Refinancing Federal Student Loans: When It Makes Sense

Table of Contents

Understanding Your Current Federal Student Loan Situation

Before considering refinancing, you need a clear picture of your current loan landscape. This involves understanding your interest rates, loan terms, and credit score.

Assessing Your Interest Rates

Knowing your interest rates on each federal loan is paramount. Different loan types – Direct Subsidized, Unsubsidized, and PLUS loans – often carry varying interest rates.

- How to find this information: Access your federal student loan account information online through the National Student Loan Data System (NSLDS) or your loan servicer's website.

- Impact of interest rates: High interest rates significantly increase the total cost of your loan over its lifetime. Lower interest rates translate to substantial savings in the long run, making refinancing attractive if you can secure a lower rate.

Analyzing Your Loan Terms

Your current repayment plan (Standard, Extended, or Income-Driven) drastically affects your monthly payments and total interest paid.

- Standard Repayment: Fixed monthly payments over 10 years.

- Extended Repayment: Lower monthly payments spread over a longer period (up to 25 years).

- Income-Driven Repayment: Monthly payments are tied to your income and family size.

Understanding the pros and cons of each plan is crucial before deciding on refinancing. Your current loan terms directly influence whether refinancing could benefit you. If you're struggling with high payments, refinancing might provide relief.

Evaluating Your Credit Score

Your credit score is the key to securing a favorable refinance rate. Lenders use it to assess your creditworthiness and risk.

- Factors influencing your score: Payment history, amounts owed, length of credit history, new credit, and credit mix.

- Improving your credit score: Pay down debt, avoid late payments, and check your credit report for errors.

- Credit score and refinancing: A higher credit score typically qualifies you for lower interest rates and better loan terms.

When Refinancing Federal Student Loans Makes Sense

While refinancing can offer significant advantages, it's not always the best option. Here are some situations where refinancing makes sense:

Lower Interest Rates as a Key Driver

The most compelling reason to refinance is securing a significantly lower interest rate. Private lenders often offer lower rates than the federal government, resulting in substantial savings over the loan's life.

- Rate comparison: Research average federal loan interest rates versus those offered by private lenders specializing in student loan refinancing.

- Savings calculation: Use online refinance calculators to estimate your potential savings based on different interest rates and loan amounts.

- Factors affecting rates: Your credit score, loan amount, and the lender you choose all affect the interest rate you'll receive. For example, a borrower with excellent credit may qualify for a rate of 4%, while someone with fair credit may receive a rate closer to 8%. The difference in total interest paid over the life of the loan can be substantial.

Simplifying Multiple Loans into One

Consolidating multiple federal loans into a single private loan simplifies repayment.

- Streamlined process: Manage one monthly payment instead of multiple payments to different servicers.

- Easier tracking: Simplify budgeting and tracking of payments.

- Single payment amount: Predictable monthly expenses make financial planning easier.

Switching to a Fixed Interest Rate

A fixed interest rate protects against future interest rate hikes, offering stability and predictability.

- Predictable payments: Know exactly how much you'll pay each month.

- Protection against increases: Avoid the risk of rising interest rates increasing your monthly payment.

- Long-term planning: Provides a stable framework for long-term financial planning.

Potential Drawbacks of Refinancing Federal Student Loans

Before you jump into refinancing, carefully consider the potential downsides:

Loss of Federal Protections

This is perhaps the most significant drawback. Refinancing federal loans means losing access to crucial federal protections:

- Income-driven repayment plans (IDR): These plans adjust your monthly payments based on your income, preventing overwhelming debt burdens.

- Deferment and forbearance: These options provide temporary pauses in payments during financial hardship.

- Public Service Loan Forgiveness (PSLF): This program forgives remaining loan balances after 10 years of qualifying public service.

Losing these benefits can have severe financial consequences if you experience unexpected job loss or financial difficulties.

Higher Fees and Penalties

Private lenders may charge origination fees and prepayment penalties.

- Origination fees: Charged upfront and increase the overall cost of the loan.

- Prepayment penalties: Charged for paying off the loan early. This is less common now than in the past, but it's important to check your loan terms.

- Fee comparison: Compare fees across different lenders to find the most cost-effective option.

Eligibility Requirements

Not everyone qualifies for refinancing.

- Credit score: Lenders have minimum credit score requirements.

- Debt-to-income ratio: Your debt compared to your income plays a role in eligibility.

- Co-signers: If you don't meet the lender's requirements, a co-signer with good credit may be necessary.

Conclusion

Refinancing federal student loans can offer significant benefits, primarily lower interest rates and simplified payments. However, the loss of federal protections is a substantial trade-off. Carefully weigh the pros and cons, considering your current interest rates, credit score, potential savings, and overall financial situation. Use online refinance calculators to estimate potential savings and research different lenders offering federal student loan refinancing options. Don't hesitate to seek professional financial advice. Ultimately, deciding whether refinancing federal student loans is the right choice depends entirely on your individual circumstances.

Featured Posts

-

Fortnite Item Shop Recent Update Receives Harsh Criticism

May 17, 2025

Fortnite Item Shop Recent Update Receives Harsh Criticism

May 17, 2025 -

Novak Djokovic Yas Siniri Yok Performans Zirvesi Devam Ediyor

May 17, 2025

Novak Djokovic Yas Siniri Yok Performans Zirvesi Devam Ediyor

May 17, 2025 -

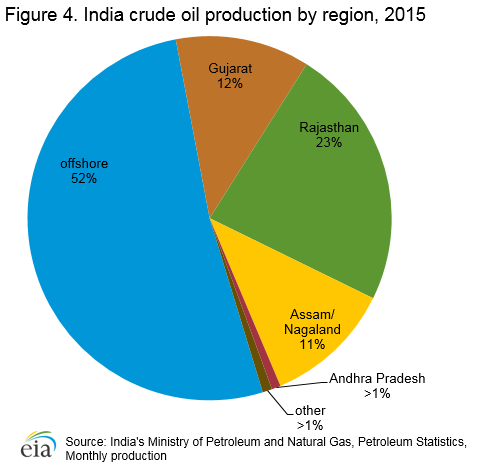

Oil Market Overview And Forecast May 16 2024

May 17, 2025

Oil Market Overview And Forecast May 16 2024

May 17, 2025 -

No Kyc Casinos 2025 7 Bit Casinos Top Rated Instant Withdrawal Service

May 17, 2025

No Kyc Casinos 2025 7 Bit Casinos Top Rated Instant Withdrawal Service

May 17, 2025 -

Tesla Berlin Prosvjed I Poruka O Ekoloskoj Prijetnji

May 17, 2025

Tesla Berlin Prosvjed I Poruka O Ekoloskoj Prijetnji

May 17, 2025

Latest Posts

-

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025 -

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025 -

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025 -

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025 -

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025