Sharp Decline In Amsterdam: Stock Market Down 7% At Opening Due To Trade War Concerns

Table of Contents

Causes of the Amsterdam Stock Market Decline

Escalating Trade War Concerns

The current state of global trade tensions is the primary catalyst for the Amsterdam Stock Market's sharp decline. The ongoing trade disputes between major economic players create a climate of uncertainty that directly impacts the Dutch economy, heavily reliant on international trade. Dutch businesses, particularly those in export-oriented sectors, are acutely vulnerable to increased tariffs and trade barriers.

- Specific examples of trade policies impacting Dutch exports: Increased tariffs on Dutch agricultural products entering key markets, such as the US and China, are significantly impacting export volumes and profitability. Similarly, restrictions on technology exports are affecting Dutch tech companies.

- Increased tariffs: The imposition of new tariffs has led to higher production costs for many Dutch companies, reducing their competitiveness in global markets and impacting their bottom line.

- Investor uncertainty: The unpredictable nature of the trade war makes it difficult for investors to assess risks accurately, leading to a significant decrease in investment confidence and a flight to safety. Data shows a clear correlation between escalating trade tensions and reduced foreign direct investment in the Netherlands. Recent reports suggest a 15% decrease in trade volume compared to the same period last year, further emphasizing the impact.

Investor Sentiment and Market Volatility

The sharp drop in the Amsterdam Stock Market is not solely attributable to trade war policies; investor sentiment plays a crucial role. Uncertainty breeds fear, and this fear is manifested in investor behavior.

- Selling off assets: Investors are reacting to the increased risk by selling off assets to reduce their exposure to potential losses. This collective selling pressure exacerbates the market downturn.

- Risk aversion: The current environment has heightened risk aversion, causing investors to move towards safer investments such as government bonds, further pushing down stock prices.

- Decreased investment confidence: The lack of clarity regarding the future trajectory of the trade war is eroding investment confidence. News outlets reporting on trade negotiations significantly influence investor psychology, creating a volatile market.

Impact of the Decline on the Dutch Economy

Short-Term Economic Effects

The immediate consequences of this market crash are already being felt throughout the Dutch economy.

- Potential job losses: Companies facing reduced demand and profitability may resort to layoffs, leading to increased unemployment.

- Decreased consumer confidence: The market downturn can lead to decreased consumer spending, as individuals become more cautious about their finances.

- Impact on GDP growth: The sharp decline in the stock market will negatively impact GDP growth, potentially leading to a slowdown or even a recession. The tourism and finance sectors, particularly vulnerable to global economic shifts, are already showing signs of strain.

Long-Term Economic Implications

The long-term effects of this market decline could be far-reaching and severe for the Dutch economy.

- Potential for decreased foreign investment: The uncertainty surrounding the trade war and the recent market crash could deter foreign investors from investing in the Netherlands.

- Slower economic growth: Continued trade disputes and diminished investor confidence could lead to sustained periods of slower economic growth.

- Government intervention measures: The Dutch government may need to intervene with significant fiscal stimulus packages to counter the negative economic effects. Economic forecasts predict a considerable slowdown in GDP growth for the next quarter.

Potential Responses and Mitigation Strategies

Government Intervention

The Dutch government has several options to mitigate the economic impact of this market downturn.

- Fiscal stimulus packages: Investing in infrastructure projects and providing tax breaks could stimulate economic activity and boost consumer confidence.

- Tax cuts: Reducing taxes on businesses and individuals could free up capital for spending and investment.

- Support for affected businesses: Providing financial aid to struggling businesses could help prevent job losses and maintain economic stability.

Central Bank Actions

De Nederlandsche Bank (DNB), the Dutch central bank, can also play a crucial role in stabilizing the market.

- Potential interest rate cuts: Lowering interest rates could encourage borrowing and investment, stimulating economic activity.

- Quantitative easing measures: The DNB could purchase government bonds to inject liquidity into the market and lower long-term interest rates.

- Market stabilization strategies: The DNB might implement measures to increase market liquidity and reduce volatility.

Investor Strategies

Navigating this uncertain market requires a strategic approach for investors.

- Diversification: Spreading investments across different asset classes can reduce overall risk.

- Risk management: Implementing strategies to limit potential losses is crucial during times of heightened volatility.

- Long-term investment strategies: Focusing on long-term investment goals rather than short-term market fluctuations can help mitigate the impact of market downturns.

Conclusion

The sharp 7% decline in the Amsterdam Stock Market, largely driven by escalating trade war concerns, has significant short-term and long-term implications for the Dutch economy. The potential consequences include job losses, decreased consumer confidence, slower economic growth, and reduced foreign investment. The Dutch government and the DNB will likely need to implement measures to mitigate the impact, while investors should adopt cautious, well-diversified strategies. Understanding the intricacies of this market downturn is crucial for navigating the complexities of investing during times of economic uncertainty. Stay informed about developments in the Amsterdam Stock Market and the global trade war situation to make informed investment decisions. Monitor the AEX index and follow reputable financial news sources for updates on the Amsterdam Stock Market decline and its ongoing effects on the Dutch economy.

Featured Posts

-

Frankfurt Stock Market Update Dax At 24 000 And Below

May 25, 2025

Frankfurt Stock Market Update Dax At 24 000 And Below

May 25, 2025 -

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 25, 2025

Glastonbury 2025 Lineup Leak Confirmed Performers And How To Buy Tickets

May 25, 2025 -

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Evening

May 25, 2025

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Evening

May 25, 2025 -

Following A Night Out With Kyle Walker Annie Kilners Poisoning Claims

May 25, 2025

Following A Night Out With Kyle Walker Annie Kilners Poisoning Claims

May 25, 2025 -

Monacos Royal Family A Financial Scandal And Its Fallout

May 25, 2025

Monacos Royal Family A Financial Scandal And Its Fallout

May 25, 2025

Latest Posts

-

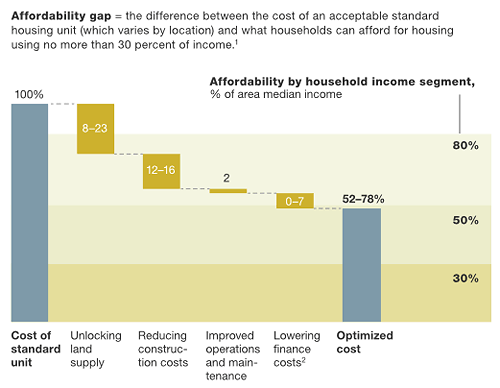

Is Gregor Robertson Right About Affordable Housing A Realistic Assessment

May 25, 2025

Is Gregor Robertson Right About Affordable Housing A Realistic Assessment

May 25, 2025 -

2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025

2025 Tornado And Flash Flood Summary April 4th Report

May 25, 2025 -

Miami Valley Flood Advisory Severe Weather And Potential Flooding

May 25, 2025

Miami Valley Flood Advisory Severe Weather And Potential Flooding

May 25, 2025 -

Severe Weather Awareness Staying Safe During Floods

May 25, 2025

Severe Weather Awareness Staying Safe During Floods

May 25, 2025 -

Protecting Yourself And Your Family From Floods Day 5

May 25, 2025

Protecting Yourself And Your Family From Floods Day 5

May 25, 2025