Rockwell Automation Earnings Beat Expectations: Stock Surge Explained

Table of Contents

H2: Strong Q[Quarter Number] Earnings: Key Performance Indicators

Rockwell Automation's Q[Quarter Number] earnings report showcased exceptional performance across several key metrics, significantly surpassing analysts' predictions. The impressive results fueled the stock price increase and solidified the company's position as a leader in industrial automation. Here's a breakdown of the standout figures:

- Earnings Per Share (EPS): Rockwell Automation reported an EPS of [Insert actual EPS figure], exceeding the consensus estimate of [Insert analyst estimate] by [Percentage difference]%. This significant outperformance demonstrates strong profitability and efficient operations.

- Revenue Growth: Revenue increased by [Percentage]% year-over-year, reaching [Insert revenue figure]. This substantial growth highlights robust demand for Rockwell Automation's products and services across various industrial sectors.

- Operating Margin: The operating margin reached [Insert margin percentage]%, demonstrating improved efficiency and cost management. This metric is crucial for evaluating the company's profitability and its ability to generate strong returns.

- Order Backlog Growth: The order backlog experienced substantial growth, indicating strong future demand and revenue visibility. This positive trend suggests continued momentum in the coming quarters.

H2: Factors Contributing to Rockwell Automation's Success

Several key factors contributed to Rockwell Automation's outstanding Q[Quarter Number] performance. These factors, combined, created a powerful synergy that propelled the company to exceed expectations.

H3: Robust Demand in Key Industrial Sectors

Rockwell Automation experienced strong growth across several key industrial sectors, indicating broad-based demand for its automation solutions.

- Automotive: The automotive industry's ongoing shift towards electric vehicles and autonomous driving technologies fueled significant demand for Rockwell Automation's automation systems.

- Food and Beverage: Increased consumer demand and the need for efficient and hygienic production processes drove growth in this sector.

- Pharmaceuticals: The pharmaceutical industry's focus on enhancing production efficiency and ensuring product quality boosted demand for Rockwell Automation's advanced automation solutions. Increased demand for automation to support supply chain resilience also played a key role.

H3: Successful Product Launches and Innovations

Rockwell Automation's commitment to innovation and the launch of new products played a crucial role in its success.

- [Name of new product/technology]: This new offering significantly improved [Specific benefit, e.g., production efficiency, quality control] for customers, leading to increased sales.

- [Name of another new product/technology]: The launch of this innovative industrial software solution helped customers achieve [Specific benefit, e.g., digital transformation, improved data analytics], driving adoption and revenue growth. The integration of IIoT capabilities in many of their offerings has been a significant driver.

H3: Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships have strengthened Rockwell Automation's market position and expanded its product portfolio.

- [Name of acquisition/partnership]: This collaboration expanded Rockwell Automation's reach into [Specific market segment] and provided access to new technologies and expertise.

- [Name of another acquisition/partnership]: This strategic move further solidified Rockwell Automation's position within the industrial automation landscape and enhanced their ability to deliver comprehensive solutions.

H2: Analyst Reactions and Future Outlook for Rockwell Automation Stock

Analysts have reacted positively to Rockwell Automation's strong earnings report, with many upgrading their price targets and maintaining "buy" ratings. [Analyst Name], from [Analyst Firm], stated, "[Insert quote from analyst expressing positive sentiment and outlook]". The general consensus points towards a positive outlook for Rockwell Automation's future growth potential, fueled by continued demand in key industrial sectors and ongoing innovation. The stock forecast suggests continued upward momentum, but as with any investment, risks exist.

H2: Impact on Investors and Investment Strategies

The exceeding of expectations in Rockwell Automation's earnings report has created positive implications for investors. For those already holding the stock, the results confirm a strong investment choice. For those considering investing, the strong performance and positive future outlook makes Rockwell Automation stock an attractive option. However, investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. Potential investment strategies could range from "buy" to "hold", depending on individual portfolios and goals. Return on investment (ROI) projections should be considered alongside potential risks.

