Reps Vow To Recover $1.231 Billion From Oil Firms

Table of Contents

The Allegations of Tax Evasion and Underpayment

The representatives' efforts stem from serious allegations of tax evasion and underpayment leveled against several major oil companies. These accusations center on various practices that allegedly allowed these firms to significantly reduce their tax liabilities.

Specific Examples of Alleged Wrongdoing

The allegations include a range of practices:

- Underreporting of production volumes: Oil companies are accused of underreporting the actual amount of oil and gas extracted, leading to lower tax assessments based on artificially reduced production figures.

- Misclassifying expenses to reduce tax liabilities: This involves improperly categorizing expenses to inflate deductions, thereby lowering taxable income. This practice has been flagged as a major area of concern.

- Failure to pay royalties or fees as required by law: Some oil companies allegedly failed to pay the mandated royalties or fees for accessing and exploiting natural resources on public lands. This constitutes a direct violation of existing legal frameworks.

- Intentional use of loopholes: Exploiting legal loopholes and ambiguities in tax regulations to minimize tax payments is another major accusation. This highlights the need for clearer and stricter regulatory oversight.

The Legal and Regulatory Framework

These actions allegedly violate several federal and state laws concerning taxation in the energy sector, including [mention specific acts or regulations, e.g., the Internal Revenue Code, specific state-level tax codes pertaining to oil and gas extraction]. The specifics of the violated regulations will be crucial in determining the legal merits of the representatives’ case.

Supporting Evidence

The allegations are reportedly supported by evidence gathered through extensive audits, internal investigations, and whistleblower testimonies. This evidence, if found credible in court, will play a critical role in the recovery process.

Representatives' Strategies for Recovery

Representatives are pursuing a multi-pronged approach to recover the alleged $1.231 billion. This strategy includes legislative action, legal battles, and a push for greater transparency.

Legislative Actions

Several legislative measures are under consideration. These include proposals for:

- Amendments to existing tax laws to close loopholes exploited by oil companies.

- Increased penalties for tax evasion within the energy sector.

- Enhanced auditing and monitoring of oil companies' tax reporting.

Legal Actions

Lawsuits have been filed against the implicated oil firms in [mention specific courts or jurisdictions]. These lawsuits aim to recover the unpaid taxes and fees plus penalties and interest.

Public Pressure and Transparency

Representatives are also leveraging public pressure to increase transparency and accountability. This involves advocating for:

- Independent audits of oil companies' financial records.

- Public disclosure of all tax-related payments and deductions by oil firms.

- Strengthening regulatory oversight of the energy sector.

Oil Companies' Responses and Defenses

The oil companies involved have responded to the allegations with varying degrees of denial.

Public Statements

Public statements from these companies generally deny any intentional wrongdoing. They often claim that any discrepancies are the result of accounting errors or legitimate interpretations of complex tax regulations.

Legal Challenges

The companies are mounting robust legal challenges to the allegations, arguing that the accusations lack sufficient evidence and that their actions were compliant with all applicable regulations.

Potential Impact on Operations

The ongoing recovery efforts could have a significant impact on the oil companies' operations and profitability. The outcome of this legal battle will potentially influence future investment strategies and the overall financial health of the involved companies.

Implications and Future Outlook

The outcome of this battle to recover $1.231 billion from oil firms has profound implications.

Impact on Tax Revenue

Successful recovery will significantly boost government revenue, potentially allowing for increased investment in public services and infrastructure. Conversely, failure to recover the funds could create a significant budget shortfall.

Implications for Energy Policy

This case is likely to influence future energy policies and regulations. It may lead to stricter enforcement of existing regulations and new legislation aimed at enhancing transparency and accountability within the oil and gas industry.

Public Opinion and Political Ramifications

The controversy surrounding these allegations is shaping public perception of the oil industry and has significant political ramifications. The public response to this case could influence future elections and legislative outcomes.

Conclusion

The representatives’ vow to recover $1.231 billion from oil firms highlights a critical battle concerning corporate accountability and fair taxation within the energy sector. The allegations of tax evasion, the strategies employed to recover the funds, and the oil companies’ responses all contribute to a complex and evolving situation. The outcome will profoundly impact government revenue, energy policy, and the public’s trust in both the oil industry and the regulatory mechanisms designed to oversee it. Stay updated on this crucial battle to recover $1.231 billion from oil firms. Follow our updates and join the conversation about ensuring fair tax practices within the energy sector.

