Should I Buy Palantir Stock Now? Assessing The 40% Growth Potential

Table of Contents

H2: Palantir's Current Financial Performance and Future Projections

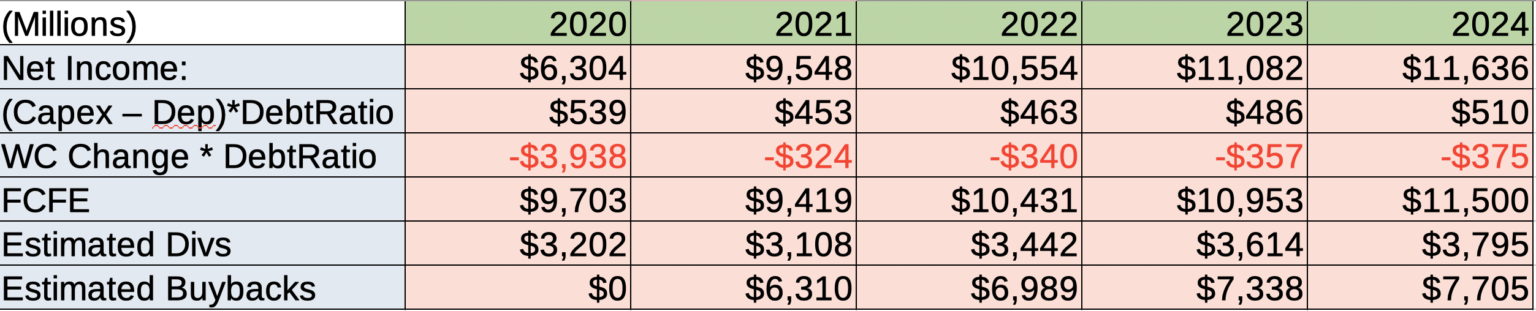

Palantir's financial performance provides a crucial foundation for evaluating its growth potential. While the company has demonstrated impressive revenue growth, profitability remains a key area of focus. Analyzing recent quarterly and annual reports reveals valuable insights into its financial health. Key Performance Indicators (KPIs) such as revenue growth rate, operating margins, and cash flow are essential for assessing the company's financial strength and its ability to sustain growth.

- Revenue Growth Rate: Palantir has consistently shown strong revenue growth over the past few years, though the rate has fluctuated. Examining the year-over-year and quarter-over-quarter growth rates helps assess the sustainability of this trend.

- Profitability: Palantir has historically operated at a loss, but the company is focused on improving its profitability. Analyzing its operating margin and net income will indicate progress toward achieving sustained profitability.

- Debt Levels and Financial Stability: A careful examination of Palantir's debt levels and its ability to manage its debt load is critical. High debt levels can pose significant risks, especially during economic downturns.

- Analyst Ratings and Price Targets: Monitoring analyst ratings and price targets for PLTR stock offers a valuable external perspective on Palantir's future prospects. However, it's essential to consider the diversity of opinions and the inherent uncertainty in these predictions.

H2: Analyzing Palantir's Market Position and Competitive Landscape

Palantir operates in the rapidly expanding market of big data analytics, serving both government and commercial clients. Its proprietary technology, particularly Gotham and Foundry, provides a significant competitive advantage. However, the market is becoming increasingly competitive, with established players and new entrants vying for market share.

- Key Competitors and Their Strengths/Weaknesses: Companies like AWS, Microsoft, and Google offer competing big data analytics solutions. Understanding their strengths and weaknesses helps assess Palantir's competitive positioning.

- Market Share Analysis: Determining Palantir's market share and its growth trajectory compared to competitors is crucial in evaluating its potential for future growth.

- Potential for Market Disruption and Innovation: Palantir's continued investment in research and development is essential for maintaining its technological edge and disrupting the market with innovative solutions.

- Growth Opportunities: Significant growth opportunities exist in sectors like government, healthcare, and finance. Palantir's ability to capitalize on these opportunities will influence its future growth prospects.

H2: Assessing the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries inherent risks, common to the tech sector and specific to Palantir's business model. Understanding these risks is crucial before making any investment decision.

- Stock Price Volatility: The tech sector is known for its volatility, and Palantir stock is no exception. Investors should be prepared for significant fluctuations in stock price.

- Government Contract Risks: A substantial portion of Palantir's revenue comes from government contracts. Changes in government policy or budget cuts can significantly impact its revenue stream.

- Economic Downturn Impact: Economic downturns can negatively affect demand for Palantir's services, particularly in the commercial sector.

- Potential for Future Dilution of Shares: Further dilution of shares through future offerings could negatively impact existing shareholders.

H2: Considering the 40% Growth Potential: A Realistic Assessment

The 40% growth potential for Palantir stock hinges on several factors. Achieving this ambitious target would require sustained revenue growth, improved profitability, and successful expansion into new markets. However, the risks outlined above could significantly hinder this growth.

- Scenario Planning: Considering both best-case and worst-case scenarios helps assess the likelihood of achieving 40% growth. This involves factoring in various market conditions and Palantir's performance.

- Growth Accelerators and Decelerators: Identifying factors that could accelerate or decelerate Palantir's growth is essential for a realistic assessment. This includes technological advancements, competitive pressures, and macroeconomic conditions.

- Comparison to Similar Companies: Analyzing the growth trajectories of similar companies in the big data analytics sector can provide valuable context for evaluating Palantir's potential.

- Long-Term vs. Short-Term Growth: Distinguishing between long-term and short-term growth potential helps manage expectations and investment strategies.

H3: Conclusion: Should You Buy Palantir Stock? A Final Verdict

Palantir's potential for growth is undeniable, particularly considering its innovative technology and strong client base. However, the inherent risks associated with investing in Palantir stock, including market volatility and dependence on government contracts, cannot be overlooked. The 40% growth prediction, while optimistic, requires several favorable conditions to materialize.

While the potential for 40% growth in Palantir stock is enticing, investors should carefully weigh the risks before making a decision. Conduct your own thorough due diligence before investing in Palantir stock. Understand your personal risk tolerance and investment goals before making any decisions related to PLTR stock. Remember, this is not financial advice, and you should consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025

Nyt Strands Hints And Answers Thursday February 20 Game 354

May 10, 2025 -

Increased Danish Involvement In Greenland Understanding Trumps Role

May 10, 2025

Increased Danish Involvement In Greenland Understanding Trumps Role

May 10, 2025 -

Academic Failure Understanding The Link Between Mental Illness And Violent Crime

May 10, 2025

Academic Failure Understanding The Link Between Mental Illness And Violent Crime

May 10, 2025 -

Improved Disney Profit Outlook Thanks To Parks And Streaming

May 10, 2025

Improved Disney Profit Outlook Thanks To Parks And Streaming

May 10, 2025 -

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 10, 2025

Is Palantir Stock A Buy Right Now A Comprehensive Analysis

May 10, 2025