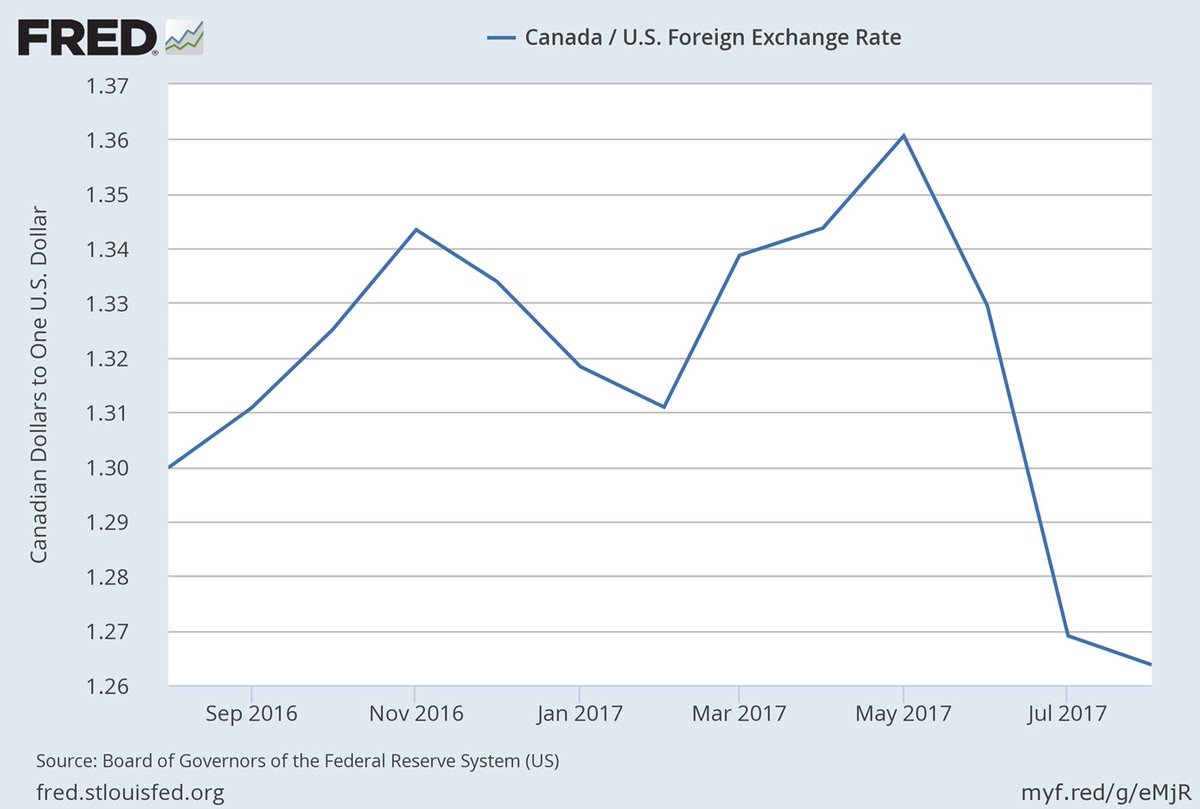

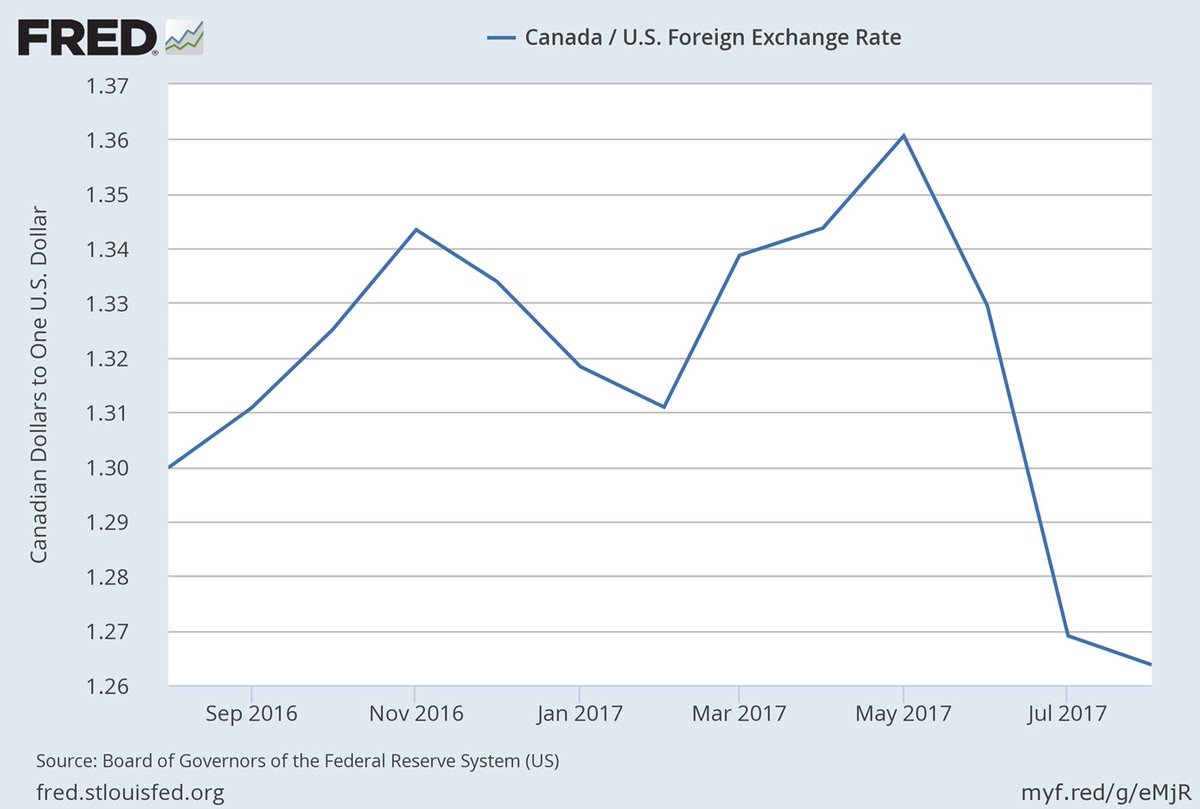

Recent Shifts In The Canadian Dollar Exchange Rate

Table of Contents

Impact of Global Economic Uncertainty on the CAD

The Canadian dollar's value is inextricably linked to global economic conditions, making it susceptible to international influences. Two key areas significantly impact the CAD exchange rate: the performance of the US economy and global commodity prices.

Influence of US Economic Performance

The strong correlation between the CAD and the USD (US dollar) means US economic data heavily influences the Canadian dollar exchange rate. A healthy US economy typically strengthens the CAD, while US economic weakness tends to weaken it. This relationship stems from several factors:

- Increased US interest rates impact CAD value: Higher interest rates in the US attract investment, increasing demand for the USD and consequently strengthening it against the CAD.

- US inflation rates directly affect CAD performance: High inflation in the US can lead to the Federal Reserve raising interest rates, impacting the CAD as described above. Conversely, low US inflation might lead to lower interest rates, potentially weakening the USD and strengthening the CAD.

- Recessions or slowdowns in the US economy negatively affect the CAD: A weakened US economy reduces demand for Canadian exports and investment, leading to CAD depreciation.

Global Commodity Prices and their Effect on the CAD

Canada's resource-rich economy makes its currency highly sensitive to global commodity prices, particularly oil. Fluctuations in oil prices, along with other key commodities like lumber and metals, directly impact the CAD's value.

- Rising oil prices generally strengthen the CAD: Increased demand and higher prices for Canadian oil exports boost the country's trade balance and strengthen the CAD.

