Should You Buy Palantir Stock After A 30% Drop?

Table of Contents

Analyzing Palantir's Recent Performance and the 30% Drop

Understanding the Reasons Behind the Stock Price Decline

Several factors contributed to Palantir's recent stock price decline. Understanding these is crucial before considering an investment.

-

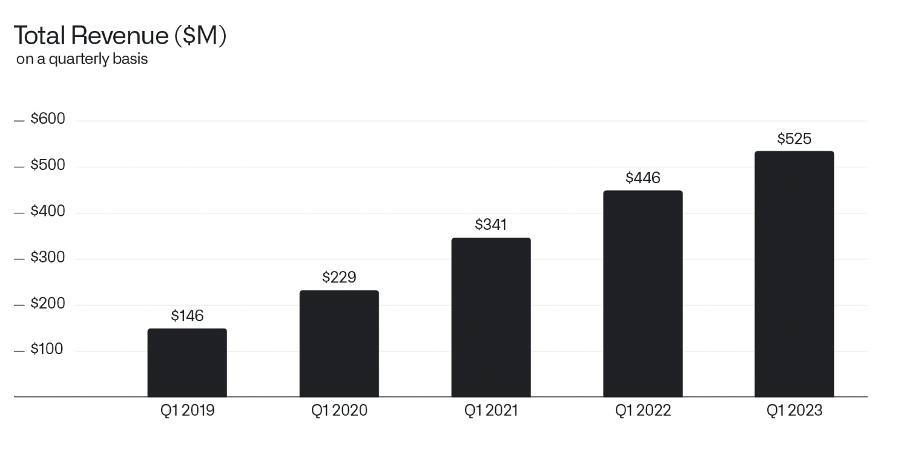

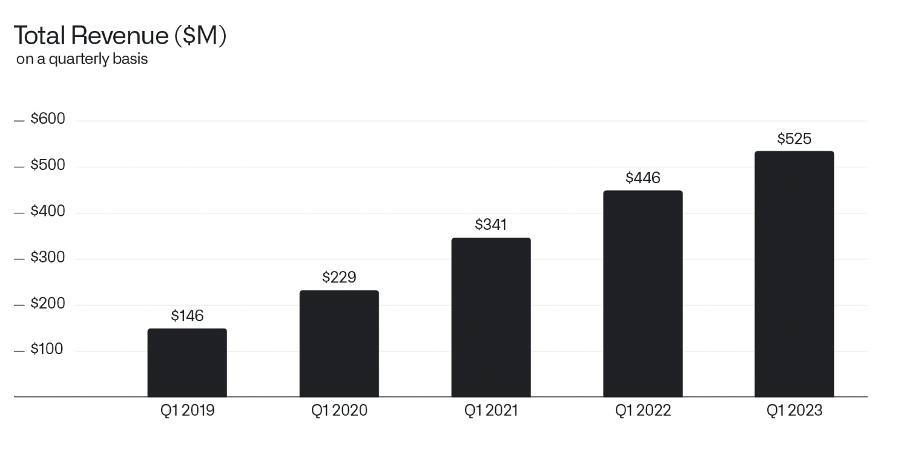

Disappointing Earnings Reports: Recent earnings reports may have fallen short of market expectations, leading to investor sell-offs. Analyzing the specific financial figures – revenue growth, profitability, and guidance – is essential for a comprehensive understanding. For example, a lower-than-anticipated revenue growth rate compared to the previous quarter or year-over-year could be a contributing factor.

-

Market-Wide Sell-Offs: The broader market downturn has negatively impacted many technology stocks, including Palantir. This macro-economic factor is beyond Palantir's direct control. Understanding the overall market sentiment and its influence on Palantir's stock price is vital.

-

Concerns About Future Growth: Investor concerns regarding Palantir's future growth prospects, particularly its ability to consistently secure lucrative government contracts and expand its commercial client base, have weighed on the stock price. Analyzing projected growth rates and the company's pipeline of potential deals would provide context here.

-

Competition Analysis: The big data analytics market is competitive. Analyzing Palantir's competitive landscape, including the market share of competitors like Microsoft, Amazon, and Google, can help determine Palantir's competitive advantages and potential vulnerabilities. Direct comparisons of growth rates and market penetration would be insightful. Keywords such as Palantir stock price, Palantir earnings, Palantir growth prospects, and Palantir competitors are important for understanding this section.

Evaluating the Long-Term Growth Potential of Palantir

Despite the recent decline, Palantir possesses considerable long-term growth potential.

-

Strategic Initiatives: Palantir's strategic initiatives, such as expanding its product offerings and focusing on key vertical markets, could significantly drive future growth. Analyzing these initiatives and their potential impact on revenue generation is key.

