Ripple's Ripple Effect: How ETF Decisions And SEC Shakeups Could Change XRP's Trajectory

Table of Contents

The SEC vs. Ripple: A Turning Point for XRP?

The ongoing legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs has cast a long shadow over the XRP cryptocurrency. The outcome of this case will significantly influence XRP's price, regulatory landscape, and overall market perception.

The Ongoing Litigation and its Potential Outcomes:

The SEC's core argument is that XRP is an unregistered security, sold in violation of federal law. Ripple counters that XRP is a currency and not a security, emphasizing its decentralized nature and widespread use in cross-border payments.

Several scenarios are possible:

- Ripple Wins: A victory for Ripple would likely result in a surge in XRP's price, as it would provide regulatory clarity and boost investor confidence. It could also pave the way for other crypto projects facing similar legal challenges.

- Ripple Loses: A loss for Ripple could severely damage XRP's price and reputation. It could also set a precedent for future SEC actions against other cryptocurrencies, chilling innovation and investment in the sector.

- Settlement: A settlement between Ripple and the SEC is also a possibility. The terms of such a settlement would heavily influence XRP's future trajectory. A favorable settlement could mitigate some negative impacts, while an unfavorable one could mirror the consequences of a complete loss.

Market sentiment surrounding the case is highly volatile, swinging wildly based on court filings and expert opinions. Legal experts offer varied predictions, adding to the uncertainty.

- Impact on XRP price volatility: Expect significant price swings depending on the outcome.

- Regulatory clarity for the crypto market: A clear ruling could provide much-needed regulatory clarity, benefiting the entire crypto space.

- Potential for future lawsuits against other crypto projects: The SEC's approach to Ripple could serve as a template for future enforcement actions.

Ripple's Legal Strategy and its Effectiveness:

Ripple's defense strategy centers on demonstrating XRP's utility as a functional currency separate from any investment contract. They emphasize its use in cross-border payments through their RippleNet platform and its decentralized nature.

Both sides have presented compelling arguments, with the SEC highlighting XRP's initial distribution and Ripple's control over its supply. The strength of each side's case depends heavily on the judge's interpretation of existing securities laws and their application to the unique characteristics of XRP.

- Use of legal precedents: Both sides are relying on existing case law to support their arguments.

- Focus on XRP's functionality and utility: Ripple's defense emphasizes XRP's practical applications and its separation from any investment contract.

- Impact of public opinion and media coverage: Public perception and media narratives significantly influence the case's outcome and market sentiment towards XRP.

The Spot Bitcoin ETF Wave and its Ripple Effect on XRP

The potential approval of spot Bitcoin ETFs is another major factor influencing XRP's trajectory.

The Correlation Between Bitcoin and Altcoins:

Bitcoin's price movements historically correlate with those of altcoins, including XRP. A positive development like ETF approval could boost overall crypto market sentiment, potentially leading to increased investment in altcoins.

Approval of a spot Bitcoin ETF could bring substantial institutional investment into the crypto market. This influx of capital could lead to increased liquidity and potentially drive up the price of altcoins, including XRP.

- Increased liquidity in the crypto market: More institutional money means more trading volume and potentially less price volatility.

- Greater mainstream adoption of cryptocurrencies: ETF approval would signal increased acceptance of cryptocurrencies by mainstream financial markets.

- Positive spillover effects on altcoins like XRP: Increased market confidence could lead to investment in other cryptocurrencies besides Bitcoin.

XRP's Unique Position in the Market:

XRP's unique position in the market lies in its utility in cross-border payments and its potential for institutional adoption through RippleNet. Unlike Bitcoin, which primarily functions as a store of value, XRP aims to facilitate fast and low-cost international transactions.

This utility could make XRP less susceptible to the volatility often associated with other cryptocurrencies. Ripple's existing partnerships with financial institutions could further enhance its resilience.

- XRP's technology and scalability advantages: XRP's technology is designed for high transaction speeds and low fees, making it attractive for institutional use.

