Should I Invest In Palantir Stock Before May 5th? A Detailed Analysis

Table of Contents

Palantir's Recent Performance and Future Projections

Q1 2024 Earnings and Key Metrics: Palantir's recent financial performance offers valuable insight into its potential for future growth. Analyzing key metrics is crucial for determining whether to invest in Palantir stock. While specific Q1 2024 figures will need to be inserted here upon release (replace bracketed information below with actual data), we can anticipate several key areas of focus:

- Revenue Figures: [Insert Q1 2024 Revenue]. Year-over-year growth will be a key indicator of Palantir's continued success.

- Earnings Per Share (EPS): [Insert Q1 2024 EPS]. Positive EPS growth signals profitability and investor confidence.

- Customer Acquisition: The number of new customers and the expansion of existing contracts will reflect the strength of Palantir's sales pipeline. [Insert Q1 2024 Customer Acquisition Data].

- Analyst Predictions: Leading financial analysts project [Insert range of analyst predictions for Q2 2024 and beyond] for Palantir's stock price and earnings. These predictions should be considered alongside other factors in your analysis. This data helps in understanding the potential trajectory of the Palantir stock price.

Government Contracts and Commercial Growth: Palantir's revenue streams come from both government contracts and commercial partnerships. Understanding the contributions of each is vital when considering whether to invest in Palantir stock.

- Government Contracts: Palantir's success in securing large government contracts, particularly within the intelligence and defense sectors, forms a significant portion of its revenue. Examples include [Insert examples of recent significant government contracts]. The stability and longevity of these contracts are key factors in assessing Palantir's long-term outlook.

- Commercial Growth: Palantir's commercial sector is experiencing expansion, albeit at a potentially slower rate than its government contracts. Key partnerships include [Insert examples of key commercial partnerships]. The growth of this sector is important for diversification and long-term sustainability. Analyzing Palantir’s market share within its targeted sectors is also crucial.

Risks and Potential Downsides of Investing in Palantir

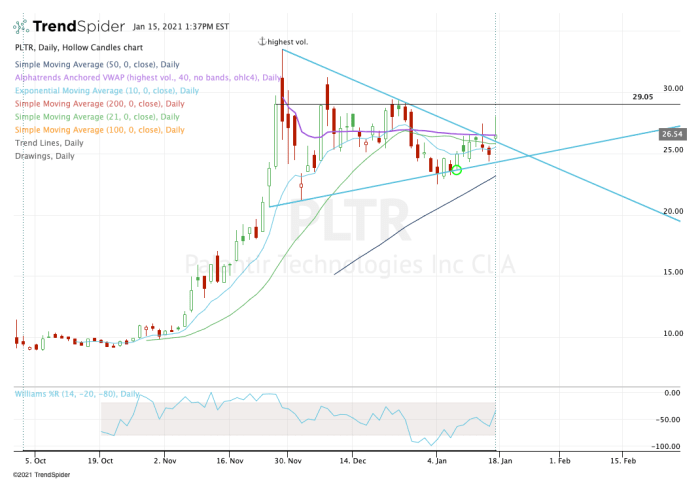

Valuation and Stock Price Volatility: Palantir's stock price has historically exhibited significant volatility. Understanding this volatility is crucial before deciding to invest in Palantir stock.

- Valuation: Compared to its competitors in the data analytics space, Palantir's valuation may be considered [High/Low/Average – replace with appropriate assessment based on current market data]. This should be weighed against its growth potential and risk profile.

- Stock Price Fluctuations: Various factors contribute to the volatility of Palantir’s stock price, including market sentiment, news events (both positive and negative), and overall economic conditions. This requires a high tolerance for risk.

Geopolitical Risks and Dependence on Specific Clients: Palantir's business model carries inherent geopolitical risks and some dependence on a smaller number of large clients.

- Geopolitical Impact: International relations and geopolitical instability could directly impact Palantir's government contracts and potentially its commercial partnerships.

- Client Concentration Risk: Reliance on a limited number of major clients increases vulnerability. Should a key client’s relationship end, it could significantly impact Palantir's revenue streams. Analyzing Palantir's efforts to diversify its client base is important in mitigating this risk.

Factors to Consider Before May 5th

Upcoming Events and News: Events leading up to May 5th could significantly impact the Palantir stock price.

- Earnings Release: The anticipated release of Q1 2024 earnings is a major factor. Market reaction to this announcement will likely be substantial.

- Product Launches or Partnerships: Any announcements of new products, strategic partnerships, or technological advancements could positively or negatively influence investor sentiment.

Your Investment Strategy and Risk Tolerance: Before investing in Palantir stock, align your decision with your own investment goals and risk tolerance.

- Long-Term vs. Short-Term: Palantir is a growth stock; a long-term investment strategy might be more suitable for mitigating the risk associated with its stock price volatility.

- Portfolio Diversification: Never put all your eggs in one basket. Diversification is key to mitigating risk in any investment portfolio.

Conclusion

Should you invest in Palantir stock before May 5th? The decision depends on a thorough assessment of Palantir's recent performance, future projections, inherent risks, and your own investment strategy and risk tolerance. While Palantir holds considerable potential for growth, significant risks and volatility are present. This analysis should be used as a starting point for your due diligence. Remember to conduct your own thorough research before investing, considering all the factors discussed above. Learn more about Palantir investing and research Palantir stock before investing to make the best decision for your financial future.

Featured Posts

-

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025

Dakota Johnsons Stunning White Dress At Materialists Premiere

May 09, 2025 -

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 09, 2025

Le Ministre Europeen Francais Vante Le Partage Du Bouclier Nucleaire

May 09, 2025 -

Divine Mercy Extended Exploring Religious Faiths In 1889

May 09, 2025

Divine Mercy Extended Exploring Religious Faiths In 1889

May 09, 2025 -

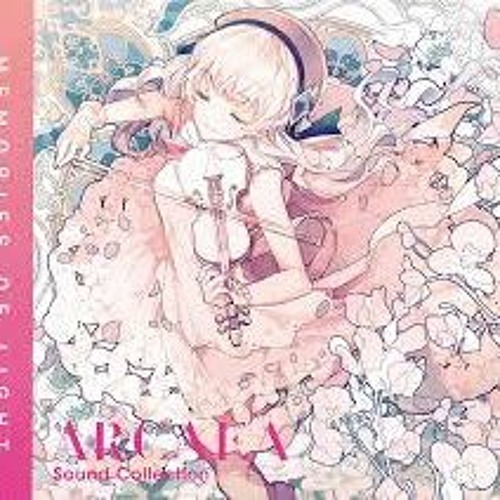

Trump Tariffs Weigh On Infineon Ifx Sales Guidance And Market Outlook

May 09, 2025

Trump Tariffs Weigh On Infineon Ifx Sales Guidance And Market Outlook

May 09, 2025 -

Elon Musks Fortune Soars Billions Added As Tesla Stock Jumps After Dogecoin Departure

May 09, 2025

Elon Musks Fortune Soars Billions Added As Tesla Stock Jumps After Dogecoin Departure

May 09, 2025