Revised Palantir Stock Predictions: Analyst Reactions To The Price Surge

Table of Contents

Analyst Upgrades and Price Target Revisions

The recent surge in Palantir's stock price has prompted several key analysts to upgrade their price targets and overall outlook. These revisions reflect a growing confidence in the company's future performance and its ability to capitalize on the burgeoning data analytics and artificial intelligence markets. For example, Analyst A raised their price target from $18 to $22, citing improved revenue projections and increased market share in the government sector. Analyst B, meanwhile, upgraded their rating from "hold" to "buy," highlighting the company's successful expansion into the commercial sector.

- Key Analyst Revisions:

- Analyst A: Price target raised from $18 to $22

- Analyst B: Rating upgraded to "buy," price target raised from $15 to $20

- Analyst C: Maintained "buy" rating, price target raised from $19 to $23

- Analyst D: Price target increased from $16 to $18.

The overall analyst consensus leans bullish, with a majority upgrading their price targets and ratings. This positive sentiment reflects a growing belief in Palantir's long-term growth trajectory. However, it's crucial to remember that even bullish predictions come with inherent risks.

Factors Driving the Palantir Stock Price Surge

Several key factors have contributed to the recent surge in Palantir's stock price. These factors, when considered together, paint a picture of a company gaining momentum in a rapidly growing market.

- Strong Q[Quarter] Earnings Report: Palantir's recent earnings report exceeded expectations, showcasing robust revenue growth and improving profitability. Specific metrics like [Insert Specific Metrics e.g., a 30% increase in year-over-year revenue and a significant improvement in operating margins] played a significant role in boosting investor confidence.

- New Government Contracts and Commercial Partnerships: The securing of lucrative new contracts with government agencies and the expansion of commercial partnerships have contributed significantly to the positive outlook. [Mention Specific Examples if available, e.g., a major contract with a national defense agency or a strategic partnership with a leading financial institution]. These partnerships showcase Palantir's ability to secure significant revenue streams across diverse sectors.

- Positive Market Sentiment Towards Data Analytics and AI: The broader market is exhibiting strong positive sentiment towards data analytics and artificial intelligence, which directly benefits Palantir as a leading player in this space. Investors are increasingly recognizing the value of data-driven insights and the crucial role that companies like Palantir play in providing those insights.

- Increased Investor Confidence in Palantir's Long-Term Growth Potential: Overall, investor confidence in Palantir’s ability to deliver on its long-term growth strategy is on the rise. This is reflected in the increasing number of institutional investors adding PLTR to their portfolios.

Risks and Potential Downsides to Palantir Stock

Despite the positive outlook, several risks and potential downsides could impact Palantir's future performance. It’s crucial for investors to carefully consider these before making investment decisions.

- Competition from Other Data Analytics Companies: Palantir faces intense competition from established players and agile startups in the data analytics market. This competitive landscape could impact Palantir's ability to maintain its market share and sustain revenue growth.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. This dependence exposes the company to potential risks associated with government budget cuts or changes in procurement policies.

- Valuation Concerns: Palantir's high price-to-earnings (P/E) ratio raises concerns about its valuation. This valuation could be considered high relative to its current earnings, leaving it potentially vulnerable to corrections if earnings growth doesn't meet expectations.

- Geopolitical Risks: Operating in a global market exposes Palantir to geopolitical risks, including international trade disputes, sanctions, and political instability in key markets.

These risks are reflected, to varying degrees, in the range of analyst predictions. While some analysts maintain a positive outlook, others acknowledge these potential headwinds and incorporate them into their price targets.

Long-Term Palantir Stock Outlook

The long-term outlook for Palantir stock remains a subject of ongoing debate among analysts. However, based on the current consensus, the future looks promising, provided certain conditions are met.

The long-term growth of Palantir will largely depend on several factors, including: successful technological advancements, expansion into new markets, and the ability to navigate the competitive landscape. Short-term investors might focus on quarterly earnings and contract wins, while long-term investors will likely prioritize Palantir's overall market positioning and technological leadership. Potential future catalysts include the launch of new products, strategic acquisitions, and increased adoption of their platform across various industries.

Conclusion: Navigating the Future of Palantir Stock Predictions

In conclusion, the recent surge in Palantir's stock price reflects a combination of strong earnings, new contracts, and positive market sentiment. While analyst predictions are largely bullish, it’s crucial to carefully consider the potential risks before making investment decisions. The long-term success of Palantir hinges on its ability to maintain its competitive edge, expand into new markets, and deliver consistent financial results.

Stay informed on future Palantir stock predictions and make informed investment decisions. Remember to conduct your own thorough research and consult with a financial advisor before investing in Palantir stock or any other security. For more information, visit Palantir's investor relations page [Insert Link Here].

