Record Bitcoin Price: Optimism Grows On US Regulatory Clarity

Table of Contents

The Impact of Potential US Regulatory Frameworks on Bitcoin's Price

Clearer regulatory pathways for cryptocurrencies in the US are significantly impacting Bitcoin's price. Reduced uncertainty is attracting institutional investment, a key driver of the recent price increases. This increased involvement brings stability and legitimacy to the market, encouraging further growth.

- Increased institutional adoption due to reduced regulatory risk: As regulatory uncertainty diminishes, large financial institutions are feeling more comfortable allocating capital to Bitcoin. This institutional investment injects significant liquidity into the market, pushing prices higher.

- Greater investor confidence leading to higher demand: Clearer regulations instill confidence among both institutional and retail investors. This increased confidence translates directly into higher demand, driving up the price of Bitcoin.

- Potential for Bitcoin ETFs boosting liquidity and accessibility: The possibility of Bitcoin Exchange-Traded Funds (ETFs) becoming available in the US is a major catalyst for growth. ETFs make Bitcoin more accessible to a wider range of investors, increasing liquidity and potentially driving further price appreciation.

- Examples of recent regulatory developments: Recent proposed bills and statements from key regulatory figures like Gary Gensler, Chairman of the Securities and Exchange Commission (SEC), are contributing to this increased clarity. While the specifics are still developing, the direction towards clearer regulatory frameworks is palpable and positively impacting market sentiment. This includes ongoing discussions surrounding the classification of various crypto assets and the potential for a comprehensive regulatory framework.

Keywords: Bitcoin regulation, US Bitcoin regulations, institutional Bitcoin investment, Bitcoin ETF, regulatory clarity, crypto regulation.

Macroeconomic Factors Contributing to Bitcoin's Record High

Beyond regulatory developments, macroeconomic factors are significantly influencing Bitcoin's price. High inflation, economic uncertainty, and geopolitical instability are pushing investors towards alternative assets like Bitcoin.

- Inflationary pressures driving investors towards alternative assets: As traditional assets struggle to keep pace with inflation, investors are seeking assets that potentially offer better protection against devaluation. Bitcoin, with its limited supply, is seen by many as a hedge against inflation.

- Geopolitical instability boosting demand for Bitcoin as a safe haven: During times of global uncertainty, investors often turn to assets perceived as safe havens. Bitcoin's decentralized nature and resilience to geopolitical events make it an attractive option for diversification and risk mitigation.

- Comparison of Bitcoin's performance against traditional markets during times of uncertainty: Historically, Bitcoin has shown resilience during periods of economic instability, often outperforming traditional markets. This track record enhances its appeal as a safe haven asset.

- Analysis of Bitcoin's correlation with macroeconomic indicators: Studies analyzing the correlation between Bitcoin's price and macroeconomic indicators like inflation and stock market performance are further solidifying its role as a valuable component in a diversified investment portfolio.

Keywords: Bitcoin inflation hedge, Bitcoin safe haven, macroeconomic factors, Bitcoin price correlation, economic uncertainty, cryptocurrency investment.

Increased Adoption and Mainstream Awareness of Bitcoin

The increasing adoption of Bitcoin by businesses and individuals is another crucial factor driving the record high. This wider acceptance is fueled by increased media coverage and growing public awareness.

- Growth in Bitcoin payments and adoption by merchants: More and more businesses are accepting Bitcoin as a form of payment, expanding its practical use cases and reinforcing its legitimacy.

- Rising number of Bitcoin ATMs and increased accessibility: The increasing availability of Bitcoin ATMs is making it easier for individuals to buy and sell Bitcoin, increasing accessibility and driving adoption.

- Positive media coverage contributing to a more favorable public perception: Increased media attention, even if sometimes negative, is contributing to wider public awareness and familiarity with Bitcoin, leading to greater acceptance.

- Impact of celebrity endorsements and social media influence: High-profile endorsements and the influence of social media personalities are playing a significant role in popularizing Bitcoin and driving public interest.

