Sensex Today: LIVE Stock Market Updates - 800+ Point Surge, Nifty Above 18,500

Table of Contents

Sensex's 800+ Point Surge: Driving Factors

The Sensex's remarkable 800+ point gain today is attributable to a confluence of positive factors, indicating robust market sentiment and strong economic fundamentals. This Sensex rally reflects a combination of global and domestic influences.

- Positive Global Cues: Positive performance in the US markets and encouraging global economic data, particularly regarding inflation and growth projections, instilled confidence amongst investors. This positive global sentiment spilled over into the Indian markets, bolstering investor optimism.

- Strong Domestic Economic Indicators: Recent positive announcements regarding India's GDP growth and inflation figures further fueled the Sensex gain. These figures suggest a healthy and growing economy, attracting both domestic and foreign investment.

- Sector-Specific News: Strong performance in key sectors like IT and banking significantly contributed to the overall market surge. Positive earnings reports and announcements from major Sensex constituents in these sectors boosted investor confidence.

- Foreign Institutional Investor (FII) Activity: Significant FII inflows played a crucial role in driving the Sensex rally. Increased foreign investment indicates a positive outlook on the Indian economy and its growth potential.

- Retail Investor Sentiment: Positive retail investor sentiment also contributed to the market's upward trajectory. Increased participation from retail investors reflects a growing confidence in the market's future performance. This positive market sentiment further amplified the impact of other factors.

Nifty Above 18,500: Implications and Analysis

The Nifty crossing the 18,500 milestone is a significant achievement, signifying a strong bullish trend in the Indian stock market. This Nifty 18500 mark holds substantial implications:

- Impact on Investor Confidence: Breaching this psychological barrier significantly boosts investor confidence, encouraging further participation and investment. This positive Nifty performance creates a ripple effect across the market.

- Potential for Further Growth or Correction: While the current trend is bullish, it's crucial to remember that market movements are dynamic. The potential for both further growth and a subsequent correction exists.

- Attractiveness of the Market for Investments: The Nifty index crossing 18,500 enhances the attractiveness of the Indian stock market for both domestic and foreign investors, potentially leading to further capital inflows.

- Sector-wise Performance within the Nifty: The overall Nifty performance masks sector-specific variations. Some sectors might outperform others, indicating specific opportunities and risks within the market. Analyzing sectoral performance provides a nuanced view of the Nifty index movement.

Top Gainers and Losers: A Sectoral Overview

Analyzing the top gainers and losers provides crucial insights into the market's dynamics. Today's performance showcases a clear sectoral trend.

- Top 3 Gaining Sectors: The IT sector led the gains, followed by the banking and FMCG sectors. Key stocks within these sectors contributed significantly to the overall market surge. This reflects positive investor sentiment towards these specific industries.

- Top 3 Losing Sectors: While the overall market showed strength, some sectors underperformed. Analyzing these stock market losers is vital for understanding potential risks and market corrections.

- Reasons for Sector-Specific Performance: Company-specific news, industry trends, and global market factors all influenced individual sector performance. A deeper analysis of these factors provides a comprehensive understanding of the market's current state. Understanding the reasons behind the performance of stock market winners and stock market losers provides valuable investment insights.

Expert Opinion and Future Outlook: Sensex and Nifty Predictions

Experts offer varying perspectives on the market's future trajectory, considering the current Sensex today and Nifty today performance.

- Short-Term Outlook (Next Few Days/Weeks): Many experts anticipate continued positive momentum in the short term, but caution against overconfidence. They advise closely monitoring global economic factors and corporate earnings reports.

- Medium-Term Outlook (Next Few Months): The medium-term outlook remains positive, with most experts projecting sustained growth, although the pace of growth might moderate. This stock market forecast suggests a period of continued, albeit potentially slower, growth.

- Factors that Could Impact Future Market Movements: Global economic uncertainties, geopolitical events, and domestic policy changes remain significant factors influencing future market movements. Understanding these potential influences is crucial for making informed investment decisions.

- Investment Advice: Experts generally advise a balanced investment strategy, considering risk tolerance and diversification across asset classes. They suggest continuous monitoring of market trends and adapting investment strategies based on prevailing conditions. This is crucial for navigating the dynamic landscape of market predictions.

