SEC Acknowledges Grayscale XRP ETF Filing: XRP Price Outperforms Bitcoin

Table of Contents

The SEC's Acknowledgment: A Significant Milestone for XRP

The Securities and Exchange Commission (SEC) plays a crucial role in regulating the US financial markets, including the approval of ETFs. While the SEC's acknowledgment of Grayscale's XRP ETF filing doesn't guarantee approval, it represents a significant milestone. It signals that the application is under review and that the SEC is actively considering the potential listing of an XRP ETF. This is a monumental step forward, considering the SEC's previous cautious stance on XRP. The timeline for a final decision remains uncertain, potentially ranging from several months to over a year, depending on the complexity of the review process and the volume of information required.

- The SEC's previous stance on XRP: The SEC's past legal battles with Ripple have cast a shadow on XRP's regulatory landscape. This acknowledgment suggests a potential shift in perspective.

- The implications of a potential rejection: While unlikely after acknowledgment, a rejection could significantly impact XRP's price and market sentiment.

- Historical precedents for ETF approvals: Examining the SEC's track record with previous ETF applications can offer insights into the potential timeline and decision-making process for the XRP ETF.

XRP Price Performance: Outperforming Bitcoin and the Market

XRP's price has seen a remarkable increase following the SEC's acknowledgment. Data indicates a percentage increase of [Insert Percentage Increase Here] in the past [Insert Timeframe Here], significantly outpacing Bitcoin's performance during the same period. This surge can be attributed to several factors, including: speculation surrounding the potential ETF approval, increased investor confidence, and broader positive trends within the cryptocurrency market.

- Specific price data (percentage increase, charts): [Insert Chart and Data Here showcasing XRP price increase].

- Comparison to Bitcoin's price movement: [Insert Comparison Data and Chart Here showing XRP's outperformance against Bitcoin].

- Technical analysis of the XRP chart (optional): [Optional Section for advanced readers with technical analysis of price charts, including support and resistance levels].

Grayscale's Strategy and the Potential Impact of an XRP ETF

Grayscale Investments, a prominent digital currency asset manager, has a proven track record in launching crypto ETFs. Their strategy typically involves accumulating significant holdings of a particular cryptocurrency before seeking ETF approval. The potential approval of an XRP ETF under Grayscale could lead to several key market impacts:

- Grayscale's track record with other crypto ETFs: Highlight Grayscale's success and experience in the ETF space.

- The potential for increased institutional investment in XRP: An approved ETF would make XRP more accessible to institutional investors, potentially driving significant price increases.

- The potential impact on XRP's price volatility: While increased liquidity is generally positive, an ETF could also increase price volatility in the short term.

Market Sentiment and Investor Confidence in XRP

Market sentiment surrounding XRP has shifted significantly following the SEC's acknowledgment. Social media conversations reflect a heightened sense of optimism, and trading volume has increased substantially. Several prominent analysts have voiced positive opinions on XRP's potential, further boosting investor confidence.

- Social media sentiment analysis: Summarize the overall sentiment from platforms like Twitter and Reddit.

- News articles and expert opinions: Reference relevant news articles and analyst predictions.

- Trading volume data: Provide data illustrating the increase in trading volume.

Conclusion: The Future of XRP and the Importance of the SEC's Decision

The recent surge in XRP's price, driven by the SEC's acknowledgment of Grayscale's XRP ETF filing, highlights the significant potential impact of ETF approval on the cryptocurrency market. While the SEC's final decision remains pending, the acknowledgment alone has already sparked considerable investor interest and optimism. The approval of an XRP ETF would likely lead to increased liquidity, broader adoption, and potentially higher price volatility. However, it's crucial to acknowledge inherent risks and uncertainties within the cryptocurrency market.

Stay tuned for updates on the XRP ETF and its impact on the cryptocurrency market. Learn more about investing in XRP and the potential benefits of an approved XRP ETF. Remember to conduct your own thorough research before making any investment decisions.

Featured Posts

-

Is Colin Cowherd Unfair To Jayson Tatum Analyzing The Criticism

May 08, 2025

Is Colin Cowherd Unfair To Jayson Tatum Analyzing The Criticism

May 08, 2025 -

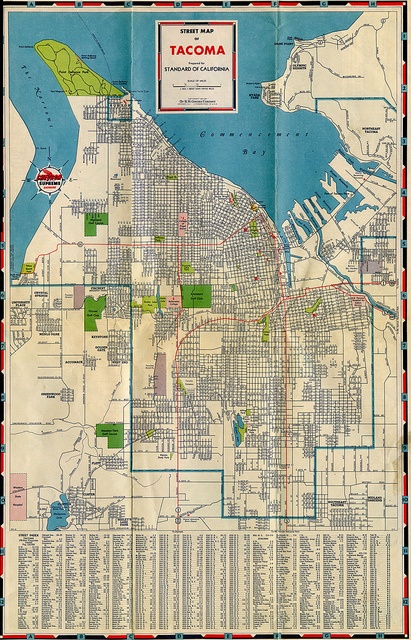

Historic Pierce County Residence From Home To Parkland

May 08, 2025

Historic Pierce County Residence From Home To Parkland

May 08, 2025 -

Ethereum Price Surges Past Resistance Will It Hit 2 000

May 08, 2025

Ethereum Price Surges Past Resistance Will It Hit 2 000

May 08, 2025 -

400 Xrp Price Increase Is This Crypto A Smart Investment Today

May 08, 2025

400 Xrp Price Increase Is This Crypto A Smart Investment Today

May 08, 2025 -

Recent Bitcoin Rebound Opportunities And Risks For Investors

May 08, 2025

Recent Bitcoin Rebound Opportunities And Risks For Investors

May 08, 2025