Rising Taiwan Dollar: Implications For Economic Restructuring

Table of Contents

Impact on Export Competitiveness

A stronger Taiwan dollar significantly impacts export competitiveness. As the currency appreciates, Taiwanese goods become more expensive in international markets, reducing their attractiveness to foreign buyers. This "currency appreciation" directly affects export-oriented industries, which form a cornerstone of Taiwan's economy. The resulting decrease in demand leads to several negative consequences:

- Reduced demand for Taiwanese goods abroad: Higher prices make Taiwanese products less competitive against those from countries with weaker currencies.

- Increased pressure on profit margins for exporters: Exporters face the difficult choice of absorbing the increased costs or passing them on to customers, potentially losing market share.

- Potential job losses in export-related sectors: Reduced export orders may necessitate production cuts and layoffs in industries heavily reliant on foreign markets.

- Need for diversification of export markets: Taiwan needs to actively explore new markets and diversify its export portfolio to reduce dependence on regions sensitive to currency fluctuations.

Industries like electronics and textiles, major contributors to Taiwan's GDP, are particularly vulnerable to the effects of a rising Taiwan dollar. Maintaining export competitiveness requires a multifaceted strategy, encompassing both governmental and corporate initiatives.

Effects on Import Costs

While a stronger Taiwan dollar poses challenges to exporters, it offers significant benefits by reducing import costs. The purchasing power of the Taiwan dollar increases, making imported goods cheaper for consumers and businesses. This leads to several positive outcomes:

- Increased purchasing power for consumers: Lower prices for imported goods increase consumer spending and overall economic activity.

- Lower input costs for businesses: Reduced costs for raw materials and intermediate goods boost business profitability and investment.

- Potential for increased consumption and investment: Lower prices stimulate demand, leading to economic expansion.

However, this positive effect can be tempered by inflationary pressures if import price reductions are not passed on to consumers. Careful monitoring of the price dynamics is crucial to ensure the benefits are widely shared across the economy.

Influence on Foreign Direct Investment (FDI)

Currency appreciation can have a mixed impact on foreign direct investment (FDI). While a stronger currency can make investments in Taiwan appear cheaper for foreign investors initially, the reduced export competitiveness offsets this advantage. Consequently:

- Reduced attractiveness of Taiwan as an export base: Higher production costs reduce Taiwan's appeal as a manufacturing hub for export-oriented businesses.

- Potential shift towards FDI in domestic-oriented sectors: Foreign investors may increasingly focus on sectors serving the domestic Taiwanese market, which is less exposed to currency fluctuations.

- Need for government policies to attract FDI: Taiwan needs to implement proactive policies to attract FDI, potentially focusing on sectors less dependent on exports and highlighting the strength of its domestic market.

Government Policy Responses and Economic Restructuring

The Taiwanese government plays a critical role in mitigating the negative impacts of the rising Taiwan dollar and facilitating economic restructuring. Several policy options can be considered:

- Monetary policy adjustments: The central bank can adjust interest rates to influence the exchange rate, but this requires careful consideration of other macroeconomic factors.

- Fiscal policy interventions: Tax incentives and subsidies can support export-oriented industries and encourage diversification.

- Structural reforms to enhance competitiveness: Investing in innovation, technology, and human capital is crucial to enhance competitiveness in a strong-currency environment.

Economic diversification is key to reducing reliance on export-led growth. The government can promote the development of domestic industries and high-value-added sectors less vulnerable to currency fluctuations. The central bank's role in managing the exchange rate becomes paramount in maintaining stability and predictability for businesses.

The Role of Innovation and Technological Advancement

In a strong-currency environment, innovation becomes a crucial driver of competitiveness. Investing in research and development (R&D) and developing high-value-added products and services is essential to maintain export competitiveness and attract FDI. Government initiatives supporting technological advancements, such as tax breaks for R&D and investments in education, are crucial in this endeavor.

Conclusion: Navigating the Rising Taiwan Dollar and Economic Restructuring

The rising Taiwan dollar presents a complex challenge for Taiwan's economy. Its impact on export competitiveness, import costs, and foreign direct investment necessitates a strategic response involving coordinated government policies and private sector initiatives. Economic restructuring, focusing on diversification, innovation, and technological advancement, is crucial for navigating this new environment and securing Taiwan's long-term economic prosperity. Further research and discussion are needed to develop effective strategies for managing the ongoing implications of the rising Taiwan dollar and ensuring successful economic restructuring. We encourage you to explore related resources and stay updated on developments regarding the rising Taiwan dollar and its impact on Taiwan's economic restructuring.

Featured Posts

-

U S China Trade Talks What To Expect From The Upcoming Meeting

May 08, 2025

U S China Trade Talks What To Expect From The Upcoming Meeting

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Uyarisi Detaylar Ve Analiz

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Uyarisi Detaylar Ve Analiz

May 08, 2025 -

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025

Daily Lotto Results For Tuesday April 15 2025

May 08, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

May 08, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Informative Podcasts

May 08, 2025 -

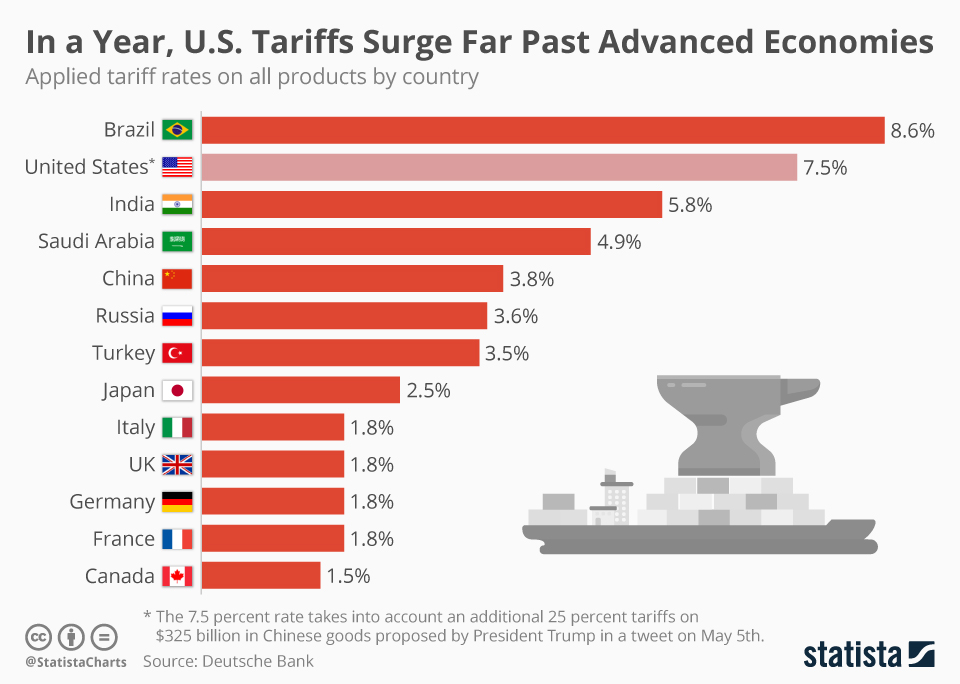

Stocks Under Pressure Assessing The Impact Of Liberation Day Tariffs

May 08, 2025

Stocks Under Pressure Assessing The Impact Of Liberation Day Tariffs

May 08, 2025