Conclusion: Stay Updated on Sensex Today and Beyond

Today's significant surge in the Sensex and Nifty reflects a combination of positive global cues, strong domestic economic indicators, and robust investor sentiment. While the short-term outlook appears bullish, it's crucial to acknowledge potential risks and maintain a balanced investment approach. Understanding the factors driving the Sensex today and Nifty today performance provides valuable insights for making informed investment decisions. Stay tuned for more Sensex today updates and in-depth analysis to make informed investment decisions. Check back regularly for the latest Sensex live data and Nifty today performance.

Featured Posts

-

Strengthened Capital Markets Pakistan Sri Lanka And Bangladeshs New Agreement

May 10, 2025

Strengthened Capital Markets Pakistan Sri Lanka And Bangladeshs New Agreement

May 10, 2025 -

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025

Hurun Report 2025 Elon Musk Still Tops Global Rich List Despite Significant Losses

May 10, 2025 -

Roman Fate Season 2 Top Potential Replacement Show And How To Stream It Spoiler Free

May 10, 2025

Roman Fate Season 2 Top Potential Replacement Show And How To Stream It Spoiler Free

May 10, 2025 -

Aocs Response To Jeanine Pirro A Point By Point Fact Check

May 10, 2025

Aocs Response To Jeanine Pirro A Point By Point Fact Check

May 10, 2025 -

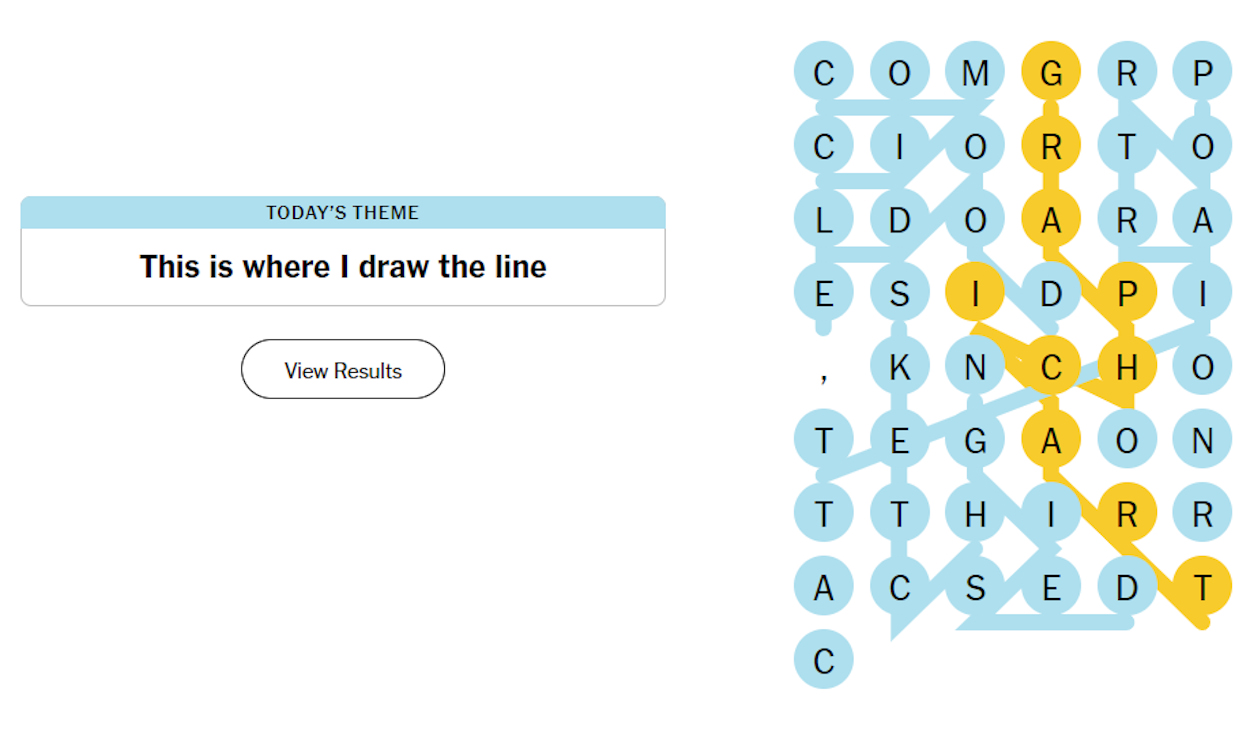

Nyt Strands Answers For Wednesday March 12 2024 Game 374

May 10, 2025

Nyt Strands Answers For Wednesday March 12 2024 Game 374

May 10, 2025