Featured Posts

-

Premier League Forward Transfer Target For Manchester United

May 20, 2025

Premier League Forward Transfer Target For Manchester United

May 20, 2025 -

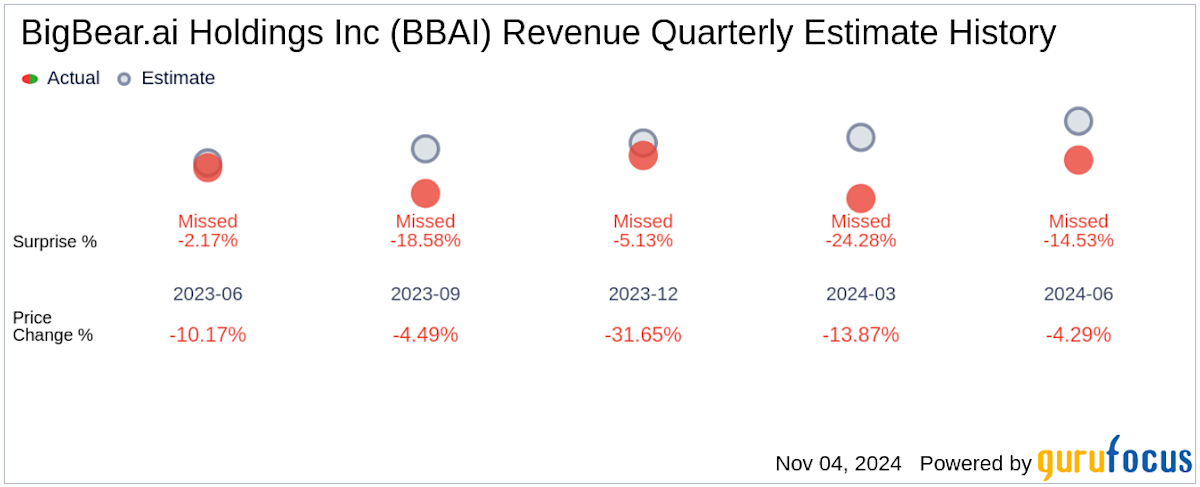

Big Bear Ai Holdings Nyse Bbai Q1 Report Sends Shares Lower

May 20, 2025

Big Bear Ai Holdings Nyse Bbai Q1 Report Sends Shares Lower

May 20, 2025 -

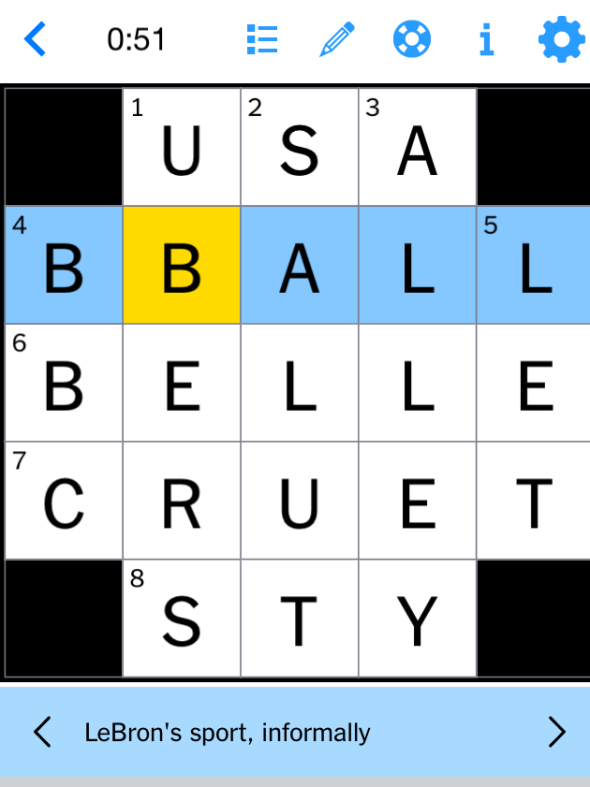

Find The Answers Nyt Mini Crossword March 26 2025

May 20, 2025

Find The Answers Nyt Mini Crossword March 26 2025

May 20, 2025 -

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025

Big Bear Ai Holdings Inc Sued Implications For Investors

May 20, 2025 -

New Business Hotspots Across The Country An Interactive Map

May 20, 2025

New Business Hotspots Across The Country An Interactive Map

May 20, 2025

Latest Posts

-

Switzerland Condemns Pahalgam Terror Attack Minister Cassis Official Statement

May 21, 2025

Switzerland Condemns Pahalgam Terror Attack Minister Cassis Official Statement

May 21, 2025 -

Chinas Taiwan Drills Draw Sharp Reprimand From Switzerland

May 21, 2025

Chinas Taiwan Drills Draw Sharp Reprimand From Switzerland

May 21, 2025 -

The Rich History Of Cassis Blackcurrant

May 21, 2025

The Rich History Of Cassis Blackcurrant

May 21, 2025 -

Pahalgam Terror Attack Swiss Condemnation And Call For Peace

May 21, 2025

Pahalgam Terror Attack Swiss Condemnation And Call For Peace

May 21, 2025 -

A Taste Of Cassis Blackcurrant Cocktails And More

May 21, 2025

A Taste Of Cassis Blackcurrant Cocktails And More

May 21, 2025