- Decreased demand for commodities weakens the CAD: Global economic slowdowns or shifts in energy consumption can lead to lower commodity prices, weakening the CAD.

- Geopolitical events impacting commodity markets significantly affect the CAD: Global conflicts or political instability in key commodity-producing regions can create price volatility and impact the CAD. For example, disruptions to oil supplies from the Middle East can dramatically affect the CAD exchange rate.

Domestic Factors Affecting the Canadian Dollar Exchange Rate

While global factors play a significant role, domestic economic conditions and policies also heavily influence the CAD exchange rate.

Bank of Canada Monetary Policy

The Bank of Canada's monetary policy decisions, particularly interest rate adjustments, significantly impact the CAD. These decisions are aimed at managing inflation and maintaining economic stability.

- Interest rate hikes attract foreign investment, boosting the CAD: Higher interest rates make Canadian assets more attractive to foreign investors, increasing demand for the CAD.

- Interest rate cuts can weaken the CAD: Lower interest rates can reduce the attractiveness of Canadian assets, potentially leading to a decrease in demand for the CAD and causing depreciation.

- Inflation targets set by the Bank of Canada influence interest rate decisions and the CAD: The Bank of Canada's commitment to its inflation target influences its interest rate decisions, directly affecting the CAD's value.

Canadian Economic Growth and Performance

The health of the Canadian economy is another crucial factor. Strong domestic economic growth generally supports a stronger CAD, while slower growth or economic contraction can lead to depreciation.

- Strong GDP growth usually supports CAD appreciation: A robust Canadian economy attracts foreign investment and increases demand for Canadian goods and services, boosting the CAD.

- High unemployment rates often lead to CAD depreciation: High unemployment signals a weaker economy, potentially leading to lower investor confidence and CAD depreciation.

- Positive consumer confidence indicators generally strengthen the CAD: Strong consumer confidence indicates a healthy economy and often translates to a stronger CAD.

Forecasting Future Movements of the Canadian Dollar Exchange Rate

Predicting future exchange rate movements is inherently complex. Numerous intertwined factors make precise forecasting challenging. However, monitoring key economic indicators, geopolitical events, and central bank actions can offer valuable insights.

- Analyzing economic forecasts from reputable institutions: Staying updated on economic forecasts from organizations like the IMF and the OECD provides valuable context.

- Tracking global commodity price trends: Monitoring commodity prices, particularly oil, provides a crucial indicator of potential CAD movements.

- Monitoring Bank of Canada statements and policy decisions: Paying close attention to the Bank of Canada's communications and policy decisions offers significant insight into future interest rate changes and their potential impact on the CAD.

- Considering geopolitical risks and their impact: Staying informed about geopolitical events and their potential impact on global commodity markets and the broader economy is essential.

Conclusion

The Canadian dollar exchange rate is a dynamic entity influenced by a complex interplay of global and domestic factors. Understanding the impact of US economic performance, global commodity prices, Bank of Canada monetary policy, and Canadian economic growth is crucial for individuals and businesses operating within or interacting with the Canadian economy. By closely monitoring these key factors, you can better navigate the fluctuations in the Canadian dollar exchange rate and make informed financial decisions. Stay informed and continue learning about CAD exchange rate trends to effectively manage your financial exposure. Understanding the intricacies of the Canadian dollar exchange rate is key to successful financial planning.