Keywords: Bitcoin adoption, Bitcoin payments, Bitcoin ATM, Bitcoin mainstream adoption, media coverage, social media influence.

Conclusion

The recent record Bitcoin price is a result of a confluence of positive factors: increasing US regulatory clarity, macroeconomic instability pushing investors towards alternative assets, and growing mainstream adoption. These developments have fueled investor optimism and contributed to a significant surge in Bitcoin's value.

Call to Action: Stay informed about the evolving regulatory landscape and market trends to capitalize on the potential of Bitcoin. Learn more about how to safely invest in Bitcoin and navigate the complexities of the cryptocurrency market. Follow our blog for the latest updates on record Bitcoin prices and the impact of US regulatory clarity on Bitcoin's future.

Featured Posts

-

Analyse Stijgende Kapitaalmarktrentes En De Euro Wisselkoers

May 24, 2025

Analyse Stijgende Kapitaalmarktrentes En De Euro Wisselkoers

May 24, 2025 -

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025

Amsterdam Residents Take Legal Action Against City Over Tik Tok Fueled Crowds At Popular Snack Bar

May 24, 2025 -

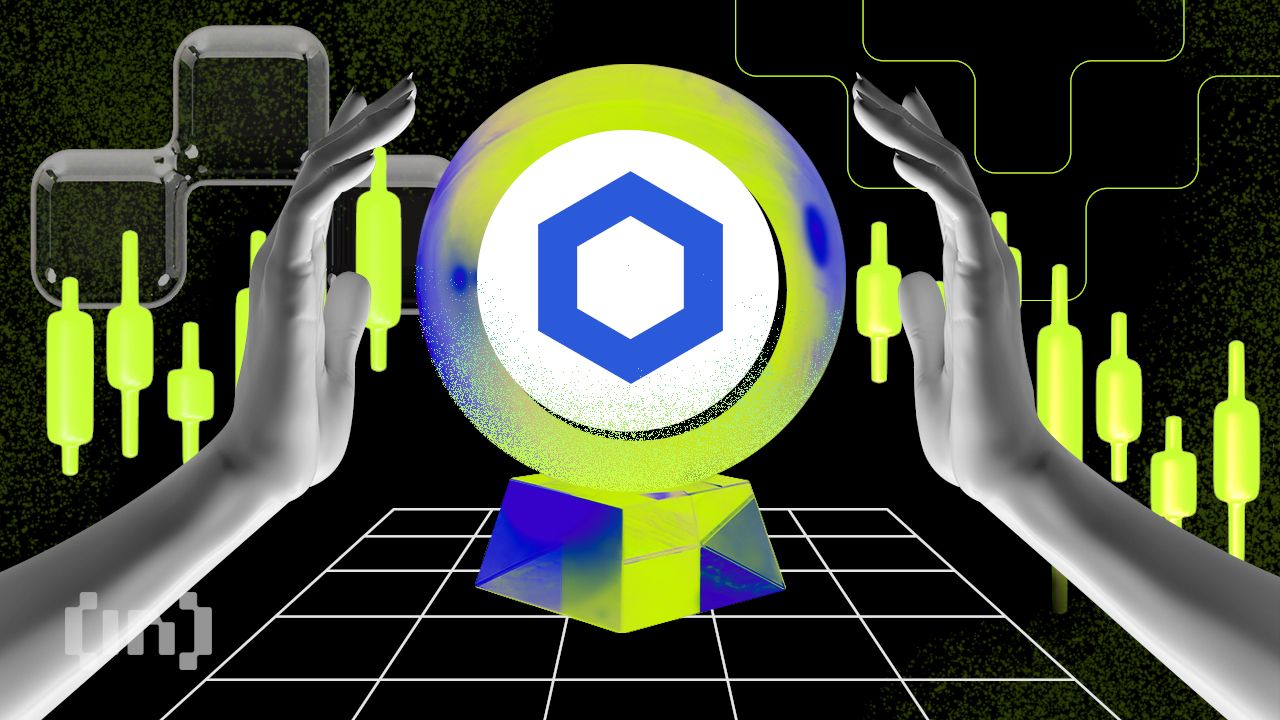

Lvmhs Q1 Results Send Shares Down 8 2

May 24, 2025

Lvmhs Q1 Results Send Shares Down 8 2

May 24, 2025 -

New Photo Of Dylan Dreyer And Brian Fichera Prompts Fan Comments

May 24, 2025

New Photo Of Dylan Dreyer And Brian Fichera Prompts Fan Comments

May 24, 2025 -

Office365 Data Breach How A Hacker Made Millions Targeting Executives

May 24, 2025

Office365 Data Breach How A Hacker Made Millions Targeting Executives

May 24, 2025

Latest Posts

-

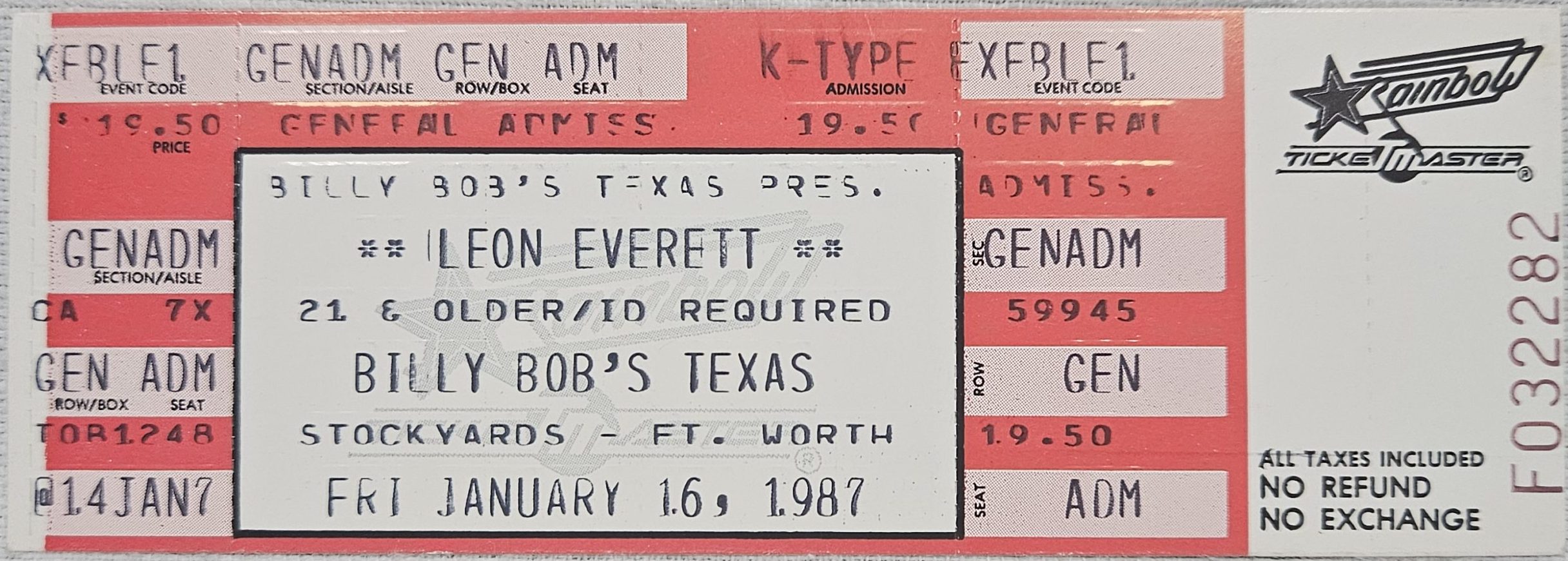

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025 -

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025 -

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025 -

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025