Reduced Chinese Steel Output: A Deep Dive Into Iron Ore Market Dynamics

Table of Contents

The Decline in Chinese Steel Production: Causes and Consequences

The downturn in Chinese steel production is a multifaceted issue stemming from a confluence of factors. Reduced Chinese steel output is not merely a cyclical fluctuation but a structural shift influenced by government policies and changing market conditions.

Government Regulations and Environmental Policies

China's commitment to environmental sustainability has led to increasingly stringent regulations aimed at curbing pollution from its steel industry. These regulations are a key driver of reduced Chinese steel output. The government's focus on carbon emission reduction targets has placed significant pressure on steel mills to adopt cleaner production methods or face severe consequences. The "dual control" mechanism, which limits both energy consumption and carbon emissions, has further constrained steel production capacity.

- Increased fines for non-compliance: Steel mills exceeding emission limits face substantial penalties, incentivizing compliance and impacting production levels.

- Stricter emission standards: The continuous tightening of emission standards forces steel mills to invest heavily in upgrading their facilities, leading to increased costs and potentially reduced output.

- Limitations on steel production capacity: Direct limitations on production capacity in certain regions have contributed to the overall reduction in Chinese steel output.

Weakening Domestic Demand

A slowdown in China's construction and infrastructure sectors, coupled with a downturn in the real estate market, has significantly reduced domestic demand for steel. This weakening demand is a major factor contributing to reduced Chinese steel output. Decreased government spending on infrastructure projects has further exacerbated the situation.

- Decreased housing starts: A decline in new housing construction directly translates into lower steel demand.

- Lower infrastructure investment: Reduced government spending on infrastructure projects, such as high-speed rail and new city development, has significantly impacted steel consumption.

- Weaker economic growth: Overall slower economic growth in China has led to a decrease in demand across various sectors, including steel.

Increased Production Costs

Rising costs of raw materials, energy, and environmental compliance have also contributed to reduced Chinese steel output. The increased cost of production makes it less profitable for some steel mills to operate at full capacity.

- Higher energy prices: Increased energy costs, particularly coal, significantly impact the profitability of steel production.

- Increased transportation costs: Rising fuel prices and logistical challenges contribute to higher transportation costs for raw materials and finished steel products.

- Stricter environmental compliance costs: The costs associated with meeting stricter environmental regulations add a considerable burden to steel production.

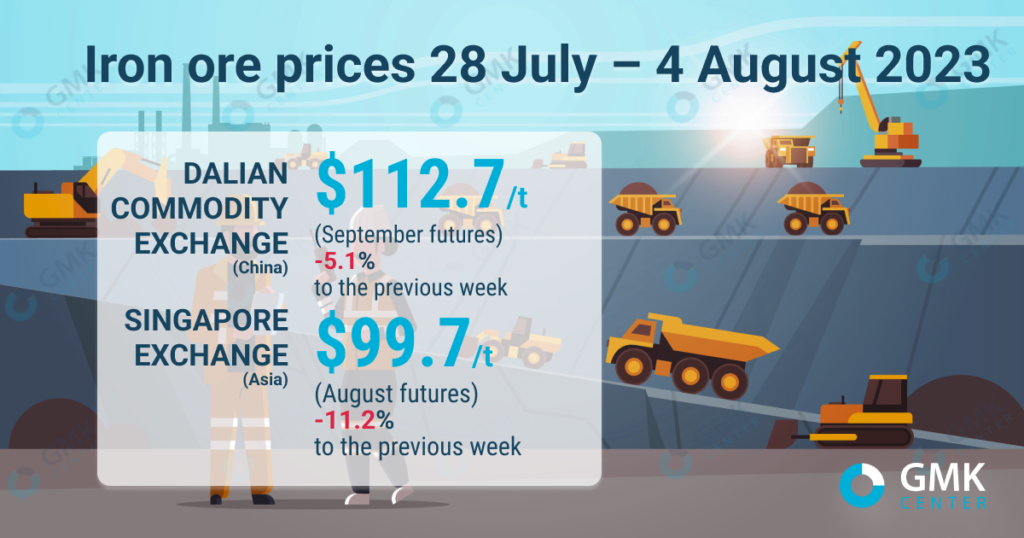

Impact on Global Iron Ore Prices and Market Volatility

Reduced Chinese steel output has had a profound impact on global iron ore prices and market volatility. The decreased demand from China, the world's largest steel producer and iron ore consumer, has created a significant ripple effect across the global market.

Supply-Demand Imbalance

The reduced Chinese steel demand has led to a global surplus of iron ore, creating a supply-demand imbalance. This imbalance is a primary driver of the volatility observed in iron ore prices.

- Decreased iron ore prices: The oversupply has pushed iron ore prices downwards, impacting the profitability of iron ore producers.

- Increased inventory levels: Higher inventory levels among iron ore producers and traders further contribute to price pressure.

- Market price volatility: The fluctuating supply-demand dynamics create significant volatility in the iron ore market, making it challenging to predict future prices.

Major Iron Ore Producers and Their Strategies

Major iron ore producers, including BHP, Rio Tinto, and Vale, have responded to the reduced demand by adjusting their production strategies and implementing cost-cutting measures.

- Production cuts: Many producers have reduced their output to manage inventory levels and avoid further price declines.

- Cost optimization strategies: Producers are focusing on improving operational efficiency and reducing costs to maintain profitability.

- Mergers and acquisitions: Consolidation within the industry is also a potential response to the challenging market conditions.

Alternative Markets and Demand Sources

While China remains a dominant force, the increasing steel production in other regions, such as India, Southeast Asia, and the European Union, offers potential alternative markets for iron ore.

- Growing steel production in developing economies: Rising steel production in developing countries creates new demand for iron ore.

- Increased infrastructure spending globally: Infrastructure development projects worldwide contribute to increased steel, and therefore iron ore demand.

- Potential for market diversification: Iron ore producers are increasingly seeking to diversify their markets to reduce reliance on China.

Conclusion: Navigating the Future of the Iron Ore Market in the Face of Reduced Chinese Steel Output

Reduced Chinese steel output continues to significantly impact global iron ore market dynamics. Understanding the interplay between government policies, domestic demand fluctuations, production costs, and evolving supply-demand relationships is crucial for navigating this volatile market. The ongoing uncertainty necessitates continuous monitoring and adaptation. Stay informed about the latest developments in reduced Chinese steel output and its implications for the iron ore market through dedicated market analysis and research. Subscribing to reputable market analysis reports can provide valuable insights to help you understand the evolving dynamics and make informed decisions.

Featured Posts

-

Local News Coverage Of Anchorage Arts A Critical Analysis

May 09, 2025

Local News Coverage Of Anchorage Arts A Critical Analysis

May 09, 2025 -

Wall Streets Next Big Winner Billionaire Backed Etf Poised For 110 Growth In 2025

May 09, 2025

Wall Streets Next Big Winner Billionaire Backed Etf Poised For 110 Growth In 2025

May 09, 2025 -

Chinas Steel Curbs And The Consequent Drop In Iron Ore Prices A Comprehensive Overview

May 09, 2025

Chinas Steel Curbs And The Consequent Drop In Iron Ore Prices A Comprehensive Overview

May 09, 2025 -

Jesse Watters Cheating Joke Sparks Outrage Hypocrisy Accusations Fly

May 09, 2025

Jesse Watters Cheating Joke Sparks Outrage Hypocrisy Accusations Fly

May 09, 2025 -

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025

Uk Visa Restrictions Impact On Pakistan Nigeria And Sri Lanka

May 09, 2025