Russian Natural Gas Spot Market: EU's Phaseout Plans

Table of Contents

The Current State of the Russian Natural Gas Spot Market

The Russian Natural Gas Spot Market, historically dominated by Gazprom, is a complex interplay of supply, demand, and geopolitical factors. Understanding its dynamics is crucial for comprehending the EU's challenges in its energy transition.

Key Players and Market Structure

The Russian natural gas export landscape is largely shaped by Gazprom, the state-controlled energy giant. Gazprom's extensive pipeline network, including Nord Stream 1 and 2 (currently inactive), Yamal-Europe, and others, dictates much of the flow of gas to Europe. Other, smaller players exist, but their influence pales in comparison to Gazprom's dominance.

- Gazprom: Holds a near-monopoly on Russian natural gas exports, controlling major pipelines and export routes.

- Nord Stream 1 & 2: Major pipelines transporting Russian gas directly to Germany, significantly impacting the European market.

- Yamal-Europe Pipeline: Another key pipeline, transporting Russian gas westward through Belarus and Poland.

The price discovery mechanism in the Russian natural gas spot market is less transparent compared to other, more liberalized markets. Prices are influenced by long-term contracts, with spot market prices often showing some correlation but with significant deviations. Regional hubs and indices play a limited role in setting prices, often reflecting Gazprom's pricing strategies.

Price Volatility and Market Dynamics

Historical price fluctuations in the Russian natural gas spot market have been dramatic, largely driven by geopolitical events and supply disruptions. The war in Ukraine has significantly amplified these fluctuations, leading to unprecedented price spikes. Sanctions imposed on Russia have further constrained the market, creating uncertainty and volatility.

- 2021-2022 Price Spike: Prices soared to record highs following the invasion of Ukraine, reflecting concerns over supply security.

- Impact of Sanctions: Western sanctions targeting Russia's energy sector have limited the availability of Russian gas in the EU, further boosting prices.

- Supply Constraints: Reduced gas flows through key pipelines, driven by both technical issues and political maneuvering, have fueled market instability.

The relationship between spot and long-term contract prices is complex, with long-term contracts often offering some price stability, but spot prices often exhibiting greater volatility, especially during periods of geopolitical tension.

The EU's Phaseout Strategy and its Challenges

The EU's plan to phase out Russian natural gas is an ambitious undertaking, fraught with challenges that demand a comprehensive strategy tackling supply diversification, renewable energy adoption, and enhanced energy efficiency.