-

Government and Commercial Markets: Both the government and commercial sectors offer significant growth opportunities for Palantir. Analyzing market size, growth rates, and Palantir's market share in both sectors would paint a clearer picture.

-

Competitive Advantages: Palantir's proprietary technology, strong relationships with government agencies, and increasing adoption in the commercial sector provide a strong competitive advantage. Examining the unique aspects of its technology compared to competitors is essential.

-

Technological Innovation: Palantir's continued investment in research and development points to a future-oriented approach. Analyzing their innovation pipeline and its potential impact on their competitive position in the long-term is important. Key terms like Palantir future, Palantir technology, Palantir government contracts, and Palantir commercial clients are essential for SEO in this section.

Assessing the Risks and Rewards of Investing in Palantir After the Drop

Identifying Potential Risks

Investing in Palantir carries several risks:

-

Stock Market Volatility: The inherent volatility of the stock market poses a risk to any investment, particularly in a growth-oriented company like Palantir.

-

Competition: Intense competition from established players in the big data analytics market represents a significant challenge.

-

Government Contract Dependence: Palantir's reliance on government contracts for a significant portion of its revenue creates dependency and vulnerability to changes in government policy or budget cuts.

-

Profitability Concerns: Palantir's path to profitability remains a key concern for some investors. Closely analyzing their financial reports will be necessary.

Key terms such as Palantir risk, Palantir investment risk, and Palantir volatility are relevant here.

Weighing the Potential Rewards

Despite these risks, the potential rewards of investing in Palantir at a lower price are considerable:

-

Discounted Valuation: The 30% drop presents a potentially attractive entry point for long-term investors.

-

Long-Term Growth Potential: Palantir's long-term growth potential, fueled by its innovative technology and expanding market reach, is a significant incentive.

-

Return on Investment (ROI): A successful investment in Palantir could yield substantial returns over the long term. Keywords like Palantir ROI, Palantir return, and Palantir investment opportunities are important here.

Comparing Palantir to Competitors in the Big Data Analytics Market

A comparative analysis of Palantir with its competitors, such as Microsoft Azure, AWS, and Google Cloud, is crucial. This involves comparing their market share, revenue growth, profitability, and technological capabilities. Factors to consider include the specific strengths and weaknesses of each competitor's offerings, their pricing models, and their target customer segments. Keywords like Palantir competitors, big data analytics market, Palantir valuation, and competitor analysis are important to include.

Considering Your Personal Investment Strategy and Risk Tolerance

Before investing in Palantir, carefully consider your personal investment strategy and risk tolerance. This includes understanding your investment goals (e.g., long-term growth, income generation), your time horizon, and your comfort level with risk. Diversification is also key to managing investment risk. Terms such as investment strategy, risk tolerance, diversification, and Palantir investment strategy should be used throughout this section.

Conclusion: Should You Buy Palantir Stock After a 30% Drop? A Final Verdict

The decision of whether or not to buy Palantir stock after its recent decline is complex. While the 30% drop presents a potentially attractive entry point for long-term investors, it's crucial to carefully weigh the potential rewards against the inherent risks. Conducting thorough due diligence, understanding your own risk tolerance, and considering your overall investment strategy is paramount. There's no definitive "yes" or "no" answer; the decision rests solely on your individual assessment. Is Palantir stock a good buy after its recent drop? Should I invest in Palantir now? Only you can answer these questions after careful consideration of the information presented here and further independent research. Remember to consult a financial advisor before making any investment decisions. Consider your own financial situation and seek professional advice before investing in Palantir stock or any other security.

Featured Posts

-

Snls Impression Of Harry Styles His Shocked Response

May 10, 2025

Snls Impression Of Harry Styles His Shocked Response

May 10, 2025 -

The It Factor Stephen Kings Opinion On Stranger Things Similarities

May 10, 2025

The It Factor Stephen Kings Opinion On Stranger Things Similarities

May 10, 2025 -

3 Year Stock Prediction Identifying 2 Potential Investments To Outpace Palantir

May 10, 2025

3 Year Stock Prediction Identifying 2 Potential Investments To Outpace Palantir

May 10, 2025 -

Strengthened Capital Markets Pakistan Sri Lanka And Bangladeshs New Agreement

May 10, 2025

Strengthened Capital Markets Pakistan Sri Lanka And Bangladeshs New Agreement

May 10, 2025 -

Space Xs Valuation Surge Adds 43 Billion To Elon Musks Net Worth Compared To Tesla

May 10, 2025

Space Xs Valuation Surge Adds 43 Billion To Elon Musks Net Worth Compared To Tesla

May 10, 2025