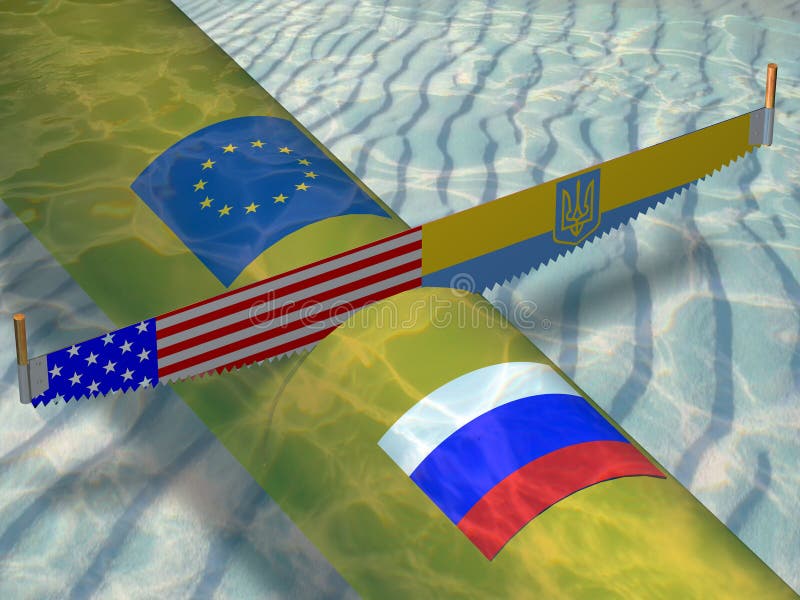

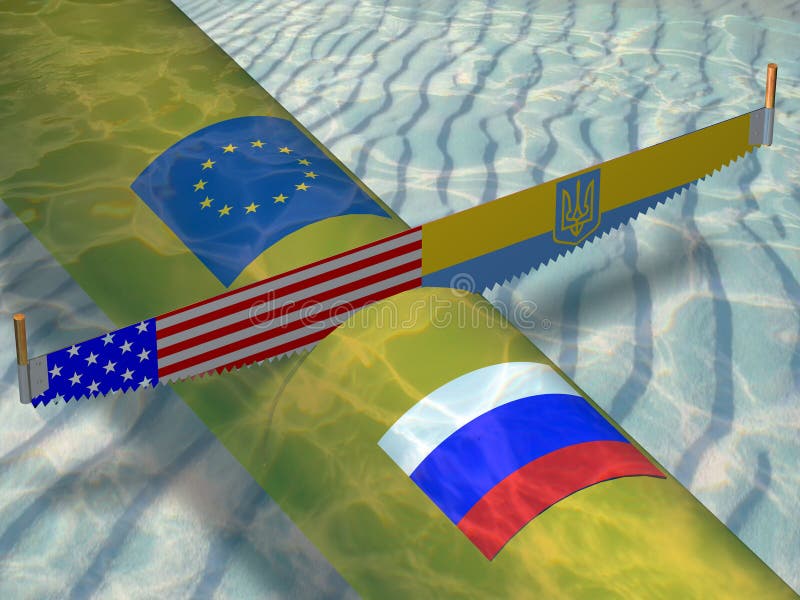

Russian Gas Pipeline: Elliott Management's Exclusive Investment Strategy

Table of Contents

Elliott Management's Investment Philosophy and Due Diligence in the Energy Sector

Elliott Management is renowned for its rigorous, data-driven approach to investing. Their philosophy emphasizes deep fundamental analysis, a thorough understanding of market dynamics, and a willingness to engage actively with target companies to unlock value. When it comes to the energy sector, and particularly high-risk ventures like Russian gas pipeline investments, their due diligence process is exceptionally thorough. This includes not only traditional financial modeling but also a comprehensive assessment of geopolitical risks, regulatory hurdles, and operational complexities.

Their investment strategy in the energy sector often involves:

- Thorough risk assessment: This encompasses geopolitical instability, sanctions risks, regulatory changes in Russia and the EU, and potential operational disruptions. The analysis extends to evaluating the long-term viability of the pipelines given shifting global energy demands and the increasing push for renewable energy sources.

- Detailed financial analysis: Elliott meticulously examines the financial performance of pipeline projects, including revenue streams, operating costs, debt levels, and potential for future growth. They evaluate the underlying assets, considering factors such as pipeline capacity, transportation fees, and contract terms.

- Assessment of management teams and corporate governance: The firm scrutinizes the expertise and track record of management teams, assessing their ability to navigate the complex regulatory landscape and manage operational challenges effectively. Corporate governance structures and transparency are also key considerations.

- Exploration of potential for restructuring or operational improvements: Elliott often seeks opportunities to improve efficiency, reduce costs, and enhance profitability through restructuring initiatives or operational improvements within the target companies. This could involve streamlining operations, optimizing logistics, or implementing new technologies.

Specific Examples of Elliott Management's Russian Gas Pipeline Investments (if any publicly known)

Unfortunately, Elliott Management's specific investments in Russian gas pipelines are not typically disclosed publicly due to confidentiality agreements and the sensitive nature of such ventures. However, we can infer potential strategies based on their past involvement in similar high-risk, high-reward situations.

Had Elliott been involved, their investment rationale might have centered on several factors:

- Undervalued assets: They might have identified opportunities to acquire stakes in Russian gas pipeline infrastructure at prices below their intrinsic value, possibly due to market volatility or sanctions-related uncertainty.

- Potential for privatization: Elliott has a history of involvement in privatization processes, potentially seeking opportunities to acquire shares in state-owned or partially privatized pipeline assets.