3. Conclusion: Rockwell Automation Earnings Beat Expectations – What's Next?

Rockwell Automation's Q[Quarter Number] earnings report delivered a resounding success, exceeding expectations across key performance indicators. This outstanding performance can be attributed to robust demand in key industrial sectors, successful product launches, and strategic acquisitions and partnerships. The positive analyst reaction and favorable outlook suggest continued growth for Rockwell Automation. To stay updated on Rockwell Automation's financial performance and future prospects, regularly check their investor relations website for upcoming earnings reports and other relevant information. Consider Rockwell Automation's strong performance and positive outlook when evaluating potential investment opportunities in the industrial automation sector. Understanding Rockwell Automation's financial performance is key to making informed investment decisions. Explore Rockwell Automation's investor relations website for further details on Rockwell Automation stock forecast and investment opportunities.

Featured Posts

-

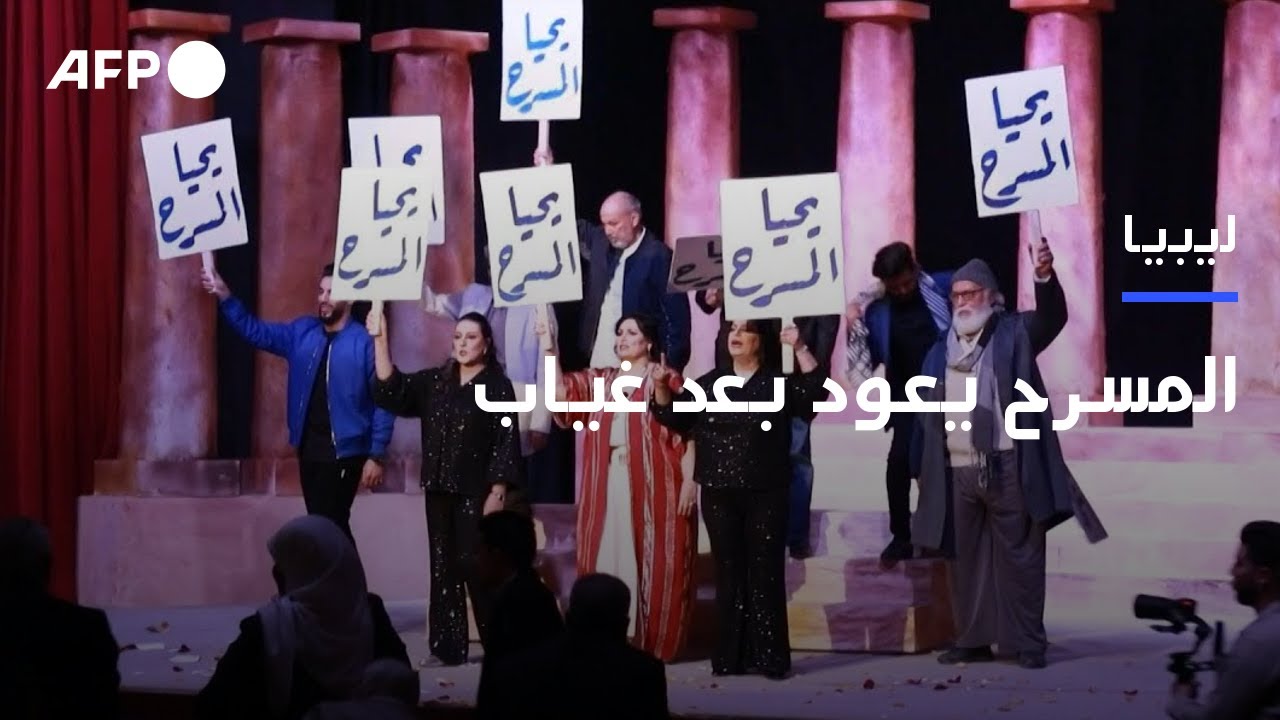

Ahtfae Jzayry Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025

Ahtfae Jzayry Binjazat Almkhrj Allyby Sbry Abwshealt

May 17, 2025 -

New F 55 Fighter Jet And F 22 Upgrade Plans Unveiled By Trump

May 17, 2025

New F 55 Fighter Jet And F 22 Upgrade Plans Unveiled By Trump

May 17, 2025 -

Rune Osvaja Barcelonu Posle Pobede Nad Povredenim Alcarasom

May 17, 2025

Rune Osvaja Barcelonu Posle Pobede Nad Povredenim Alcarasom

May 17, 2025 -

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025

Wednesdays Market Winners Rockwell Automation Among Top Performers

May 17, 2025 -

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Latest Posts

-

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025 -

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025 -

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025 -

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025 -

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025