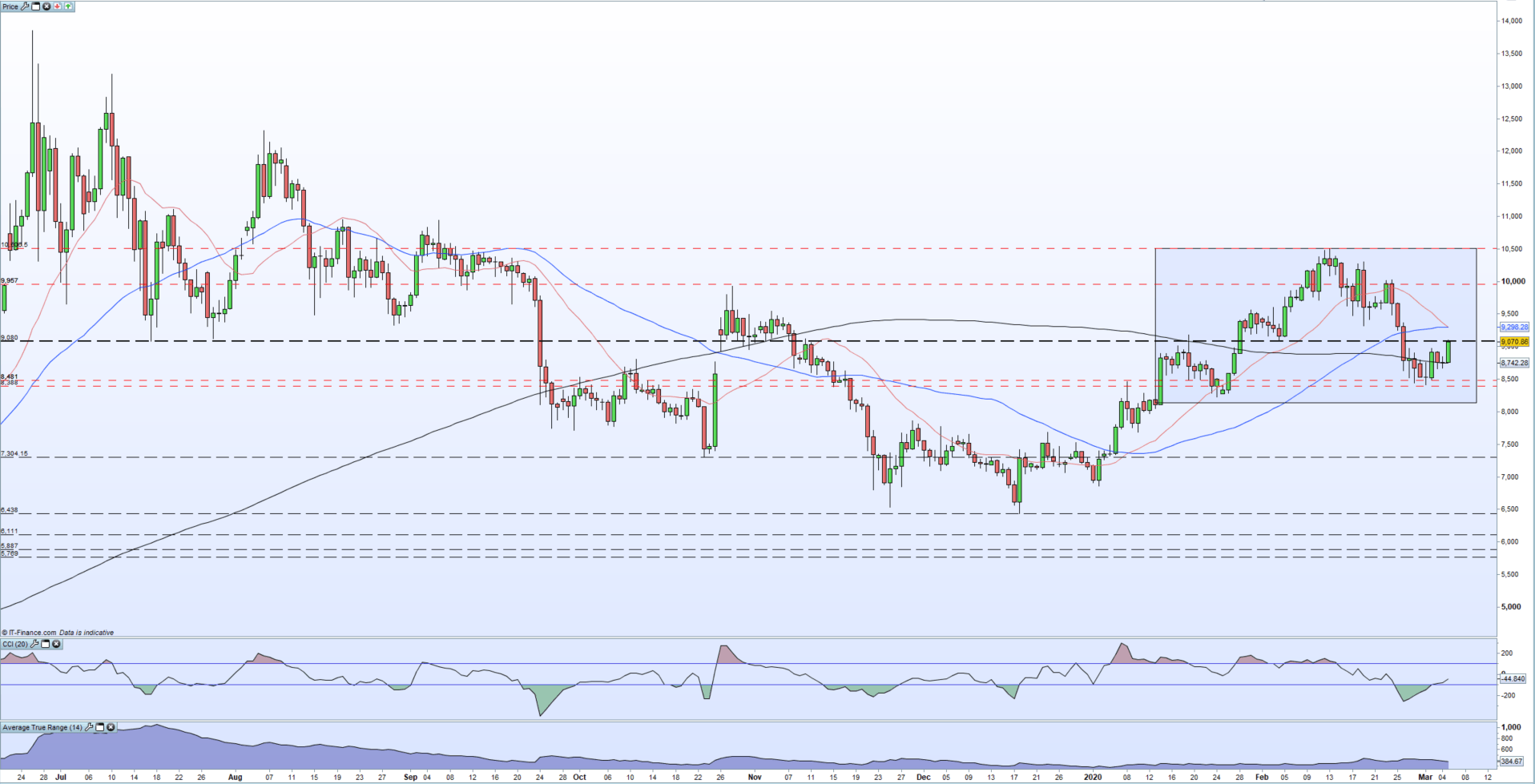

Charts illustrating the correlation between Bitcoin's price and its hash rate (a measure of the computational power dedicated to mining) would visually reinforce this point. (Ideally, a chart would be inserted here). This demonstrates that higher prices directly translate to increased mining activity.

Mining Difficulty Adjustment

Bitcoin's ingenious design includes a difficulty adjustment algorithm. This algorithm dynamically adjusts the computational difficulty of mining new blocks to maintain a roughly 10-minute block generation time.

- Mechanics: If many miners join the network, increasing the overall hash rate, the difficulty adjusts upwards, making it harder to mine blocks and thus maintaining the intended block generation frequency.

- Implications: This adjustment impacts both large and small-scale operations. While large mining farms with substantial hashing power can adapt better, smaller miners may find it harder to compete and remain profitable. This dynamic constantly reshapes the competitive landscape within the Bitcoin mining industry.