Diversification of Gas Supplies

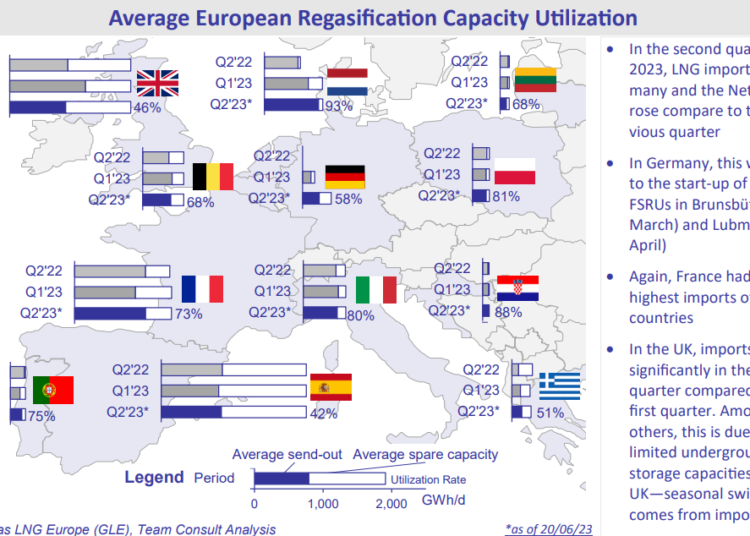

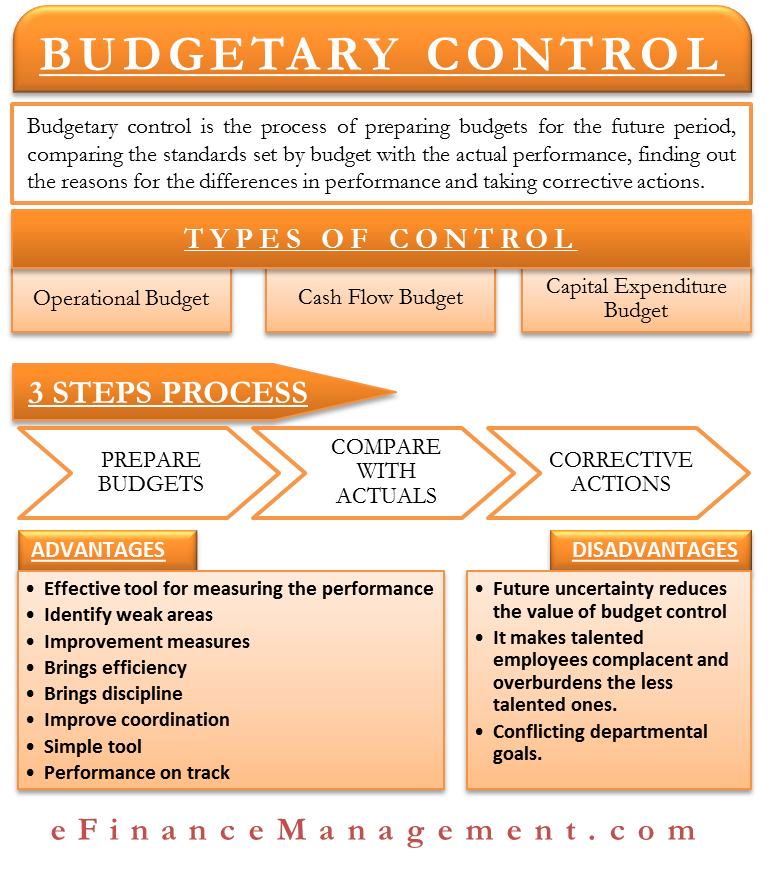

The EU is actively pursuing diverse gas supply sources to mitigate its dependence on Russia. This includes increased reliance on liquefied natural gas (LNG), strengthening ties with existing suppliers like Norway, and exploring new partnerships with countries like Azerbaijan. However, infrastructure limitations and competition for LNG supplies represent significant hurdles.

- LNG Imports: Increased LNG imports are crucial, requiring investments in new LNG terminals and regasification infrastructure across Europe.

- Norwegian Gas: Norway remains a key supplier, but increasing its output to meet increased demand is not without challenges.

- Southern Gas Corridor: The Southern Gas Corridor, supplying gas from Azerbaijan, is being expanded but its capacity is limited compared to Russian pipeline flows.

The cost and speed of diversification are major considerations. Securing new supply sources, developing necessary infrastructure, and ensuring sufficient import capacity will require substantial investments and long lead times.

Accelerated Renewable Energy Transition

The EU’s REPowerEU plan emphasizes a rapid transition towards renewable energy sources like solar and wind power. This involves massive investments in renewable energy infrastructure, grid modernization, and the development of smart grid technologies.

- Increased Renewable Energy Targets: The EU has set ambitious targets for renewable energy penetration by 2030 and beyond.

- Investment in Renewables: Significant investment is needed in renewable energy projects, including offshore wind farms, solar installations, and grid infrastructure upgrades.

- Energy Storage Solutions: Addressing the intermittency of renewable sources through energy storage solutions such as batteries and pumped hydro storage is crucial.

The speed and feasibility of this transition are crucial. Scaling up renewable energy production to replace natural gas will take time and significant technological advancements.

Energy Efficiency Measures

Reducing overall energy consumption through increased energy efficiency in buildings, industry, and transportation is a critical component of the EU's strategy. This involves implementing stricter building codes, promoting energy-efficient technologies, and improving industrial processes.

- Building Retrofits: Upgrading the energy efficiency of existing buildings through insulation and energy-efficient heating systems.

- Industrial Energy Efficiency: Implementing best practices and technologies to reduce energy consumption in industrial processes.

- Transportation Electrification: Promoting the adoption of electric vehicles and improving public transportation.

The effectiveness of these measures depends on swift and widespread implementation, coupled with public and private sector cooperation. Addressing potential social and economic challenges arising from these changes is also critical.

Conclusion

The EU's phaseout of Russian natural gas presents a monumental challenge requiring multifaceted solutions. Diversification of supply sources, accelerated renewable energy deployment, and aggressive energy efficiency measures are crucial to reducing dependence on the Russian Natural Gas Spot Market. Success hinges on significant investment, rapid technological advancements, and effective policy implementation. Continued monitoring of the Russian Natural Gas Spot Market and its evolving dynamics is vital for anticipating and mitigating potential disruptions in the years ahead. Understanding the intricacies of the Russian Natural Gas Spot Market is essential for navigating this critical period of energy transition. Learn more about the complexities and future of this volatile market by exploring further resources on energy policy and geopolitical analysis.