Featured Posts

-

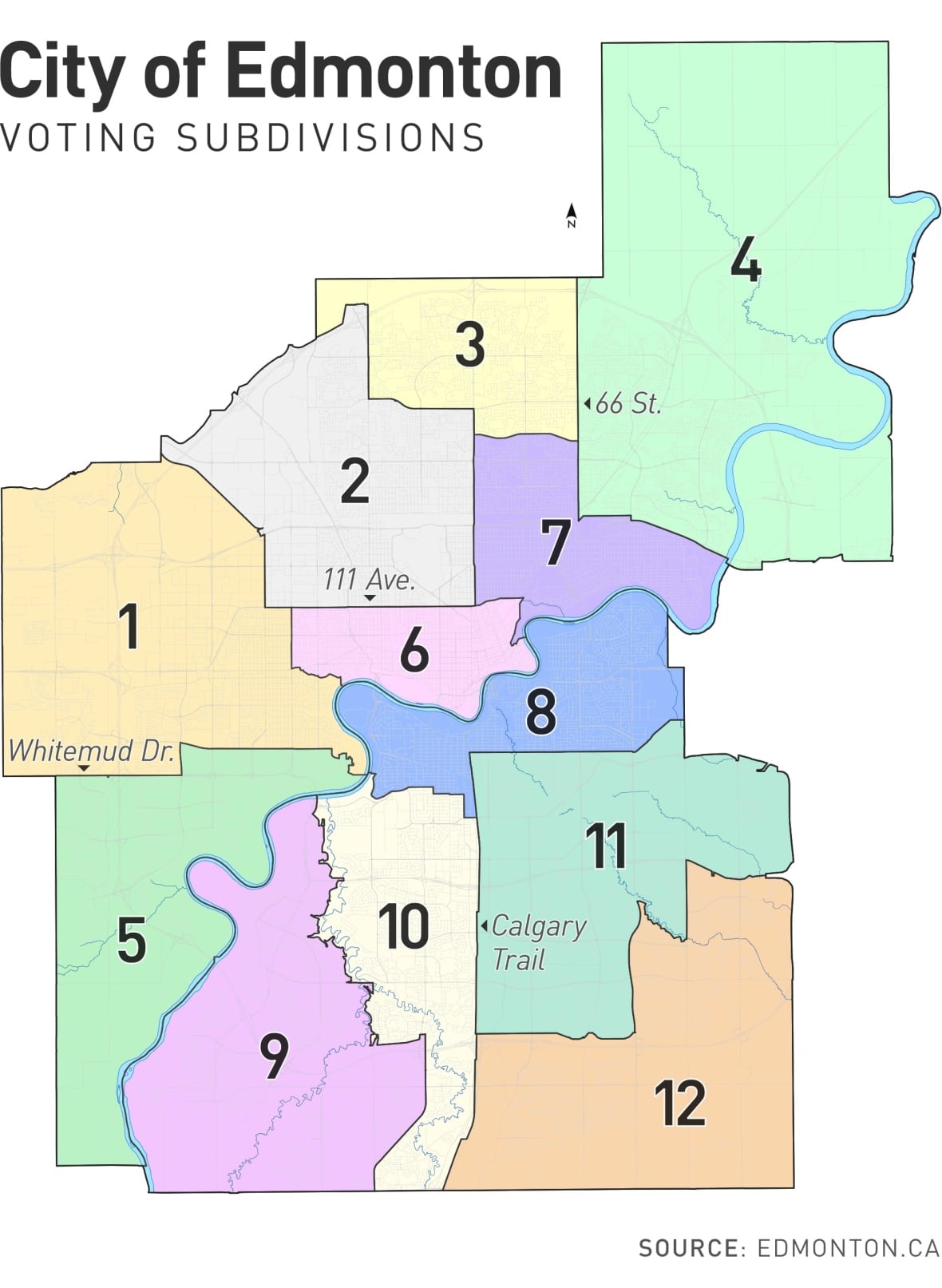

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025

Edmonton Federal Riding Changes What Voters Need To Know

May 10, 2025 -

Womans Racist Attack Results In Mans Death Investigation Ongoing

May 10, 2025

Womans Racist Attack Results In Mans Death Investigation Ongoing

May 10, 2025 -

Golden Knights Face Uncertain Future Hertls Absence Looms Large After Lightning Hit

May 10, 2025

Golden Knights Face Uncertain Future Hertls Absence Looms Large After Lightning Hit

May 10, 2025 -

Finding The Right Location A Guide To The Countrys Top Business Hotspots

May 10, 2025

Finding The Right Location A Guide To The Countrys Top Business Hotspots

May 10, 2025 -

Feds Rate Hike Pause Why A Cut Isnt On The Horizon

May 10, 2025

Feds Rate Hike Pause Why A Cut Isnt On The Horizon

May 10, 2025