- Anticipated market growth: Given the long-term demand for natural gas, particularly in Europe, they may have anticipated future growth in pipeline transportation volumes, driving up the value of their investments.

While we lack concrete examples of direct Elliott Management involvement in specific Russian gas pipelines, analyzing their past investments in other energy sectors offers valuable insight into their likely approach. This includes studying their engagement in restructuring distressed energy companies and their participation in projects with similar geopolitical complexities.

Navigating Geopolitical Risks in Russian Energy Investments

Investing in Russian energy infrastructure presents significant geopolitical risks. These include:

- Impact of sanctions: Western sanctions imposed on Russia can severely restrict access to capital, limit trading opportunities, and create uncertainty for investors.

- Potential for nationalization or expropriation: The Russian government retains considerable control over its energy sector, and there is always a risk of nationalization or expropriation of assets.

- Political instability: Political instability within Russia or changes in its relations with other countries can disrupt operations and negatively impact investment returns.

- International relations: The complex interplay of international relations, particularly between Russia and the West, can significantly affect the stability and profitability of Russian energy investments.

Elliott Management, with its expertise in navigating complex geopolitical situations, likely employs a number of risk mitigation strategies, such as:

- Diversification: Spreading investments across various energy projects and geographical locations to reduce exposure to any single risk.

- Hedging strategies: Utilizing financial instruments to protect against adverse price movements or currency fluctuations.

- Political risk insurance: Obtaining insurance coverage to mitigate the financial impact of unforeseen political events.

The Role of Activist Investing in Restructuring Russian Gas Pipelines

Elliott Management's expertise in activist investing could play a significant role in restructuring or improving the efficiency of Russian gas pipelines. Their strategies might include:

- Shareholder activism: Engaging with management and the board of directors to advocate for changes that enhance shareholder value, such as improving operational efficiency or implementing better corporate governance.

- Strategies for improving operational efficiency: Implementing cost-cutting measures, optimizing logistics, and utilizing advanced technologies to enhance the efficiency and profitability of pipeline operations.

- Seeking improved transparency and accountability: Elliott could push for greater transparency and accountability in the management of Russian gas pipelines, leading to better decision-making and reduced operational risks.

The success of such strategies would heavily depend on the specific circumstances of each pipeline project and the willingness of the relevant stakeholders to cooperate.

Conclusion: Assessing the Future of Elliott Management's Russian Gas Pipeline Strategy

Elliott Management's potential involvement in the Russian gas pipeline sector represents a high-stakes gamble with substantial potential rewards. The firm's sophisticated investment approach, coupled with its expertise in navigating complex geopolitical situations, suggests they are equipped to handle the inherent challenges. However, the significant risks associated with Russian energy investments – sanctions, political instability, and the potential for nationalization – cannot be overlooked. The long-term success of any such strategy hinges on successfully mitigating these risks and effectively capitalizing on the potential for value creation through restructuring or operational improvements.

Learn more about the complexities of Russian gas pipeline investment and the strategies employed by leading firms like Elliott Management. Understanding these intricacies is critical for anyone seeking to navigate this challenging but potentially lucrative sector.

Featured Posts

-

The Case Against John Wick 5 Is Enough Enough

May 11, 2025

The Case Against John Wick 5 Is Enough Enough

May 11, 2025 -

Bayern Muenchen Verliest Icoon Thomas Mueller Het Begin Van Een Nieuw Hoofdstuk

May 11, 2025

Bayern Muenchen Verliest Icoon Thomas Mueller Het Begin Van Een Nieuw Hoofdstuk

May 11, 2025 -

Bundesliga 2023 24 Relegation Confirmed For Bochum And Kiel Leipzig Out Of Champions League

May 11, 2025

Bundesliga 2023 24 Relegation Confirmed For Bochum And Kiel Leipzig Out Of Champions League

May 11, 2025 -

The Debbie Elliott Story Journey And Influence

May 11, 2025

The Debbie Elliott Story Journey And Influence

May 11, 2025 -

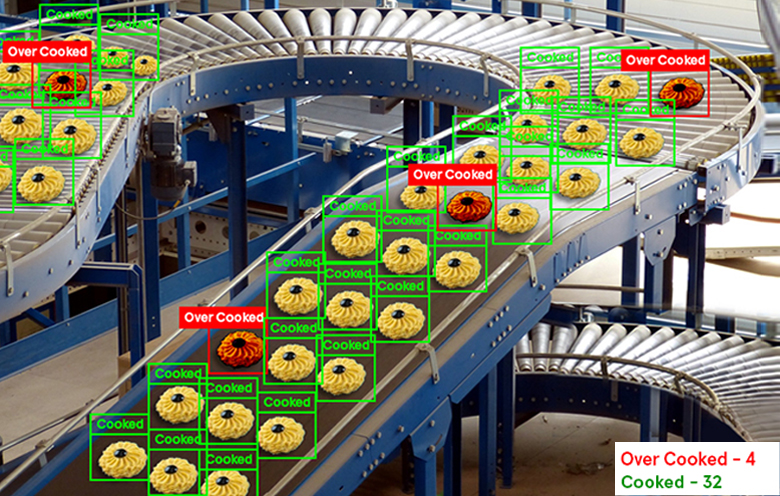

The Future Of Automated Visual Inspection For Lyophilized Vials Technological Solutions To Current Challenges

May 11, 2025

The Future Of Automated Visual Inspection For Lyophilized Vials Technological Solutions To Current Challenges

May 11, 2025