Featured Posts

-

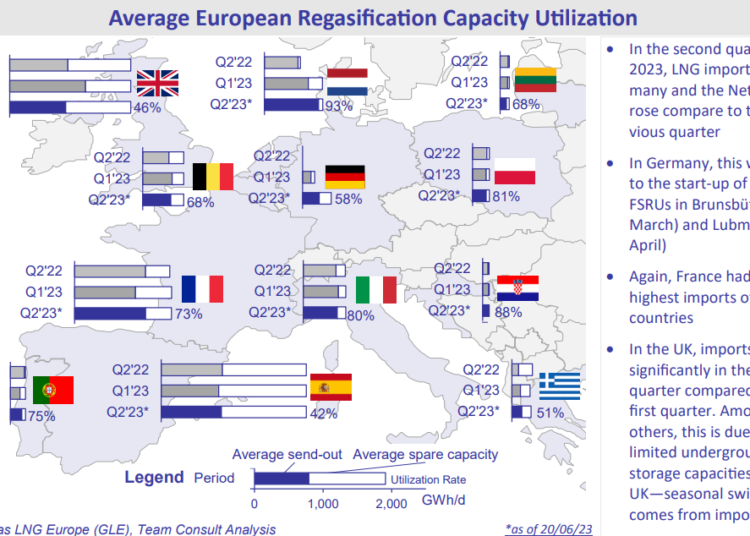

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025

Indias Nifty Index Understanding The Current Bullish Momentum

Apr 24, 2025 -

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

Hong Kongs Chinese Stock Market Rebounds Amidst Trade Deal Hopes

Apr 24, 2025

Hong Kongs Chinese Stock Market Rebounds Amidst Trade Deal Hopes

Apr 24, 2025 -

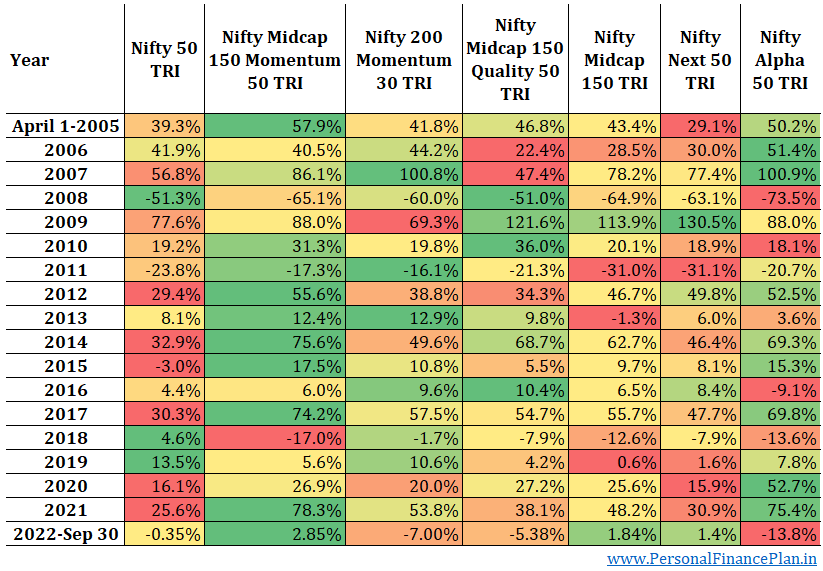

Analysis Trumps Budgetary Changes And Increased Tornado Risk

Apr 24, 2025

Analysis Trumps Budgetary Changes And Increased Tornado Risk

Apr 24, 2025 -

Investing In Growth Locating The Countrys Promising Business Hotspots

Apr 24, 2025

Investing In Growth Locating The Countrys Promising Business Hotspots

Apr 24, 2025

Latest Posts

-

Sylvester Stallone And Coming Home A Look At A Lost Oscar Opportunity

May 12, 2025

Sylvester Stallone And Coming Home A Look At A Lost Oscar Opportunity

May 12, 2025 -

Action Thriller Armor Starring Sylvester Stallone Available For Free Streaming

May 12, 2025

Action Thriller Armor Starring Sylvester Stallone Available For Free Streaming

May 12, 2025 -

Coming Home 1978 Sylvester Stallones Biggest Regret

May 12, 2025

Coming Home 1978 Sylvester Stallones Biggest Regret

May 12, 2025 -

Did Sylvester Stallone Regret Rejecting Coming Home The 1978 Oscars

May 12, 2025

Did Sylvester Stallone Regret Rejecting Coming Home The 1978 Oscars

May 12, 2025 -

Watch Sylvester Stallones Armor A Free Action Thriller This Month

May 12, 2025

Watch Sylvester Stallones Armor A Free Action Thriller This Month

May 12, 2025