- Ripple's partnerships with financial institutions: These partnerships provide XRP with real-world use cases and potential for integration into existing financial systems.

- Potential for increased demand for XRP due to its utility: The increased demand for faster, cheaper international payments could lead to greater adoption of XRP.

Navigating the Uncertainty: Investment Strategies for XRP

Investing in cryptocurrencies, especially during periods of uncertainty like this, involves significant risk.

Risk Assessment and Diversification:

Investing in XRP requires a thorough understanding of its inherent risks. The SEC case outcome, market volatility, and broader regulatory uncertainty all contribute to the risk profile.

Diversification is crucial. Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

- Dollar-cost averaging: Investing smaller amounts regularly reduces the impact of price fluctuations.

- Setting stop-loss orders: Protecting your investment by automatically selling if the price falls below a certain level.

- Researching reputable exchanges: Choosing secure and reliable platforms for your XRP transactions is crucial.

Long-Term vs. Short-Term Outlook for XRP:

The long-term outlook for XRP hinges on the outcome of the SEC case and the broader adoption of cryptocurrencies. A favorable outcome could lead to significant long-term growth, while an unfavorable outcome could severely impact its future.

Short-term price fluctuations are highly likely, driven by news related to the SEC case, ETF approvals, and overall market sentiment.

- Impact of technological advancements: Continued improvements to XRP's technology could enhance its appeal.

- Regulatory changes and their influence on XRP: Favorable regulatory changes could boost XRP's price, while restrictive regulations could have the opposite effect.

- Adoption by financial institutions and individuals: Increased adoption by both institutions and individual users is essential for long-term growth.

Conclusion

The SEC's decision regarding Ripple and the potential approval of spot Bitcoin ETFs will undoubtedly have a significant ripple effect on XRP's trajectory. While uncertainty remains, understanding the interplay between these events allows investors to make more informed decisions. By carefully considering the potential outcomes and employing appropriate risk management strategies, investors can navigate this dynamic market and potentially capitalize on the opportunities presented by XRP. Stay informed on the latest developments in the Ripple case and the ETF landscape to best position yourself in the ever-evolving world of XRP and cryptocurrency. Keep researching and learning about XRP investments to make the best decisions for your portfolio.

Featured Posts

-

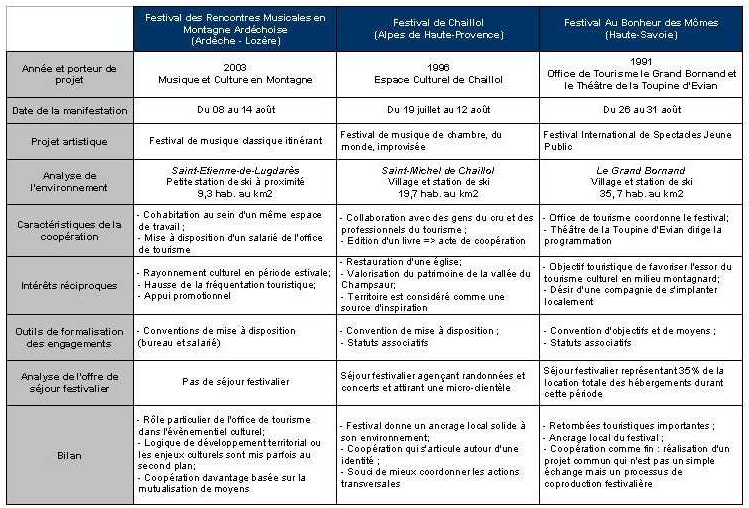

Capacites Geometriques Exceptionnelles Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025

Capacites Geometriques Exceptionnelles Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025 -