Technological Advancements in Bitcoin Mining Hardware

Advancements in mining hardware have played a crucial role in the recent surge in Bitcoin mining activity. These technological improvements have increased efficiency and profitability, making mining more accessible to a wider range of participants.

ASIC Development and Efficiency Improvements

Application-Specific Integrated Circuits (ASICs) are specialized microchips designed solely for Bitcoin mining. Constant innovation in ASIC design has led to significant efficiency gains.

- Major ASIC Manufacturers: Bitmain, MicroBT, and Canaan Creative are leading manufacturers continually releasing more powerful and energy-efficient ASICs.

- Improved Energy Efficiency: Newer ASICs consume considerably less energy per unit of hashing power, making mining more cost-effective and environmentally less demanding (although still energy intensive). This improved efficiency is a key driver of the recent increase in mining.

Specialized Mining Farms and Infrastructure

The rise of large-scale, industrial-level mining farms is another significant factor. These operations benefit from economies of scale, allowing them to achieve significantly lower operational costs per unit of Bitcoin mined.

- Economies of Scale: Large farms can negotiate better prices for electricity and hardware, significantly reducing their overall operational expenses.

- Cheap Energy Sources: Access to cheap renewable energy sources, such as hydroelectric or geothermal power, further enhances the profitability of these large-scale mining operations. This often results in them being located in regions with readily available cheap and renewable energy sources.

Increased Institutional and Corporate Investment in Bitcoin Mining

The increasing involvement of institutional and corporate investors is a relatively recent but impactful factor driving the recent increase in Bitcoin mining.

Public Companies Entering the Mining Space

Several publicly traded companies have entered the Bitcoin mining space, bringing significant capital and expertise to the industry.

- Examples: Riot Blockchain, Marathon Digital Holdings, and Core Scientific are examples of publicly traded companies heavily invested in Bitcoin mining.

- Implications: This institutional interest brings greater stability and transparency to the Bitcoin mining sector, attracting further investment and driving industry growth.

Growing Institutional Adoption of Bitcoin

The broader adoption of Bitcoin as a legitimate asset class by institutional investors like pension funds and hedge funds contributes indirectly to increased mining.

- Effect on Price and Profitability: Increased institutional demand pushes Bitcoin's price higher, directly increasing mining profitability and encouraging more mining activity. This creates a positive feedback loop.

Environmental Concerns and Sustainable Mining Practices

The significant energy consumption of Bitcoin mining has raised serious environmental concerns. However, efforts are underway to mitigate these concerns and promote more sustainable practices.

Energy Consumption and its Environmental Impact

Bitcoin mining's energy footprint is considerable. The exact figures vary depending on the methodology and data sources, but it's undeniable that it consumes substantial amounts of electricity.

- Statistics: While precise figures are debated, the sheer scale of energy used is a major area of concern and discussion. This has spurred calls for increased transparency and adoption of renewable energy sources.

- Potential Solutions: The transition towards renewable energy sources for mining operations is crucial to reducing the environmental impact of Bitcoin mining. Hydroelectric and solar power are leading candidates for more sustainable mining.

The Rise of Green Mining Initiatives

There's a growing movement towards more environmentally responsible Bitcoin mining. Several initiatives aim to reduce the carbon footprint of this computationally intensive process.

- Renewable Energy Focus: Many mining companies are actively investing in renewable energy sources to power their operations.

- Carbon Offsetting: Some miners are exploring carbon offsetting programs to compensate for their energy consumption.

Conclusion

The recent increase in Bitcoin mining is a multifaceted phenomenon influenced by the rising price of Bitcoin, technological advancements in mining hardware, increased institutional investment, and the ongoing debate surrounding its environmental impact. The implications are far-reaching, affecting the cryptocurrency market's stability, the technological landscape of blockchain, and the broader conversation around sustainable energy practices. Understanding these factors is crucial to comprehending the future of Bitcoin and its role in the evolving digital economy. Stay updated on the ongoing developments in the Bitcoin mining landscape to understand its impact on the future of cryptocurrency. Follow our blog for more in-depth analyses on the Recent Increase in Bitcoin Mining.

Featured Posts

-

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025

10 Best Characters In Saving Private Ryan Ranked

May 08, 2025 -

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025

Nba Star Jayson Tatum Welcomes Son With Singer Ella Mai

May 08, 2025 -

The Ultimate Guide To The Best Krypto Stories

May 08, 2025

The Ultimate Guide To The Best Krypto Stories

May 08, 2025 -

Understanding Ethereums Price Predictions And Market Analysis

May 08, 2025

Understanding Ethereums Price Predictions And Market Analysis

May 08, 2025 -

Bitcoin Price Rebound A Look At Potential Future Growth

May 08, 2025

Bitcoin Price Rebound A Look At Potential Future Growth

May 08, 2025