Featured Posts

-

Sk Hynix Surpasses Samsung As Leading Dram Manufacturer The Ai Factor

Apr 24, 2025

Sk Hynix Surpasses Samsung As Leading Dram Manufacturer The Ai Factor

Apr 24, 2025 -

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025

Herro Edges Hield In Thrilling Nba 3 Point Contest

Apr 24, 2025 -

Pete Hegseth And The Trump Agenda Navigating The Signal App Controversy

Apr 24, 2025

Pete Hegseth And The Trump Agenda Navigating The Signal App Controversy

Apr 24, 2025 -

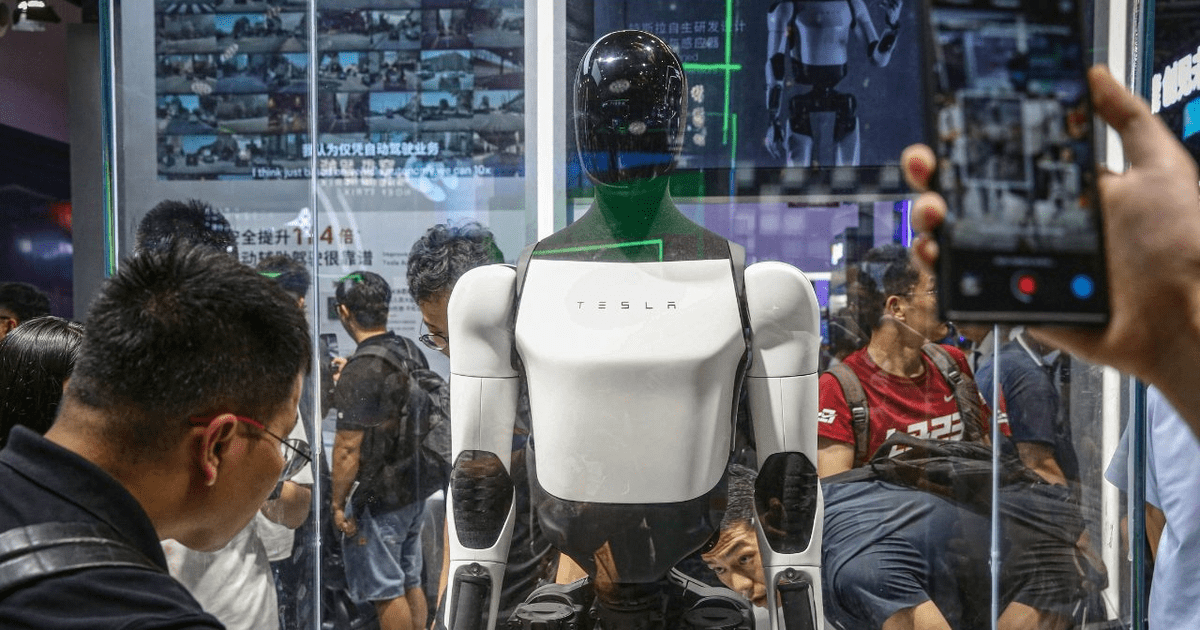

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Rare Earth Supply Issues

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Rare Earth Supply Issues

Apr 24, 2025 -

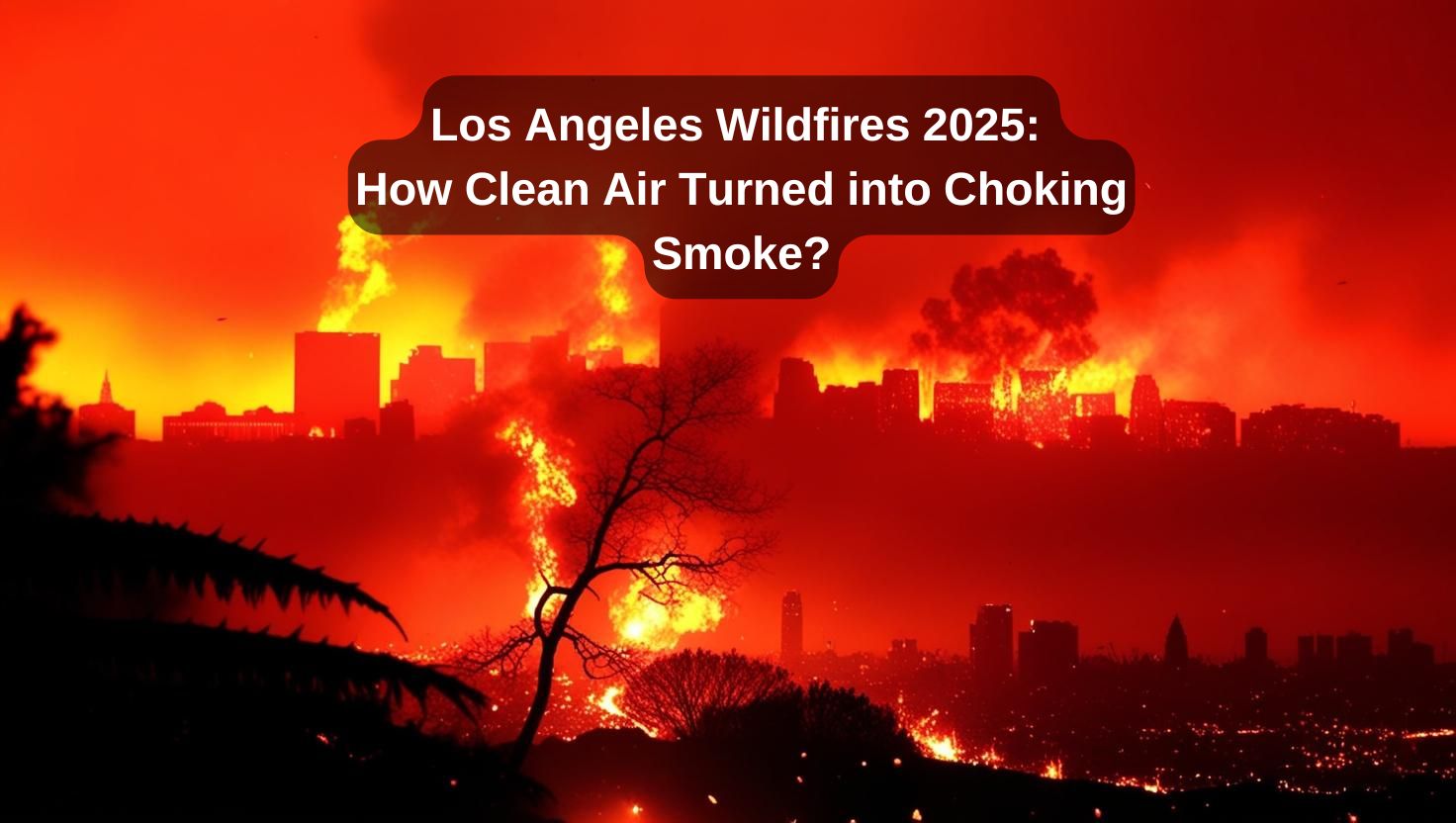

Gambling On Calamity The Los Angeles Wildfires And The Trend Of Disaster Betting

Apr 24, 2025

Gambling On Calamity The Los Angeles Wildfires And The Trend Of Disaster Betting

Apr 24, 2025

Latest Posts

-

Did Tyla Copy Britney Spears Style For Coachella 2025

May 12, 2025

Did Tyla Copy Britney Spears Style For Coachella 2025

May 12, 2025 -

Rich Kids Cribs A Modern Day Look At Mtv Cribs Extravagance

May 12, 2025

Rich Kids Cribs A Modern Day Look At Mtv Cribs Extravagance

May 12, 2025 -

Inside The Cribs Of Todays Wealthy Youth An Mtv Cribs Perspective

May 12, 2025

Inside The Cribs Of Todays Wealthy Youth An Mtv Cribs Perspective

May 12, 2025 -

Mtv Cribs Rich Kids Cribs Opulence And Excess On Display

May 12, 2025

Mtv Cribs Rich Kids Cribs Opulence And Excess On Display

May 12, 2025 -

Mtv Cribs Exploring The Luxurious Mansions Of The Wealthy Young

May 12, 2025

Mtv Cribs Exploring The Luxurious Mansions Of The Wealthy Young

May 12, 2025