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025 -

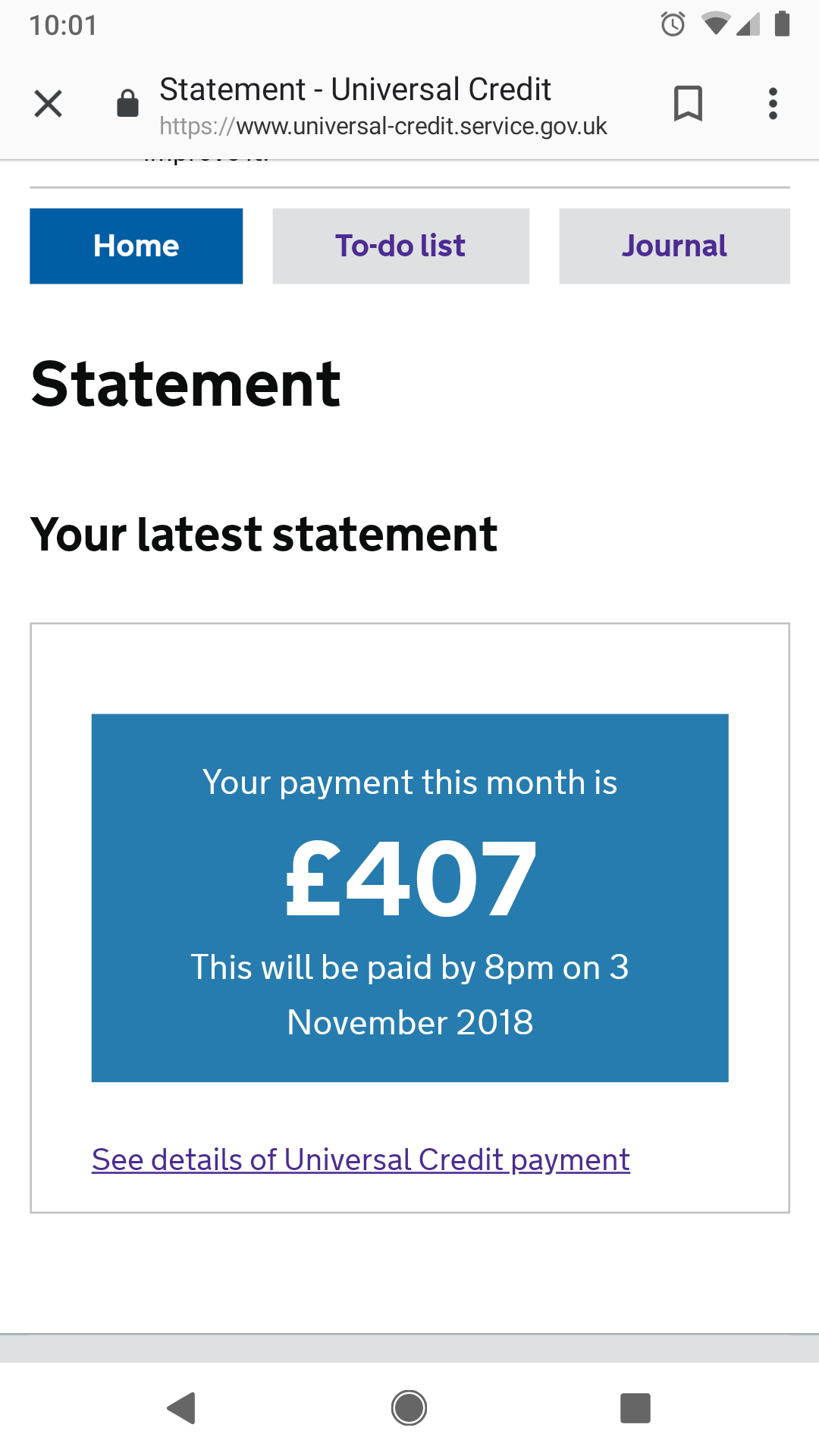

Universal Credit Historical Payments Check Your Entitlement

May 08, 2025

Universal Credit Historical Payments Check Your Entitlement

May 08, 2025 -

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025

Investing In 2025 Micro Strategy Stock Compared To Bitcoin

May 08, 2025 -

Ethereums Resilient Price Signs Of An Upcoming Bull Run

May 08, 2025

Ethereums Resilient Price Signs Of An Upcoming Bull Run

May 08, 2025